The Bitcoin market experienced a significant downturn, with prices falling below the $66,000 mark. This sudden price movement of -5.6% can be attributed to four main factors: a long liquidation event, a rising US dollar index (DXY), profit taking by investors, and outflows from Bitcoin ETFs.

#1 Long clearances

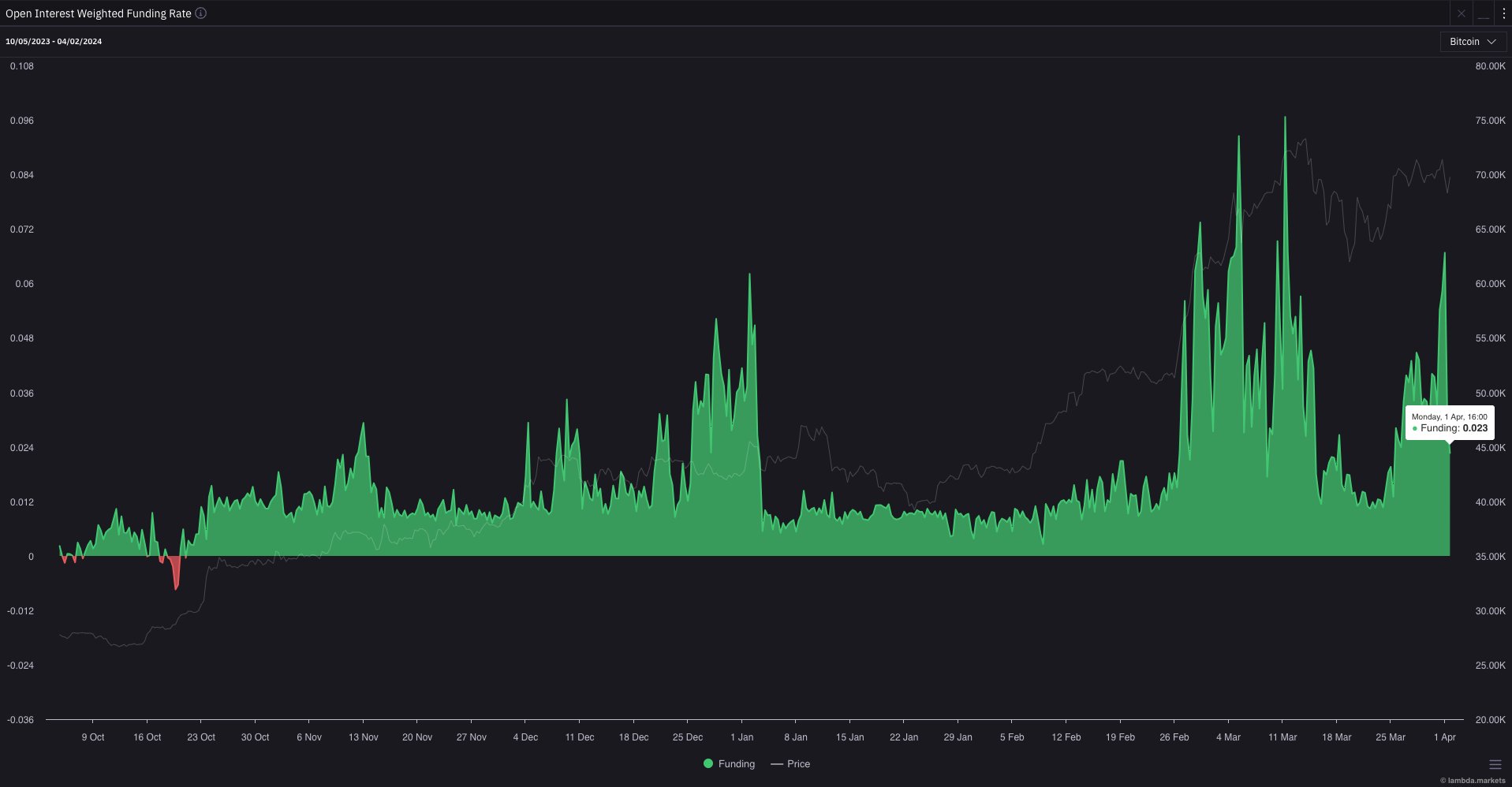

The main force that led to today’s downturn in Bitcoin’s price was a significant deleveraging event characterized by an unusually high level of long liquidations. Prior to the downturn, Bitcoin’s open interest (OI) weighted funding rate was unusually high, indicating that leveraged traders were paying premiums to maintain long positions in anticipation of future price increases. However, this optimism made the market vulnerable to sudden corrections.

Crypto analyst Ted, known as @tedtalksmacro on X (formerly Twitter), noted, “Today was the biggest long liquidation event since March 19.” He further elaborated on the effects of this correction, noting, “Nice recovery in overall positioning today, even with only a 5% drop lower for Bitcoin…Next leg higher is loading I think.” This comment highlights the severity of the liquidations and suggests a possible recovery or restructuring within the market as it stabilizes.

Coinglass data reveals that over the past 24 hours, 120,569 traders have been liquidated, amounting to $395.53 million in total liquidations, with $311.97 million being long positions. Bitcoin-specific long liquidations were at $87.42 million.

#2 DXY puts pressure on Bitcoin

At 105.037, the DXY closed yesterday at its highest level since November, proving a strengthening US dollar. Given Bitcoin’s inverse correlation with the DXY, the stronger dollar could have shifted investor preference toward safer assets, away from riskier investments like Bitcoin.

This correlation stems from the global market’s risk sentiment, where a rising DXY often signals a shift to safer investments, detracting from riskier assets such as Bitcoin. However, analyst Coosh Alemzadeh provided a counter perspective, suggesting through a Wyckoff redistribution scheme that despite the DXY’s recent rise, the next move could favor risk assets, possibly including Bitcoin.

See more

#DXY ⬆️4 weeks in a row/has broken out of its downtrend, so consensus is that a new uptrend is starting, but risk assets are consolidating at ATH

Next move ⬆️in risk assets on deck IMO pic.twitter.com/u6ORa76vkj

— “Coosh” Alemzadeh (@AlemzadehC) April 2, 2024

#3 Profit taking by investors

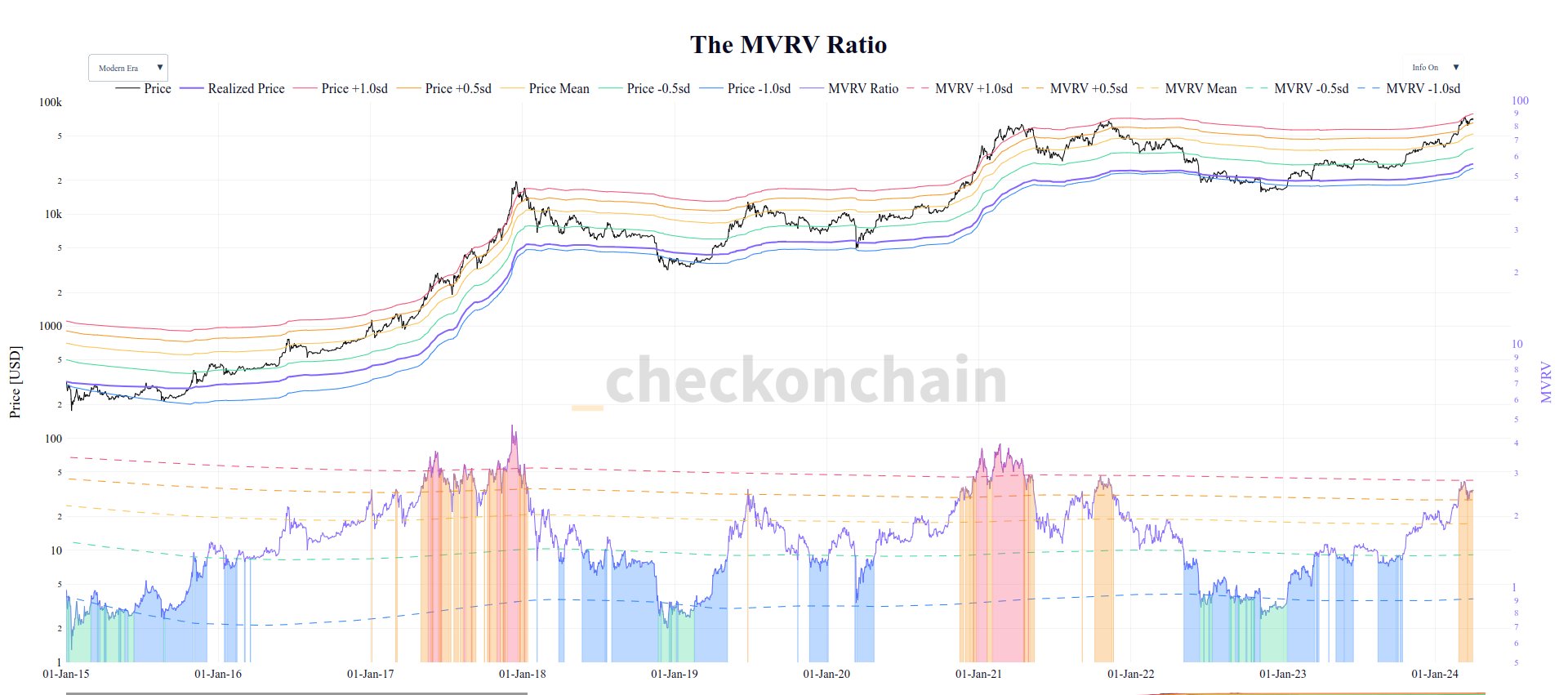

Profit-taking by investors has also played a significant role in the recent price adjustments. The Bitcoin on-chain analysis platform Checkonchain has reported an increase in profit-taking activity.

Sharing insights via X, Glassnode’s leading on-chain analyst Checkmatey said: “The classic Bitcoin MVRV ratio is hitting conditions we characterize as ‘heated but not yet overcooked’. MVRV = above +0.5sd but below + 1sd This suggests that the average BTC holder is sitting on a significant unrealized profit, causing an increase in spending.

The profit-taking coincided with Bitcoin hitting a high of $73,000, marking a cycle high in profit-taking with over 352,000 BTC sold for profit. This selling behavior is typical in bull markets, but plays a crucial role in creating resistance levels against local price tops.

#4 Bitcoin ETF outflows

Finally, the market saw remarkable outflows from Bitcoin ETFs, a reversal of last week’s significant inflows. Total outflows totaled $85.7 million in a single day, with Grayscale’s GBTC experiencing the most significant withdrawal of $302 million.

Meanwhile, Blackrock’s IBIT and Fidelity’s FBTC reported positive inflows of $165.9 million and $44 million, respectively. Commenting on this, WhalePanda noted: “Overall negative day, but not as negative as the price implied. Closing of Q1 so taking profit here makes sense. Some bullshit around [the] new term and halving are to be expected.”

At press time, BTC was trading at $66,647.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news