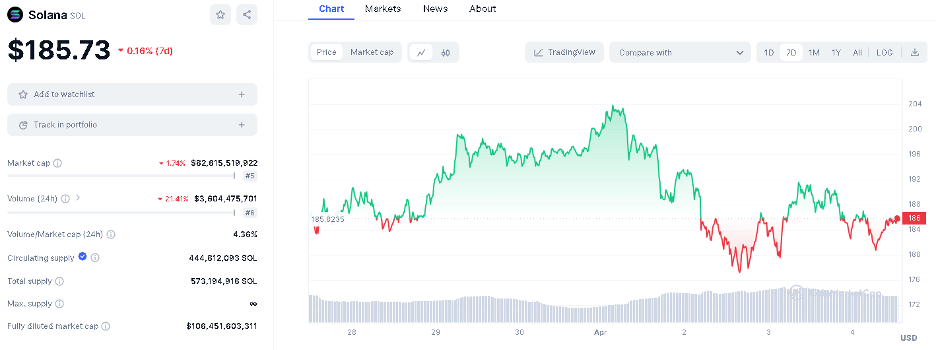

Solana whale wallets have been seen transferring a large amount of funds to the Binance and various other exchanges.

Typically, when multi-million wallet holders transfer those amounts from one wallet to another, it creates a huge selling pressure on the crypto in question.

However, SOL price held strong despite the increase in transactions, indicating a strong foundation, and a possible new bull run for the asset.

Solana’s power mainly comes from community-centric meme coins like Slothana ($SLOTH), Book of Meme (BOME) and Sponge V2 (SPONGEV2).

Signs like these have recorded staggering returns in the previous weeks, and SOL’s resistance suggests we can expect even more as we approach the halving event.

Let’s see what happens behind the curtain.

>>>Get the best presale project now<<

Whales transfer funds to unknown wallets, but SOL holds fort – new bull run in sight?

Solana was rocked this week as crypto whales moved around massive SOL stacks to unknown wallets.

However, despite these high-value moves, the SOL token held its ground, fueling speculation that a new bull run could be on the horizon.

It all started on Monday when the market cooled and SOL fell below $190. That’s when whale watchers spotted four colossal transactions totaling almost 5 million SOL – worth more than $950 million at the time – on their way to new wallet addresses.

While such concentrated outflows can sometimes indicate incoming selling pressure, the motive here is unclear. The whales can redistribute funds through OTC channels to minimize the market impact. Or they can simply rearrange their portfolios.

Regardless of the whales’ intentions, SOL remained afloat. The sign continues to trade sideways, indicating that bulls are committed to maintaining its uptrend.

As the broader bearish pressure fades, many investors are using this as an opportunity to load up on dipped SOL and its swarm of viral meme coins. The thinking is that once SOL reclaims $200, the rally for Solana’s viral token ecosystem will start again.

For those high-rolling whales behind the massive deals, the continued optimism of smaller buyers is a reassuring sign – this hype train has not yet lost steam. Now it’s a matter of when, not if, the next bull of meme coin mania will erupt.

>>>Get the best presale project now<<

Slothana ($SLOTH) – New Viral SOL Meme Coin Presale Raises Millions Despite Market Drop

While the broader crypto market has been mired in a slump, one project is proving that the right combination of virality and tokenomics can still raise funds.

Combining the words “sloth” and “Solana,” this cheekily-named sign managed to raise an impressive $8 million in just under a week through its ongoing presale.

That’s no small feat in the current bearish conditions, suggesting that Slothana could be poised for exponential gains once the bulls start charging again.

So what’s driving all this fuss? To begin with, Slothana has streamlined the investment process with a simple pre-sale model.

Send SOL from your crypto wallet to a designated address, and you’ll receive an airdrop of SLOTH tokens at a rate of 10,000 per SOL once the presale is closed.

Slothana’s team also worked overtime to build hype through a multi-pronged marketing blitz across major crypto media outlets.

Notable voices like Jacob Bury have even drawn comparisons between Slothana and the viral success of Book of Meme on Solana.

While this blistering start is undoubtedly promising for Slothana’s future endeavors, the real challenge will be maintaining that momentum in the killer meme coin area.

But for now, the market “veils” this project as the potential new king of Solana’s meme kingdom.

>>>Buy the Slothana Project now<<

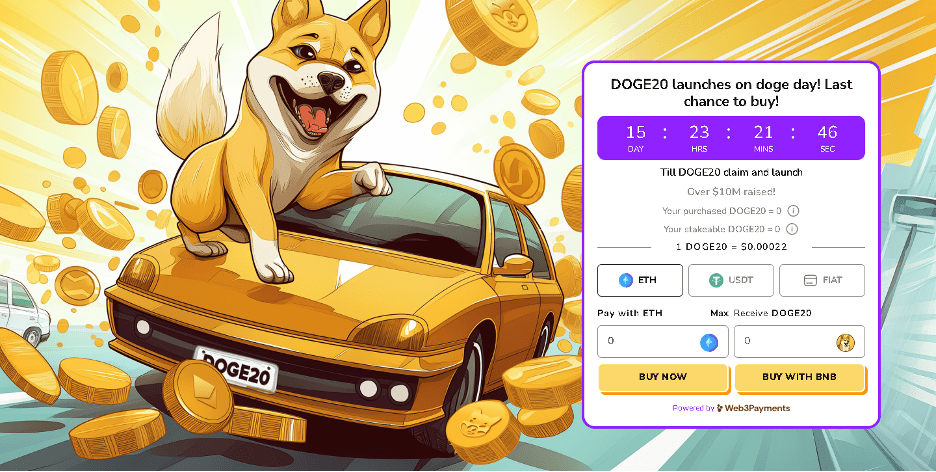

Dogecoin 20 ($DOGE20) – Prepared For Price Explosion As Halving And DOGE Day Approach

Although not based on SOL, we had to include Dogecoin 20 in our list due to the high profit potential it offers by aligning its launch with two major crypto events that could boost its momentum right out of the gate.

First up is the highly anticipated “DOGE Day” celebrations on April 20, which holds cultural significance for the Dogecoin maniacs.

Supporters of the OG meme coin use this opportunity to gather, share jokes and memes and rally behind their beloved DOGE.

But the launch of DOGE20 isn’t just to ride on Doge Day – it’s also perfectly timed for Bitcoin’s upcoming halving event, another key milestone that has ushered in historically significant crypto market swings.

So what exactly sets this sign apart from its iconic predecessor?

First, DOGE20 addresses environmental issues by using an energy-efficient proof-of-stake consensus mechanism instead of Dogecoin’s mining-based model.

Perhaps DOGE20’s most important feature, however, is its profitable strike program. Holders can stake their tokens to earn a portion of the 15% token supply allocated for strike rewards, spread over two years. Currently, the advertised APY for strikers exceeds 60%.

With more than $10 million raised during its recent presale, DOGE20 has already shown a rabid appetite from investors.

That’s why the team prepared a ‘Last Chance to Buy’ stage for all investors who didn’t make it in time during the official pre-sale hike.

Be sure to act fast though, as this one is also expected to sell out well ahead of schedule.

>>>Buy the Dogecoin 20 Project Now<<

Book of Meme (BOME) – $1M+ Solana Meme coin

Book of Meme took the meme coin world like crazy and quickly engraved its name among the most explosive launches.

After hitting the scene in March, this Solana-based token has soared to a staggering $1.4 billion market cap – briefly edging Dogecoin as the #2 most traded meme coin.

While BOME has retreated about 44% from those highs, it still has a strong following on social media.

Many holders believe that if the broader meme coin mania regains momentum, Book of Meme could be perfectly positioned for another significant boom.

>>>Buy now the best pre-sale project<<

Closure

Although whale moves have put a lot of selling pressure on the SOL blockchain, several coins with strong foundations have managed to fight off the bears.

That alone speaks volumes about their potential once the pressure eases and SOL trading volumes pump again.

Experts and crypto influencers suggest that SLOTH and DOGE20 might be your best dip buying option to prepare for the impending bull run.

However, keep in mind the volatility of the meme market, always do additional research and never invest more than you can afford to lose.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news