As the Bitcoin (BTC) Halving event concluded for the fourth time, the cryptocurrency market saw remarkable changes in key statistics.

These developments have led Charles Edwards, a market expert and founder of Capriole Invest, to issue bold predictions that indicate a paradigm shift in the BTC market.

Bitcoin Trading at ‘Deep Discount’

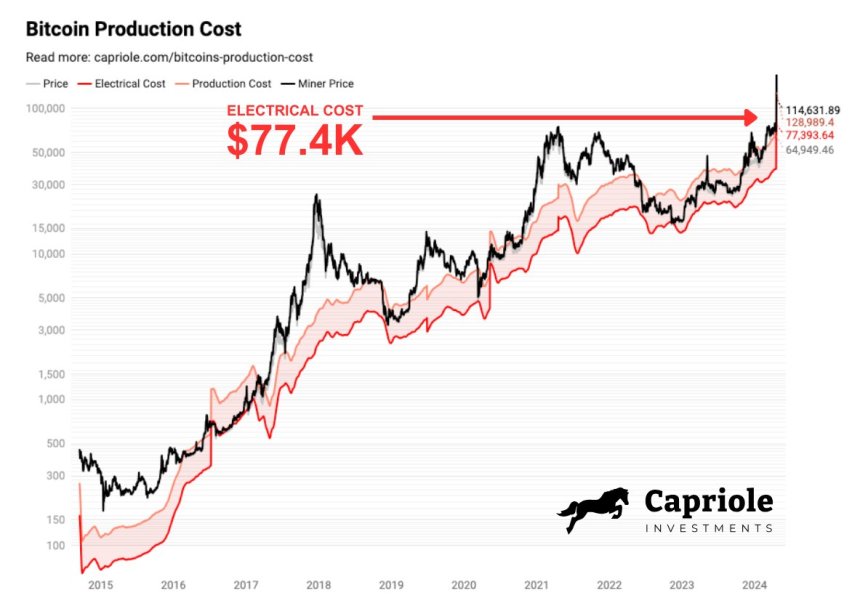

One of the most important metrics highlighted by Edwards is the staggering electrical cost associated with mining a single Bitcoin. Edwards reveals that these costs have now reached an astonishing $77,4000. This figure represents the raw electricity expenditure required to power the Bitcoin network for each newly mined BTC.

Another important metric that Edwards draws attention to is the Bitcoin Miner Price, which rose to $244,000 on Saturday. This criterion includes the block reward and fees miners receive for each Bitcoin they successfully mine.

Notably, this rise in mining price coincided with transaction fees soaring to $230, a fourfold increase compared to the previous peak of $68 set in 2021.

Considering the statistics above, Edwards suggests that BTC is currently trading at a “deep discount”. This is because BTC’s price is lower than the electrical cost of mining it.

Typically, this situation only lasts for a few days every four years, suggesting that it will only take a short time for the price to catch up and surpass this price level, which is slightly below BTC’s all-time high (ATH) of $73, 7000 is reached on March 14.

Edwards outlines three possible outcomes in the wake of these developments. First, he anticipates a scenario in which the price of Bitcoin experiences a significant surge.

Second, there is a likelihood that around 15% of miners may be forced to shut down due to unfavorable economy. Finally, Edwards suggests that average transaction fees are expected to remain significantly higher.

Based on the analysis of these metrics and the potential scenarios, Edwards boldly predicts that Bitcoin’s days below the $100,000 mark are “numbered.” While it remains to be seen which of the three outcomes will prevail, Edwards expects a combination of all three factors to contribute to Bitcoin’s price appreciation.

Optimal buying opportunity?

Bitcoin has shown significant price consolidation above the $60,000 mark since Friday, after temporary dips below this threshold amid growing anticipation for the Halving event.

Crypto-analyst Ali Martinez recently analyzed Bitcoin’s current price state, suggesting that a potential bottom has formed above these levels, increasing the likelihood of breaking the upper resistance levels soon.

According to According to Ali Martinez’s analysis, Bitcoin is aiming to establish the $66,000 price level as a crucial support zone. Data reveals that approximately 1.54 million addresses collectively purchased 747,000 BTC at this level. If Bitcoin successfully secures this support, it could pave the way for further upward movement.

Martinez identifies Bitcoin’s next critical resistance levels, between $69,900 and $71,200. These levels represent significant price barriers for BTC bulls, and Bitcoin may experience selling pressure at these levels.

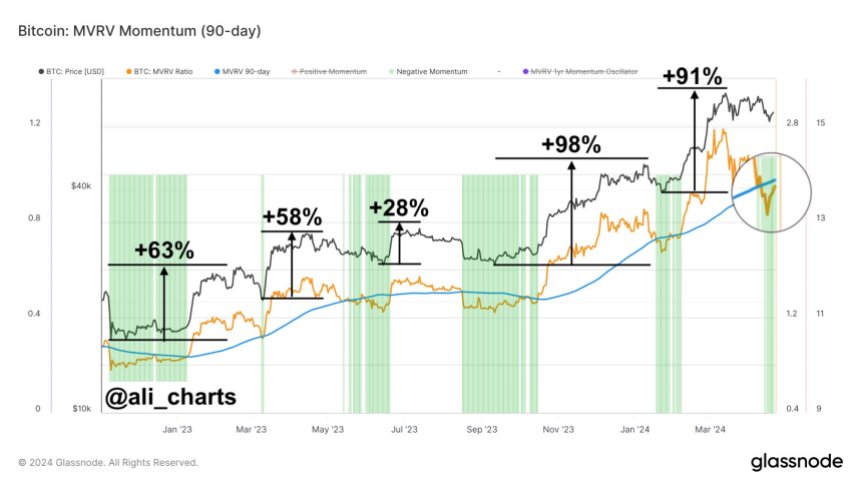

In addition, the analyst point to it that the Bitcoin MVRV ratio, a measure that compares the market value of Bitcoin to its realized value, has shown a promising pattern, as seen in the chart below.

Martinez emphasizes that when the MVRV ratio falls below its 90-day average since November 2022, it historically indicates an optimal buying opportunity for Bitcoin. Interestingly enough, so buying opportunities resulted in average gains of around 67%.

According to Martinez, based on current market conditions and an analysis of the MVRV ratio, now may be a favorable time to consider buying Bitcoin. The historical data and the potential for significant price appreciation support this view.

BTC is trading at $66,100, up 1.6% in the last 24 hours.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news