[ad_1]

In the world of crypto trading, analysts have been using technical analysis to predict future price changes for years. This method involves studying char patterns and candlestick formations. Before a signal pattern appears, the price goes through several steps to complete its formation. Whether the market is moving up (bullish) or down (bearish), the double-top and double-bottom formations serve as crucial tools in technical analysis. Let’s explore the importance and trading strategies associated with these patterns in the dynamic realm of cryptocurrency trading.

1. Double Tops & Double Bottoms: What you need to know

In simple words, Double Tops and Double Bottoms patterns are important tools in technical analysis. They help crypto traders to detect possible signals indicating a change in the trend.

1.1. Double top pattern explained

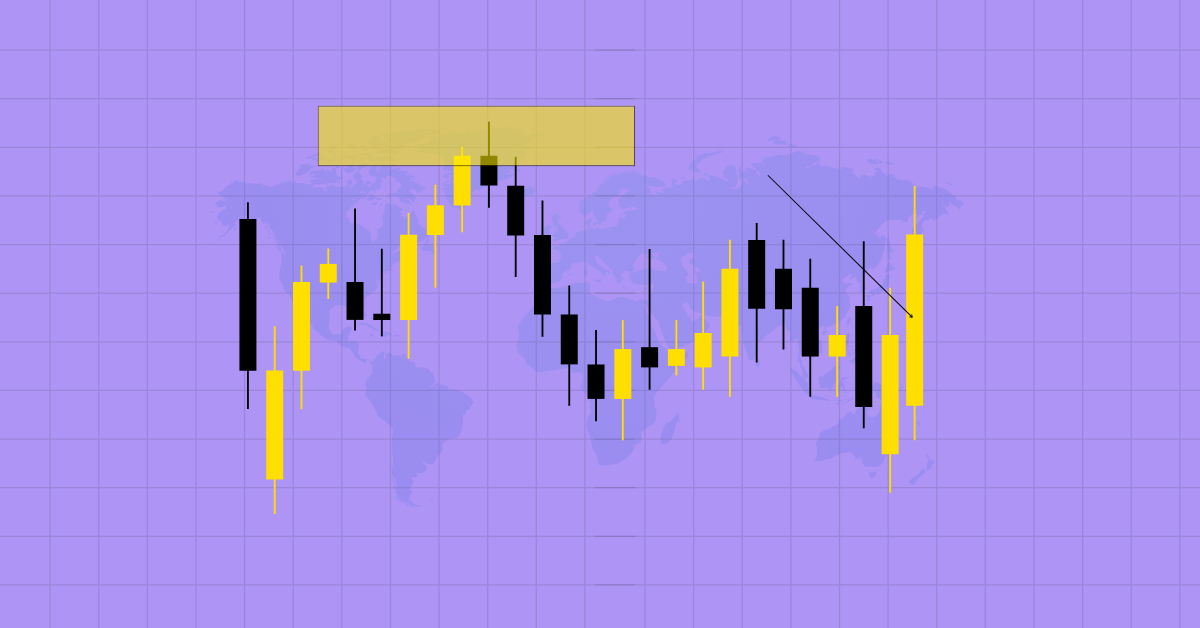

In crypto trading, a double top pattern occurs after an uptrend when prices reach the same high level twice, forming a resistance. This indicates a weakening uptrend, as the failure to make a higher high indicates a loss of momentum and buying strength. Cryptocurrency traders often interpret this pattern as a potential trend reversal, suggesting a shift from bullish to bearish market sentiment.

1.2. Double bottom pattern: what is it

In crypto trading, a double bottom pattern forms during a downtrend when prices reach the same low level twice, establishing a support. This indicates a potential reversal, as the failure to make a lower low indicates a loss of downside momentum and seller influence. Crypto traders interpret this pattern as a shift from bearish to bullish market sentiment, suggesting a potential uptrend.

2. How to identify double top and double bottom patterns

Identifying Double Tops and Double Bottoms in crypto trading involves recognizing key chart patterns that indicate possible trend reversals.

A double top occurs when an asset’s price reaches a high, then pulls back, returns to a similar high, and falls again. The pattern looks like the letter ‘M.’ Cryptocurrency traders often look for a breakdown of the ‘neckline’, a line connecting the trough between the two peaks, indicating a potential downtrend.

Conversely, a double bottom forms when the price hits a low, bounces, revisits a comparable low, and rises again, resembling a ‘W’ shape. The connecting line between the two lows is the ‘neck line.’ A break above the neckline indicates a potential uptrend.

In both patterns, the neckline serves as a critical level. A break below the double top neckline or above the double bottom neckline confirms the pattern. Crypto traders use this confirmation to make informed decisions about entering or exiting positions. These patterns are valuable tools for anticipating market shifts, providing insights into potential trend changes.

3. Best strategies to trade using Double Tops & Double Bottoms pattern

Here are the five best strategies for trading the Double Tops & Double Bottoms pattern.

Neckline Break Entry Strategy

In crypto trading, when a double top forms, indicating two price peaks, the neckline connects their reversal points. A short trade becomes viable when the price breaks this neckline, indicating a shift from an uptrend to a downtrend.

Conversely, with a double bottom, a neckline break above indicates a transition from a downtrend to an uptrend, triggering a potential long trade. This strategy relies on confirmation by clear trend outlines, which enhances its relevance in crypto market dynamics.

Neckline Break Plus Retracement Entry Strategy

After confirming a Double Top, choose a pullback entry at the neckline that offers resistance, which adds precision to entries.

For Double Bottoms, consider a pullback entry at the neckline pivoted support, especially when validated by extended pips candles, a crucial aspect in crypto trading where volatility is common.

In crypto trading, identifying crucial support or resistance levels is extremely important. Taking a trade when a Double Top or Bottom lines up with these levels ensures a strategic entry point, adding strength to the reversal signal.

Aggressive early entry strategy

When a double bottom forms at an important support level in crypto trading, an early entry at the second reversal point is considered aggressive. This approach bypasses waiting for the neckline break by using candlestick patterns, such as inverted long wicks, to indicate a reaction to the support level and buying presence.

Key level candlestick plus double pattern inside strategy

Combining candlestick patterns at key levels with Double Tops or Bottoms increases the trading quality in crypto markets. This nuanced strategy leverages the power of both candlestick analysis and pattern recognition, providing a comprehensive approach to price action trading in the volatile crypto space.

Imagine identifying a double bottom near an important support level. By analyzing accompanying candlestick patterns such as a bullish engulfment at key level, you get additional confirmation. This combination improves trade quality using both candlestick analysis and pattern recognition. For example, if a double bottom coincides with a bullish reversal candlestick pattern against a significant support, it reinforces the buy signal, making the strategy more robust in navigating the volatile crypto market.

4. Triple Top and Triple Bottom Pattern: A Brief Definition

In crypto trading, Triple Tops and Triple Bottoms are patterns that indicate potential trend reversals, similar to double tops and double bottoms.

A triple top forms in the middle of an uptrend when the price hits a resistance level three times, creating a triple peak. This confirmation of a trend shift comes with the break of the neckline, which promotes a short entry.

Conversely, a Triple Bottom develops within a downtrend as the price reaches a support level three times, forming a triple trough. This reversal is validated when the neckline breaks, indicating a potential uptrend.

Similar to Double Tops and Double Bottoms, strategies such as neckline breakout entries and pullback entries apply to Triple Tops and Triple Bottoms which provide a versatile approach to navigating crypto market dynamics.

End note

Mastering the art of identifying and trading Double Tops, Double Bottoms and their triple counterparts is essential to success in crypto markets. These patterns provide valuable insights into potential trend reversals, enabling traders to make informed decisions. By combining technical analysis, candlestick patterns and strategic entry approaches, crypto enthusiasts can navigate the dynamic crypto space with greater confidence. Stay alert, adapt to market shifts and take advantage of these patterns to stay ahead in the ever-evolving world of cryptocurrency trading.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news