[ad_1]

Bull run or bullish market trend or concept of bullish in stock market stock exchange 3d illustration

For Bitcoin (BTC), the largest cryptocurrency in the market, the month of September saw a lack of definitive strength from both bulls and bears, leading to a period of sideways chop and rapid bouts of volatility.

Material Indicators, a prominent crypto analysis firm, sheds light on the prevailing market conditions and highlights the intricacies of short-term price action (PA) against the backdrop of macro sentiment.

Unpredictable market conditions prevail as BTC searches for direction

Despite bearish macro sentiment, where a broader downtrend is expected, short-term price action often deviates from the macro trend. This phenomenon explains the short-term pumps and rallies occasionally observed even within a prevailing downtrend.

Material indicators highlight the importance of understanding these dynamics and the potential implications they hold for Bitcoin.

Yesterday’s performance of the leading cryptocurrency may have come to an end, but Material Indicators are pointing to indications that another rally may be on the horizon.

The firm highlights the Trend Precognition A1 indicator developed and used to detect micro trends, and macro trends by the firm – continues to show a slight increase in bullish momentum across the daily (D), weekly (W) and monthly (M) graphs , as seen above.

This trend suggests the possibility of a resurgence in Bitcoin’s value, albeit with the need for caution and further analysis.

At the time of writing, Bitcoin is currently trading at $25,800, continuing its long period of sideways price movement since the beginning of the month. However, it is worth noting that Bitcoin failed to regain the critical $26,000 level, which holds significant importance for the cryptocurrency.

Retrieving this level is crucial to nullify any potential bearish pressure and reduce the possibility of Bitcoin experiencing a further drop in its price.

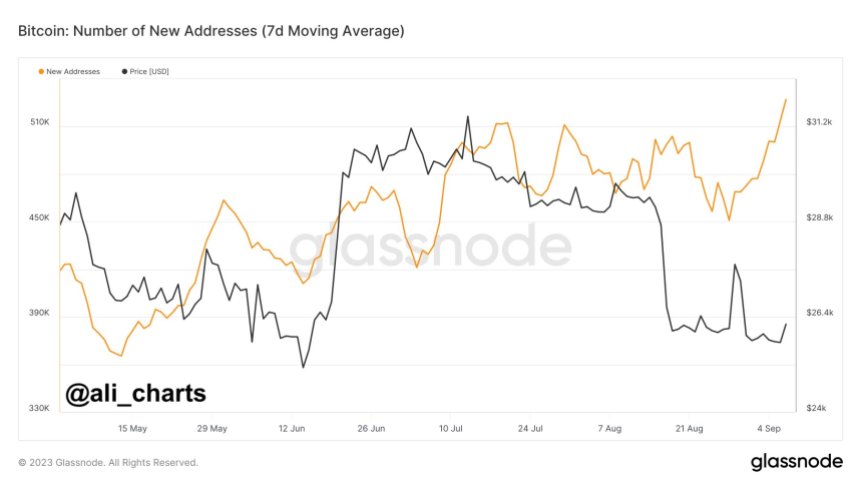

Surge in new Bitcoin addresses indicates growing interest

Amid ongoing uncertainty and sideways price action, has an interesting trend emerged which sheds light on the growing interest in Bitcoin.

Notably, approximately 527,000 fresh Bitcoin addresses are created daily, reaching a new annual high. Renowned crypto analyst Ali Martinez digs into the significance of this boom and its implications for the cryptocurrency market.

The surge in new Bitcoin addresses indicates a growing curiosity and engagement with the digital currency, even during a period when its price has seen occasional drops.

This surge in address creation suggests that an increasing number of individuals are showing interest in Bitcoin, possibly attracted by its underlying technology, decentralized nature, and potential for financial independence.

For long-term investors and advocates of Bitcoin, this increase in address creation serves as a positive sign, reflecting continued interest and confidence in the cryptocurrency’s network. This shows that individuals are not deterred by short-term price volatility and are committed to participating in the Bitcoin ecosystem for the long-term.

By actively creating new Bitcoin addresses, individuals essentially establish a connection to the network and position themselves to engage in various Bitcoin-related activities, including sending and receiving funds, participating in decentralized applications (DApps), and the broader cryptocurrency ecosystem.

Ali Martinez emphasizes that this upward trend in address creation is significant, as it represents a growing user base and a potential influx of new entrants into the Bitcoin market.

As more individuals join the network, it strengthens the overall resilience and legitimacy of Bitcoin, further solidifying its position as a prominent player in the global financial landscape.

Featured image from iStock, chart from TradingView.com

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news