The price of BTC has come down from its all-time highs, after 4 failed attempts to move to new highs in 2024. This time the $60k level is under threat. This is why BTC is down again.

Crypto investors tend to always ask the question “what happened” when the price of Bitcoin is lower. Instinctively very likely to turn to X for BTC analysis. Needless to say, it is impossible to provide a thorough analysis to understand why BTC is down in a tweet.

This article provides a detailed examines the factors contributing to Bitcoin’s (BTC) recent decline in value. It helps crypto investors to understand what is really going on; it explains the current conditions and market environment that make it almost an inevitable outcome for the price of Bitcoin to fall.

RELATED – Bitcoin Price Drop Predictions

The author, Charlie Morris, examines the relationship between Bitcoin and broader economic indicators, highlighting how the cryptocurrency responds to changes in inflation, interest rates and overall economic growth.

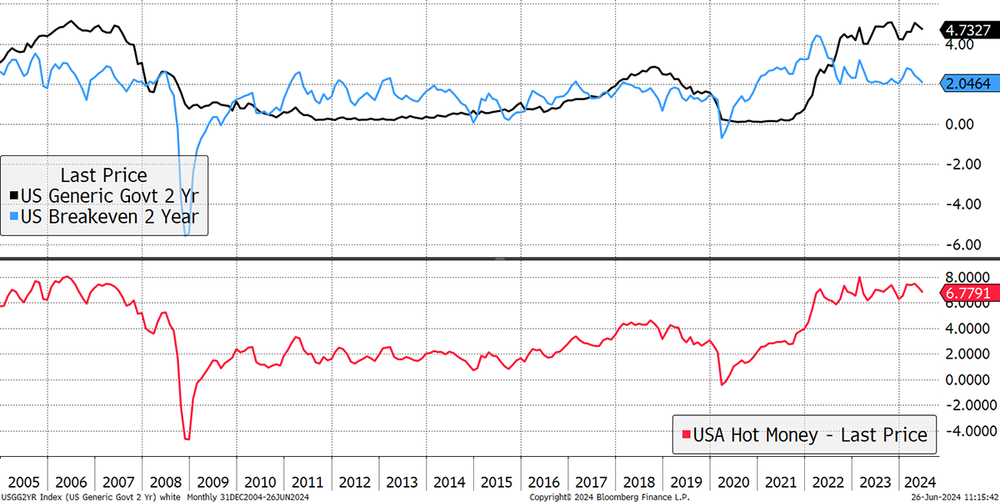

This analysis is based on the concept of “hot money”, which refers to periods when the financial system is flush with cash, leading to rising short-term interest rates and inflation.

Bitcoin’s macro picture: Bitcoin loves hot money

The Money Chart, which I often refer to in The Multi-Asset Investor, explains the regime that fits the asset classes. Bonds and stocks like low inflation, since they are financial assets, and do well when fiat money stops. In contrast, Bitcoin and gold keep inflation higher as they become stores of value during periods of fiat decline. But as we move to the x-axis, Bitcoin and gold diverge. Bitcoin likes rising rates because it happens when the world is full of cash and the economy is growing. In contrast, gold likes the economy when it is weak and rates fall.

The Money Card

Source: ByteTree

I repeat this because many investors seem to think that Bitcoin likes rates to fall, while this thesis suggests that it wants them to rise. There is one more difference between what ATOMIC believes about Bitcoin and mainstream opinion. Bitcoin is much more sensitive to short-term rates, while gold is linked to long-term rates.

To illustrate this on Bitcoin, the two-year US bond yield (black) is added to two-year inflation expectations (blue), which becomes a kind of hot money index (red). In simple terms, the higher rates and inflation, the more money there is in the system. The graph starts in 2005 to illustrate the freezing of the economy in the 2008 credit crisis and the driving force beforehand.

Hot money with two-year rates and inflation

Source: Bloomberg

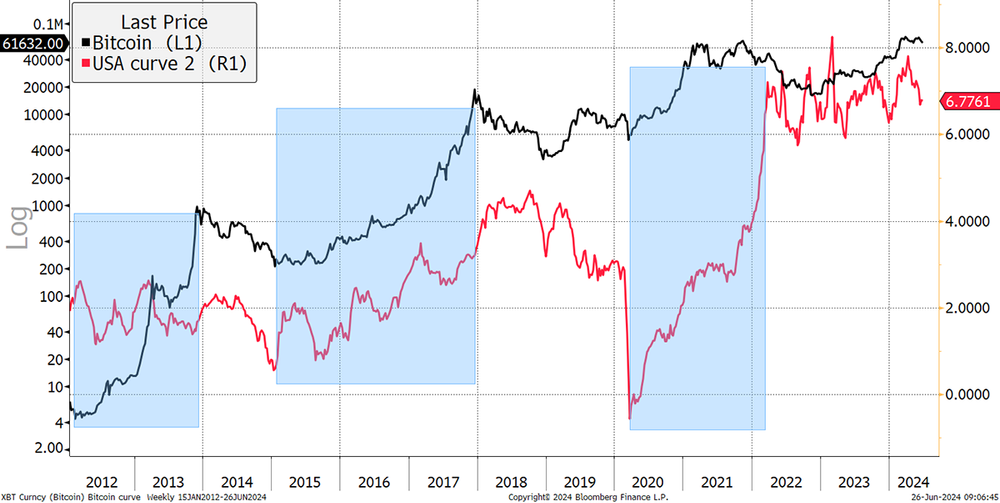

I will next transfer the hot money with Bitcoin. The link is imperfect, as there are many other influencing factors that matter, but it’s pretty clear that there is a link. The blue squares highlight Bitcoin bull markets, which tended to coincide with the amount of hot money in the financial system.

Bitcoin and Hot Money

Even more impressive are the links to Bitcoin bear markets. In both 2014 and 2018/9 we saw rates and inflation fall, coinciding with a period of Bitcoin weakness. When the reading turned negative in March 2020, Bitcoin crashed, just like in November 2014. The 2020 bull market followed rates and inflation higher until early 2022 when the situation stabilized. Now the hot money is falling again, from very high levels. If you believe that inflation is contained and rates are back to the floor, then Bitcoin is in for a rough ride.

i don’t

Canada cut rates last month as they felt the inflation battle was won, as it fell to 2.3%. Then inflation was published yesterday at 2.6% for the year and 0.6% for the month. There is a chance that they moved to cut too early. But then the developed economies cannot afford high interest rates for much longer, and so the system will force austerity, which will cause inflation to resume. The hot money indicator could stay quiet with lower rates, provided higher inflation can offset this.

It all comes back to the economy and nominal GDP growth. The economist Knut Wicksell suggested that interest rates should approach the level of nominal GDP growth (real growth and inflation). This idea is linked and is something we often see in emerging markets where rates and inflation remain structurally higher than in developed markets. I don’t see how such an environment can be bad for Bitcoin.

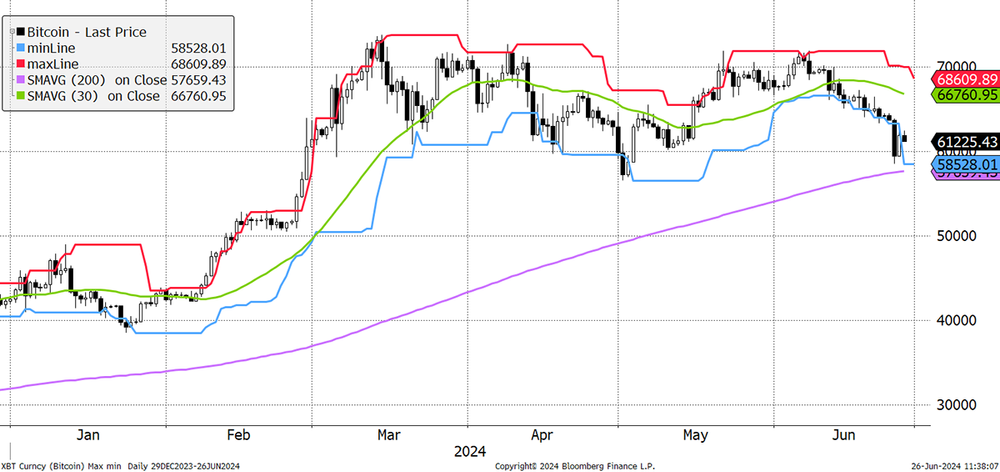

Bitcoin price down: Bitcoin’s technical neutral

Still, the trend weakened. Bitcoin’s price is hovering around the 200-day moving average, which is near a support level. We cannot ignore the failure to make a new high after March. There were four attempts and all failed.

Bitcoin 2/5 trend score

Source: Bloomberg

The $60k zone should hold, but it doesn’t have to. This could be an early warning for markets in general. Bitcoin has historically been a useful leading indicator.

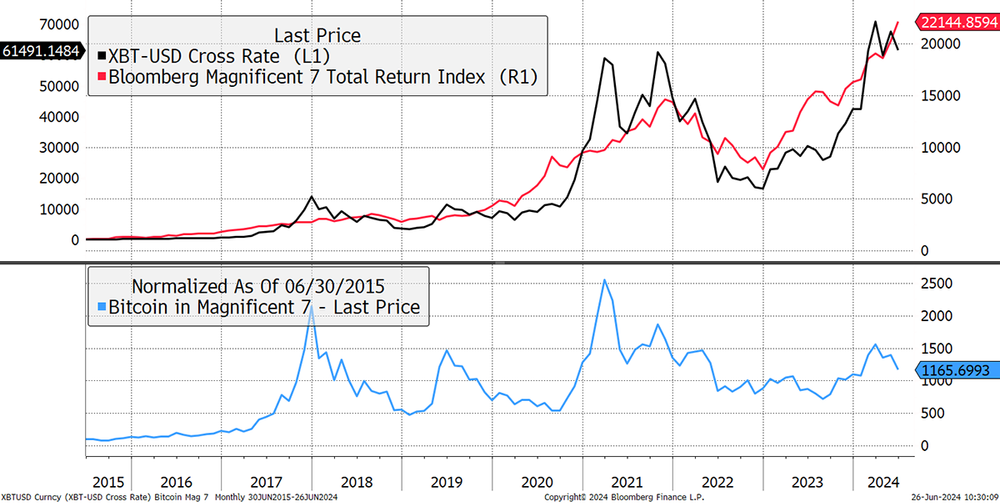

Then there is the difference with the Power 7 stocks (NVDA, AAPL, etc.). The correlation is clear, but Bitcoin declined. More importantly, and notwithstanding the possibility of the leading indicator, the lower blue line is half the level it was in 2021 when Bitcoin last rode high.

Bitcoin and the Magnificent Seven

Source: Bloomberg

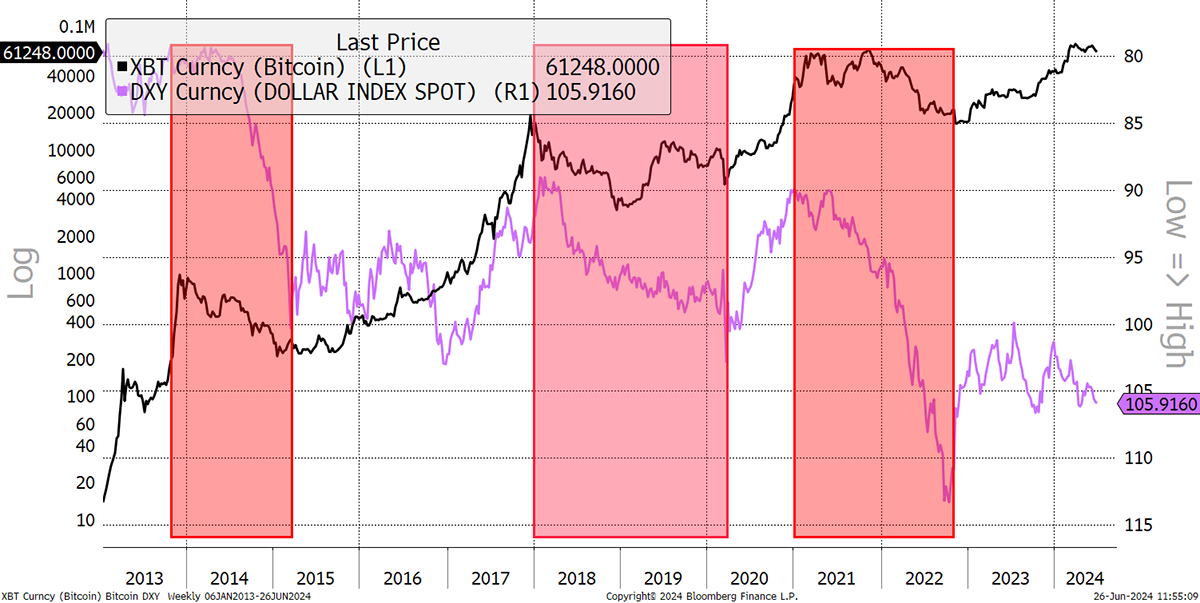

Is it a difficult comparison? Potential. We should not worry about the delay because AI currently has the spotlight while Bitcoin is back in the shadows. That will change, but maybe not for a while. We also need to consider the dollar, which is shown in reverse in the chart below. A strong dollar has been bad news for Bitcoin.

Bitcoin and the dollar

Source: Bloomberg

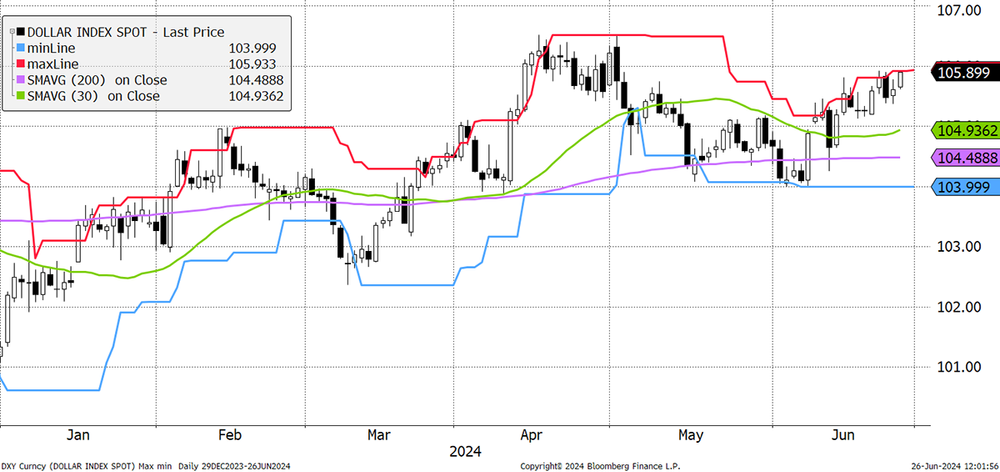

And we have a strong dollar. The trends are positive and a break higher could happen at any time.

Dollar Index 5/5 Trend Statement

Source: Bloomberg

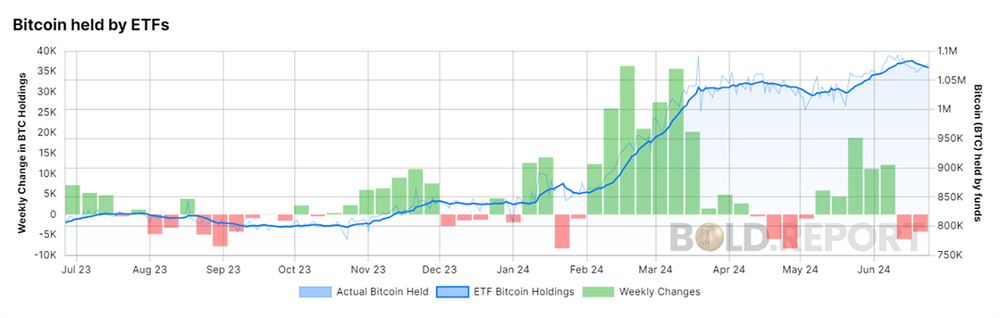

Bitcoin Investment Flow: Neutral

The super strong flows in February and March, caused by the new ETFs, are over. There was another valiant attempt recently, but that too is over. The Bitcoin network is currently seeing modest outflows.

Source: BOLD.report

This can be confirmed because just as Bitcoin and Gold have a low price correlation, so does the flow it seems. As investors face lower rates, they stopped selling the gold ETFs and started allocating them. It will be interesting to see how these flows battle it out.

Conclusion: Why Is the Price of Bitcoin Down… Again?

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news