[ad_1]

The Dow Jones Industrials has a very interesting long-term chart from which we can draw meaningful conclusions. In fact, what we’ve found is that a top-down approach to the Dow Jones long-term charts yields some really valuable insights. Put another way, if we look at Dow Jones long-term charts on various time frames, we get much more incremental insights from the Dow Jones 20 year chart. Combined with directional bullish 2024 forecasts,

[Ed. note: Last update November 2023. We originally wrote this article in September of 2022 but we update charts and commentary every other month. The charts and commentary mention the month of the last update.]

Dow Jones in 2024 – no secular turning point Dow Jones long-term charts +20 years Dow Jones long-term chart on 20 years The ‘line in the sand’ levels Dow Jones long-term charts on less than 20 years Conclusions

Dow Jones in 2024 – no secular turning point

The single most important fear of investors is the fear of a stock market crash.

That’s why we want to start by looking at a potential bearish secular reversal that could occur in 2024.

Let’s review conclusions and observations from recent writings.

How to know if stocks will rally in 2024?

The answer to the question “will stocks tank or even crash in the first half of 2024” can be answered by (a) leading indicator TIP ETF should not push more than 3 monthly candles below 105 points (b) volatility index VIXY should not push no more than 5 daily candles above 27.2 points.

Will Industrial Stocks Be Positive in 2024?

The answer to this question will be clear long before 2024 kicks off. The long-term chart of XLI will have the answer before January 2024.

Although the above two points are not intended to represent a complete analysis, on the contrary, we can confirm that markets are moving in the right direction, that is, to confirm that the first quarters of 2024 will be positive for stocks. This is why we believe that the Dow Jones Industrials will do well in 2024, for sure the first 4 to 5 months of the year.

Dow Jones long term charts +20 years

We follow a top-down approach in this article. We start with the longest time frames, especially the Dow Jones long-term chart over 100 years and 30 years.

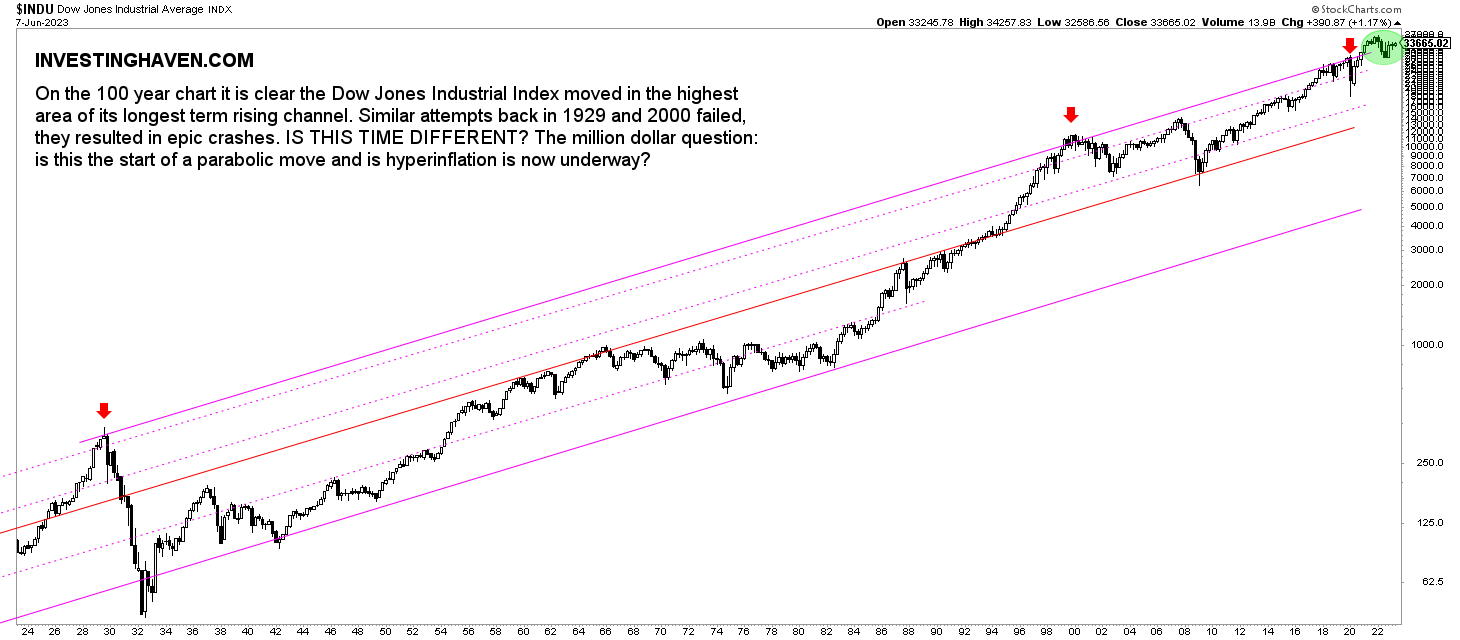

The Dow Jones historical chart over 100 years comes with a few takeaways:

The Dow Jones reached the top of the channel. Anytime in the past this has happened (1929, 2000, 2020) it has led to massive market sell-offs. The one difference between now and then is that those previous rises to the top of the channel came with very steep, multi-year rallies. The 2021/2022 test of the top of the channel did not come after a steep rally. For the first time in history, the Dow Jones surpassed the top of the 100-year channel. This happened between March 2021 and April 2022. At the time of updating this article, in November 2023, the top of the channel comes in at 35.5k points. The top of the channel will be around 37,000 points (ATH) in the period Feb to April of 2024. Since our 2024 forecast is bullish for stocks (bull bias, limited bullish momentum), we believe this will be the first time in history that the Dow Jones will trade near the top of its 100-year channel for such an extended period of time.

Note that we cannot derive detailed insights, certainly not medium-term oriented predictions, from this ultra long Dow Jones chart.

Chart update: November 2023

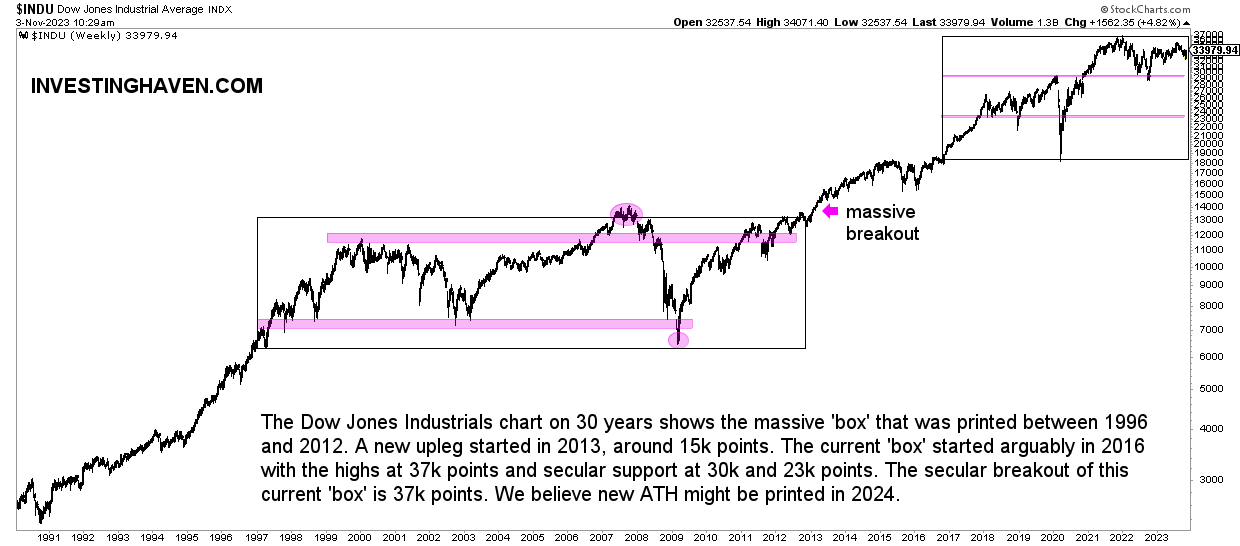

Dow Jones long-term chart over 30 years is a time frame that comes with more useful insights.

First, we see massive consolidation periods: 1997-2012 and 2016-present.

Second, the 2020 highs acted as support in 2022. Needless to say, the 28.8k level in the Dow Jones is crucial.

Third, in the current consolidation period, we tend to see 3 levels, as indicated by the pink lines: 23k and 30k points. In our previous update, in June 2023, we said: “We believe 30k could be tested this decade.” Interestingly, a few months later, in October 2023, the Dow Jones came quite close to the 30k test. It fell to 32,380 points. Our view, in November of 2023, is that this is a higher low versus September of 2022, making it unnecessary to retest the 30k level.

Chart update: November 2023

We don’t see the Dow Jones trading near 40,000 before the end of 2023. However, we believe there is a real possibility that the Dow Jones will test 40,000 before the summer of 2024. For sure, we expect that 40k will be exceeded in the Dow Jones in late 2024 and in 2025. Remember, the top of the 100 year channel comes in around 37,000 in Feb/April 2024.

Dow Jones long-term chart on 20 years

In this paragraph we include the Dow Jones long-term chart over 20 years. In this way, we work with the takeaways from the previous section.

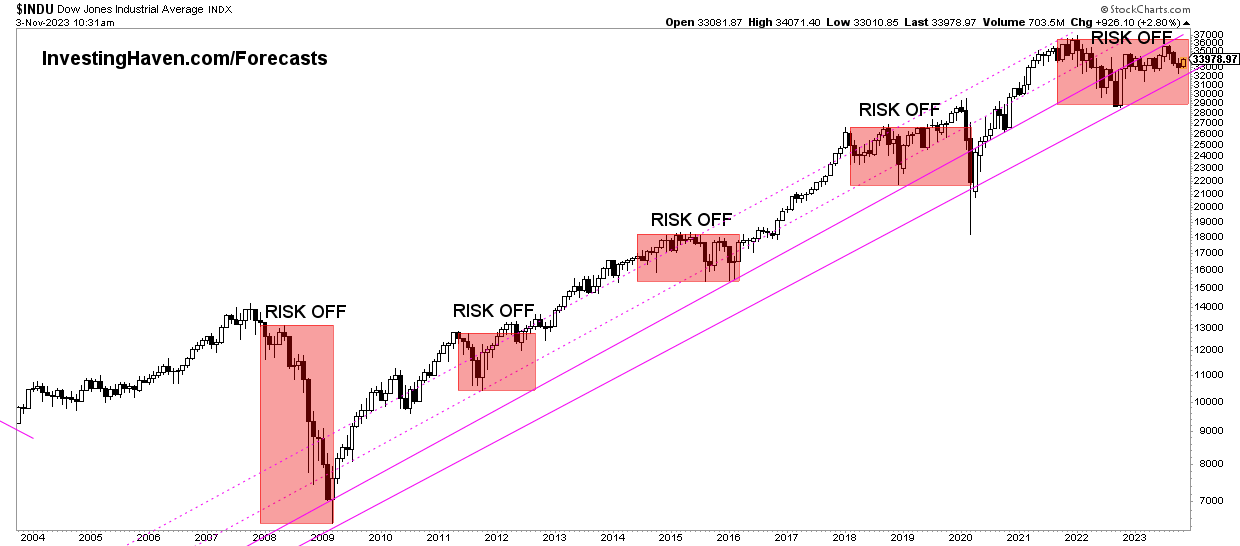

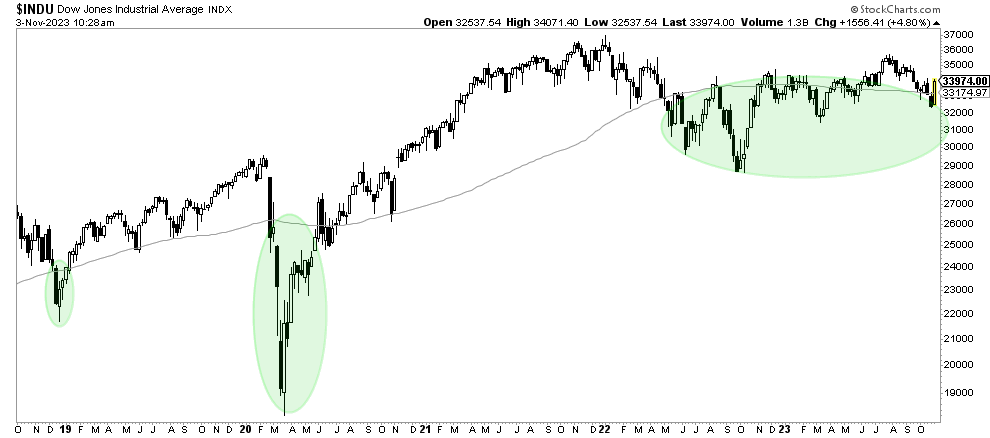

What stands out on the Dow Jones long-term chart over 20 years are the 5 ‘risk-off’ periods since 2007. Each such period has tended to last between 12 and 24 months. The ongoing ‘risk-off’ period should end in January 2023, but no later than the 2nd half of 2023.

The Dow Jones Industrial Average is expected to move higher once this ongoing ‘risk-off’ period is complete. We need a lower time frame to understand when that would be and what price point is going to be the turning point.

Combining the insights from the Dow Jones charts +20 years with the one below, we conclude that there is a high probability that the Dow Jones will move to 37k points in the first half of 2024 (where it is the ‘end of the risk off structure’ and also the 100-year channel). We can reasonably expect a quick pullback, followed by a secular breakout later in 2024 or 2025. This is how we combine insights from the multiple timeframes with the Dow Jones long-term chart over 20 years.

The ‘line in the sand’ levels

As stated in the previous sections, we strongly believe that the lows of February 2018 and June 2022 are the lows in the sand price levels. In particular, the 23,000 area and the 28,000 area in the Dow Jones Industrial Average are the most important levels to watch, not only in 2023, but also this decade.

Any monthly close below this area, as well as 3 to 5 consecutive weeks closing below this area, would be a huge red flag for US stock markets as well as global stocks.

As long as the ‘line in the sand’ area is respected, we may see a continuation of the long-term bull market that may have started in 2013.

In other words, the Dow Jones long-term chart over 20 years teaches that this ongoing bull market (1) may have started in 2013 (2) as long as it continues, it could be similar to the early 90s. As seen on the chart above, there was a lot of upside potential in 1991. It was a very volatile year, admittedly, but in the grand scheme of things it represented a small blip, barely visible, and a massive buying opportunity.

The point is this: as long as the Dow Jones Industrials continue to make higher lows and continue to respect the structure we find on the Dow Jones 20 year chart, we are in a secular bull market. It is an insight based on the long-term pattern, which is why the long-term Dow Jones 20-year chart is so important.

Dow Jones long-term charts on less than 20 years

What else can we find on the Dow Jones charts, albeit shorter time frames than 20 years?

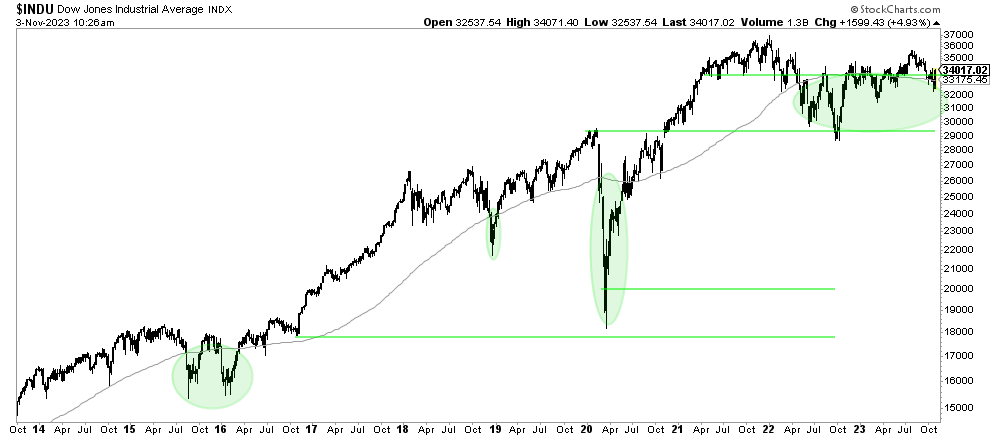

First, the Dow Jones 10 year chart comes with a very interesting insight. The long-term moving average (90 weeks) is the one that appears on the next chart. As seen, ‘risk-off’ periods usually come with a period in which the Dow Jones trades below its 90-week moving average for a certain period of time.

In 2015/2016 it took the Dow Jones a double W reversal over 12 months. In 2018, the pullback below the 90WMA took about 3 months. In 2020, it took the Dow Jones about 6 months below its 90 WMA.

In 2022, the Dow Jones fell below its 90 WMA in April. We can reasonably expect the Dow Jones to clear its 90 WMA in March 2023 at the latest. Note that the level to clear is 33.6k points, just 6% above the 31.7k point ‘line in the sand’ level we mentioned before.

As we add comments in November 2023, we do see the Dow Jones continue to trade around its 90 WMA for 6 full months. In June 2023, we wrote: “One final sell-off could occur by the start of the summer of 2023 before the reversal confirms its bullish intent and resolves higher.” Interestingly, this is exactly what we got, in Sept/October 2023. We believe, at the time of writing, that the Dow Jones is poised to move higher, and ‘kiss its 90 WMA goodbye’.

Chart update: November 2023

The 5 year Dow Jones chart zooms in and gives a little more nuance and detail. We can reasonably expect 2022 to be all about a W reversal below the long-term moving average, one that could take nearly 12 months to complete.

As we add comments in November 2023we see a successful retest of the 2023 lows around 32k points.

Chart update: November 2023

Conclusions

This is what we deduce from the Dow Jones long-term charts over 20 years, 30 years, 100 years:

The top of the 100 year channel has been reached. Although it has come with a huge sellout every time it has been done in the past (1929, 2000, 2020), we believe it won’t be as bad this time. The reason is that the rally that preceded it is not that steep. The Dow Jones is likely to trade in a wide range this decade: the 2017 lows to the 2021 highs. The line in the sand levels are 23k and 28k points. Other important price points, this decade, will be 31.7k and 33.3k. We do expect at least one market to sell off in the next 3 to 4 years and the levels tested could be 23k (probably temporary). We believe that a mini version of the Corona crash could occur in the first half of 2024. On the other hand, we see the Dow Jones clear ATH at some point. The Dow Jones 100 year channel will cross 37,000 points in Feb/April 2024. As we add commentary in November 2023, we see a successful test of the 90 WMA. The market is poised to move higher, the Dow Jones poised to successfully clear its 90 WMA.

From the 10- and 5-year charts, we conclude that 2022 was all about creating a reversal below the long-term moving average (90 weeks). It usually took the Dow Jones between 3 and 12 months to complete a bullish reversal below its 90 WMA. The Dow Jones fell below its 90 WMA in April 2022 and should complete its bullish reversal in March 2023 at the latest (which was confirmed when we added comments in November 2023).

Do you enjoy our work? We provide weekly, detailed market analysis to members of our Momentum Investing premium service. As part of the service, we offer detailed sector coverage in AI and robotics stocks, silver, lithium and graphite, alternative energy. If you prefer to let us do the hard work while you focus on other challenges in your life, you may want to consider our unique passive income service – create compound portfolio growth by outsourcing your trades.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news