Key takeaways

On-chain data helps analyze investor behavior and potentially identify market trends. While blockchain data brings a unique perspective on investor behavior, one must also consider technical and fundamental analysis to make well-informed trading and investment decisions. Phemex, one of the most popular cryptocurrency exchanges in the industry, offers a wealth of information about on-chain statistics to help you become a successful trader.

Share this article

![]()

On-chain analytics (also known as blockchain analytics) is an emerging field that obtains information about public blockchain activity.

Use of On-chain Data

For anyone unfamiliar with the technology, blockchains are public databases where information regarding network transactions (but not the identity of who transacts) is accessible by anyone.

While technical analysis focuses on the price and volume of an asset, on-chain analytics focuses on extracting data from the state of the blockchain, such as transaction activity patterns, the concentration of token ownership, social sentiment or exchange flow.

This area of analysis emerged in 2011 with the creation called Coin Days Destroyed (CDD), a metric used to verify the age of tokens transferred on a given day to measure market participation. Since then, we have seen the creation of a much larger number of on-chain analysis tools (Glass button alone has developed more than 75 on-chain metrics).

The following section summarizes the most useful and commonly used on-chain indicators that crypto-investors can use to evaluate activity on the blockchain:

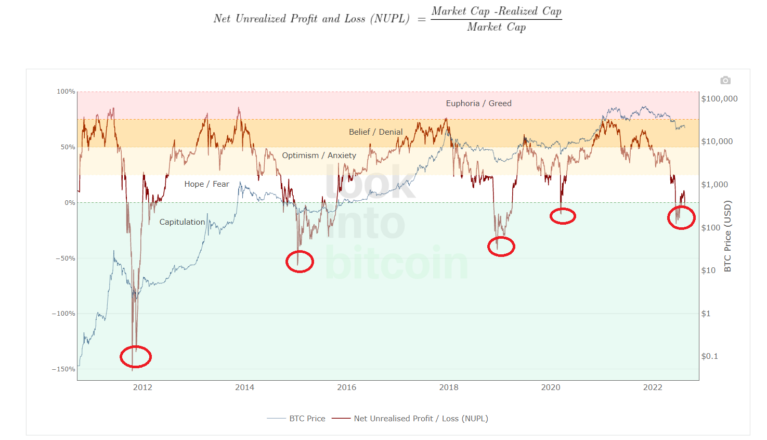

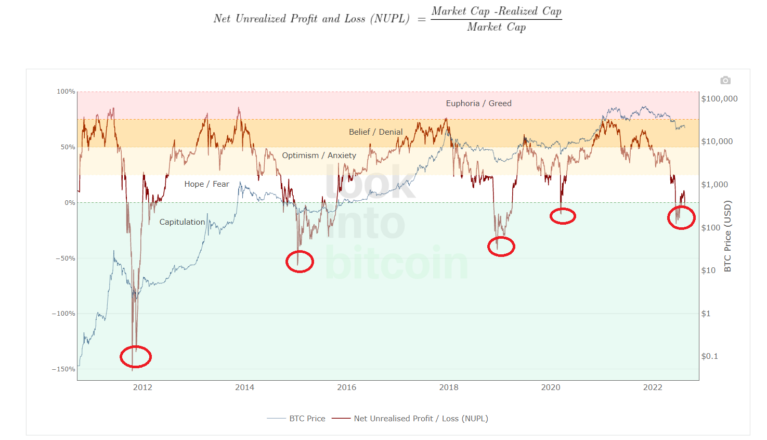

Net Unrealized Profit or Loss (NUPL): NUPL tells us whether the market as a whole is holding an unrealized profit or loss. According to lookintobitcoin.comUnrealized profit/loss is obtained by subtracting realized value from market value.

Market value refers to the current price of a token multiplied by the number of tokens in circulation. The realized value is an average of the added value of each coin when it was last moved, multiplied by the total number of coins in circulation.

By dividing unrealized profit/loss by market capitalization, we obtain the net unrealized profit/loss.

A NUPL greater than zero means that, in aggregate, investors are currently in a state of profit. If it is less than zero, the market as a whole holds an unrealized loss.

Market Value to Realized Value (MVRV): this metric helped predict Bitcoin tops and bottoms. It determines whether the current market capitalization is overvalued or undervalued. MVRV is calculated by dividing market value daily by realized value.

The higher the ratio, the more people will realize profits if they sell their tokens. And vice versa: the lower the ratio, the more people will take a loss by selling their coins.

Funding rates and open interest: investors use both indicators to weigh the interest levels in the crypto market.

Funding Rates are regular payments that perpetual contracts (perps) traders must pay to keep an open position. Perpetuals are a type of futures contract that does not have an expiration date. These payments ensure that the perp price and spot price often coincide.

On the other hand, open interest (a volume-based measure) is the sum of all open futures contracts. However, Open Interest does not tell us whether the contracts are long or short. Open interest is useful as it shows how much capital is flowing into a market and can help predict market tops and bottoms when combined with price trends.

Spent Output Profit Ratio (SOPR): this is another tool that helps measure the market sentiment. The ratio indicates whether investors are selling at a profit or loss at a given time. This is obtained by dividing the USD value when the UTXO (wallet balance) is created by the value when the UTXO is spent.

A ratio greater than one means that, for a specific time frame, more people are selling coins at a profit. Conversely, a SOPR of less than one implies that more coins are being sold at a loss compared to their purchase price.

Exchange Flow: Exchange flows follow the movement of coins entering and leaving exchanges.

When exchange inflows are dominant, we assume that traders sell their tokens to protect profits. Heavy inflows can signal the start of a bear market or correction.

Exchange outflows may indicate that token buyers are sending their assets to escrow wallets with the intention of holding, thus creating a shortage of tokens in exchange and increasing their price.

The combination of on-chain analysis and other technical and fundamental indicators can help investors make wise investment decisions. Phemex provides all this knowledge in one hub, allowing users to get the most out of their chain and trading skills, filter out the noise and profit by predicting the next market move.

Share this article

![]()

The information on or accessed through this website is obtained from independent sources that we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not provide personal investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become out of date, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete or inaccurate information.

Crypto Briefing can supplement articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight – and oversight – of experienced crypto-natives. All AI-augmented content is carefully reviewed, including for factual accuracy, by our editors and writers, and is always drawn from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision about an ICO, IEO or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice regarding an ICO, IEO or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sale, securities or commodities.

See full terms and conditions.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news