[ad_1]

What is DeFi 2.0?

DeFi 2.0 refers to the next generation of decentralized finance platforms built on faster, more scalable blockchain networks outside of Ethereum. While DeFi 1.0 mainly runs on Ethereum, DeFi 2.0 uses more advanced layer 1 and layer 2 networks such as Solana, Avalanche, Polygon, BNB Chain, Arbitrum, etc.

DeFi 2.0 aims to provide users with significantly faster transactions, lower fees, improved interoperability between chains, and greater accessibility. This expands DeFi’s reach beyond just crypto-enthusiasts to mainstream adoption. Leading DeFi 2.0 projects are building the foundation for the future of decentralized finance.

Why invest in DeFi 2.0?

Investing in top DeFi 2.0 projects early on can offer several benefits:

Early access to disruptive next-generation platforms before widespread adoption. Potential for much higher rewards and return opportunities. Drastically lower transaction fees compared to Ethereum DeFi. Ability to use protocols seamlessly across multiple chains. More advanced DeFi infrastructure for complex financial services.

Although DeFi 2.0 comes with risks typical of emerging technology, it offers great potential for the future of crypto.

Top DeFi 2.0 Projects to Watch

Here are some of the most promising DeFi 2.0 projects to research and consider investing in:

Quick Summary: Best DeFi 2.0 Tokens

roof (TET)

Tectum, developed by the cybersecurity firm CrispMind, stands out as a pioneering Layer 2 blockchain solution, particularly overcoming challenges posed by networks such as the Lightning Network. With a remarkable 1.3 million transactions per second (TPS) without splitting, it is recognized as the world’s fastest blockchain.

Launched by Tectum, SoftNote enables instant, cost-free, trustless crypto-transactions and generates digital cash, offering limitless scalability across blockchains and aligning with its vision of a decentralized, frictionless monetary system that ensures universal “equal opportunity”.

Besides being the fastest blockchain, Tectum is establishing a decentralized ecosystem of various products, secured by the CrispMind team’s eight-plus years of cybersecurity expertise. It provides multiple tokens, including Tectum Emission Token (TET) and its ERC-20 and BEP-20 wrapped versions, each offering unique utilities such as SoftNotes coining and merchant fee reduction, supported by clear tokenomics and diverse revenue paths, such as SoftNote coining and merchant terminal fees.

Tectum, with a forward-looking roadmap introducing SoftNote and NFT marketplaces and cross-chain integration, has created 1.4 million+ SoftNotes and attracted 45,000+ wallet holders. Positioned for significant blockchain growth, especially with the integration of the T12 protocol into the Metamask wallet, Tectum allows users to transfer Bitcoin, Ethereum and USDT for free.

For more information, check out their Pitch Deck, Website, Telegram, Twitter, Facebook, Tokenomics and WhitePaper.

GMX (Arbitration)

GMX is a decentralized venue and perpetual trading platform built on Arbitrum, an Ethereum layer 2. It offers fast trades across thousands of currency pairs with minimal slippage. Users can also deposit GMX or provide liquidity to earn rewards.

GMX has merged its previous utility tokens into a simplified GMX management and reward token. By leveraging GMX, users can earn a share of platform fees and vote on proposals.

RLB(Solana)

RLB is the utility token for crypto casino and trading platform Rollbit. Users can stake RLB for chances to win a share of the casino’s profits. The lottery system is designed to drive demand for RLB.

Although not yet on major exchanges, RLB can be traded on DEXs such as Orca, Raydium and Jupiter on Solana. The total token supply is 5 billion RLB.

HMX (Arbitration)

HMX (formerly Perp88) is a rebrand that introduces a V2 to improve decentralized perpetual trading. Upgrades include lever market fabrication, improved LP protection and an expanded battery lineup.

HMX moves to Arbitrum for its low fees, growth potential and robust DeFi ecosystem. It will also introduce a management token for protocol fees and adoption incentives.

SummerFi (multiple chains)

SummerFi enables no-code DeFi automation across chains like BNB, Polygon, Avalanche etc. Users can build automated yield farming strategies without coding expertise. This maximizes earning potential.

Ethereum 2.0 (Eth2)

Ethereum’s gradual transition to Eth2 will enable greater scalability, security and sustainability through proof of play. This will empower DeFi 2.0 platforms built on Ethereum, such as Arbitrum.

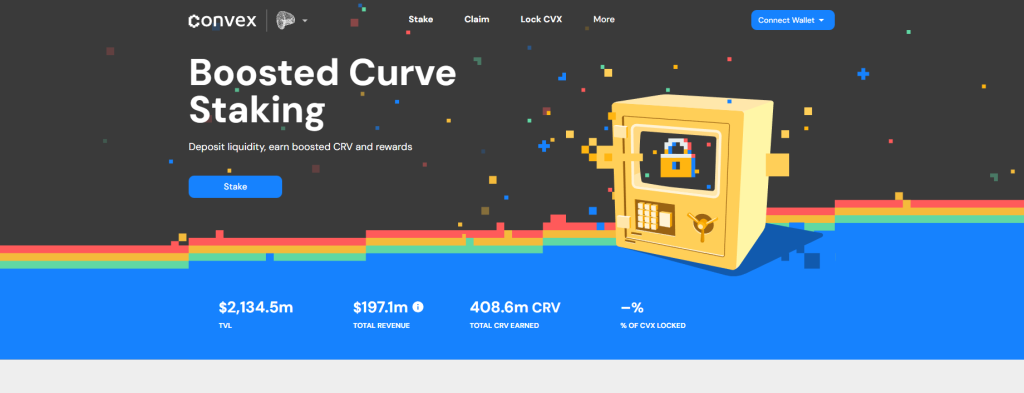

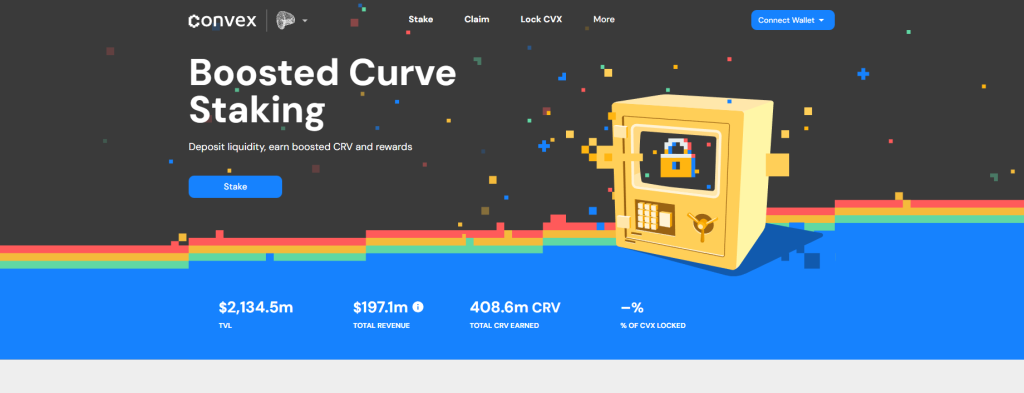

Convex Finance (CVX)

Convex Finance increases returns for stakeholders on Curve DEX by optimizing reward distribution. It also facilitates the management and tracking of returns across DeFi protocols. CVX unlocks enhanced earning opportunities.

Evaluation of risks and disadvantages

Although the growth potential is immense, investors should be aware of the additional risks:

Development of platforms leads to higher failure rates Complex protocols have a steeper learning curve Requires deeper understanding of emerging ecosystems Increased volatility typical of crypto markets Regulatory uncertainty remains for DeFi

In summary, DeFi 2.0 presents a major breakthrough for decentralized finance, enabling it to achieve mainstream adoption. By investing early in top projects, you can participate in and benefit from revolutionary changes in the crypto space.

Read also:

Frequently Asked Questions

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news