[ad_1]

Bitcoin bears are eyeing a possible break below the psychologically important $40,000 level as Bitcoin ETF approval moves into place and macro headwinds rise.

The Bitcoin (BTC) price dropped as low as $40,200 on Friday, but has since fallen back to $42,000.

Despite a solid nearly 4% recovery from intraday lows, the Bitcoin price remains about 15% off annual highs above $49,000.

And the BTC price is still trading well below its 21 and 50DMAs, suggesting that the Bitcoin bears remain in control.

Stronger-than-expected US economic data in recent weeks dampened expectations for rate cuts from the Fed.

This pushed US bond yields and the US dollar index (DXY) higher, creating macro headwinds for the crypto space.

But post-Bitcoin ETF approval profit-taking, particularly in Grayscale’s Bitcoin Trust (GBTC), and Bitcoin investment product rotations also weighed heavily.

High Bitcoin Selling Pressure Amid GBTC Profit Taking and Bitcoin Investment Product Rotation

Newly launched Bitcoin ETFs from Blackrock and Fidelity have enjoyed significant demand.

Both have already exceeded $1 billion in inflows since launch.

With more than $30 billion in total assets under management across Bitcoin ETF products, Bitcoin is already the second most popular commodity ETF product, behind only gold, which has roughly $95 billion worth of ETFs.

However, this does not tell the whole story.

Traders are clearly concerned about a higher than expected level of rotation from existing Bitcoin investment products to new Bitcoin investment products.

GBTC continues to see significant outflows, having sold a total of 52,800 BTC since becoming a spot ETF.

While some of this flow may go to cheaper spot ETF products offered by competitors, some may represent direct profit-taking by traders who bet on the close of the GBTC discount to net asset value (NAV).

As recently as early 2023 and before it became an ETF, GBTC’s discount to NAV reached as much as 50%.

Some traders may have bought GBTC at the time not to express a bullish view on Bitcoin, but rather to express a view that GBTC would be converted to an ETF, and redeemable on a 1:1 basis become real Bitcoin.

JP Morgan estimated in a research note on Friday that $1.5 billion in profit-taking flows had already exited GBTC.

But the US bank reckons there could be another $1.5 billion in GBTC profit taking.

As other Bitcoin products, such as those spot ETFs issued in Canada and Europe and futures ETFs see significant outflows, there is a high risk that selling pressure remains high in the near term.

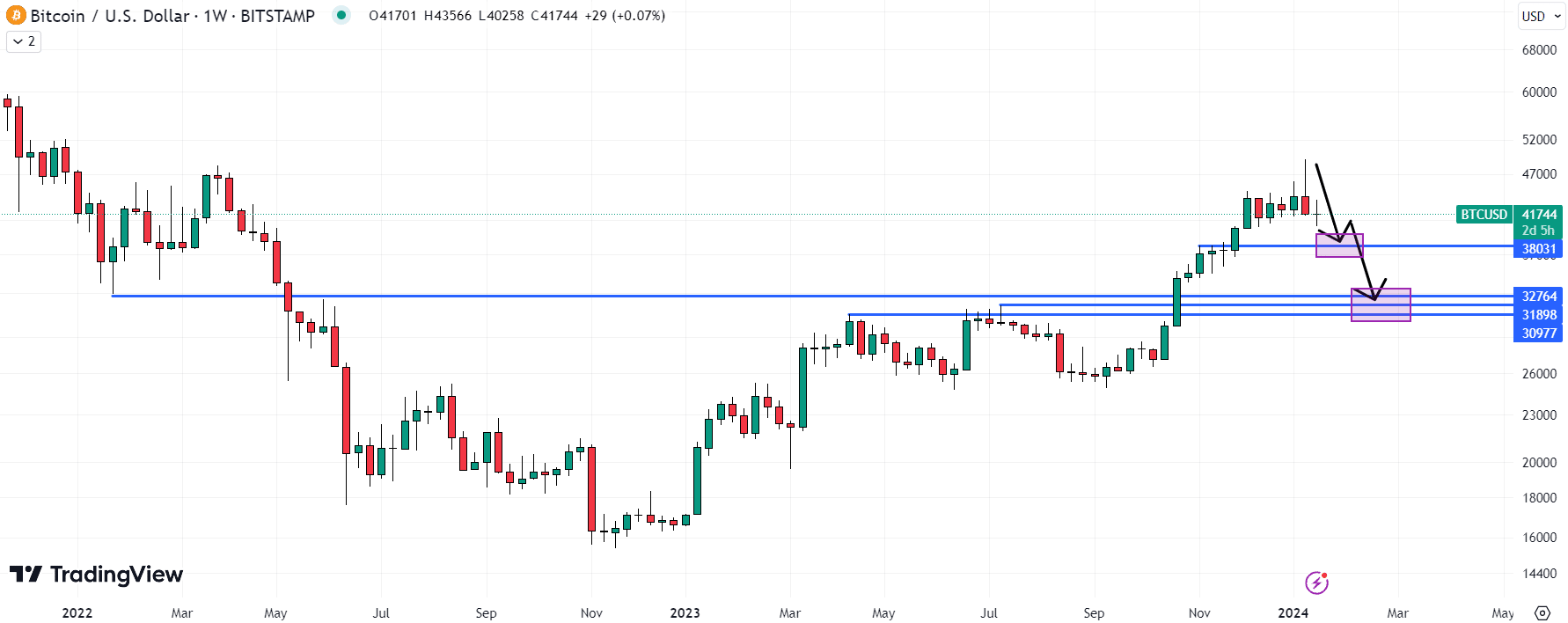

Here’s how low the Bitcoin bears can push the price

All told, those who bet that the approval of spot Bitcoin ETFs last week would be a “sell-the-fact” appear to have been vindicated.

And if JP Morgan is right, Bitcoin bears are likely to remain in charge as selling pressure remains high.

Another factor that could play in the Bitcoin bear’s favor is potential macro headwinds.

Traditional asset investors still appear to be betting that Fed interest rate cuts will begin as soon as March.

US interest rate futures markets are still pricing in a nearly 50% chance of a 25-bps rate cut in March, according to the CME’s Fed Watch Tools.

That’s despite recent data not supporting the case for a rate cut so soon, and Fed policymakers saying March would be too soon.

US money markets are likely to be forced to reduce expectations for a March rate cut to zero.

This could support further gains for US yields and the DXY, strengthening the Bitcoin bear case.

Such a break below $40,000 looks very much on the cards for the weeks ahead.

This could trigger a new wave of technical selling as $40,000 is a key support zone.

The November 2023 highs in the $38,000 area would be the first area targeted by the Bitcoin bears.

But simple chart analysis suggests that a retest of long-term support resistance at $32,000-$33,000 is a possibility.

Will Bulls buy the dip?

All of the above said, Bitcoin’s bull case for 2024 remains strong.

New spot Bitcoin ETFs add a new structural source of long-term demand.

Meanwhile, the upcoming halving will structurally reduce the selling pressure of Bitcoin miners.

And while questions remain about how soon it will begin, Fed rate cuts are most likely in 2024.

This means liquidity conditions should be about to improve significantly, just as demand rises and supply falls.

This is a very bullish cocktail.

Long-term bitcoin bulls will be lucky to pick up tokens from the Bitcoin bears as BTC falls into the $30,000s.

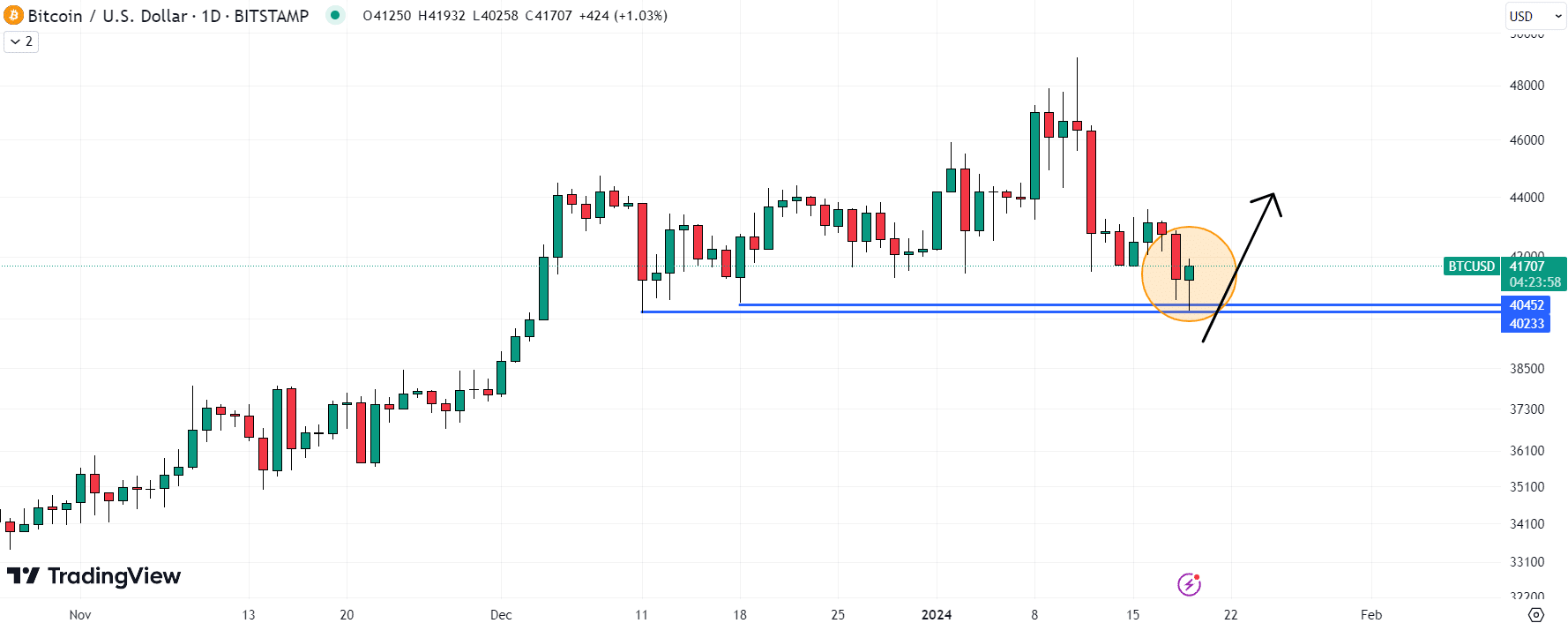

Chart analysis also suggests a possibility that Bitcoin bears may not even get their wish of a price below $40,000.

If the Bitcoin price closes the day at current levels, its daily candlestick will look like a “hammer”.

Candlestick pattern analysts often refer to such daily candlesticks as indicating a bullish reversal.

BTC could also benefit from technical buying as price barrier support in the form of its mid-to-late December lows just above $40,000.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news