This article is co-author of David Puell (@kenoshaking). David is a full-time cryptocurrency analyst and market researcher. David is best known for pioneering work in the emerging field of uncut analysis, and has created original Bitcoin valuation methods, including the MVRV ratio and the Puell multiple.

In this series, we introduce a framework to analyze Bitcoin’s fundamentals in more depth than we believe is usually possible for any traditional asset. We characterize the depth with a three-layer pyramid, the lower layers that serve as building blocks for the higher layers, as shown below.

Note: The relationship between market value to realized value (MVRV) is a long -term metric used to judge Bitcoin’s long -term market cycles. Hodl is a term derived from a wrong spelling of ‘holding’ that refers to buy-and-hold strategies in the context of Bitcoin and other cryptocurrencies.

Source: Ark Investment Management LLC, 2020

In Part 1, we set out the data in the bottom layer of the pyramid, which assesses the health of Bitcoin’s network. In Part 2, we will focus on the data in the middle layer and judge at any time in Bitcoin holders’ positions and cost bases.

The value of a monetary asset like Bitcoin is a function of demand relative to supply. While the offer of bitcoin is mathematically measured, its question is a function of the financial qualities that enable it to play the unique role of a global digital money. Since the inception more than 12 years ago, the demand for bitcoin has drawn upwards[1] But over shorter periods, it varied dramatically. Based on uncut data, investors can assess the variability of demand and its likely impact on price by analyzing the behavior of Bitcoin buyers and sellers at any time.

On-chain analysis: A look at Bitcoin’s inner economy

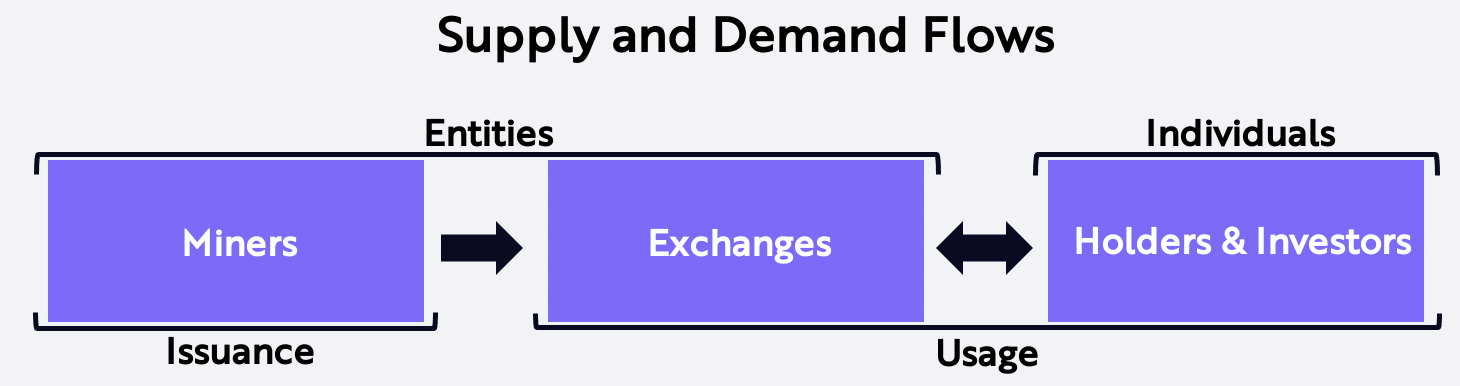

Investors can use Bitcoin’s uncovered data to assess the economic behavior-inclusive inflow, outflow, holding patterns and cost bases-of all market participants. It follows each participant on the chain using simple address -based heuristics. Here we define these participants and their roles in the Bitcoin economy and then depict it in the chart below.

Miners and miners: Miners are responsible for issuing new Bitcoin. They are the only natural sellers involved in the network, their operations with exploited Bitcoin. The sales pressure associated with miners is proportional to the rate of newly issued Bitcoin. Exchanges: Exchanges are responsible for Bitcoin’s price discovery. Through exchange addresses are by most market participants, including miners, OTC desks, custodians and containers/investors. Holders, investors and users: containers, investors and users exclude Bitcoin’s economy. Data data measure the rate at which financial institutions, individuals and traders take on and the periods during which they hold Bitcoin.

Based on the economic flow and interactions between and among these market participants, we can assess Bitcoin’s value.

Source: Ark Investment Management LLC, 2020

UTXOS: Bitcoin’s transaction -Greatbook

Bitcoin’s un-chain data contains the behavior of participants with a simple and transparent accounting system: the unspent transaction output or UTXO for short. UTXOS records the number of bitcoins in each address at the time of each transaction. For example, if Miner Bob deserves two Bitcoins to ratify a block of transactions and sell one of them to investor Alice, both Bob’s and Alice’s Utxos take the addition of one Bitcoin to the transaction. If participants have complete nodes, they can detect and verify all Bitcoin UTXOs.

Most importantly, UTXOS allows investors to detect two data points in each address on the Bitcoin Great Book: the number of coins located in each address (volume) and the amount of time the coins were in each address (time). If the same system rules the stock markets, someone interested can detect the ownership of company shares by quantity, holding period and buying/selling prices.

The building blocks of uncut analysis

We believe that the behavior of buyers and sellers on the chain can help to help investors identify the prices of Bitcoin. As described in the next section, several statistics can monitor the behavior of buyers and sellers. From these statistics, we can obtain relative valuation statistics that identify short- to mid-term inefficiencies in Bitcoin’s price.

I. COINTIME DESTROY

First conceptualized by the pseudonym bytecoin on the Bitcointalk.org forum in 2011.

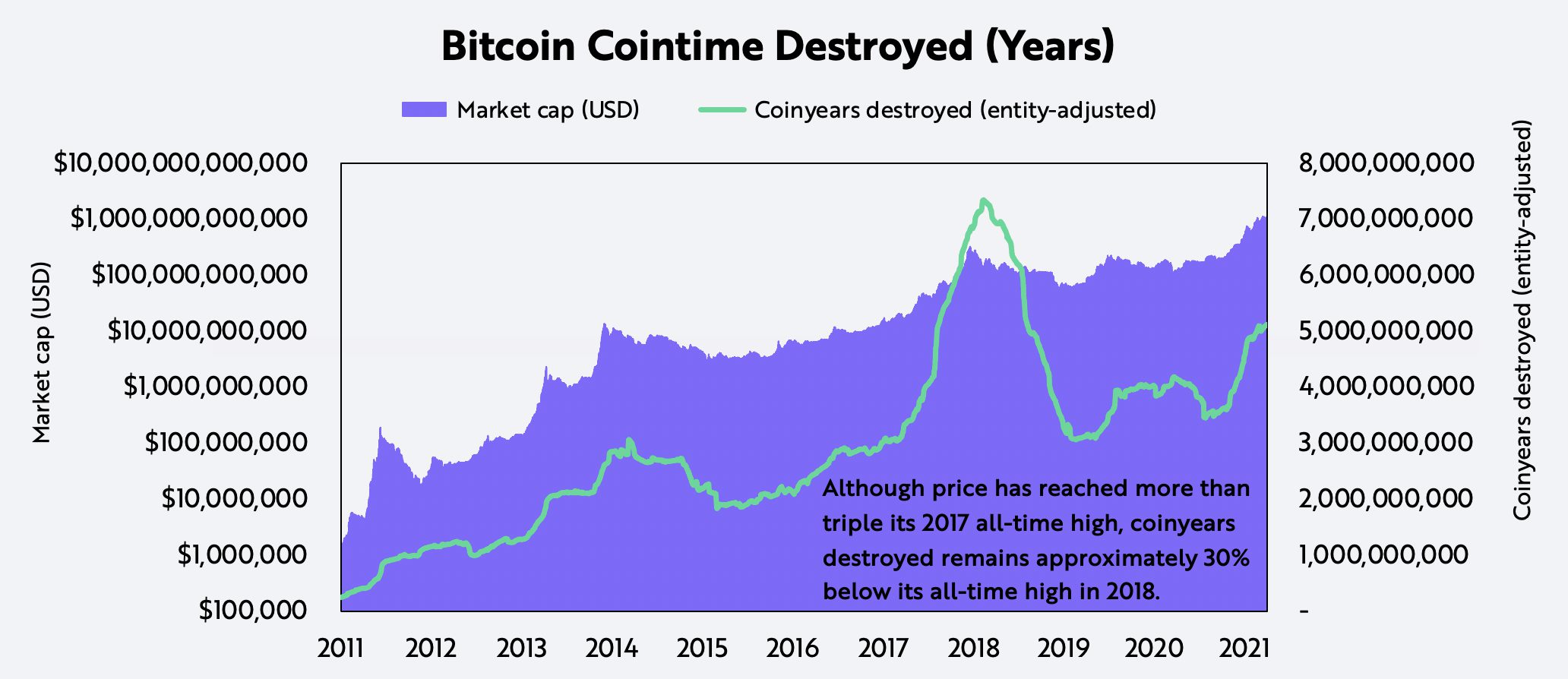

Cointime destroyed, which is widely offered as coding destruction, measures the time -weighted turnover of Bitcoin: the number of bitcoins performed within a given period (volume) and the time held before being executed (holding period). If two bitcoins did not move in seven days, but then worked on a transaction, 14 cover days would have been destroyed. An increase in Cointime destroys implies that containers move coins from long -term storage and take profits. On a slightly above 5 billion these days, Ceinyars destroyed, the rolling sum of coindays destroyed over the past 365 days is, in our opinion, a healthy bull market, as shown below: Bitcoin’s price hit more than threefold in the 2017 high, and yet Coinyars is still destroyed under the highlight in early 2018.

For information purposes only and should not be considered investment advice, or a recommendation to buy, sell or hold any security or cryptocurrency.

Source: Ark Investment Management LLC, Glassnode

Ii. Profits and losses on the chain

First conceptualized by Glassnode in 2019.

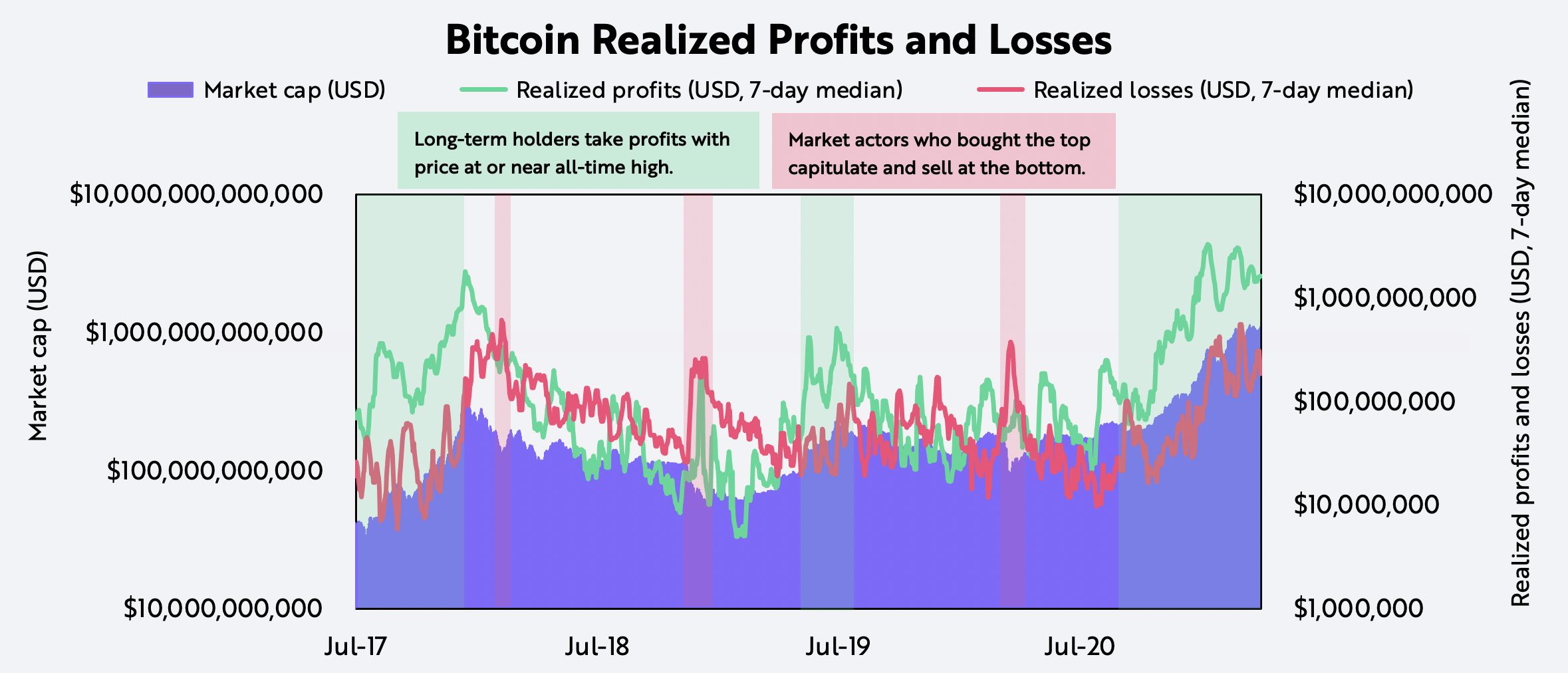

Realized profits /losses measure the total USD value of Bitcoins which is with a profit or loss. If a bitcoin does a higher or lower price than the price at which it last moved, the subsequent move creates a profit or loss respectively. Periods of extreme volatility maximize the gains and losses at the markets and bottom respectively, as shown below.

For information purposes only and should not be considered investment advice, or a recommendation to buy, sell or hold any security or cryptocurrency.

Source: Ark Investment Management LLC, Glassnode

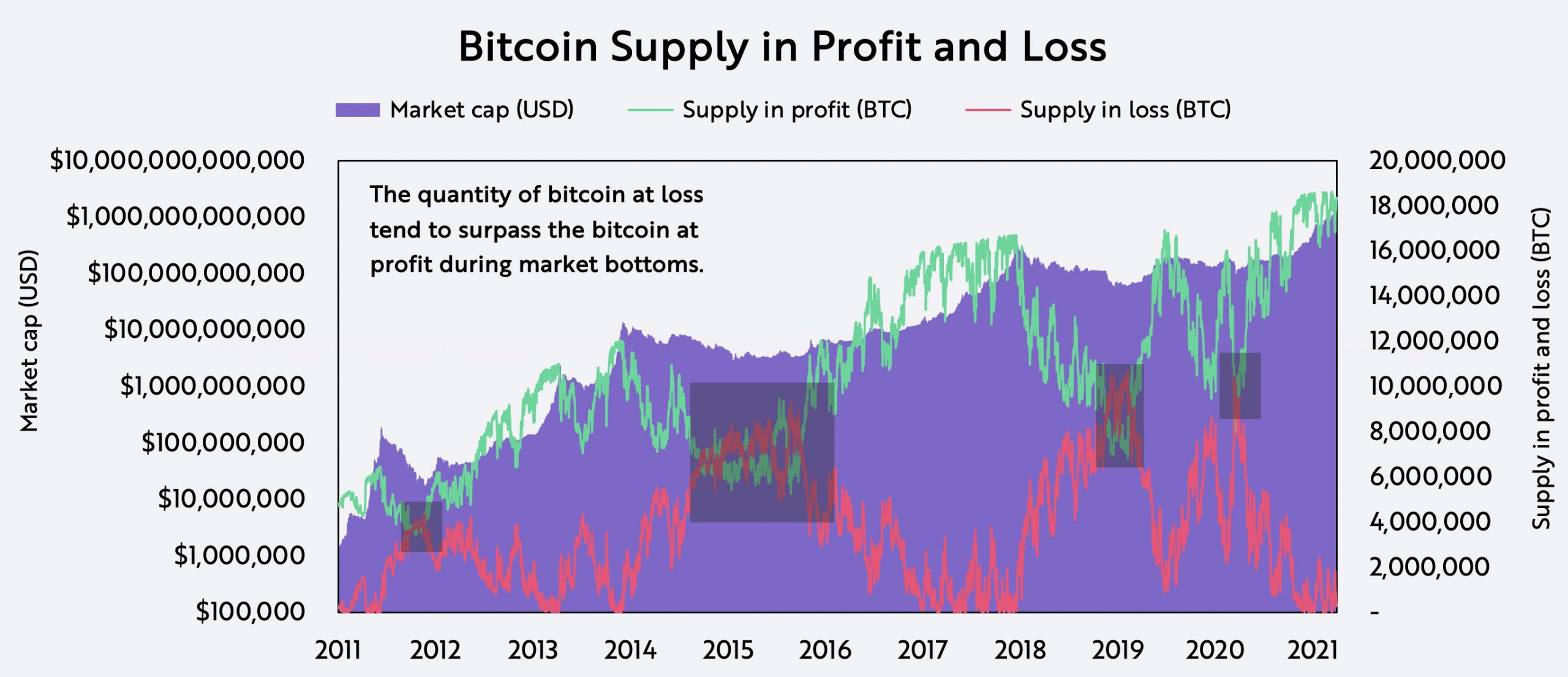

Offer in profit /loss measures the number of outstanding Bitcoins with a profit or loss relative to their last transaction. Today, the offer of bitcoin in profit is almost at a peak of all time and the loss of loss has not been since the end of 2017.

For information purposes only and should not be considered investment advice, or a recommendation to buy, sell or hold any security or cryptocurrency.

Source: Ark Investment Management LLC, Glassnode

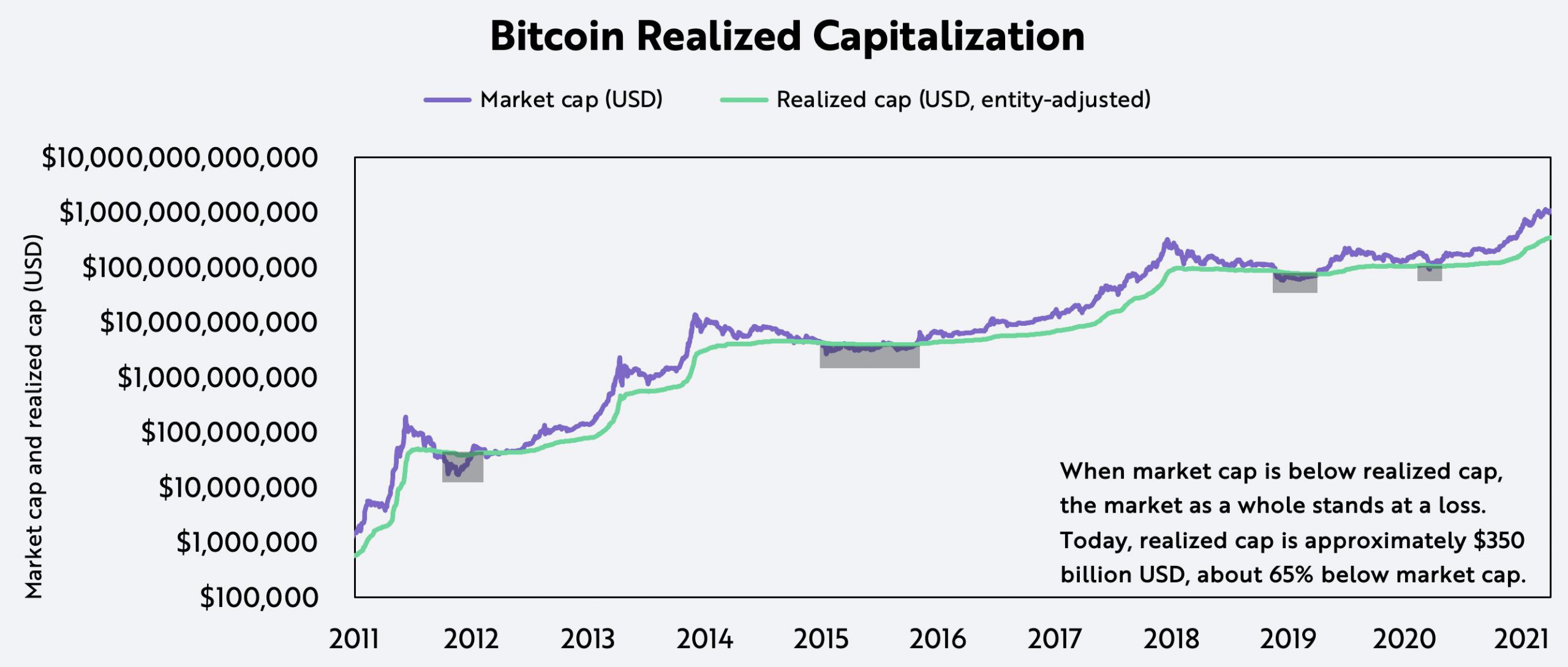

Iii. Realized capitalization

First conceptualized by Nic Carter and Antoine le Calvez in 2018.

While market cap (market cap) increases the value of all Bitcoins in circulation at current prices, the realized capitalization (realized cap) is their average cost base, which every bitcoin appreciates at the price of its last move. Each time the market capitalization falls below the realized cap, the overall bitcoin market sells at a loss, which is an indication of capitulation. Bitcoin’s market cap is nowadays about $ 1 trillion, almost three times its about $ 350 billion in realized hood.

For information purposes only and should not be considered investment advice, or a recommendation to buy, sell or hold any security or cryptocurrency.

Source: Ark Investment Management LLC, Glassnode

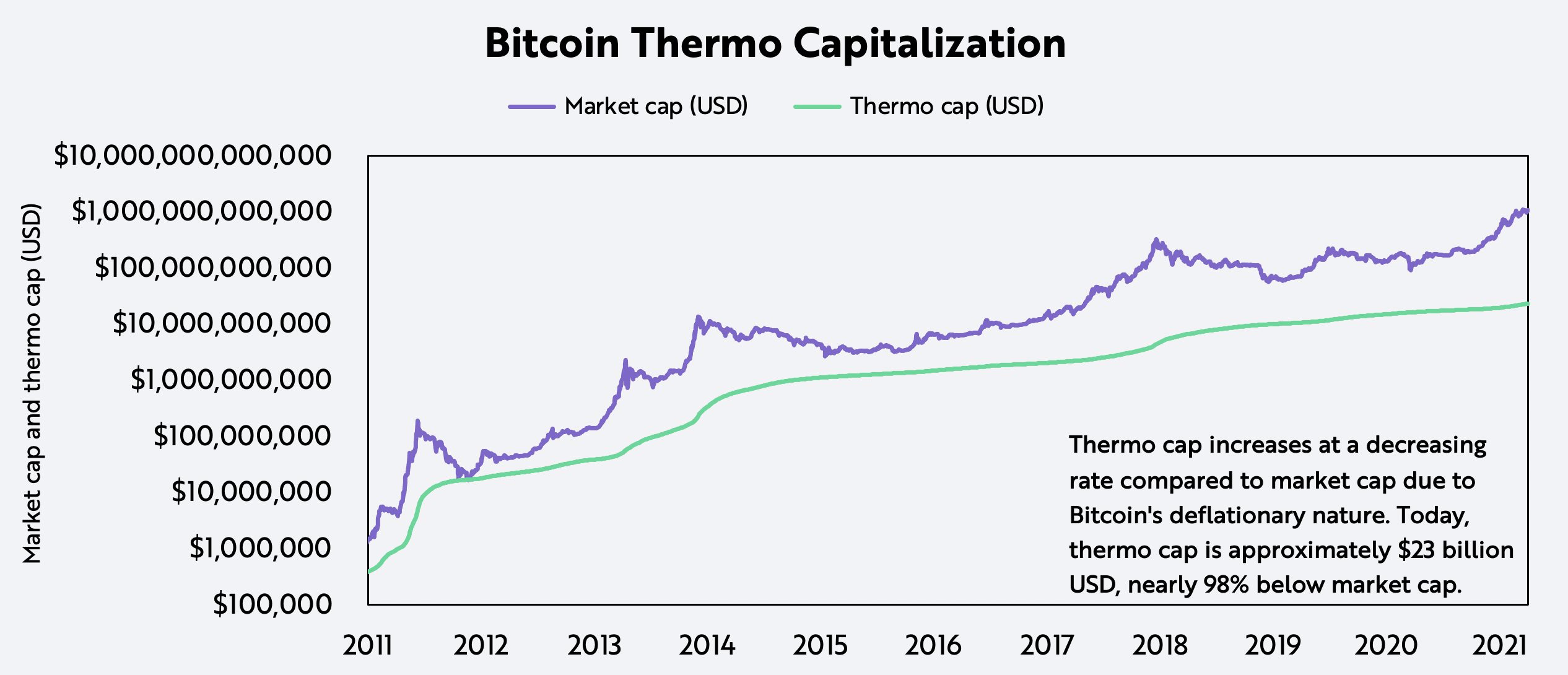

Iv. Thermo -Capitalization

First conceptualized by Nic Carter in 2018.

Thermo capitalization is the total USD value of coins paid to miners for validating transactions and the security of the Bitcoin network. Like Bitcoin’s market cap over the past 12 years, thermo cap has increased, although at a falling rate thanks to the logarithmic increase in Bitcoin’s offer. From April 1, thermo cap is approximately $ 23 billion, almost 98% under Bitcoin’s market cap and 93.5% under the realized captain, who illustrates that miners no longer dominate than natural sellers. Thermo capitalization therefore does not offer clear signals of buying and selling behavior, but as we will investigate in Part 3, it can be an important measure of valuation.

For information purposes only and should not be considered investment advice, or a recommendation to buy, sell or hold any security or cryptocurrency.

Source: Ark Investment Management LLC, Glassnode

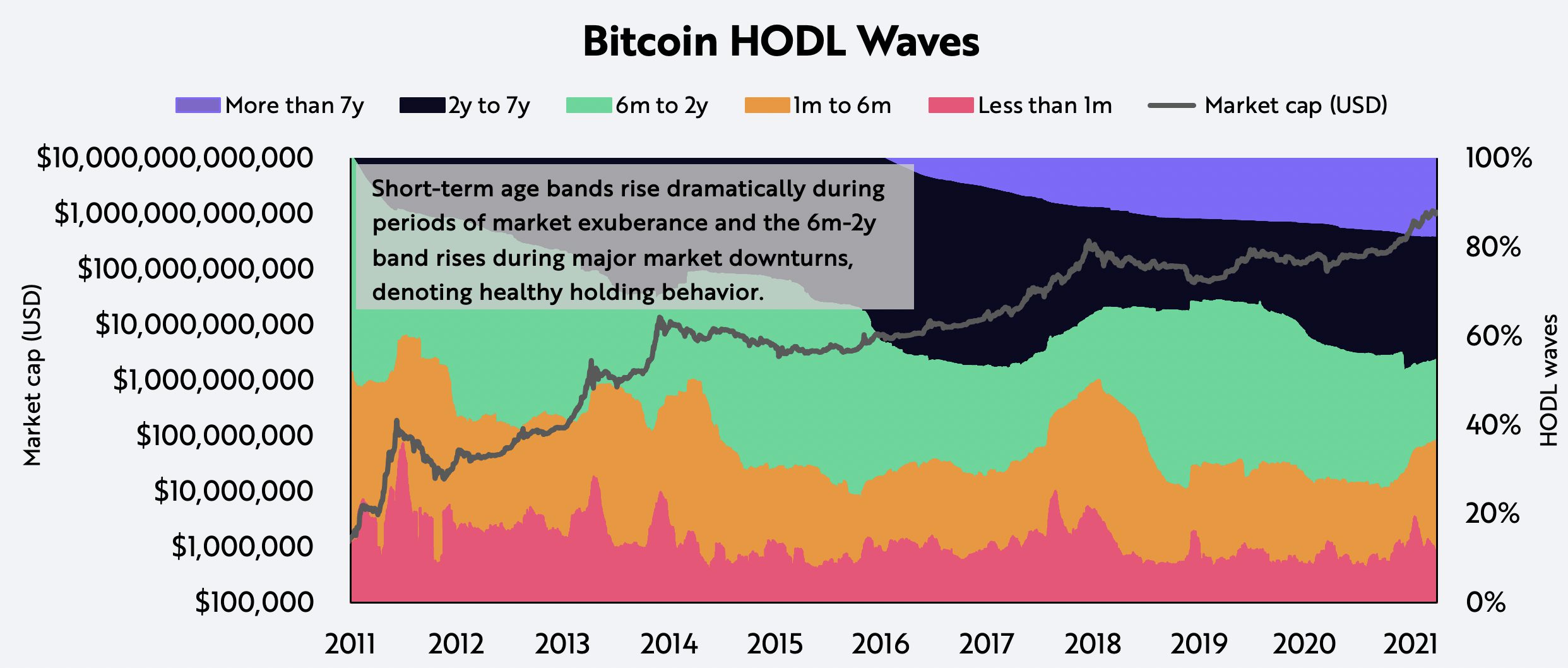

V. Woods Waves

First conceptualized by Dhruv Bansal in 2018.

“HODL” waves, named after the Bitcoin Parody word for ‘HOLD’, divide the total circulating offer of the bitcoin network in holding period. The 1-week HODL wave, for example, measures the percentage of bitcoin done over the past week, the 1 to 2-year Hodl wave measures the percentage of bitcoin that moved between one and two years ago, and so on. Although it typically contains 12 waves, the simplified chart below illustrates that the short-term holding period tires rise dramatically during phases of exuberance in the market and that long-term ties increase in the market during large downturns. About 55% of Bitcoin’s offer has not moved for more than a year these days, and we believe that investors’ beliefs and focus of investors illustrate.

For information purposes only and should not be considered investment advice, or a recommendation to buy, sell or hold any security or cryptocurrency.

Source: Ark Investment Management LLC, Glassnode

Based on these statistics that assess the purchase and sale of Bitcoin, in Part 3 of this series, we will analyze the third data layer of the pyramid and offer relative valuation statistics that help identify inefficiencies in Bitcoin’s price.

This article is in collaboration with Glassnode (@glassnode). Glass node is a data and intelligence provider of blockchain who generates innovative OP-chain statistics and tools for digital assets stakeholders.

To learn more, we invite you to download Ark’s two-part Bitcoin white paper: Bitcoin: a new economic institution and bitcoin as investment.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news