As the crypto market continues to evolve, the health and performance of the Bitcoin (BTC) network remains of utmost importance to investors and market participants. However, recent trends indicate a possible slowdown in Bitcoin network activity.

Key metrics such as trading volume, daily active addresses, circulation and network value to transactions (NVT) unravel the puzzle behind this slowdown.

Bitcoin Trading Volume: Meaning and Implications

Trading volume refers to the total number of BTC traded on various exchanges within a specific period of time. It is a crucial measure for assessing market liquidity and investor interest.

A high trading volume indicates a lively market with a large number of transactions. Conversely, a low trading volume indicates reduced interest and limited market activity.

In the context of the slowdown of the Bitcoin network, the sharp drop in trading volume after an initial price increase highlights the potential weakness in the market. This sudden drop could indicate that investors are either adopting a wait-and-see approach or shifting their capital to other cryptocurrencies or investment opportunities.

If trading volume remains low, it could hinder Bitcoin’s ability to maintain or further increase its price.

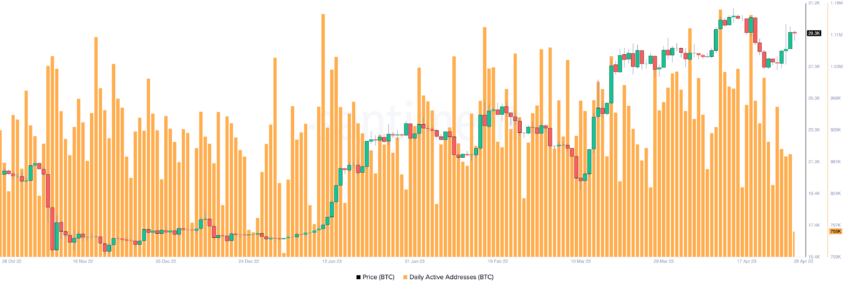

Daily active addresses: assessing network engagement

Daily active addresses represent the number of unique addresses that participate in transactions on the Bitcoin network each day. This metric provides insights into network engagement, adoption and overall activity.

An increasing number of active addresses implies that more users are joining the network. Meanwhile, a declining or stagnant number may indicate declining interest or reduced use.

Despite the recent price increase, the slow growth of daily active addresses suggests that Bitcoin network activity is not keeping pace with the price gains.

This may indicate a difference between the market value and the actual use of Bitcoin. As a result, this could undermine the long-term sustainability of its price growth.

Circulation: Understanding BTC Movement

Circulation refers to the number of individual tokens that are moved between addresses on the Bitcoin network per day. This metric provides valuable information about the flow of capital within the ecosystem and users’ propensity to transact with Bitcoin.

An increase in circulation indicates an active market with more tokens being transferred. Conversely, a decline indicates reduced transactional activity.

Despite a rising price, the current reduction in Bitcoin circulation implies that fewer tokens are being transferred across the network. This could be due to users holding onto their coins in anticipation of future price increases or shifting their focus to other cryptos.

In either case, reduced circulation may signal a decline in the Bitcoin network’s transactional utility. This could adversely affect its long-term growth prospects.

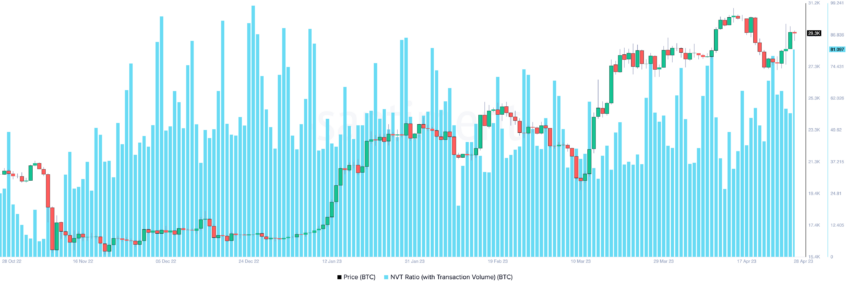

N/A Divergence: Examining network value relative to transactions

The Network Value to Transaction Ratio (NVT) is a measure that compares the market value of Bitcoin to the volume of transactions that take place on the network. A high N/A ratio indicates that the network is overvalued relative to its transaction volume. Meanwhile, a low N/A ratio indicates that the network is undervalued.

A rising N/A ratio, rising prices and falling unique tokens moved indicate a bearish divergence, which could be a warning sign of an impending market correction.

The observed NVT deviation in the Bitcoin network highlights the disconnect between its market value and actual transactional activity. This divergence raises concerns about the network’s sustainability and may contribute to increased market volatility if not addressed by improvements in on-chain utility.

Bitcoin Price Prediction: A Warning for Bulls

While it is challenging to predict the exact trajectory of the Bitcoin price, the slowdown in network activity suggests a cautious outlook. The difference between key metrics and the rising price may indicate an overvaluation of the asset. This could potentially lead to a market correction in the short to medium term.

Still, it is essential to recognize that the crypto market is inherently volatile and subject to various external factors. These include regulatory changes, macroeconomic developments and technological advances. These factors could affect the Bitcoin price and network activity, either mitigating or exacerbating the current slowdown.

It is worth noting that if the Bitcoin network activity can improve, it can regain momentum and strengthen its position. Additionally, positive developments in the broader crypto market, such as increased institutional investment, may also contribute to a more optimistic outlook for the Bitcoin price.

In compliance with the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, designed to extract, analyze and organize information from a wide variety of sources. It works without personal beliefs, emotions or biases, providing data-centric content. To ensure relevance, accuracy and adherence to BeInCrypto’s editorial standards, a human editor carefully reviewed, edited and approved the article for publication.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news