[ad_1]

Support truly independent journalism

Find out moreNear

Our mission is to deliver unbiased, fact-based reporting that holds power to account and exposes the truth.

Whether $5 or $50, every contribution counts.

Support us in delivering journalism without an agenda.

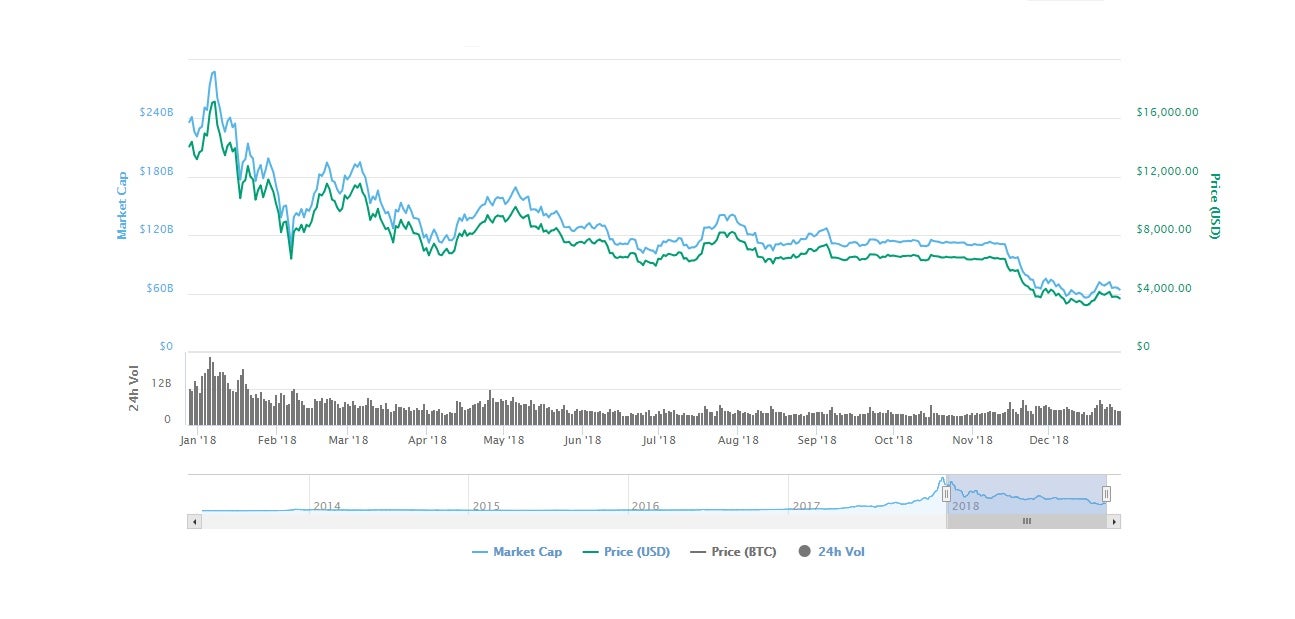

It’s been a bad year for bitcoin. After the highs of 2017, which saw the price of bitcoin rise to $20,000 (£15,700), the world’s most valuable cryptocurrency is currently trading close to its lowest point in 16 months.

Bitcoin has fallen 3 percent over the past 24 hours, adding to losses of 5 percent in the past week, 10 percent in the past month and nearly 80 percent over the past year – leaving little doubt that last year’s peak was indeed the result of an over-inflated bubble.

There have been five major price increases in bitcoin’s 10-year history, and after each previous crash the market has managed to recover to even higher levels. But the magnitude of the 2018 losses has led some cryptocurrency experts to question whether bitcoin will see another market swing.

Forecasting bitcoin’s fortunes in 2019 has thus divided analysts, with predictions from high-profile figures within the cryptocurrency industry ranging from a complete capitulation, to a 10-fold increase from today’s price of $3,650.

The most radical predictions come from bitcoin cash founder Calvin Ayre and Fundstrat co-founder Thomas Lee. Mr Ayre predicts bitcoin will become completely worthless and crash to $0 in 2019 as it has “no use”.

Bitcoin’s volatile history in pictures

Show all 10

1/10Bitcoin’s volatile history in pictures

Bitcoin’s volatile history in pictures

Satoshi Nakamoto creates the first bitcoin block in 2009

On January 3, 2009, the genesis block of bitcoin appeared. It comes less than a year after pseudonymous creator Satoshi Nakamoto detailed the cryptocurrency in a paper titled ‘Bitcoin: A peer-to-peer Electronic Cash System’.

Reuters

Bitcoin’s volatile history in pictures

Bitcoin is used as a currency for the first time

On May 22, 2010, the first real bitcoin transaction ever took place. Lazlo Hanyecz bought two pizzas for 10,000 bitcoins – the equivalent of $90 million at today’s prices

Lazlo Haniecz

Bitcoin’s volatile history in pictures

Silk Road opens for business

Bitcoin soon gained notoriety for its use on the dark web. The Silk Road marketplace, founded in 2011, was the first of hundreds of websites that offered illegal drugs and services in exchange for bitcoin

Screenshot

Bitcoin’s volatile history in pictures

The first bitcoin ATM appears

On October 29, 2013, the first ever bitcoin ATM was installed in a coffee shop in Vancouver, Canada. The machine allowed people to exchange bitcoins for cash

Reuters

Bitcoin’s volatile history in pictures

The fall of MtGox

The world’s largest bitcoin exchange, MtGox, filed for bankruptcy in February 2014 after losing nearly 750,000 of its customers’ bitcoins. At the time, it was about 7 percent of all bitcoins and the market inevitably crashed

Getty Images

Bitcoin’s volatile history in pictures

Will the real Satoshi Nakamoto please stand up

In 2015, Australian police raided the home of Craig Wright after the entrepreneur claimed to be Satoshi Nakamoto. He later withdrew the claim

Getty Images

Bitcoin’s volatile history in pictures

Bitcoin’s Great Split

On August 1, 2017, an intractable dispute within the bitcoin community split the network. The fork of bitcoin’s underlying blockchain technology spawned a new cryptocurrency: Bitcoin cash

Reuters

Bitcoin’s volatile history in pictures

Bitcoin’s price sky rockets

By the end of 2017, the price of bitcoin had risen to nearly $20,000. This represents a 1,300 percent increase from its price at the start of the year

Reuters

Bitcoin’s volatile history in pictures

What’s up…

Bitcoin price crashes spectacularly, losing half of its value in a matter of days

Getty Images

Bitcoin’s volatile history in pictures

Bitcoin dives

The cryptocurrency finally reaches below $4,000 in 2019 before slowly rebuilding momentum to outperform more traditional assets

Getty Images

According to Ayre, bitcoin will be replaced by a more technologically advanced cryptocurrency that functions better than a real currency, such as bitcoin cash.

At the other end of the scale is Mr Lee, whose predictions about bitcoin have proven to be very optimistic in the past. As recently as November, Mr Lee predicted that bitcoin would reach $15,000 by the end of 2018, but appeared undeterred by more price declines in his prediction that bitcoin could reach $36,000 in 2019.

Those bullish on bitcoin’s future point to the general progress of the cryptocurrency and blockchain industry over the past 12 months, with one analyst suggesting that bitcoin is currently undervalued.

“In my opinion, now is a good time to buy bitcoin,” blockchain advisor Olver Isaacs told The Independent. “Bitcoin’s surrounding infrastructure has never looked better. Along with the likes of Coinbase, Cirlce and Blockchain, major traditional financial institutions are stepping into the market.”

It’s a sentiment shared by Misha Libman, co-founder of blockchain art lab Snark.art, who puts bitcoin’s price volatility down to the nation of the industry.

“Ultimately, we are dealing with a new technology and new asset that is highly speculative, illiquid and elusive, and drivers for its rise and fall are anyone’s guess,” he said. “But without a doubt, I believe blockchain and cryptocurrencies have a place in our future and the roller coaster volatility we’re seeing today is something we’ll have to live with for a while until we start using cryptocurrencies to chew gum for sale .”

“For those feeling nostalgic for the excitement they felt about bitcoin’s boom at the end of last year, keep the faith,” added Donald Bullers, who works for blockchain firm Elastos.

“The latter half of 2018 was a critical maturation point for the industry, and 2019 will bring viable products going to market. Crypto is far from dead.”

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news