Bitcoin’s price has risen above the $30,000 level, which is an important milestone not seen since April.

This remarkable rally begs the question: Can Bitcoin sustain its upward momentum and continue to rise?

However, it is important to note that Bitcoin is facing firm resistance near the $30,700 mark, forming a double-top pattern.

The critical question remains: Will Bitcoin manage to break through this resistance or face a potential drop? Let’s dig into the analysis to get further insights.

Unemployment Claims Data and Current Account Deficit Report: Potential Impact on Bitcoin Price

The recent release of unemployment claims data and the current account deficit report have important implications for the Bitcoin market.

Here are the key points:

Unemployment claims remain high: The number of individuals filing for government unemployment benefits remained at a 20-month high for the third week in a row.

This trend indicates a potential weakening in the labor market as the Federal Reserve tightens credit conditions.

Last week, 264,000 new claims were submitted, matching the previous week’s increased level, the highest since October 2021.

Economists’ expectations were slightly lower at 260,000.

Unemployment Insurance Weekly Claims

Initial claims were 264,000 for the week ended 6/17, unchanged from the previous week’s revised level.

Insured unemployment was 1,759,000 for the week ended 6/10 (-13,000).https://t.co/ys7Eg5LKAW

— US Department of Labor (@USDOL) June 22, 2023

Decline in continuing claims: The number of individuals receiving unemployment benefits after the first week decreased to 1.759 million.

This figure was slightly lower than economists’ median estimate of 1.782 million, suggesting a mixed picture in terms of continued unemployment.

Widened Current Account Deficit: The US current account deficit, which measures the flow of goods, services and investment, widened slightly in the first quarter of 2023.

After three quarters of narrowing, the deficit widened to $219.3 billion from a revised $216.2 billion in the previous quarter. Economists had forecast an expansion to $217.5 billion.

US current account deficit widened by $3.1 billion to $219 billion in the first quarter

➡️#Trade deficit narrowed $13bn to $201bn Goods deficit: +$11bn on more exports/less imports Services surplus: +$2bn

➡️ Primary income surplus – $9 billion to $50 billion (higher rates)

➡️Secondary revenue shortfall: -$7 billion to $31 billion pic.twitter.com/86CRokJXHB

— Gregory Daco (@GregDaco) June 22, 2023

These economic indicators can affect the sentiment and direction of the Bitcoin price as market participants assess the overall health of the US economy and potential implications for monetary policy.

Bitcoin price

The current price of Bitcoin is $29,860, and its trading volume in the last 24 hours amounts to $28.8 billion.

In the past day, Bitcoin has experienced an increase of almost 1%, and in the past seven days, it has seen a growth of about 20%.

With a market capitalization of $579 billion, Bitcoin occupies the top position in the CoinMarketCap ranking.

Bitcoin Price Prediction

Taking a closer look at the technical analysis of Bitcoin, especially on the daily time frame, we see the formation of three bullish candles known as “three white soldiers”, which drove the price of Bitcoin towards the $30,000 level.

However, on the daily time frame, there is significant resistance around the $30,700 level, forming a double-top pattern that limits Bitcoin’s overall upward momentum.

This resistance level could potentially trigger a corrective move in Bitcoin’s price.

As Bitcoin failed to break through the $30,700 level, a close below this level could lead to a correction, possibly sending the price towards the 23.6% Fibonacci retracement level, which is projected around $29,300 .

Further selling pressure could push the price towards the 38.2% Fibonacci level at around $28,400.

In case of a more pronounced bearish trend, the next targets could be around $27,750 or $27,000, corresponding to the 50% and 61.8% Fibonacci retracement levels respectively.

The $27,000 level is particularly important from a technical perspective as it previously acted as a resistance level.

Additionally, a downward channel is visible on the daily time frame chart, further reinforcing the importance of this level.

Currently, the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators are both indicating overbought conditions, suggesting that the bullish momentum may weaken.

However, for those considering a sell position, it is advisable to closely monitor the $30,700 level and watch for potential short positions below this level, with stop-loss orders placed above $31,000.

On the other hand, if Bitcoin returns to the $27,000 area, it could present an attractive buying opportunity.

Top 15 Cryptocurrencies to Watch in 2023

Keep up with the latest ICO (Initial Coin Offering) projects and alternative cryptocurrencies with our carefully curated collection of the top 15 digital assets to watch in 2023.

Our list has been hand-picked by industry experts from Industry Talk and Cryptonews, guaranteeing professional recommendations and valuable insights.

Stay one step ahead and explore the potential of these cryptocurrencies as you navigate the dynamic landscape of digital assets.

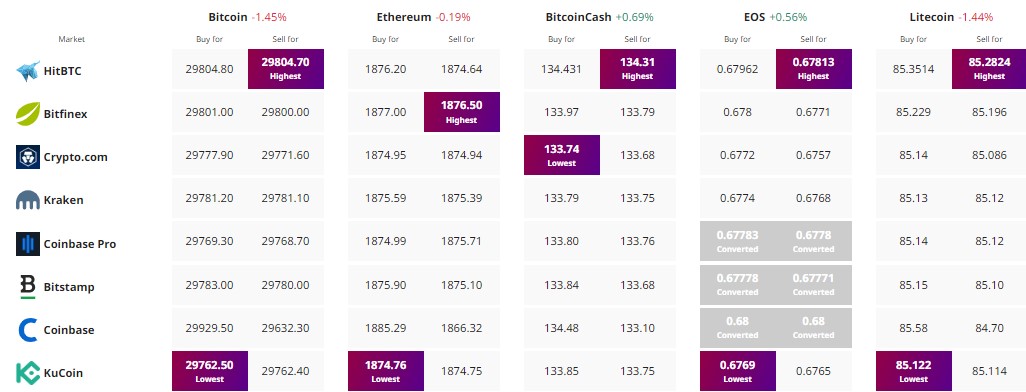

Find the best price to buy/sell cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publisher author or publication – cryptocurrencies are highly volatile investments with significant risk, always do your own research.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news