[ad_1]

The bitcoin price is flying higher today to almost 8.6% at $20,963 and it is pulling up the rest of the crypto complex.

The data site CoinGecko shows prices of the top 20 coins all trading strongly in the positive, with gains of between 5% and 9%, as does the cryptonews.com price tracker across different exchanges.

The Ethereum price, which has received a bid lately due to the Ethereum Merge upgrade, is flashing green for the week, up 6.6%. Today, ETH has already traded as high as $1,714 and at the time of writing is priced at 1,699, up 4.8% in the last 24 hours.

Among other top alts, breakout meme coin Shiba Inu is advancing 9% to $0.00001324, while Layer 1 token Polkadot is finding favor at $7.77, 9% for the better.

Other gains include OKB, the coin of the OKX exchange, up 19% to $16.49, Ravencoin, a PoW coin likely to benefit from the merger, is up 21% at $0.044 and NFT ecosystem digital asset ApeCoin is trading 17% higher at $5.25 today.

Total market capitalization is back above $1 trillion at $1.026 billion as traders shrug off bearish sentiment that has built up this week.

Did the death of Queen Elizabeth ignite the bitcoin price rally or drop in the dollar?

While the superstitious may link the pullback to the death of British sovereign Queen Elizabeth II, the truth is probably more prosaic in that bitcoin has already entered oversold territory, as the chart above on the RSI gauge shows.

Nevertheless, an oversold signal can lead unsuspecting traders into a value trap – simply, a price can be low for a very good reason. But as we argue below, it could be otherwise.

To get a handle on whether we are seeing a dead cat bouncing off something more promising from a bullish perspective, as always in recent times, we must first refer to other asset classes, namely stocks, bonds and currencies.

Risk on as crypto and stocks trade higher in tandem

Crypto’s lock-step positive correlation with tech stocks in particular, but the stock market more broadly, is still very evident.

So when you’re looking for drivers of crypto buying interest today, look no further than the rally in stocks.

On a global view, if the green wave continues in the Asia equity session to open the US and go later today, it will be the first positive week for global equity prices in the last four.

Economic indicators today indicated that demand in China is not as soft as feared and stimulus measures there could further improve the outlook.

Yet it is inflation, and the response of the US Federal Reserve and other central banks, that concentrates the minds of market players.

The European Central Bank (ECB) raised interest rates by a whopping 0.75% after raising rates for the first time in 11 years in July.

The ECB is making a late effort to control rising inflation. But on a more positive note for stock markets, gas prices eased on hopes that the EU will propose measures today that could tame energy prices, thereby dampening inflation.

Dollar and bonds fall – gold and crypto rise

Elsewhere on the macro front, the dollar is 1% lower. U.S. bond yields sold off, as yields rose, in a sign of a tentative return to some risk-on sentiment.

Bonds are often bought as insurance in bearish markets, although inflation eats into the value of their yield – bond yields move inversely to bond prices.

Also, oil and gold are both rising, with the later development suggesting that investors are still looking for safe haven, even as they buy stocks and crypto for the time being.

While there are valid fears that the bitcoin market could revisit lows of around $17k seen in June of this year and that it could easily drop below $15k and even $10k, these are both likely bottom-line events, which the current mini rally can be taken as a leading confirmation of.

Is it time to DCA in the crypto markets?

In other words building up bitcoin and other crypto with a dollar cost averaging strategy at and around current levels is likely to be profitable on a medium term view looking 12 months from now.

The encouraging scenario for bulls is that lower dips from here, to say $17k, could continue to attract buyers, as we are seeing now.

Even though there was a lot of coverage of the crypto winter, there wasn’t as much on the prospect of the boom that has always followed in the past.

Institutions are preparing to improve the prices of bitcoin and crypto

It is with this in mind that market participants should keep in mind that there is a good reason why institutions are moving into the space.

In that regard, the latest fund manager is Franklin Templeton, but it follows news today that Singapore’s Whompoa Group is also opening up to crypto and so is DBS, which announced earlier this week that it is offering its wealthiest 300,000 clients access to digital assets.

Watch the dollar like a hawk for crypto signals

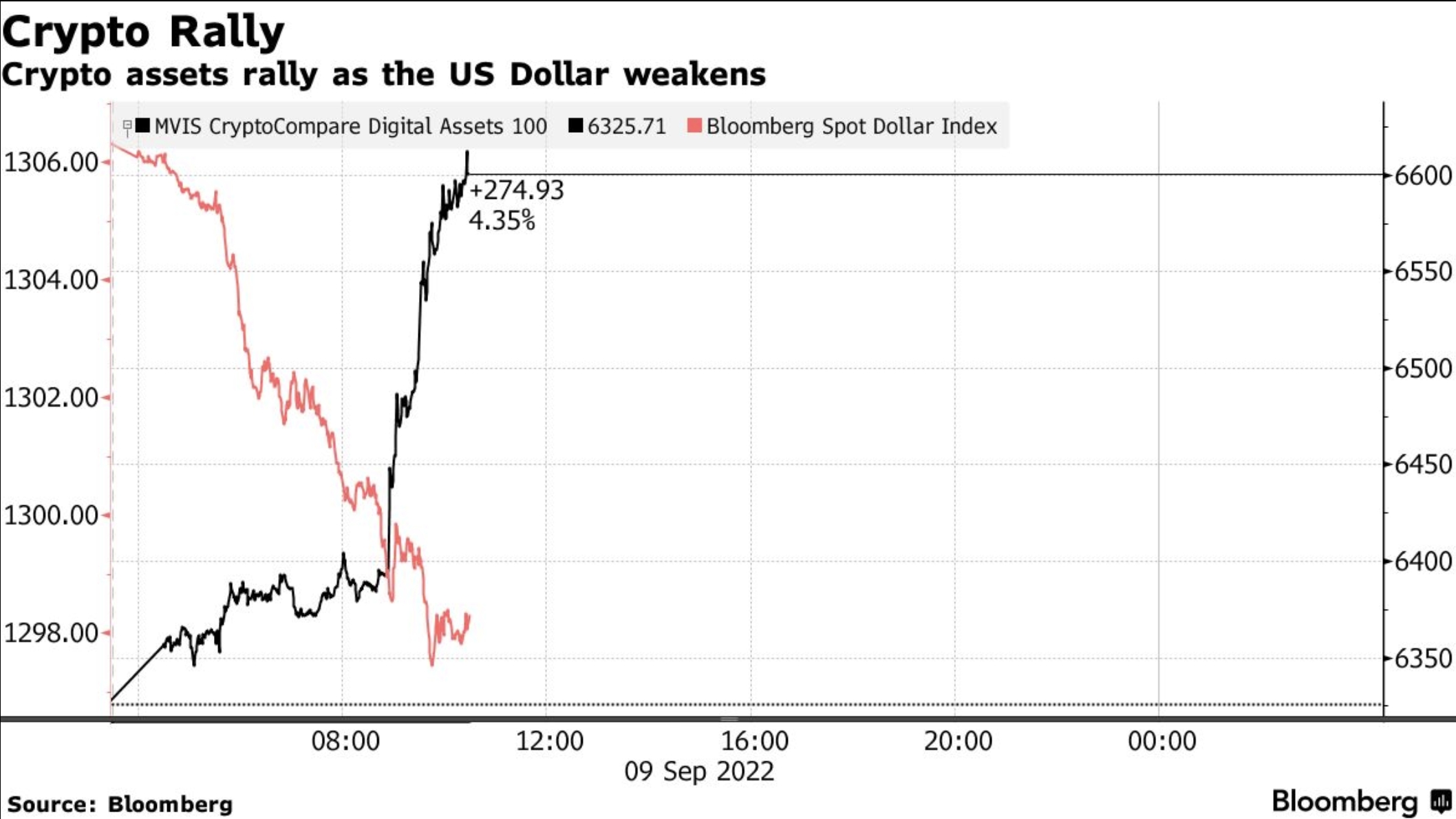

To distill the analysis above, the standout data point relates to the US dollar, where we see dollar weakness related to bitcoin crypto strength, as this Bloomberg chart clearly shows:

Also, as we reported earlier this week, open interest in crypto futures is on the rise, especially in Ethereum, which pushed volumes above bitcoin for the first time.

But it’s in the BTC perp futures market that we’re seeing decidedly bullish action today, as Kaiko analyst Riyad Carey pointed out:

Sharp jump in $BTC open interest on FTX and Binance in past few hours; Binance up to 166k from 154k, FTX up to 64k from 58k. pic.twitter.com/Qab3Mnzoq6

— Riyad Carey (@riyad_carey) September 9, 2022

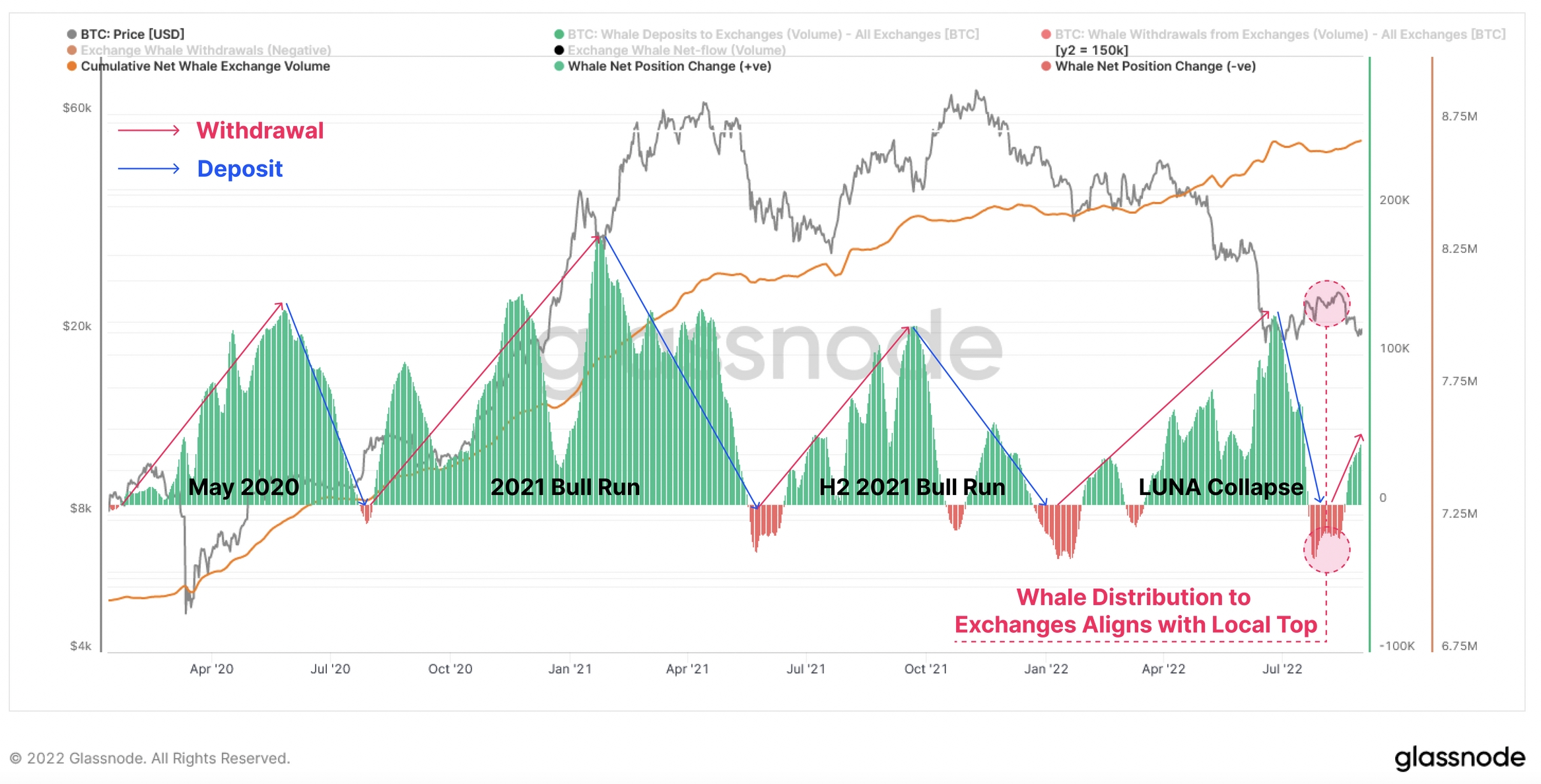

We should add to that the fact that 1k bitcoin whales have spread to exchanges since the Luna crash and how it matches local tops, as you can see in the chart below from Glassnode.

This provides strong evidence for an argument against dollar cost averaging in the market, despite bitcoin recently collapsing.

Certainly from here volatility will continue and possibly increase, but we can see the first murmurs of a bottom being placed in the crypto market.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news