In a previous article, BeInCrypto predicted the Bitcoin price rise to $72,000, supported by our comprehensive analysis of on-chain statistics.

BeInCrypto prediction is validated by the recent price movement, which highlights the importance of continuous monitoring and analysis of these indicators.

Dig deeper into Bitcoin on-chain data

By analyzing key indicators such as Hash Ribbons and the 90-day moving average of Coin Days Destroyed (CDD), we can gain a deeper understanding of market dynamics.

This continuous monitoring approach is essential for making informed decisions and highlights the importance of keeping up with expert analysis like that of BeInCrypto.

What are Bitcoin Hash Ribbons?

Hash Ribbons is a powerful metric that identifies when BTC miners capitulate or give up and when they start to recover. Miners are essential to securing the Bitcoin network by solving complex transaction validation problems.

When mining becomes unprofitable, miners can shut down their machines, causing the network’s hash rate to drop.

The chart highlights periods where the 30-day moving average exceeds the 60-day moving average, indicating miner capitulation. These periods often precede significant price recoveries.

In the early part of 2023, the chart shows a capitulation phase, followed by a recovery where the 30-day average crosses above the 60-day average. This crossing corresponds to the recent price rise to $73,000, confirming the effectiveness of the Hash Ribbons indicator in predicting market bottoms.

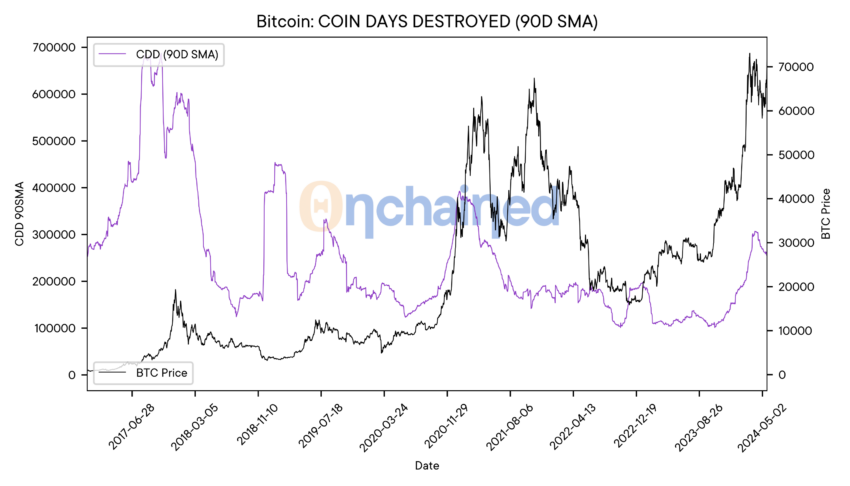

What is Coin Days Destroyed (CDD)?

Coin Days Destroyed (CDD) measures the activity of long-term BTC holders.

Each Bitcoin accumulates “coin days” because each day it remains untouched. When finally moved, these coin days are “destroyed.” This metric helps identify significant shifts in market sentiment among long-term holders.

CDD is calculated by multiplying the amount of Bitcoin moved by the number of days it was held. The 90-day SMA smooths out daily fluctuations, providing a clearer view of long-term trends.

The 90-day SMA of CDD showed a steady increase in 2023, indicating growing activity among long-term holders.

However, recent declines in CDD indicate reduced selling pressure from long-term holders, indicating confidence in continued price appreciation. This aligns with the recent bullish momentum in Bitcoin’s price, further supporting our analysis.

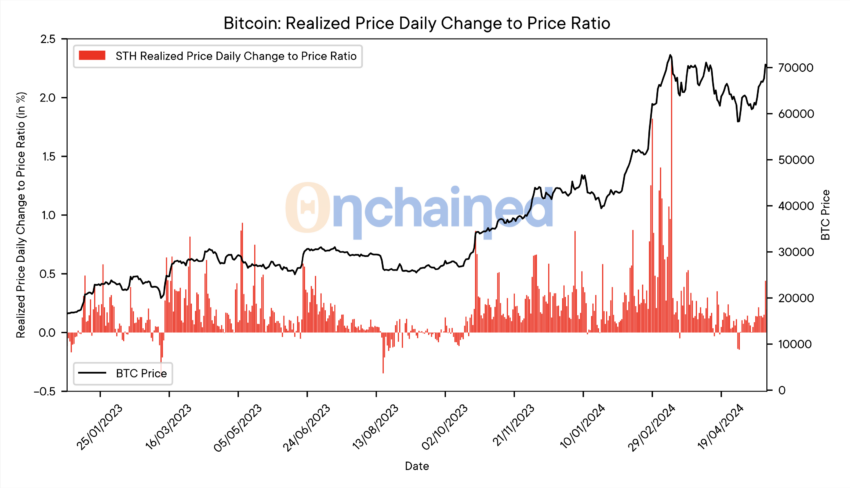

What is the STH RP Daily Change to Price Ratio?

The short-term holders realized price to price ratio (STH RP/PR) is an innovative indicator that identifies potential buy signals during bull markets. This measure compares the realized price daily change of short-term holders to the current market price, highlighting periods of negative sentiment as potential buying opportunities.

Negative STH RP/PR values indicate that short-term holders are capitulating, often marking good entry points for new investments.

We can observe that the short-term holders’ realized price-to-price ratio (STH RP/PR) increased to $72,000 during Bitcoin’s appreciation. This suggests that the price may continue to rise as short-term holders on average do not face unrealized losses relative to the current BTC price.

Strategic recommendations and future price projections

On-chain data and Bitcoin fundamentals point to an impending bull run. A sustained break above the $73,000 resistance level could easily push the price to $82,000.

It is clear that a sustained drop below $68,000 could reverse market trends, but the likelihood of that happening is diminishing. As highlighted in previous BeInCrypto analyses, the majority of the chain data has been showing positive signals for weeks.

BeInCrypto will continuously monitor these metrics and provide updates to keep you informed of key market movements and events. Stay tuned for detailed future outlook and strategic insights.

Disclaimer

In accordance with the Trust Project Guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimers have been updated.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news