The Chainlink price fell 1.5% in the last 24 hours, falling to $19.01 on a day when the cryptocurrency market as a whole posted a very modest gain of 0.3%.

Still, LINK has played a role lately, with the altcoin sitting on a 26% gain in a week and a 41% gain in a month.

It’s also up 172% over the past 12 months, underscoring a very successful year for Chainlink, which has seen significant growth as a decentralized data network serving multiple blockchains.

And since many analysts expect a bull market later this year, the Chainlink price could really have some big gains in the not-too-distant future.

Chainlink Price Forecast as Rally Extends to 22-Month High – Could LINK Reach $100?

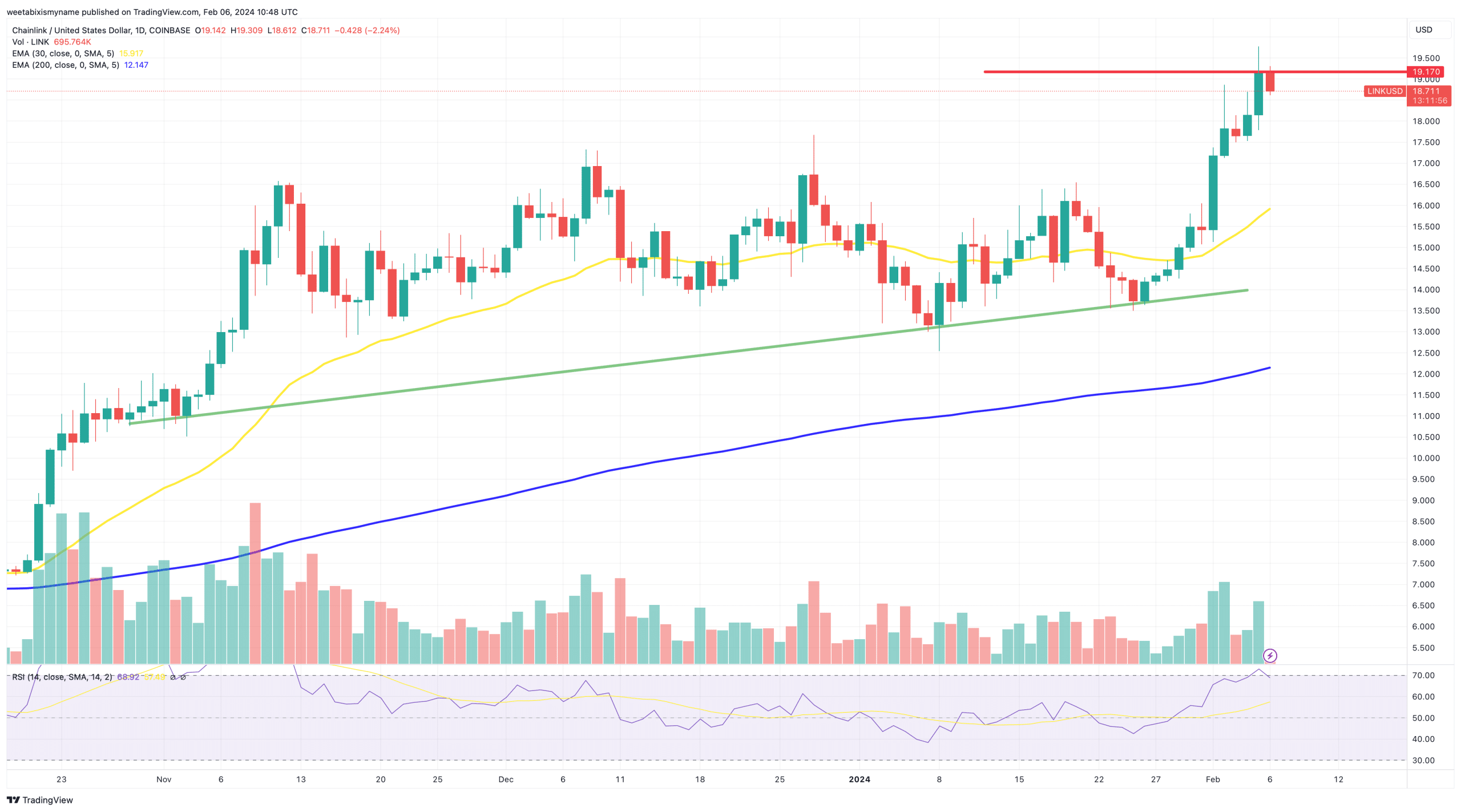

Despite today’s fall, LINK’s chart still looks very bullish, with its indicators still showing plenty of momentum.

Its 30-day moving average (yellow) continues to rise sharply above its 200-day average (blue), while its current price has surged past both averages.

This indicates significant buying pressure, with LINK’s relative strength index (purple) also indicating a high level of demand, given that it remains at the 70 level.

Also encouraging is that LINK’s trading volume remains over $1 billion, indicating that investors are still very interested in the token.

In fact, we are still seeing large transfers to and from exchanges, although some whales seem to be taking advantage of LINK’s current price by selling.

🚨 🚨 🚨 🚨 🚨 🚨 7,949,999 #LINK (144,455,820 USD) transferred from unknown wallet to #Binancehttps://t.co/TK61fSXks1

— Whale Alert (@whale_alert) February 2, 2024

But even with some profit-taking, LINK appears to be in the midst of a strong expansion phase, so more gains are likely soon.

Much of its power comes from its fundamentals, with Chainlink currently attracting more use as an oracle network, feeding data and connecting other chains.

For example, it partnered with Circle last month, with the pair now working on cross-chain USDC transfers.

And Chainlink also partnered with Vodafone in October, demonstrating how blockchain has applications in international trade.

What’s crazy to me is the range of use cases $LINK enables

Let’s take the Chainlink + Vodafone announcement a few weeks back as an example

Vodafone used CCIP to demonstrate how it is possible to securely transfer important documents

They transferred this legal receipt… pic.twitter.com/TcfoOGPx2K

— Crypto Moose🫎 (@MooseCryptos) November 7, 2023

Such developments highlight how Chainlink is arguably one of the most fundamentally strong platforms in crypto.

In turn, they point to a steadily rising Chainlink price over time, with LINK potentially on track to reach $50 by the end of the year.

Alternative high-potential Altcoins

Of course, LINK is not the only altcoin with potential right now, with the market full of several highly promising new alts and presale tokens.

Probably the biggest presale happening right now belongs to Bitcoin Minetrix (BTCMTX)‘a Ethereum-based play-to-mine platform that has raised over $10.3 million.

China’s latest crackdown on #Cryptocurrency mining marks a major shift in the regulatory landscape. 🇨🇳

Will this push for energy conservation lead to a more sustainable future for #Crypto, or will it simply shift mining operations elsewhere? 🌍#BitcoinMinetrix has… pic.twitter.com/3GkQeLND6F

— Bitcoinminetrix (@bitcoinminetrix) February 5, 2024

Once Bitcoin Minetrix launches in the coming weeks, its users will be able to mine Bitcoin (BTC) simply by staking the platform’s native token, BTCMTX.

Stake provides users with signed mining credits, with users then able to spend such credits on Bitcoin hash power.

Once they do this and buy enough hashing power, users will receive a share of mined BTC.

Additionally, strikers receive a steady stream of new BTCMTX tokens, making Bitcoin Minetrix possibly one of the most profitable new platforms.

That helps explain why its pre-sale has done so well, and with its platform also boasting a streamlined interface, it’s likely to be a success.

Interested investors can still join the pre-sale by visiting the official Bitcoin Minetrix website, where they can buy BTCMTX at a price of $0.0133 per token.

The coin should then list on exchanges in the next one or two months, and with a limited supply of four billion, it could quickly find a lot of demand.

Visit Bitcoin Minetrix now

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and is not investment advice. You can lose all your capital.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news