[ad_1]

Understand open interest

Open interest is a key concept in financial markets, especially when trading futures and options. It represents the total number of active contracts for a specific financial instrument that exist at any given moment.

A futures contract means that two parties have agreed to buy or sell the underlying asset at a specified price on or before a predetermined future date. Open interest represents the total number of contracts that have not been settled or fulfilled by delivery, as opposed to trading volume, which measures the total number of contracts exchanged within a given period.

Open interest is a key metric that traders and analysts use to evaluate market sentiment and anticipate future price movements. The fundamental idea behind open interest is that it provides information about the general activity of the market as well as possible future moves. While falling open interest may indicate a worsening trend, rising open interest implies growing market interest and the potential for longer-term price trends.

Implications of open market for market direction

The direction of the market can be determined by open interest, and traders can gain useful insights from both bullish and bearish scenarios.

Increasing open interest and rising prices indicate a strong trend and possible upward momentum, continuing in a positive scenario. This alignment reinforces confidence in the general positive attitude and represents a consensus among market participants.

On the other hand, a bearish situation occurs when open interest increases in the face of falling prices, suggesting that the downtrend may continue. This alignment indicates continued selling pressure and traders’ agreement on the bleak outlook.

Examining shifts in open interest is necessary to spot possible trend reversals. For example, a divergence in which prices are rising but open interest is falling could indicate a weakening in bullish support and possibly portend a reversal.

In a similar vein, falling prices combined with falling open interest can signal a waning bearish trend and a potential upside reversal. Open interest is a leading indicator that trend-reversal-focused traders regularly use to predict changes in market sentiment and modify their methods for better informed trading decisions.

Trading volume vs open interest

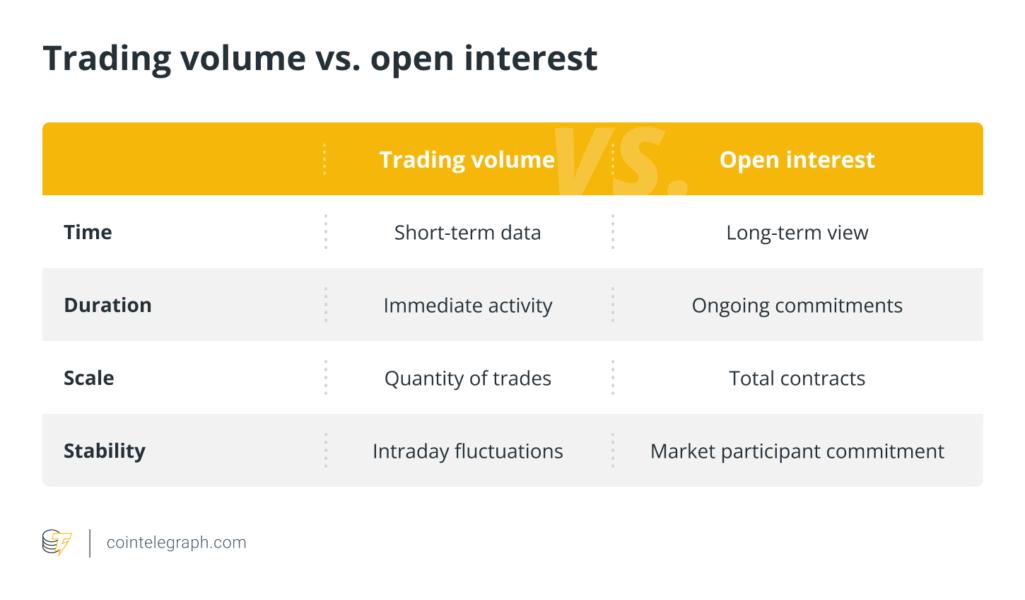

Trading volume and open interest are both essential metrics in financial markets, but they convey clear information about market activity.

The total number of shares or contracts traded during a given period, or trading volume, indicates the volume of buying and selling that occurred during that time. It does not distinguish between new and existing holdings; instead, it provides insights into the liquidity and immediacy of a market.

Conversely, open interest measures the entire number of contracts still in force in the market, which is a representation of all the traders’ liabilities. In contrast to trading volume, only contracts that have not been completed by delivery or settled by a counter transaction are taken into account by open interest.

How open interest is calculated for crypto futures

To track the total number of outstanding contracts at any given time, it is necessary to calculate open interest for cryptocurrency futures, which provides insightful information about market sentiment and possible trend changes.

Open interest is a dynamic concept that changes as new positions are established or old ones are offset. Both buy and sell transactions must be taken into account when calculating open interest because each trade involves two parties, resulting in the creation of a long and a short position.

For example, the open interest increases by one contract if trader A goes long (buy) and trader B goes short (sell) on a single Bitcoin (BTC) futures contract. The open interest is unaffected if Trader C later buys one Bitcoin futures contract from Trader B because the contract is only transferred from one party to another. However, the open interest increases by one if Trader D enters the market and buys one additional Bitcoin futures contract.

Open interest in cryptocurrency futures reflects traders’ active participation, the opening of new positions and the possibility of market trends based on shifts in participants’ obligations. As a result, traders are able to assess the changing sentiment and possible future movements in the cryptocurrency futures market by tracking these changes in open interest.

Strategies based on open interest analysis

Open interest analysis forms the foundation for various trading strategies, providing traders with insights into market sentiment and potential trend developments.

One tactic often used is to use open interest to support or challenge existing price patterns. Prices rising along with an increase in open interest indicate that the trend is likely to continue. On the other hand, a decline in public interest may indicate waning support for the trend if prices rise.

Another tactic is to keep an eye on shifts in open interest as well as movements in prices. Deviations, characterized by open interest moving against prices, can indicate a possible trend reversal. For example, rising prices in the presence of falling open interest may indicate that the current uptrend is losing steam.

Furthermore, to improve decision making, traders frequently combine open interest with other technical indicators. By integrating open interest research with other analytical tools such as momentum indicators or moving averages, traders can develop a more comprehensive picture of market conditions, which in turn helps them determine optimal trading points.

Limitations of Open Interest for Crypto Futures

Open interest in crypto futures may not provide a complete market picture due to difficulties in distinguishing new activity from closings, volatility and the potential under-representation of institutional positions.

One disadvantage is that open interest may not be sufficient to provide a complete picture of market dynamics. It can be difficult to distinguish between new market activity and position closures as changes in open interest can arise from both new positions and offsetting trades.

Furthermore, the inherent volatility of the cryptocurrency market can cause sudden and erratic changes in open interest, which can undermine its validity as a stand-alone indicator. Furthermore, the open interest data may not accurately reflect the extent of significant positions held by institutional players, nor does it provide information on the size of individual positions.

In the dynamic and often changing world of cryptocurrency futures trading, traders and analysts frequently combine open interest analysis with other technical indicators to circumvent these limitations and gain a more nuanced understanding of market conditions.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news