[ad_1]

This blog is a preview of our Guide to On-Chain User Segmentation for Crypto Exchanges. Register here to download the full report!

With Bitcoin’s price up more than 50% in 2023, the crypto winter may be thawing, but business is still tough for exchanges nonetheless.

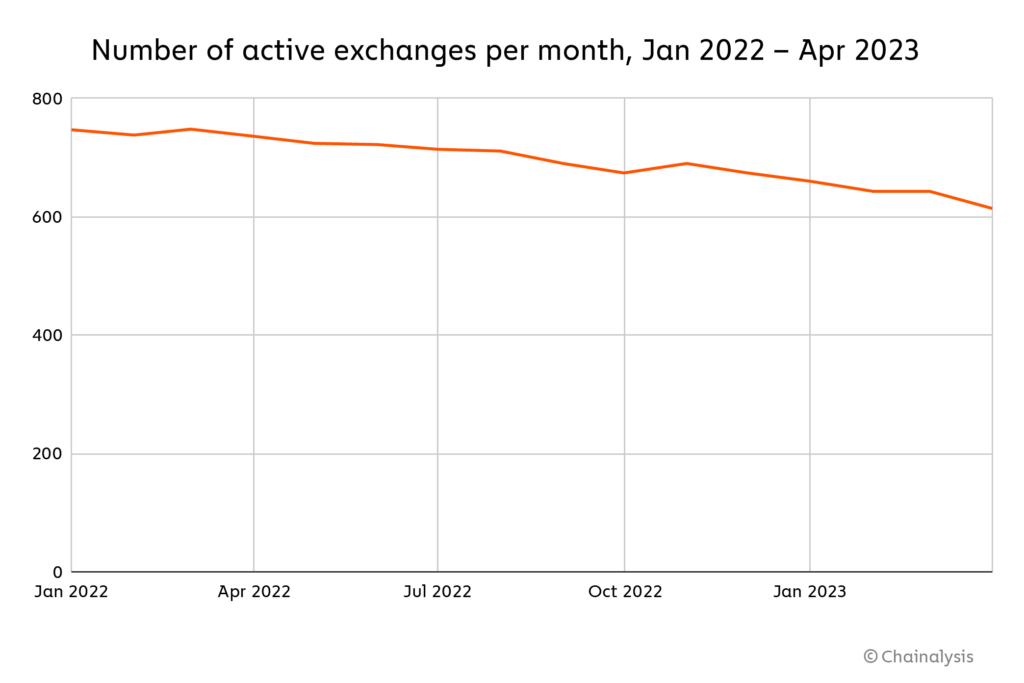

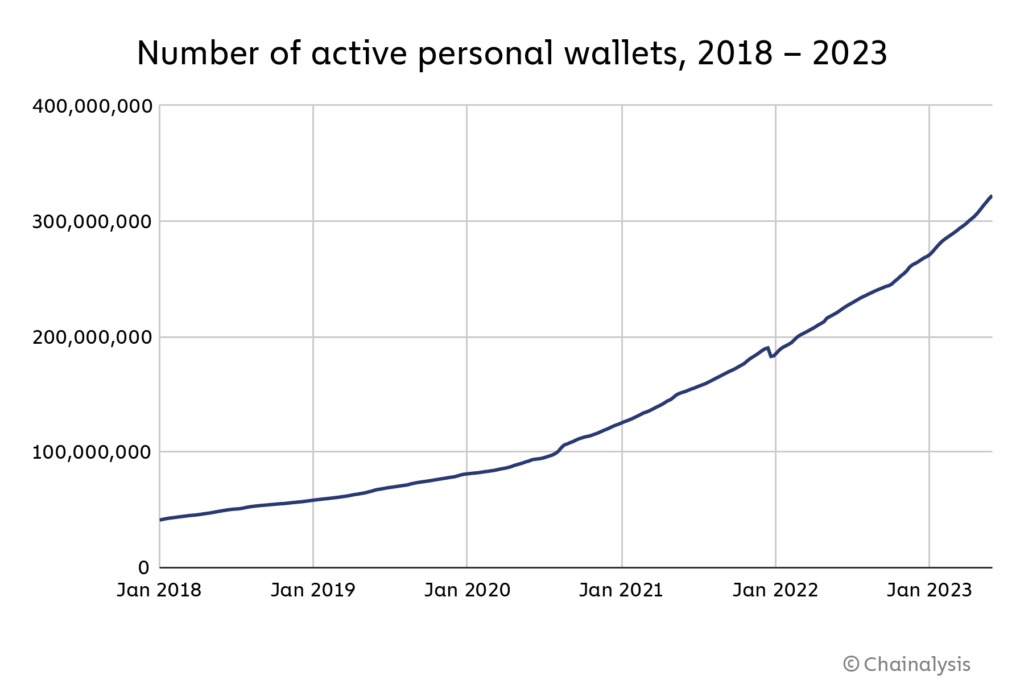

Since the beginning of 2022, the number of active centralized cryptocurrency exchanges has fallen from 750 to 640, due to pressure from declining transaction volumes amid tough market conditions, and ever-increasing competition from decentralized exchanges (DEXs). However, at the same time, the number of cryptocurrency users continues to increase. We estimate that growth on the chart below, which shows the number of active or balancing personal wallets – also known as unhosted wallets, as they are not hosted by a service and are under the sole control of the owner – over all blockchains Chainalysis has supported over the past five years.

Exchanges that can win over the crypto users behind those wallets and take market share now will be in the best position to reap the rewards when the crypto winter ends and transaction volumes pick up again. But not all users are the same. Exchanges need to segment their users, and focus on onboarding and retaining those who will drive the best outcomes for their business.

Fortunately, cryptocurrency’s inherent transparency allows exchanges to segment more effectively than in any other industry. Only in cryptocurrency can you see the holdings, transaction habits and product preferences of your users and prospects in real time. Armed with that data, exchanges can make data-driven decisions about where to focus their user acquisition and retention efforts. How exactly can they do this? In this guide, we’ll lay out an example model for exchange user segmentation based on on-chain data, and show you how those segments translate into insights that can drive ROI in exchanges’ user acquisition and retention strategies.

Segmentation of crypto users by wallet age and holdings

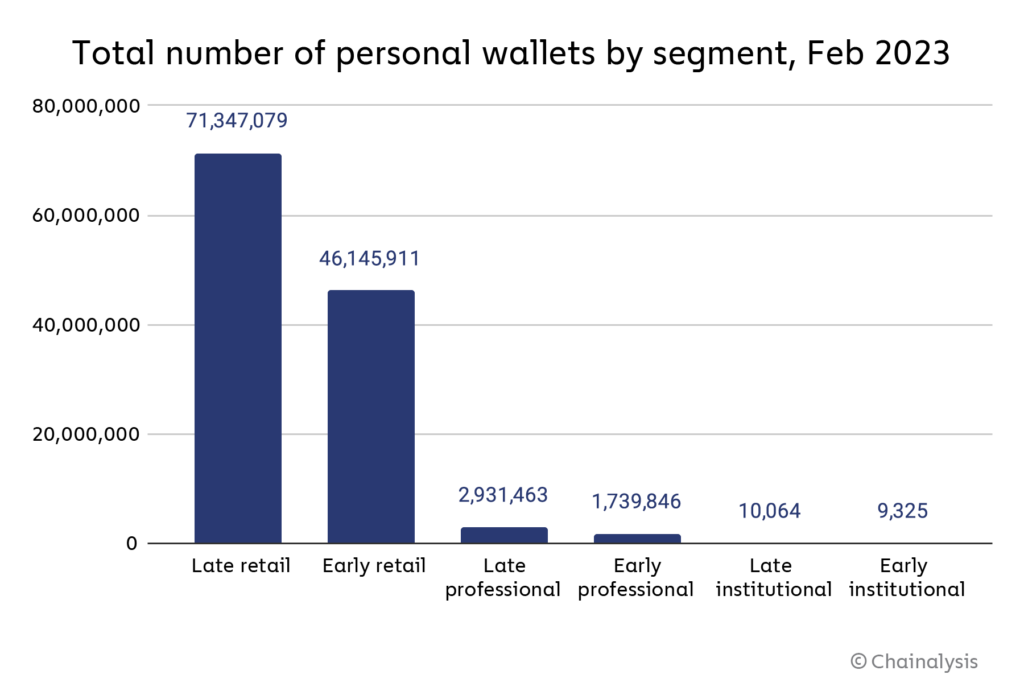

On-chain data-based user segmentation can take many forms, as there are various characteristics a business can use to compare crypto wallets. However, for the purposes of this exercise, we’ll focus on two simple ones: overall holdings and wallet age. By separating wallets along those two axes, we came up with six distinct segments, although an exchange could obviously look at more segments if they separated wallets more granularly.

Early Retail: Wallets active since before January 1, 2020 with holdings less than $10,000 USD.

Early Professionals: Wallets active since before January 1, 2020 with holdings between $10,000 and $10 million.

Early Institutional: Wallets active since before January 1, 2020 with holdings over $10 million.

Late Retail: Scholarships that became active on or after January 1, 2020 with holdings less than $10,000.

Let professionals: Scholarships that became active on or after January 1, 2020 with holdings between $10,000 and $10 million.

Leave institutional: Scholarships that became active on or after January 1, 2020 with holdings of more than $10 million.

Here’s what those segments look like across the Bitcoin and Ethereum blockchains.

Segment

Value held by segment

Number of personal wallets

Average held per wallet

Average active weekly wallets

Early Retail

$20,629,986,812

46 145 911

$447

249,768

Early professional

$124,348,073,934

1,739,846

$71,471

142 148

Early institutional

$108,472,035,881

9,325

$11,632,390

1,595

Late retail

$15,454,498,456

71 347 079

$217

10,440,095

Late professional

$129,011,881,592

2,931,463

$44,009

1,745,170

Leave institutional

$176,802,248,828

10,064

$17,567,791

4 309

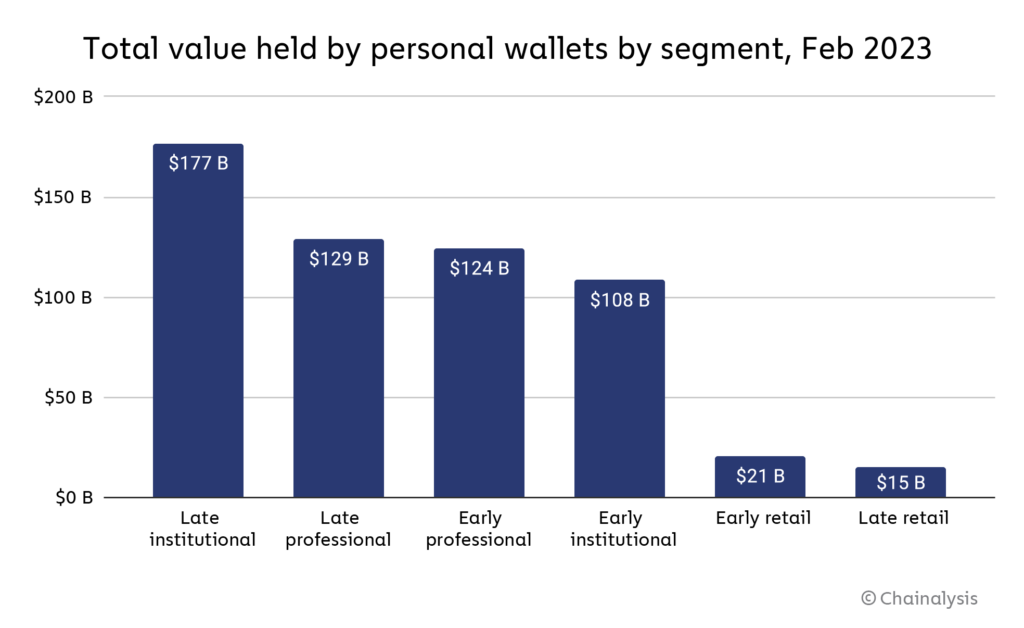

The vast majority of active wallets in a given week are those in late retail, meaning relatively new wallets with a low balance. Interestingly, there are also many more active wallets in the late professional segment than the early retail segment, which only highlights how many people have come to cryptocurrency in recent years and made significant investments, while many earlier entrants have either dropped out, shifted their activity. to new wallets, or embrace a passive long-term control strategy. In general, late retail wallets represent the majority of all wallets by a wide margin, but have the least capital.

Overall, the relative newcomer groups of late institutional and late whale wallets account for the majority of Bitcoin and Ether currently held by personal wallets. But the more important question for this exercise is, how do these segments interact with exchanges? Centralized exchanges usually make money from trading fees. Although we don’t have the insight into exchange order books needed to calculate fees generated by each segment—all we have is chain data—let’s assume that the total funds transferred in the chain to exchanges from each segment are roughly matched with trading fees generated from each segment. Crypto is typically sent from personal wallets to exchanges to be traded rather than held, so this seems like a reasonable assumption.

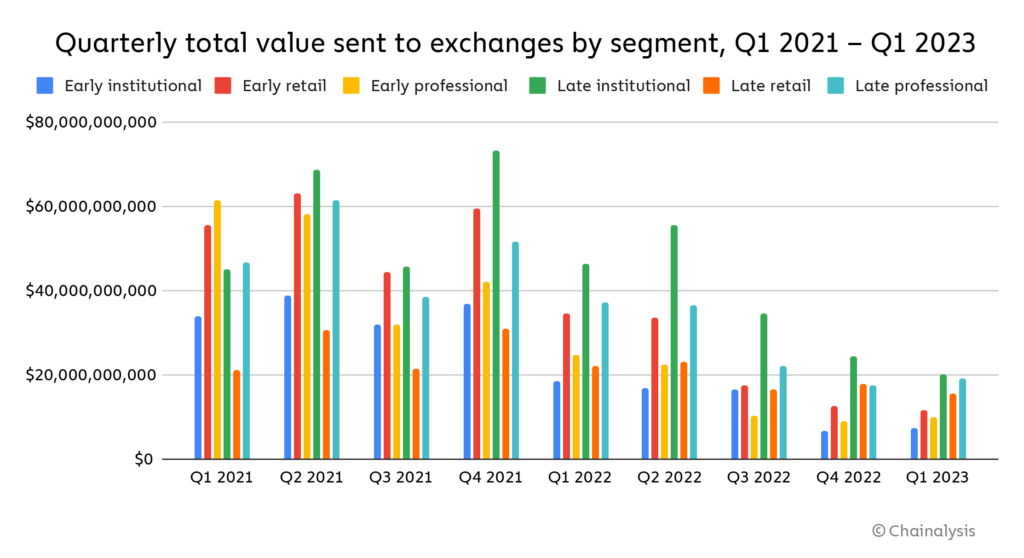

Since the beginning of 2021, institutional wallets have accounted for the majority of the value sent by personal wallets to centralized exchanges at 23.6%. However, both late professional and early retail wallets are close behind at 18.8% and 19.0% respectively. Overall, there is relative parity between segments in value sent to exchanges in most quarters, with the exception of late retail exchanges and early institutional exchanges, which account for 11.4% and 11.9%, respectively, of the total value sent during sent to scholarships this period. Both segments exhibit this lag for different reasons – late retail wallets because they have the least amount of capital compared to other segments, and early institutional wallets because they make up the lowest portion of all active wallets.

Testing segment analysis on a real exchange: FTX case study

Our wallet-based user segments differ in how they interact with exchanges, but what do those differences mean for exchanges? And how can the people running exchanges turn segment behavior into a successful acquisition and retention strategy? We will examine this below using on-chain data from a real, widely used exchange: FTX. While FTX of course collapsed in November 2022, before that it was one of the most popular exchanges in the industry, with a large, active user base. The chain footprint of those users in the months leading up to FTX’s demise gives us a large, real data set to analyze through the lens of our user segmentation framework.

Download the full report here to find out how wallets across our six segments interacted with FTX, and see the insights exchanges can gain from on-chain user segmentation!

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news