[ad_1]

Will the crypto market sustain its upward trajectory in 2024? Discover expert insights and predictions.

The crypto industry could be poised for a significant year of transformation. Prominent figures such as Michael Saylor and Cathie Wood are bullish, highlighting the potential impact of Bitcoin halving in April 2024 and the expected inflow of institutional investments through ETFs.

Saylor specifically points to a “supply shock” that, along with ETF approvals, could create a “perfect storm” for Bitcoin’s valuation.

Despite the scars of a bruising crypto winter in 2022 and early 2023, the recent gains in certain crypto assets point to growth potential.

For example, Bitcoin (BTC) reached a new milestone in March 2024, when its value exceeded $70,000. Ethereum’s price reached the $4,000 mark despite widespread liquidations across the market and the US SEC delaying decisions on ETH ETF listings from Blackrock and Fidelity.

The altcoin sector is also under the spotlight, with Solana (SOL), Polygon (MATIC) and Polkadot (DOT) registering notable gains over the weeks.

What does this momentum portend for crypto predictions for 2024? Let’s find out.

Trends that dominate crypto forecast for 2024

Let’s dig into the specific factors that could have a potential impact on crypto predictions for 2024.

Introducing Spot Bitcoin ETFs

The launch of spot Bitcoin ETFs in January 2024 was a defining moment for the crypto industry, marking a major step towards institutional acceptance and investor accessibility.

Since their inception, these ETFs have attracted considerable attention, amassing a total market capitalization of more than $66 billion as of March 11.

Leading the pack is Greyscale, with its Bitcoin Trust ETF (GBTC) amassing more than $42 billion in market capitalization.

The Block reported that Standard Chartered Bank predicted that Bitcoin could experience gains of similar magnitude to gold, which saw its price rise more than fourfold in the seven to eight years following the ETF launch.

With expectations that between 437,000 and 1.32 million new Bitcoins could be held in US spot ETFs by the end of 2024, representing an inflow of $50-100 billion, the outlook for Bitcoin’s price remains bullish.

BTC halving

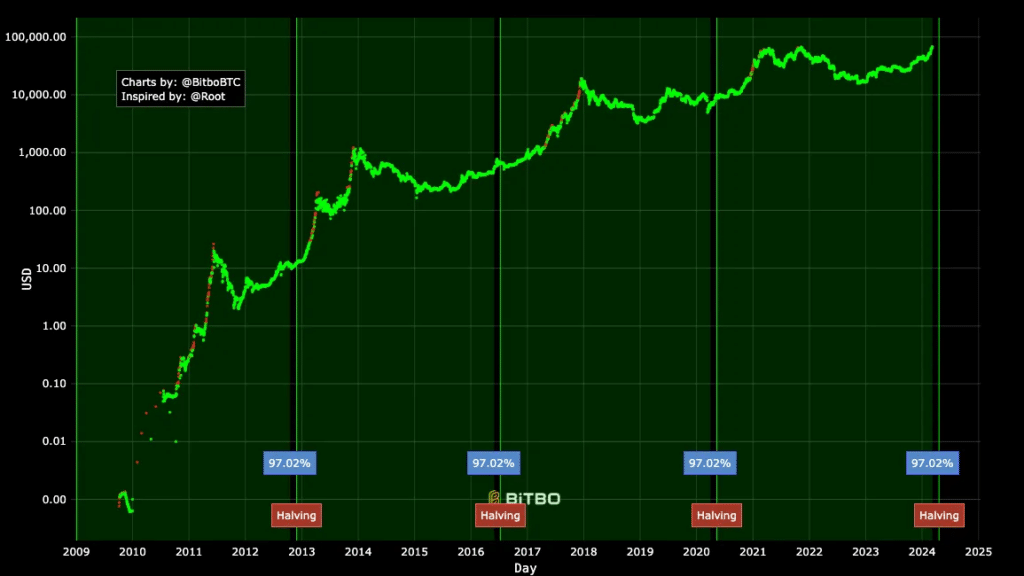

The Bitcoin halving is an important event that cuts the reward for mining Bitcoin transactions in half. This event occurs approximately every four years. The next one is expected in April 2024.

The halving reduces the rate at which new Bitcoins are generated, directly affecting miners’ rewards and indirectly affecting Bitcoin’s price due to changes in supply dynamics. The 2024 halving will reduce the mining reward from 6.25 BTC to 3.125 BTC per block.

Historically, halving events have been associated with periods of price increases in the months following the event, although past performance does not necessarily indicate future results.

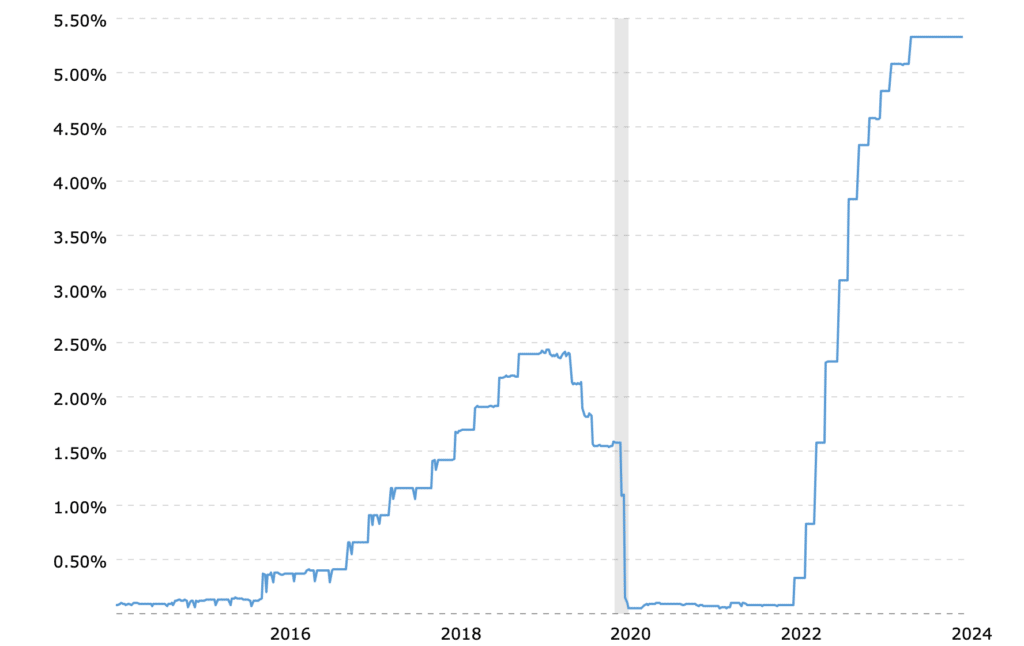

Federal Reserve interest rates

The next meeting of the Federal Open Market Committee (FOMC), scheduled for March 20, will remain crucial.

The Fed has kept interest rates at a range of 5.25% – 5.50% for several months, providing a semblance of stability to the banking sector and the stock market amid prevailing economic tensions. This steady rate environment reflects the central bank’s efforts to balance combating inflation while supporting economic growth and stability.

The Fed’s interest rate policy has far-reaching implications, not only for traditional financial markets, but also for the crypto market.

Historically, lower interest rates have made risk assets, including crypto, more attractive to investors seeking higher returns, as traditional savings and bonds offer lower returns. Conversely, higher rates could lead to a stronger dollar, potentially dampening the appeal of cryptocurrencies.

Therefore, the Fed’s stance on interest rates is a critical factor that could influence investor sentiment and decision-making in the crypto space as we approach the Bitcoin halving in 2024.

Crypto forecast and predictions for 2024

Bitwise’s predictions

In 2023, Bitcoin’s performance outperformed all major asset classes with an impressive 128% increase, which contrasted sharply with the S&P 500’s 21%, gold’s 12% and bonds’ modest 2% returns.

Bitwise expects this upward trajectory to continue into 2024, predicting that Bitcoin will breach the $80,000 mark and set new all-time highs.

This optimism is supported by their internal studies which suggest that spot Bitcoin ETFs could capture 1% of the $7.2 trillion US ETF market, amounting to $72 billion within five years – a milestone almost reached with nearly $50 billion in collected less than two months.

Meanwhile, Bitwise considers Coinbase’s conservative revenue growth projections, pegged at 9% year-over-year from $2.8 billion to $3.1 billion by Wall Street, to be significantly understated.

Forecasting at least a doubling in revenue for Coinbase, Bitwise highlights three overlooked factors: the ongoing bull market’s impact on trading volumes, the traction gained from a range of new products including perpetual futures and regulated futures, and Coinbase’s potential as the primary custodian for most Bitcoin ETFs.

Amidst this, Bitwise foresees 2024 as a pivotal year for stablecoins, predicting that they will surpass Visa in fixed volume.

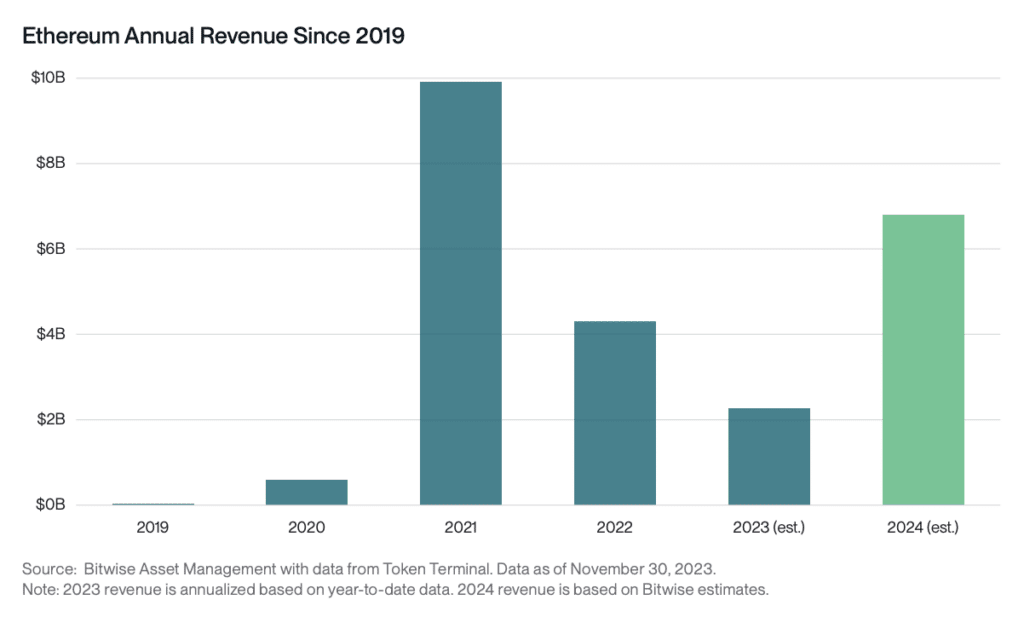

Ethereum’s ecosystem is also expected to see significant growth, with network fees expected to double from $2.3 billion in 2023 as crypto applications become mainstream.

Furthermore, Bitwise predicts that Ethereum’s upgrade, EIP-4844, which aims to drastically reduce transaction costs, could catalyze the first wave of mainstream crypto applications by enabling new use cases such as micropayments and large-scale gaming.

CoinShares predictions

The crypto market outlook for 2024, as analyzed by CoinShares, points to a year of transformation and opportunity.

According to CoinShares, the macroeconomic environment, especially monetary policy and the US dollar’s stability, may still remain critical in the appreciation of Bitcoin.

Rising interest rates have historically driven investors to alternative stores of value such as US Treasuries. However, with inflation rates in developed countries declining and expectations of a Fed interest rate cut in early 2024, fixed-income assets such as Bitcoin and gold may see greater appeal.

Further complicating the dollar’s dominance are global geopolitical shifts and emerging concerns about US debt sustainability, reflected in the rising cost of Credit Default Swaps – a sign of growing investor unrest.

These factors, combined with the potential for a crisis of confidence in US debt or banking system instability, could strengthen Bitcoin’s reputation as a reliable safe-haven asset.

On the technology front, CoinShares highlights the critical role of data availability (DA) in the crypto landscape, with Solana poised to lead in this arena due to its superior data throughput.

This shift is expected to disrupt the current defi market dynamics, potentially challenging Ethereum’s dominance by providing a more scalable and cost-effective alternative for applications that require high data capacity.

The way forward

As we look ahead, the launch of spot Bitcoin ETFs and the anticipated Bitcoin halving could significantly impact investor sentiment and market dynamics.

These events, along with technological advances, can improve the functionality and reach of digital currencies, promoting greater adoption in various sectors of the economy.

However, the broader economic environment, such as monetary policy and the global financial landscape, remains a critical determinant of the crypto market’s direction.

As interest rates fluctuate and the stability of traditional financial institutions is tested, the crypto industry’s response will be indicative of its resilience and adaptability.

The journey to 2024 and beyond will undoubtedly require careful consideration of both the opportunities and obstacles that lie ahead.

Disclosure: This article does not represent investment advice. The content and materials on this page are for educational purposes only.

Frequently Asked Questions

What is the future of crypto in the next 5 years?

The future of crypto in the next five years looks promising. Advances in technology, increased institutional investment through ETFs and key events such as the Bitcoin halving can drive market growth. In addition, the development and integration of blockchain in various sectors can lead to broader utility and adoption of crypto-assets.

Does crypto have a future?

Yes, crypto probably has a bright future ahead. The resilience shown during previous market downturns, combined with the recent rise in prices and institutional interest, highlights the sector’s potential. Yet regulation and the broader economic context, including monetary policy and the global financial landscape, remain crucial in shaping the trajectory of the crypto market.

Will the crypto market recover in 2024?

The crypto market could recover in 2024, driven by several key factors. The Bitcoin halving event is expected to create a supply shock, potentially increasing Bitcoin’s value. Furthermore, the launch of spot Bitcoin ETFs has already attracted significant investment, indicating strong market confidence. Forecasts from experts such as Michael Saylor and institutions such as Standard Chartered Bank also point to a bullish outlook, with expectations of significant price increases and increased institutional participation.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news