Are you an investor who prefers to use technical analysis rather than mere intuition to make digital asset investments? If so, here is a must-see list of the top ten crypto technical analysis resources to add to your trading tool arsenal in 2019.

Chart Analysis Platforms

The main resources for crypto-technical analysis are charting platforms. Fortunately, there are two high-quality technical analysis platforms that offer free versions, namely: TradingView and CryptoWatch.

TradingView

TradingView is probably the leading chart analysis platform you can find online. While the platform originally focused on assets such as stocks and currencies, the Chicago-based company began adding bitcoin cards to its platform in 2014. Today, every major (and some minor) digital currencies and tokens can be found on the platform.

TradingView offers a wide variety of technical analysis indicators and tools, which can make it scary for beginners. However, once you get used to the dashboard and its features, it offers practically everything a trader needs to analyze digital asset charts.

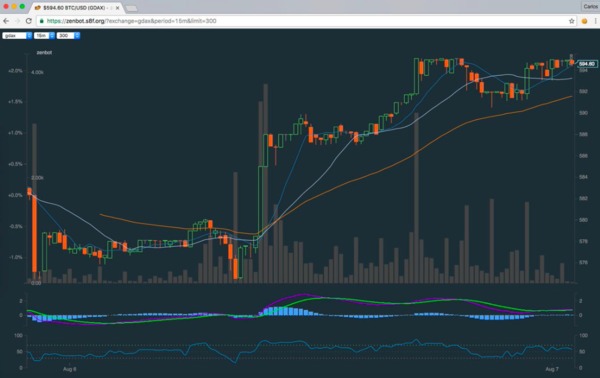

CryptoWatch

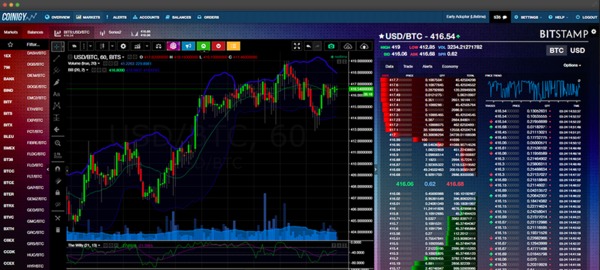

CryptoWatch is a digital asset-focused chart analysis platform recently acquired by US-based digital asset exchange Kraken. CryptoWatch offers users a wide range of technical analysis tools. The CryptoWatch terminal allows traders to track their portfolios, analyze charts and execute transactions directly on the Kraken exchange through the platform.

CryptoWatch is a digital asset-focused chart analysis platform recently acquired by US-based digital asset exchange Kraken. CryptoWatch offers users a wide range of technical analysis tools. The CryptoWatch terminal allows traders to track their portfolios, analyze charts and execute transactions directly on the Kraken exchange through the platform.

Digital asset portfolio management applications

In addition to free-to-use chart analysis platforms, there are digital asset portfolio management apps with high-quality charting tools that also offer built-in trade execution and portfolio tracking features. Two examples are Coinigy and TabTrader.

Coinigy

Coinigy refers to itself as “the ultimate cryptocurrency portfolio management suite,” and it’s not wrong with this statement. The Coinigy platform offers wallet management, portfolio tracking and management functions, execution access to over ten exchanges, and chart analysis tools, all in one dashboard.

TabTrader

TabTrader is probably one of the most popular on-the-go trading apps for digital asset investors, as it offers a range of features, including chart analysis tools, and execution access to 30 cryptocurrency exchanges. For active traders who cannot sit in front of their computers all day, TabTrade offers the ideal solution for on-the-move trading and market analysis.

Momentum Indicator Applications

Momentum indicator apps, such as the RSI Hunter or the Fear and Greed Index, can also be valuable tools for a chart player.

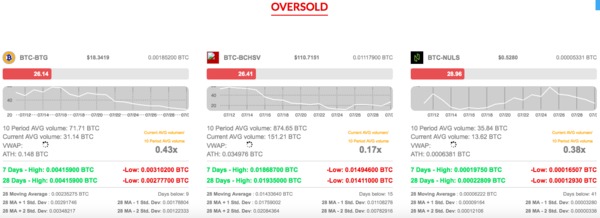

RSI Hunter

The RSI Hunter is a technical analysis platform that uses the Relative Strength Index to indicate whether a digital asset is “overbought” or “oversold”. According to its website, RSI Hunter tracks 296 digital assets listed on Bittrex, 201 assets listed on Binance, 12 assets listed on Bitmex, and 206 assets listed on Kucoin, and its prices and RSI indicators are updated on a minute-to-minute basis. updated. If you’re a big believer in momentum, the RSI Hunter can be a valuable addition to your technical analysis tools.

Crypto Fear and Greed Index

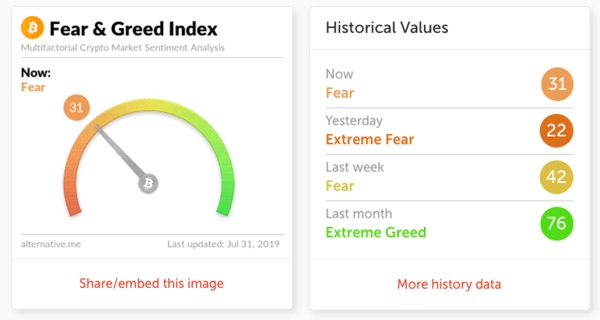

While the Crypto Fear and Greed Index is not technically a technical analysis indicator, it can still be very useful for active bitcoin traders who can use this metric to gauge market sentiment. Using a range of factors, the Fear and Greed Index can give you insight into whether traders are feeling fearful or greedy at the moment.

While the Crypto Fear and Greed Index is not technically a technical analysis indicator, it can still be very useful for active bitcoin traders who can use this metric to gauge market sentiment. Using a range of factors, the Fear and Greed Index can give you insight into whether traders are feeling fearful or greedy at the moment.

Crypto Trading Bots

If you use technical analysis as a basis for your bitcoin trading decisions, you can use bitcoin trading bots to execute your strategy in an automated way (even while you sleep). Once you’ve found a technical analysis-based trading strategy that works, using a bot is probably the best way to execute it, as bots take emotions and potential manual errors out of the equation. The two most popular free, open source bitcoin trading bots are Gekko and ZenBot.

Gecko

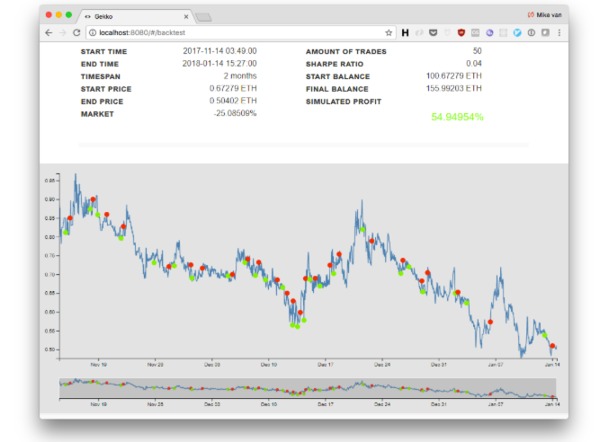

Gekko was launched in 2013 as one of the first bitcoin trading bots and has managed to remain a popular option for bitcoin traders today. Using the Gekko bot, you can build, backtest and execute a number of bitcoin trading strategies based on technical indicators.

ZenBot

Just like Gekko, Zenbot has been in the market for quite some time. Since its launch in 2016, ZenBot has been continuously improved by a number of developers, resulting in the bot becoming a favorite among traders. Apart from the standard functions of backtesting and live execution of self-developed trading strategies, the ZenBot also offers a paper trading mode to test strategies and configurable orders.

Technical Analysis YouTube Channels

There are dozens of crypto YouTube channels you can tune into to learn more about bitcoin, altcoins, and the blockchain. There are also channels for fans of technical analysis. The two most popular are Josh Olszewicz’s Crypto Technical Analysis Channel and Crypto Cred.

Josh Olszewicz’s Crypto Technical Analysis Channel

Josh Olszewicz is a digital currency analyst and author who runs a YouTube channel where he shares his insight into the latest price trends based on technical indicators of his choice. More than 24,000 subscribers watch his videos.

Crypto Cred

Crypto Cred is another popular YouTube channel that focuses on technical analysis for digital assets. However, this channel focuses more on the educational aspect of chart analysis than on current market trends. Therefore, it is generally recommended for newbies who want to learn about technical analysis, as opposed to experienced traders who want regular market updates from a chart holder. More than 34,000 subscribers follow this channel.

Related articles:

To discover the latest trends and market developments in the digital asset markets, subscribe to the Bitcoin Market Journal newsletter today!

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news