[ad_1]

![]() Bitcoin L1Bitcoin is an innovative payment network and a new kind of money. View Profile” class=”stubHighlight”>Bitcoin has been off 40% from its local bottom since mid-September, and with the impending approval of a spot BTC ETF now priced in, Crypto Twitter is ecstatic! 🥳

Bitcoin L1Bitcoin is an innovative payment network and a new kind of money. View Profile” class=”stubHighlight”>Bitcoin has been off 40% from its local bottom since mid-September, and with the impending approval of a spot BTC ETF now priced in, Crypto Twitter is ecstatic! 🥳

Indicative of the market’s bullish expectations for spot BTC ETF, crypto investment firm Galaxy released a report predicting that approval would trigger $14B of Bitcoin buying pressure and BTC price should rise 74% within the first year of launch !

But while the brave souls remaining in crypto have positioned themselves for new highs, external capital is required to take us there, and the mere approval of a spot BTC ETF is no guarantee that flows will follow.

Despite prevailing narratives that institutions and investment advisors are waiting for the arrival of a mock ETF to unleash a capital tsunami in crypto, there appears to be little evidence to support that this will be the case, with AUM of Canadian spot BTC ETFs virtually unchanged since July 2022.

Canada has had a spot ETF for over two years. Investments are essentially unchanged since July 2022.

If there was an urgency among the $2T Canadian pension market to gain exposure to this asset, wouldn’t the value go up?

What am I missing? pic.twitter.com/lZRvuL0eWh

— 𝐓𝐗𝐌𝐂 (@TXMCtrades) October 28, 2023

Crypto remains a zero-sum game where assets compete for the limited amount of dollars available. Pumps are simply the result of the rotation of internal capital. The evidence that capital will flow into the industry following the approval of a mock BTC ETF is simply non-existent!

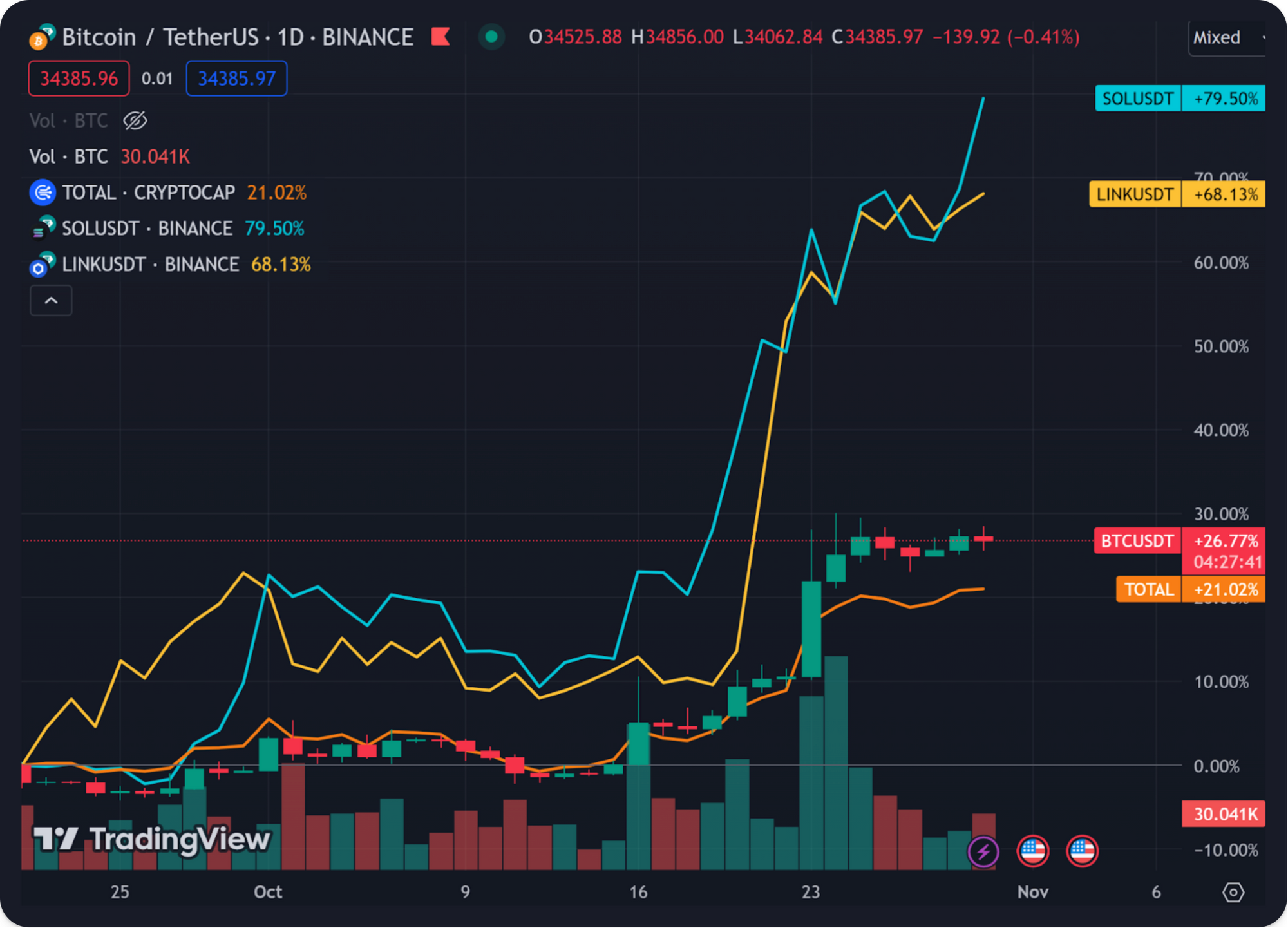

Tokens that have found their way into the spotlight, such as BTC, LINK and SOL, have been able to eke out gains thanks to extremely thin liquidity, allowing small amounts of buying pressure to result in massive moves, but the broader market is lagging behind. the leaders. This shows that the rally is being led by the outperformance of a select number of assets and shows the lack of breadth in crypto markets.

Just as the market has swung from apathy to exuberance over the past month, sentiment is positioned to move in the opposite direction in a nanosecond. While the recent rally has been exciting, it’s time to temper your expectations and remind yourself that we’re still deep in the macro woods.

Federal Reserve Chairman Jerome Powell stood firm in his commitment to bring inflation back to the Fed’s long-term inflation target of 2%, a feat accomplished by raising interest rates. At the same time, US deficits are bulging, and major US Treasuries such as China and Japan are selling dollar assets to defend struggling local currencies, putting further upward pressure on yields.

The Bank of Japan announced yesterday that it will revise its yield curve control policy to allow rates on long-term Japanese government debt to exceed the previous 1% ceiling, signaling that interest rates may have to continue rising.

🔴 BANK OF JAPAN TO REVIEW INTEREST RATE CONTROL, TO MAKE LONG-TERM INTEREST RATE MORE FLEXIBLE THAN 1% – NIKKEI. https://t.co/zdL8zpAPbq

— Breaking Market News (@financialjuice) October 30, 2023

Crypto projects are long-term investments, and “higher-for-long” interest rates can cause liquidity to evaporate from risk markets, such as crypto and stocks, further depressing valuations.

The only alternative to further rate hikes is a collapse of the economy in which monetary policymakers respond by cutting rates. Despite the global economy showing resilience to previous rises, cracks are beginning to emerge in the system, threatening to drag down the prices of risk assets.

Consumer spending was financed by rising debt levels, but high interest rates sent credit card delinquencies soaring and auto loan defaults to new highs! While stimulus delayed the inevitable end of the business cycle, it produced inflation, and the remedy—higher rates—left many borrowers unable to afford their payments.

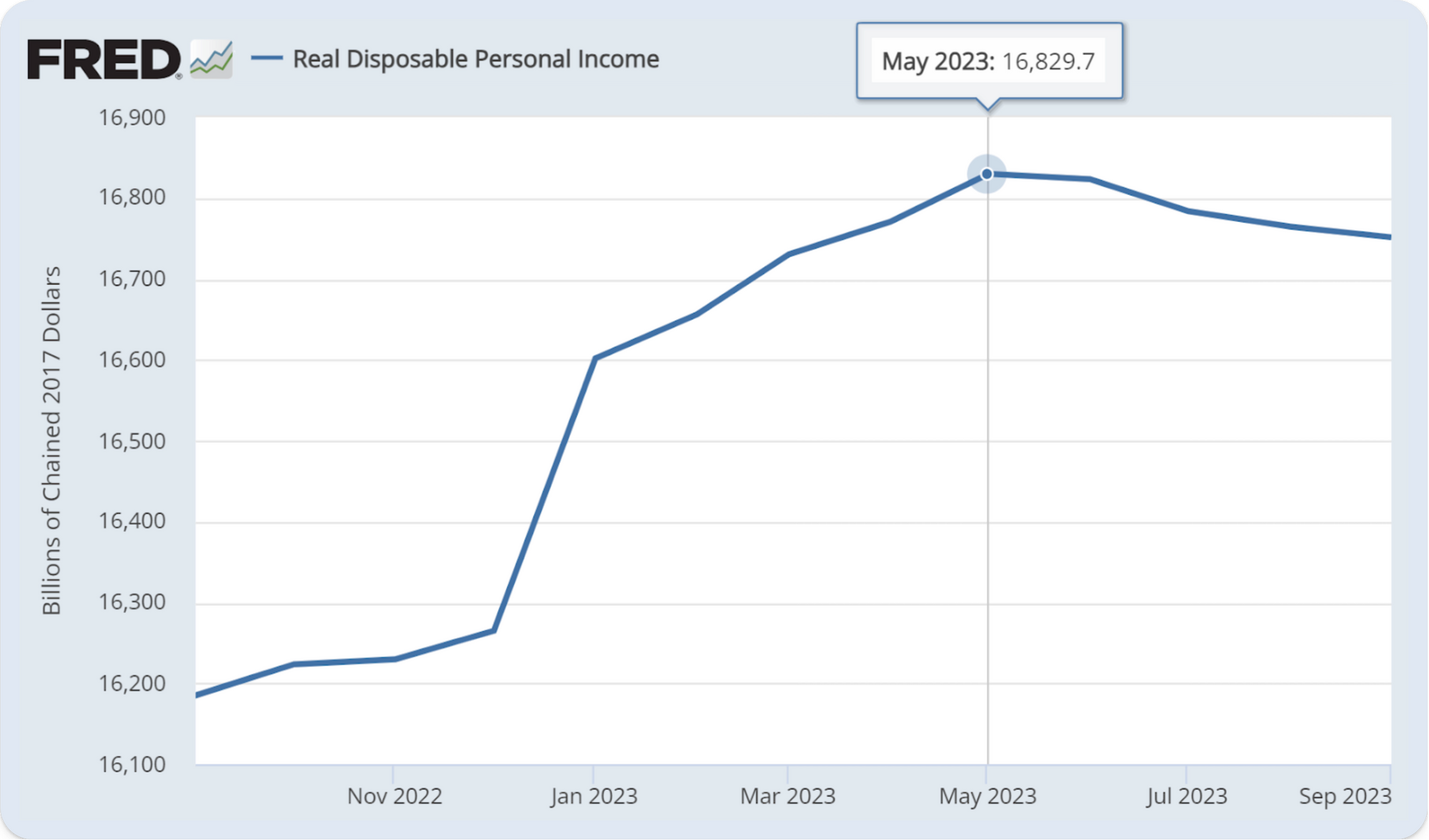

At the same time, real disposable personal income has declined since May, leaving consumers with less money to pay off growing debt burdens. This suggests that further increases in arrears and defaults can be expected, which will result in even lower spending levels that will force businesses to lay off employees, causing even further economic contraction.

While an era of fast and loose money helped propel crypto to all-time highs in 2021, the post-COVID credit bubble threatens to burst, and investors will have to scramble for dollars; the resulting deflationary failure will almost certainly put crypto investments under pressure.

The only asset that stands a chance of surviving the blowout is Bitcoin, which could serve as a potential hedge against the monetary unwinding that would ensue should central banks engage in another round of quantitative easing to stop the crisis; however, it will still compete with the dollar during a period of deflation.

While a healthy dose of FOMO in a low liquidity environment was enough to cause a brief squeeze that sent crypto momentarily higher to send crypto momentarily higher, rates will continue to rise until things start to break, and when that happens , increased unemployment and further declines in income will force long-term oriented holders to capitulate and sell their bags.

Virtually no asset has a chance against the dollar in either the “higher-for-long” or deflationary bust scenarios. 🐻

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news