[ad_1]

IMPORTANT POINTS

Bitcoin mining will help prevent the waste of previously wasted renewable power: ESG expert Daniel BattenGovernments singling out Bitcoin mining above energy use and ignoring other industries have created trust issues, he said a KPMG report highlights how other industries outside Bitcoin had higher emissions, including tourism

Bitcoin has come a long way since it was first introduced to the financial world by Satoshi Nakamoto, but the heartbeat of the ecosystem – Bitcoin mining – is what has kept the community alive for over a decade. An evolving story is changing the way the industry is viewed by the world, and with much-needed positive recognition from governments, the nascent sector can finally find its place in the spotlight of efforts to help achieve global zero-emissions targets.

Bitcoin miners are turning to renewable energy sources

More and more $BTC miners are investing in renewable energy sources to power their operations, and others, such as Gryphon Digital Mining, are already certified to be 100% renewable.

In an exclusive with International Business Times, prominent Bitcoin ESG (environmental, social and governance) analyst Daniel Batten shared his thoughts on the collective efforts of the Bitcoin mining industry towards more sustainable operations and the impact of the government’s approach on the sector.

“Through the work of Margot Páez and also the Digital Assets Research Institute, we are now getting much better data on the use of sustainable energy… the whole industry is now moving towards sustainable energy at about 3.5% per year, which the industry on track to be 80% sustainably powered by the end of 2030,” says Batten, who is also a climate technology investor.

Páez is known in the cryptocurrency community for her research on climate modeling and Bitcoin’s intersection with climate change and the energy sector.

What Recent Studies Say About Bitcoin Mining and Energy

A February study published in the peer-reviewed Proceedings of the National Academy of Sciences (PNAS) journal suggested that synergy of hydrogen technologies with $BTC mining could enhance the deployment of renewable energy sources. “Specifically, through the economic potential derived from green hydrogen and Bitcoin for incremental investment in renewable energy penetration, this dynamic duo can enable capacity expansion of up to 25.5% and 73.2% for solar and wind power installations,” the researchers said. writing.

For Batten, the study has “sound model assumptions” as Bitcoin mining has previously been shown to improve profitability in some businesses, including businesses that require low-temperature heating, OTEC (ocean thermal energy conversion) and renewable micro-grid development.

Miners will not really face challenges in terms of adopting the model proposed in the study. However, there will be initial “skepticism from the solar or wind producer,” Batten noted. However, he believes that once solar and wind producers have a good understanding of how the synergy will work, “that will probably be the single best influence on how quickly they can expand because they now have a guaranteed buyer for all their energy, including a large amount of energy that no one wanted before.”

What are the options for smaller miners?

Since the April halving, competition has only intensified, and at this point in the game, smaller Bitcoin miners “have no choice but to switch to the cheapest energy available,” Batten said.

The World Bank said renewable energy sources are a good alternative to rising fossil fuel costs. These sources would not only help countries mitigate climate change, but could also “build resilience to volatile prices and lower energy costs.”

In the Global Electricity Review 2023 presented by the independent global energy think tank Ember, it was revealed that the reason some governments are now prioritizing wind and solar energy sources is due to the fact that such sources are “cheaper and safer than fossil fuels” in many countries are.

The International Energy Agency (IEA) supports this data, as it said that utility-scale solar PV and onshore wind are “the cheapest options for new electricity generation in a significant majority of countries worldwide.”

In the case of Bitcoin mining, Batten noted that transition will only drive greater sustainability not only within the industry, but also contribute to global climate action efforts.

“Bitcoin mining will help prevent the waste of previously wasted renewable power, which will help accelerate the renewable transition. This is no longer theory—it has been observed firsthand on the ERCOT grid and there is now a Cornell- university paper supporting data that renewable transition is in fact accelerated by the economic rise Bitcoin mining companies provide renewable operations,” he added.

Bitcoin mining and the government

More and more miners have become transparent about their energy use in recent years amid lingering concerns among environmentalists who remain skeptical of the industry’s power consumption. However, there is still the issue of the approach governments and regulators have taken to demanding information from miners.

“What is clear is that Bitcoin mining companies are generally happy to share with academic institutes, but distrustful of the way the government has tried to extract data using threats of fines, singling out Bitcoin mining while larger and less flexible data center users are ignored.” Batten pointed out.

The IEA said in its Electricity 2024 report that data centers, AI and crypto mining could collectively double electricity consumption by 2026. The report did not single out Bitcoin mining as the only sector that saw its power consumption increase.

The issue of exempting $BTC mining came up as early as 2022, when it was reported that the White House was drafting policy recommendations on how crypto miners could lower their energy consumption. But is policy the right route?

Batten believes policies that specifically target Bitcoin miners’ electricity consumption and renewable energy transition are “unnecessary and potentially counterproductive.” Miners are already transitioning without government mandates, and more mining companies are taking the step toward more environmentally responsible operations even without regulatory pressure.

“It’s also a dangerous precedent for the government to start mandating that certain industries are only allowed to use a certain source of energy, while others like Netflix, AI, gaming and others have impunity to use any source they want. want,” he argued.

A path for the industry’s efforts to be seen

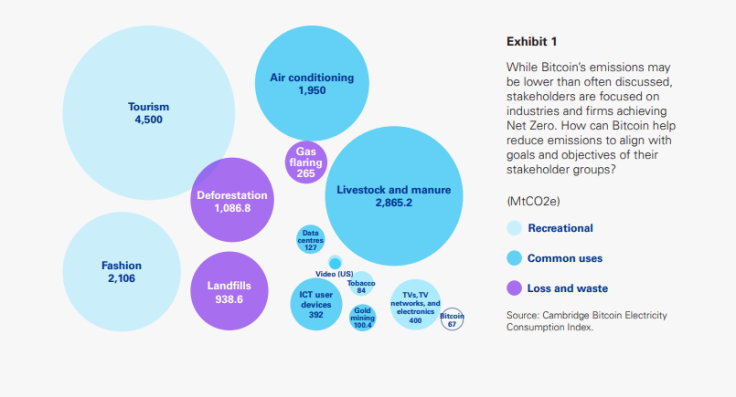

Professional services firm KPMG wrote in 2023 that “the use of energy is not the primary issue, but rather the emissions associated with the production of that energy such as those from burning fossil fuels.” The report reiterated that if comparisons were to be made, “it is useful to compare the emissions associated with Bitcoin’s operations with the emissions of a wide range of industries and services.”

Compared to the 4,500 MTCO2e (unit of measurement meaning a metric ton of carbon dioxide equivalent) from the tourism sector, and 2,865.2 MTCO2e emitted by livestock and fertilizer industries, Bitcoin emitted 67, according to the Cambridge Bitcoin Electricity Consumption Index.

Cambridge Bitcoin Electricity Consumption Index

Instead of creating policies targeting the mining industry’s power use, the government might as well “shine the light on the positive example that Bitcoin mining companies have shown by helping them achieve zero emissions targets, to encourage others inspire industries to do the same.” Batten said.

The path to sustainable operations is different for each miner, but as more Bitcoin miners voluntarily make the transition — as per Bitcoin ESG Forecast’s June report that $BTC mining’s sustainable energy consumption peaked at 54.5% — the narrative around the industry can finally become much more positive, and proper recognition can finally be given to an industry whose collective efforts at climate action have often been overshadowed by earlier negative narratives and common misconceptions.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news