Are you curious about the impact of artificial intelligence (AI) in the ever-evolving world of AI forex trading? It is reshaping the landscape, unlocking incredible potential for market analysis, risk management and automated trading. But does it really deliver results?

Join us as we dive into the power of AI in forex trading, explore its applications and how you can leverage this technology to improve your trading strategies amid market complexities.

The Power of AI in Forex Trading

Have you considered the significant progress that the integration of AI in forex trading has brought? This development offers numerous advantages to traders. AI-powered strategies allow you to make fast and precise automated trading decisions while effectively managing risks and maximizing profits.

Explore with us the three key areas in which AI excel within the forex trading industry. These areas include improved market analysis, improved risk management and automated trade execution.

Improved market analysis

AI algorithms possess the remarkable ability to process large volumes of market data quickly. In doing so, they uncover valuable insights into trends and patterns that may be elusive to human analysts. This advanced market analysis empowers traders by enabling them to identify emerging opportunities and make well-informed decisions.

Furthermore, AI-based market analysis offers more efficient and cost-effective methods of identifying and capitalizing on opportunities. By automating trading decisions through AI algorithms, manual intervention is reduced, allowing traders to focus on strategic tasks.

The cost of using AI for ChatGPT tradingfor example, is also a very compelling factor for people to utilize this new technology.

Improved risk management

AI can play a crucial role for traders like you in managing risk. It helps by identifying potential pitfalls and suggesting adjustments to your trading strategies. By providing the ability to recognize and mitigate risks, AI-driven risk management empowers you to make more informed decisions and reduce your overall exposure to risk.

In addition, AI algorithms serve as a valuable tool in detecting fraudulent or suspicious activity within the forex market. This important feature helps protect merchants from potential scams and manipulative practices.

By providing an extra layer of protection, AI significantly increases the overall value and reliability of forex trading.

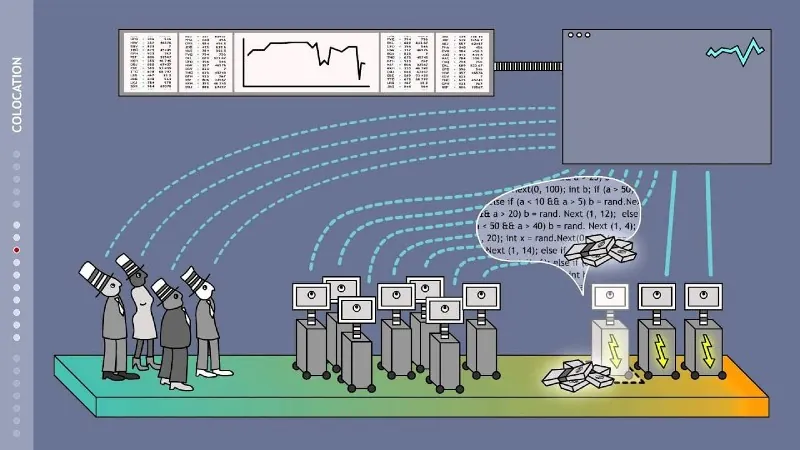

Automatic trade execution

AI empowers you to automate trade execution, enabling you to seize opportunities quickly and efficiently. Using AI trading bots, you can effortlessly design automated strategies and…

Formulate ‘if-then’ strategies

Convert it into coded algorithmic strategies

Integrate them with trading platforms, web and mobile applications.

By choosing to execute trades automatically, traders can:

Free up time to focus on strategic decision making and other aspects of their trading

Ensure more accurate and reliable trading decisions using AI algorithms

Minimize costly mistakes

Developing an AI-based Forex Trading Strategy

Now that you have an understanding of the immense potential of AI in forex trading, let’s delve into the process of developing an AI-based forex trading strategy. To create a successful strategy powered by AI, it is essential to follow a few key steps.

1. First, you need to carefully choose the most suitable AI technology for your specific needs.

2. Next, define the trading parameters that match your investment goals and risk tolerance.

3. Finally, test and optimize rigorously.

Choose the right AI technology

If you want to take full advantage of artificial intelligence in forex tradingit is imperative that you choose the appropriate AI technology.

You, as a forex trader, can benefit from using machine learning, natural language processing and computer vision solutions that meet your specific trading requirements.

Machine learning algorithms possess the ability to analyze large amounts of historical data. Using this data, they can accurately predict future market trends. In addition, natural language processing algorithms can be used to examine news articles and social media, helping in understanding market sentiment.

Conversely, computer vision algorithms can be harnessed to examine maps and graphs, facilitating pattern identification.

To create customized strategies maximizing the strengths of each AI technology, traders like you can carefully select the most suitable one.

Define trading parameters

To guide AI in decision making, it is essential to establish trading parameters. These parameters include various aspects of a trade, including entry and exit points. In addition, it involves risk management and trade management strategies.

Technical analysis tools such as trend lines, support and resistance levels, as well as chart patterns can help identify the entry and exit points.

Risk management is an important factor in trading parameters. Traders can effectively manage their risk and optimize their trading strategies by implementing various risk management techniques, such as setting stop loss orders, diversifying investments and using leverage.

Backtesting and refinement

An important step in developing an AI-based forex trading strategy is backtesting. You evaluate the accuracy and potential performance of the strategy using historical data. This process allows you to measure its effectiveness and make informed decisions.

Measure the risks and returns of their strategies

Identify any flaws or weaknesses in the strategy

Optimize and refine the strategy before implementing it in the market

If you want to improve your chances of success in the forex market, it is essential for traders to perform thorough backtesting.

By using these powerful tools in backtesting, you can evaluate how your strategies would have performed in different market conditions. This valuable analysis allows you to refine and optimize your approaches, leading to smarter decisions based on past performance.

Ultimately, this translates into increased profitability for your trades.

Real-life examples of AI in Forex Trading

AI has already made a significant impact on forex trading. Real examples clearly demonstrate its effectiveness. In the next section, we will delve into three key applications of AI in forex trading: high-frequency trading, sentiment analysis, and pattern recognition.

Did you know that high frequency trading is a type of algorithmic trading that is used artificial intelligence (AI) to make quick and informed decisions?

High Frequency Trading (HFT)

Did you know that High Frequency Trading (HFT) represents a prime illustration of AI’s potential in the world of forex trading? Using powerful computers and AI algorithms, HFT executes numerous orders efficiently at remarkable speeds. This strategy takes advantage of even the smallest market price fluctuations.

Although high frequency trading (HFT) can be highly profitable, it is important to recognize the associated risks. This includes relying on unpredictable algorithms and potential market manipulation. However, it is worth noting that when implemented correctly, HFT showcases the immense potential of artificial intelligence in forex trading.

Sentiment Analysis

Did you know that sentiment analysis is a remarkable application of artificial intelligence (AI) in forex trading? This shows the tremendous capabilities of AI in analyzing market trends. Using AI to analyze news articles and social media data, sentiment analysis can effectively measure market sentiment and make predictions about potential market movements.

This technique provides valuable insights into customer sentiment and market trends. It helps businesses make more informed decisions regarding product development, marketing strategies and customer service. Moreover, sentiment analysis shows the immense potential of AI for forex traders.

Pattern recognition

Want the power to predict future market trends? Pattern Recognition, an AI application, is here to help traders like you. By analyzing historical data, it identifies recurring patterns that can help you anticipate market movements. This approach not only recognizes trends, but also determines support and resistance levels and other patterns that can optimize your trading decisions.

You can reduce risk and improve your trading performance by leveraging pattern recognition. This real-life example shows how artificial intelligence in forex trading empowers traders to make more informed decisions.

Overcoming Challenges in AI Forex Trading

AI offers enormous potential for forex trading, but along with its benefits come challenges that traders must navigate to fully utilize its capabilities. In this section, we will delve into three core challenges in AI forex trading: ensuring the quality and availability of data, adapting to evolving market conditions, and a balance between automation and human expertise.

To ensure successful AI forex trading, it is crucial to prioritize data quality and accessibility. Artificial intelligence algorithms rely heavily on accurate and available data.

Data quality and availability

Data quality and availability play an important role in enabling AI algorithms to make accurate predictions and informed decisions in forex trading. Ensuring the accuracy, completeness and timeliness of the data used by these algorithms is critical to generating reliable insights and minimizing potential errors.

To make timely decisions, it is essential to have access to up-to-date data. AI algorithms rely on current data for accurate predictions and informed decisions. By addressing these challenges, traders can fully utilize the potential of AI in forex trading.

Adapting to market changes

The forex market undergoes constant fluctuations, requiring AI algorithms to adapt and remain effective. By assimilating new information and adjusting strategies based on prevailing market conditions, these algorithms empower insightful predictions and savvy trading decisions in the realm of forex markets.

Techniques such as high-frequency trading, sentiment analysis and pattern recognition can help AI algorithms adapt to market changes. Using these methods, traders can ensure that their AI-driven strategies remain relevant and effective in the ever-changing forex market.

Balancing automation and human expertise

To optimize processes and judgement, it is crucial to find a balance between automation and human expertise in forex trading. AI can complement human decision-making without fully replacing it. Therefore, it becomes essential to find the right combination of leveraging technology and leveraging human cognition.

Carefully evaluate the strengths of AI and the unique value that people bring. By finding the right balance between AI, automation and human supervision, traders can optimize the benefits of AI-driven forex trading strategies while minimizing potential risks.

Summary

Finally, AI offers tremendous opportunities for forex trading. It offers advanced market analysis, enhanced risk management and automated trade execution. Traders can harness the power of AI by selecting appropriate technology, defining trading parameters and fine-tuning strategies through backtesting.

This enables them to make well-informed decisions and optimize their trading performance. While exploring the potential of AI in forex trading, it is essential to strike a balance between automation and human expertise.

By doing so, we ensure that AI functions as a powerful tool rather than replacing human intuition and judgement.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news