[ad_1]

As an emerging industry, GameFi requires participants to ask a lot of questions about projects before investing. Chief among these are questions about tokenomic models.

Tokenomics refers to the structure of a project’s economics and value system. At its core, tokenomics governs the relationship between NFTs and tokens within the game.

Footprint Analytics also provides dashboards for users to track the tokenomic of a specific game and the token holders analysis including daily active holders, new holders and top 10 token holders.

In this article, we will look at single token games and the ways in which they organize value. We will also explain the best way to profit from each of these models with the least risk.

3 Tokenomics models for games with only one token

Single token GameFi projects have only one token that supports all economic roles. Some examples include Crypto Zoon, Playvalkyr, Hashlandand Radio Caca.

This model requires a constant stream of new players to enter or repeat investments of former players, i.e. to achieve 100% external circulation.

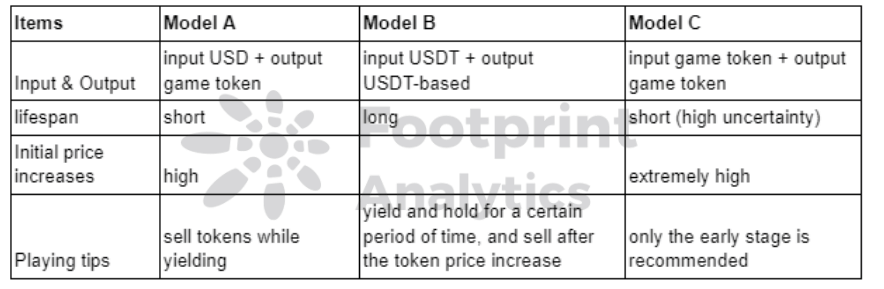

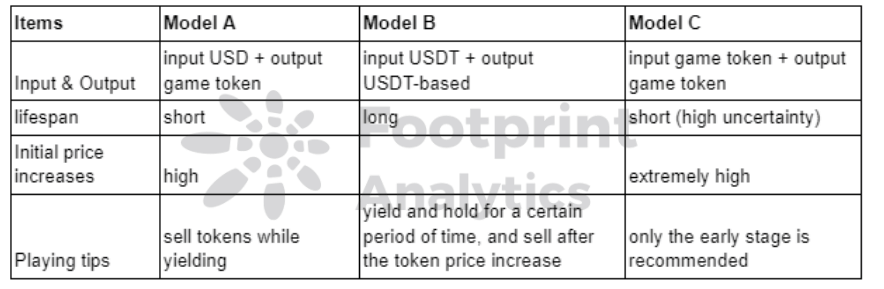

The single-token model can be broken down further by the relationship between the game token and fiat.

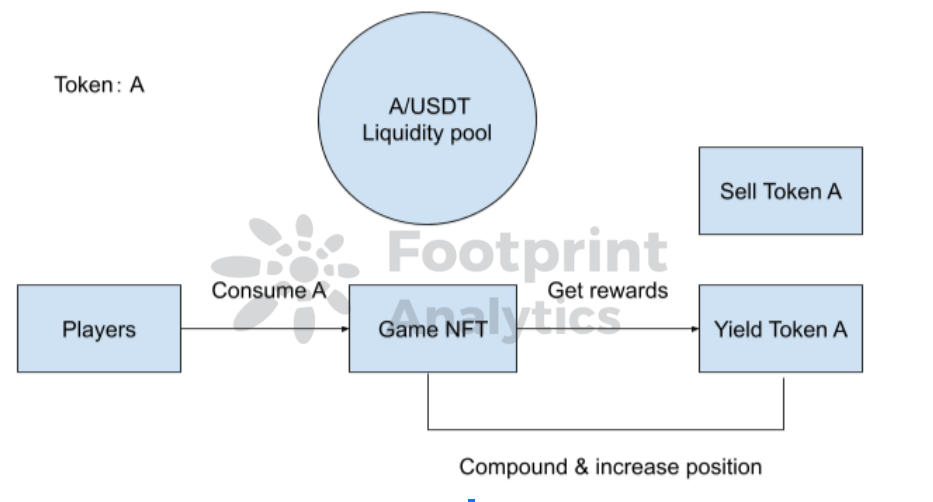

Model A: Input USD + output game token

This model was common at the beginning of the GameFi boom in 2021, in which users used USDT or BNB to buy and play NFTs to earn game tokens. This method is also commonly used in DeFi yield farming.

The characteristic of this model is that the entry price is fixed and the earnings vary with the token price.

The payback period will decrease as the toke price increases if the token is in an uptrend. This model can create a strong FOMO effect once a positive spiral around the project starts.

However, it also boosts the output and consumption of the tokens, easily causing an irreversible death spiral. Once the token reaches a downtrend, a pullback will occur in a degen project, while a solid project should continue to use real money to support the market and release good news to attract new players.

Most drawmat projects like to use this model—get real money and give tokens to the players.

This model is prone to fast initial runs and has a short lifespan. It is recommended that players sell tokens while conceding. As soon as the price downtrend appears, sell the token immediately.

Model B: Import USD + export USD value-based

To counter the constant threat of an irreversible falling knife inherent in the first model of single token games, a more recent type of game has emerged where the token is always tied to USD value. For example, if the game is assumed to yield 100 USDT/day, the number of tokens will change according to the token price. If the token price is 1 USDT today, the player gets 100 tokens. If the token price becomes 0.5 USDT tomorrow, the player receives 200 tokens.

This model enables fixed costs and returns for the players. In the upward trend of token price, the return cycle remains stable due to the decrease of the corresponding output quantity. In contrast, in the downtrend, the daily USDT-based returns obtained by the player are constant for a short period of time.

But is it too good to be true? Model B usually establishes a lock-in period. The token price after 7 days may not be 0.5 USDT.

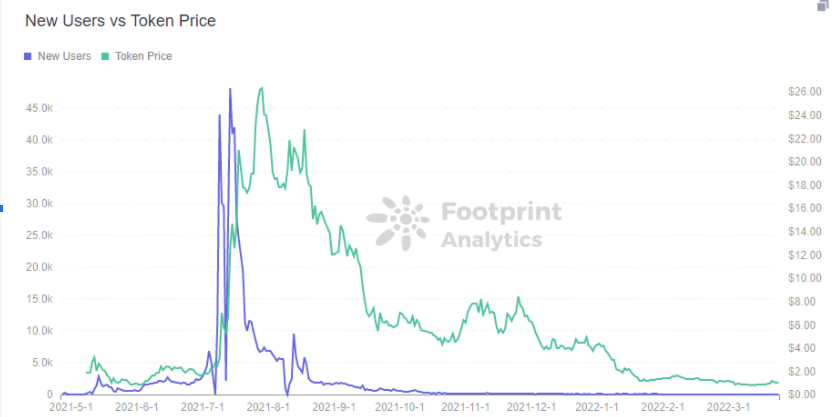

Valkyrio is a typical Model B project. The game itself is not fancy, but within two weeks of its launch it quickly attracted many new users and the token price grew rapidly, attributed to the new token model and the GameFi boom.

Income is stable and projects have longer lifespans. Token prices under this model tend to withstand sudden spikes and dips. It is recommended that players give in and hold for a certain time and sell after the token price increases to gain more income. After seeing a slowdown in new players, sell the tokens immediately.

Model C: Input Game Token + Output Game Token

In projects with Model C tokenomics, the costs and returns are both highly correlated with the token price.

For example, a game requires 100 tokens to play and offers a return of 10 tokens per day. The cost and return will vary from 100 USDT and 10 USDT to 200 USDT and 20 USDT if the token price grows from 1 USDT to 2 USDT.

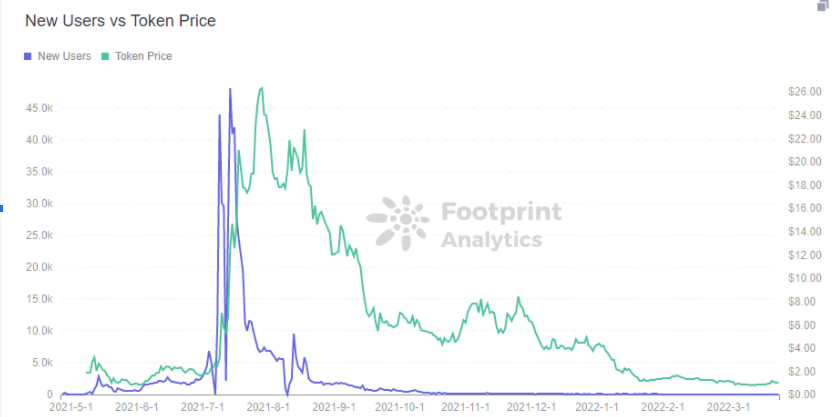

RACA (Radio Caca) is an example of this model. This is the exclusive manager of Maye Musk Mystery Box (MPB) NFT. Maye Musk, who is Elon Musk’s mother, and Binance’s founder Changpeng Zhao held an AMA for this project, which drew a steady stream of players.

As more players join, the prices rise and a FOMO cycle begins. Early players benefit from the dividends of rising token prices and derive income from the high costs of new players. Many projects applying this model make a fortune overnight.

Token prices are prone to ups and downs. These types of projects have a short lifespan unless they can maintain a large user base. It is recommended to join only at an early stage and keep an eye on the ability of the game to attract new users.

Summary

While many people label games as single or multi-character, these categories seem quite broad once you study GameFi data. Even among single-token games, there are several tokenomics models, each with its own distinctive features and dangers.

This was an article originally by Watermelon Game Guild, edited by Footprint Analytics

This piece is contributed by the Footprint Analytics community.

The Footprint Community is a place where data and crypto enthusiasts worldwide help each other to understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the world of blockchain. Here you will find active, diverse voices supporting each other and driving the community forward.

What is Footprint Analytics?

Footprint Analytics is an all-in-one analytics platform to visualize blockchain data and discover insights. It cleans and integrates chain data so users of any experience level can quickly start exploring tokens, projects, and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own custom charts in minutes. Uncover blockchain data and invest smarter with Footprint.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news