In this guide, we will help you take your first steps into the borderless world of Decentralized Finance, better known as DeFi. DeFi is a growing movement that has the potential to access financial services. This emerging ecosystem is built on global, public and distributed networks like Ethereum, and uses smart & hellip;

In this guide, we will help you take your first steps into the borderless world of Decentralized Finance, better known as DeFi.

DeFi is a growing movement that has the potential to democratize access to financial services. This emerging ecosystem is built on global, public and distributed networks like Ethereum, and uses smart contracts – or self-executing digital agreements. It is highly interconnected and composable, forming a colorful financial system made up of “money legos”.

DeFi provides products and tools for anyone in the world to leverage sophisticated financial applications with minimal capital, and without trusting a third party.

DeFi as an ecosystem consists of many sectors or categories, largely driven by:

Lending – the ability to easily lend and borrow cryptocurrencies without intermediaries Decentralized Exchanges (DEXs) – mediums to exchange assets while always retaining full ownership. Derivatives – on-chain representations of complex financial vehicles packaged into standalone assets. Insurance – protection against smart contract vulnerabilities or price volatility. Asset Management – ways to monitor, deploy and manage capital as you choose.

You will see that many projects use the term TVL, short for Total Value Locked. When users deposit funds into a DeFi protocol, it adds to the TVL, a financial metric to measure relative ‘success’ or popularity within the wider sector. A popular site to see how these protocols rank is DeFi Pulse.

In this article, we will help you interact with the most popular DeFi protocols today, giving you a first glimpse into an endless rabbit hole of innovation.

Please note that this guide is intended to serve as an educational tool only, meaning that none of the assets, products or services used are intended to be a solicitation or to be used as financial advice. Please proceed with caution and never invest more than you are willing to use.

Note: Subscribe now and join over 100K subscribers and stay up to date with the latest Crypto, DeFi and NFT content.

Set up Crypto account

Most of DeFi is built on Ethereum, so to tap into a large part of the ecosystem, you need the Ethereum network’s token called Ether (ETH), which is used to pay for transactions. Here’s a look at how to acquire Ether, and where to send it for use in popular DeFi products.

Step 1: Set up an account on a crypto exchange

Create an account with a crypto exchange like Coinbase. After setting up your password, follow the on-screen instructions to verify your email and ID.

Please note that there are many fiat ramps, and that Coinbase is one of the most used ways to go from fiat currencies like the US dollar (USD) to cryptocurrencies like Ether (ETH) in the US.

Step 2: Buy ETH

1. To make your first purchase, make sure you have linked a bank account, debit card or credit card to your new Coinbase account.

2. Click the “Trade” button on your Coinbase Dashboard.

trading coin base

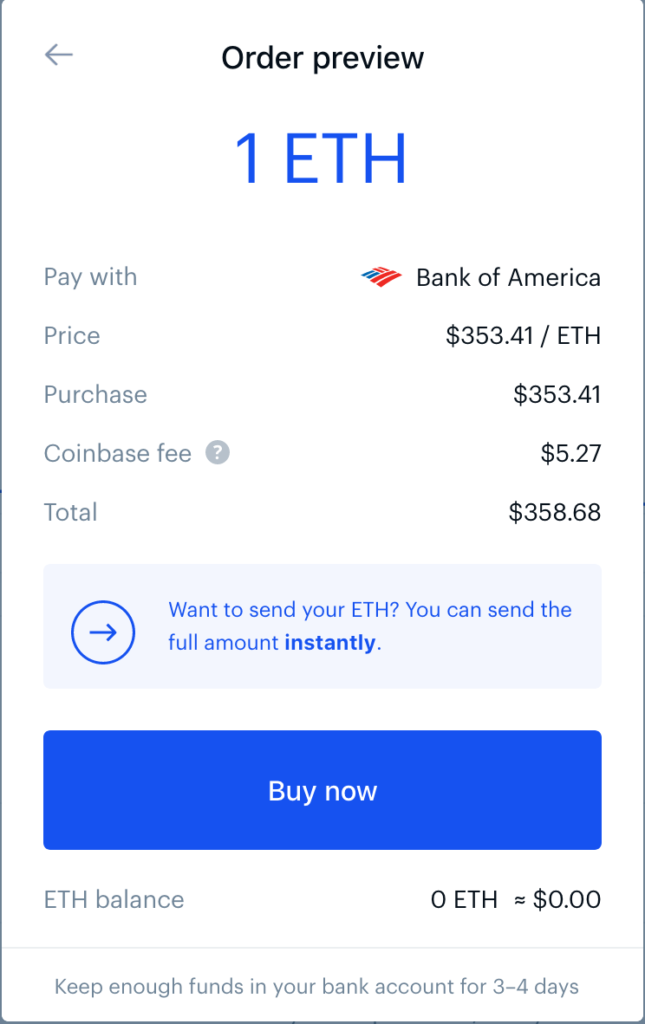

3. Preview your purchase after choosing the amount of ETH you want to buy in dollars.

coin base order

It is necessary to buy ETH, as it is necessary to carry out transactions on the Ethereum network. Without ETH, you won’t be able to access the vast majority of DeFi products.

Step 3: Set up an Ethereum wallet

1. Download an Ethereum wallet. This will be your gateway to DeFi.

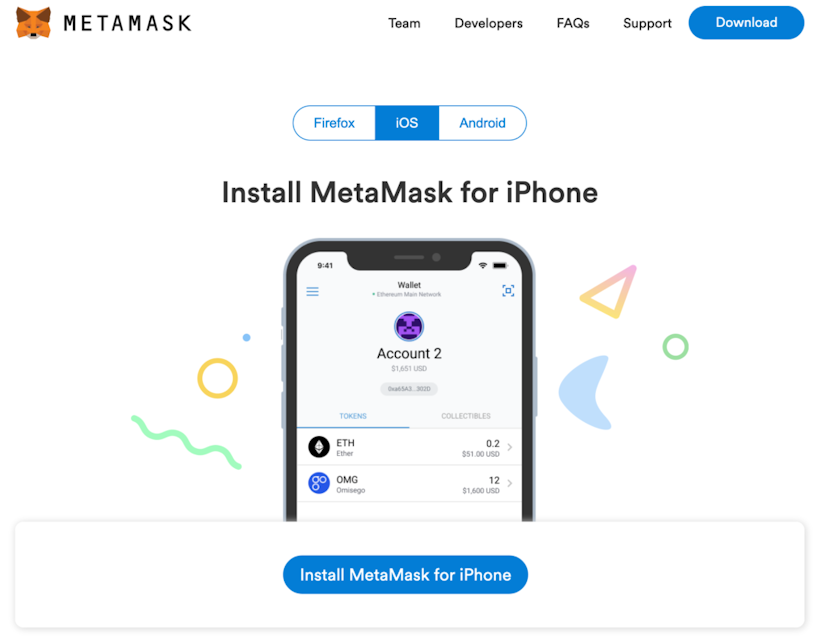

2. MetaMask is one of the most popular. Go to the https://metamask.io/download.html

3. Download the appropriate version of MetaMask depending on the device you are using and add as a browser extension.

meta ios

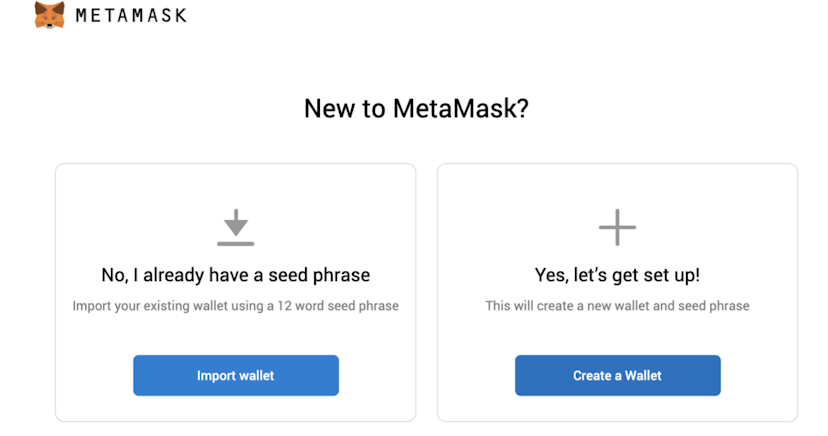

4. Set up a new wallet by clicking on “create wallet” and set a new wallet password.

create meta

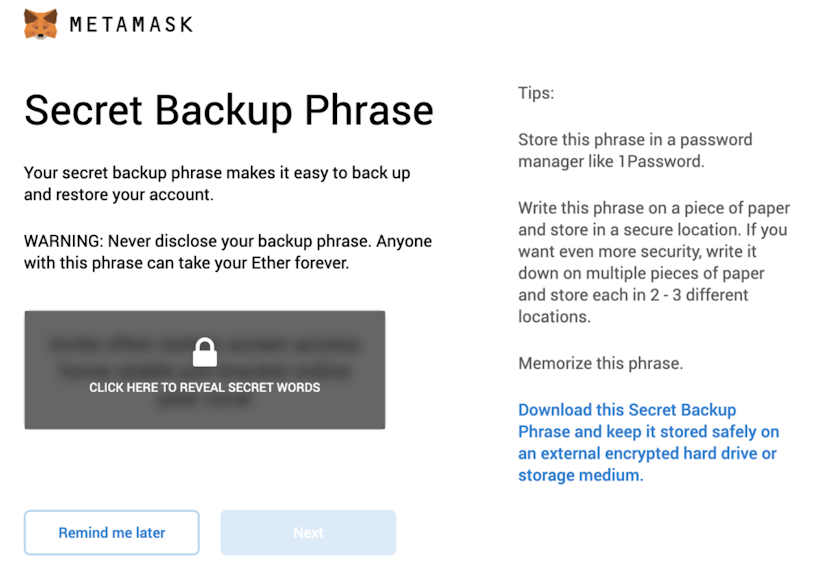

5. Very important: Store your secret recovery phrase somewhere safe. If you forget your password, it will be the only way to access your account as there is no entity that stores your information.

meta seed

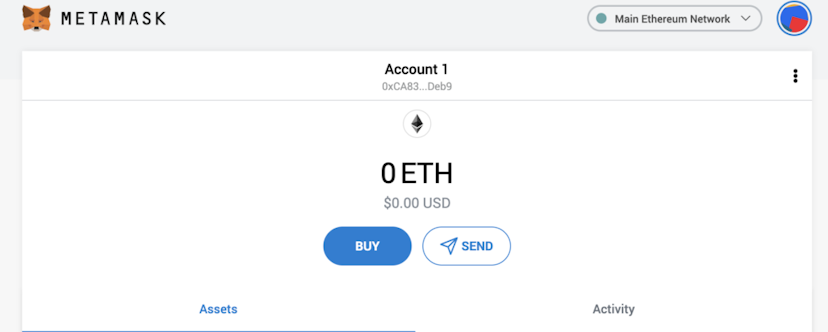

6. View your new wallet address right below where it says “Account 1.”

meta account

MetaMask is the most popular Ethereum wallet, and one that is supported by virtually every DeFi application. You will be able to find your MetaMask address at the top of the browser extension.

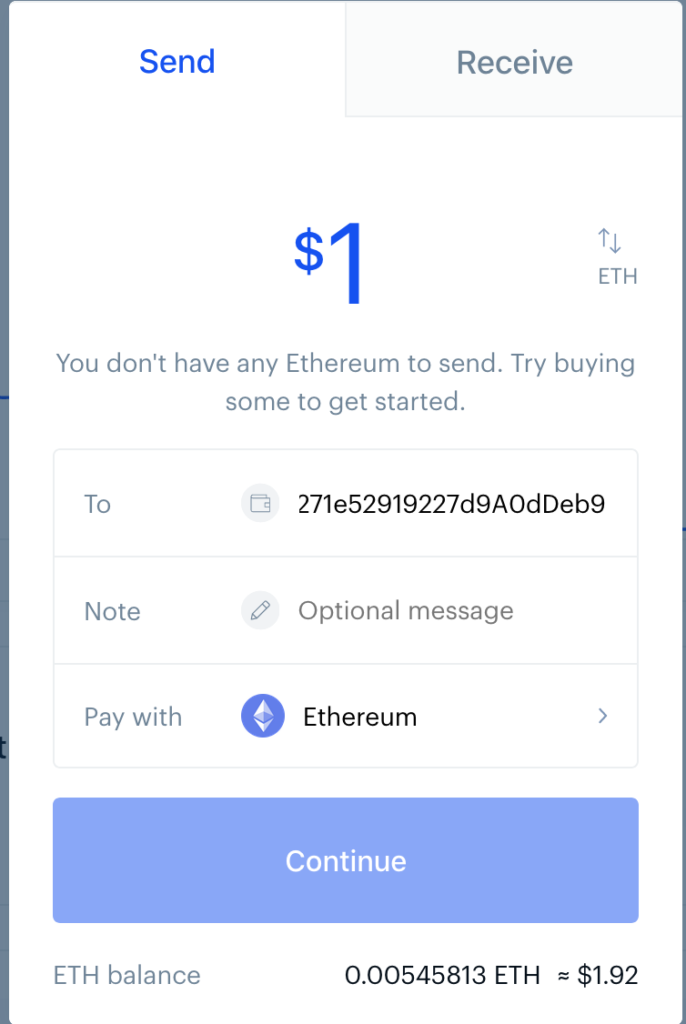

Step 4: Extract to MetaMask

1. Click the “Send/Receive” button in your Coinbase web app (or other crypto exchanges)

2. Copy and paste your newly created MetaMask wallet address.

3. Confirm the transaction.

cb2meta

Now that you have ETH, you will need to send it to Metamask to take advantage of DeFi products and services. Metamask supports all Ethereum-based assets, which means any ERC20 tokens can be sent to the same address.

DeFi Trading 101

Now that you have ETH in Metamask, you can interact with the beautiful world of Decentralized Exchanges (DEXs), starting with trusted protocols like Uniswap.

How to: Use Uniswap to trade from ETH to Dai

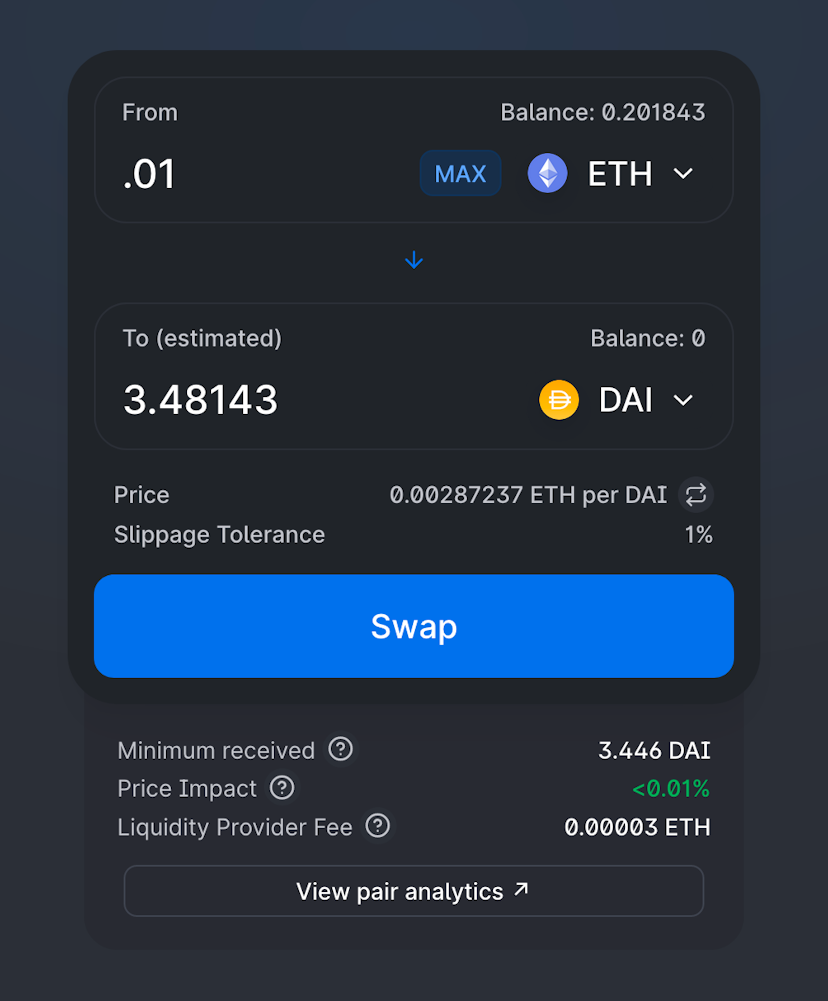

1. To trade your ETH to DAI on Uniswap, go to https://uniswap.org/

2. Select the crypto asset you have as ‘From’ (ETH) and the asset you want to exchange into as ‘To’.

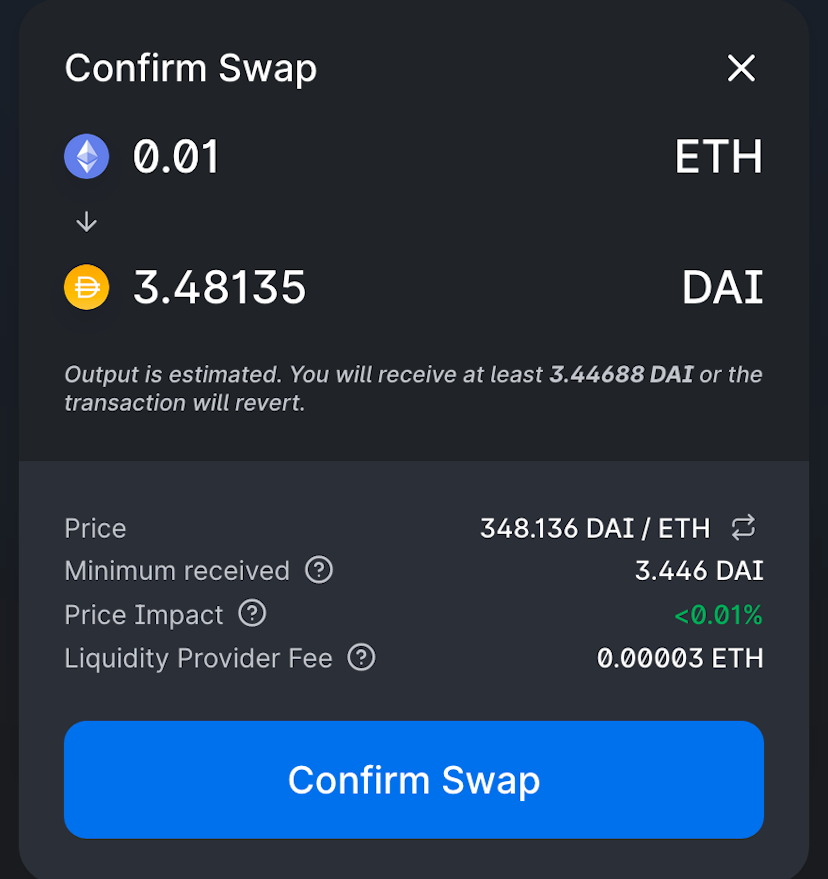

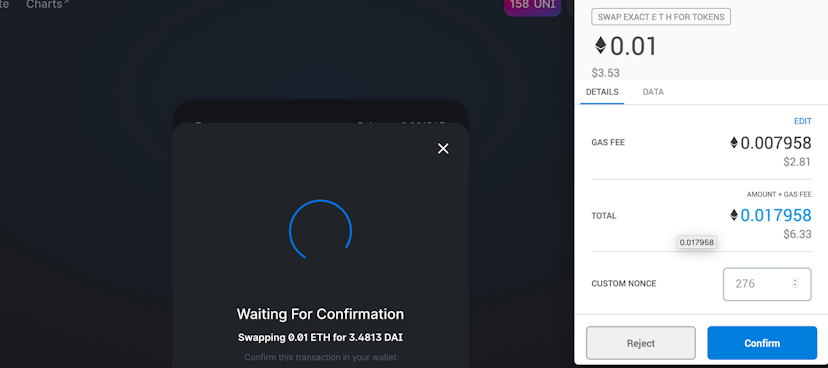

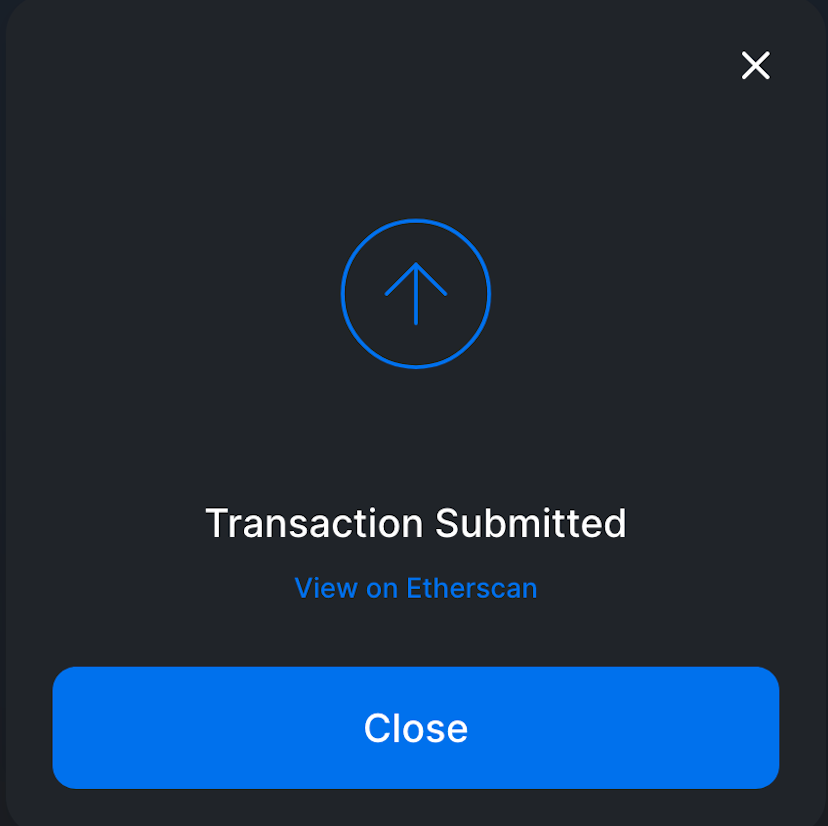

3. View the details of the exchange and confirm the transaction on the Uniswap interface.

4. Verify the transaction in your MetaMask popup.

5. Once you see the confirmation message on the Uniswap webpage, just wait for your transaction to execute and you will see it reflected in your MetaMask wallet.

Uniswap is the best place to find any supported token and trade. Watch out for slippage, or difference in price from spot value, as this will vary depending on the asset’s liquidity. Uniswap depends on liquidity providers to provide assets to the protocol for other users to trade against. In return, they receive 0.3% of trading fees and stand to control the protocol through UNI tokens.

DeFi Lending 101

Now that you have stablecoins (DAI, USDC), you can take advantage of DeFi loans. In short, users provide assets and receive interest. Interest rates change relative to the real-time supply and demand of a given asset, and are automatically accrued thanks to smart contracts.

How to: Use DeFi protocols to lend stablecoins

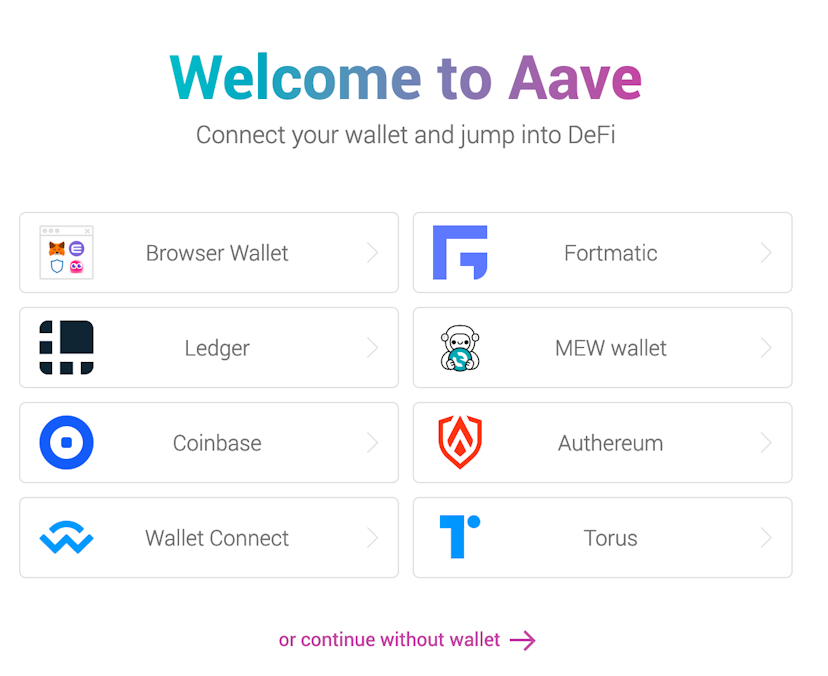

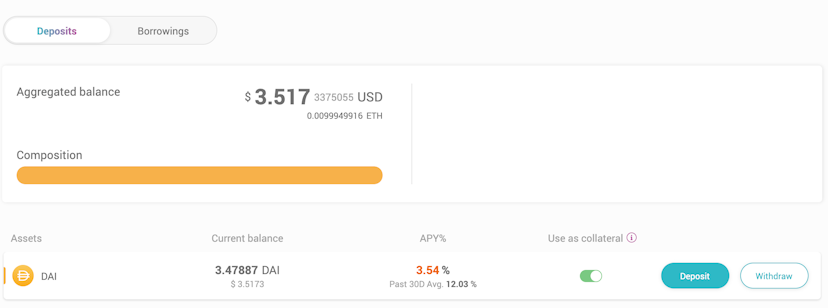

1. Navigate to https://aave.com/ and connect your MetaMask wallet by selecting the browser wallet option when prompted

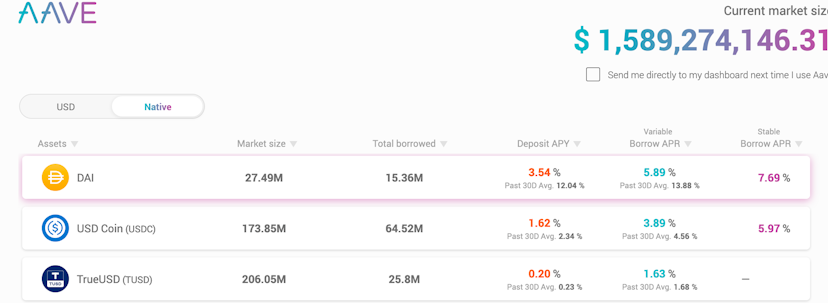

2. Look at the different lending and borrowing rates for each asset and select the asset you want to borrow, in this example we will deposit the DAI we bought earlier with ETH.

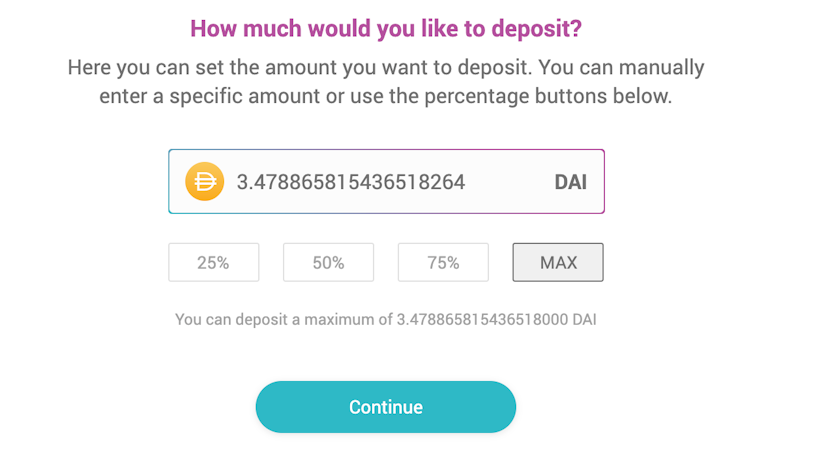

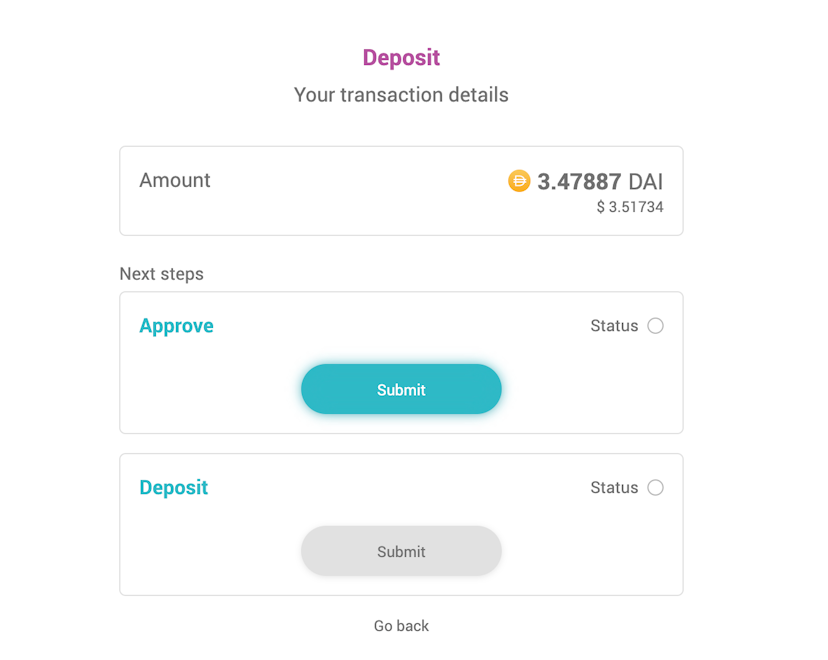

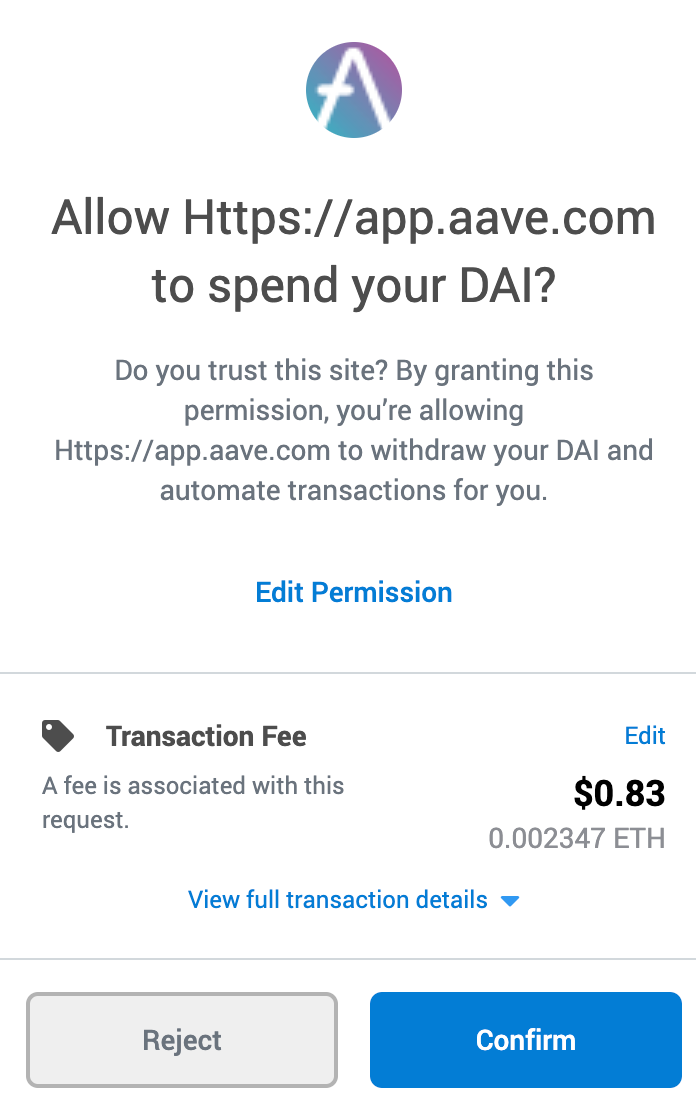

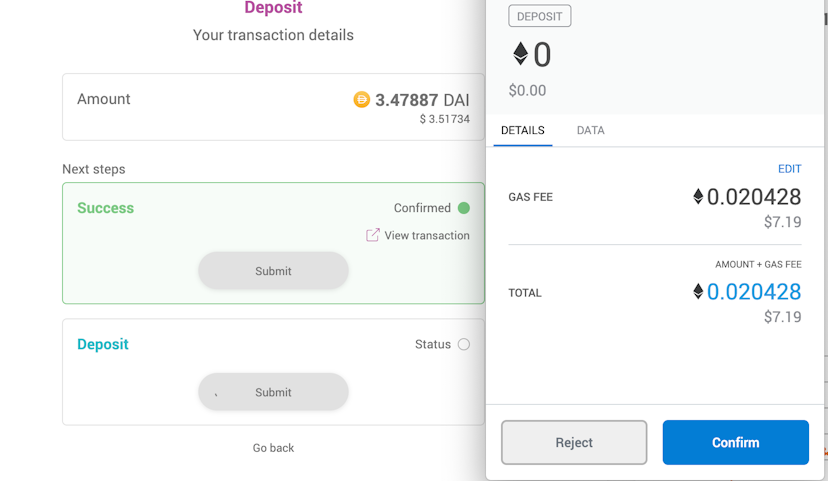

3. Click on “Deposit” and select the amount DAI you want to deposit.aave44. Give Aave permission to communicate with the DAI in your wallet and finalize your deposit.

5. Confirm the approval and deposit transactions in MetaMask.

6. Go to the “Dashboard” page and view your earnings live.

Both Aave and Compound are trusted DeFi protocols that have supported billions of dollars in volume. Although both are very similar in principle, they differ slightly in terms of the assets supported and the incentives to use the protocol.

While Aave features a more diverse pool of assets, different types of loans and unique markets, Compound is largely seen as the most trusted US entity, with users able to earn COMP management tokens for lending and borrowing from the protocol.

DeFi Asset Management 101

Now that you’re lending assets via Aave or Compound, you’ll want to easily track and manage those positions from one trusted dashboard.

Portfolio tracker

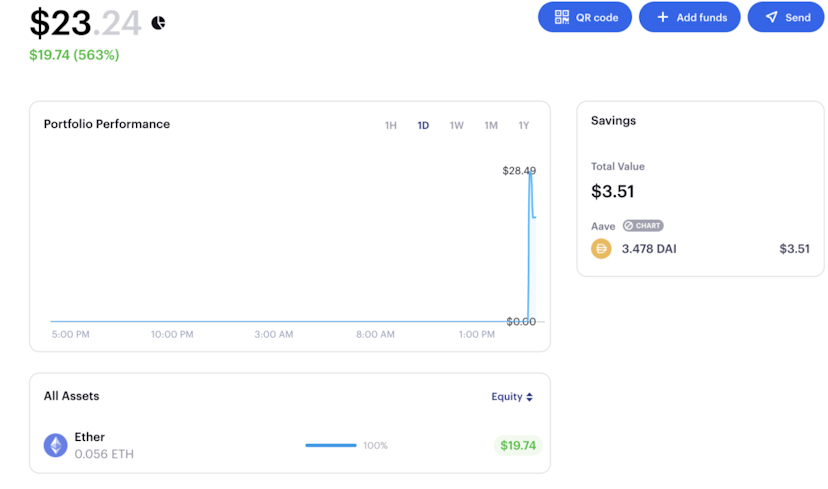

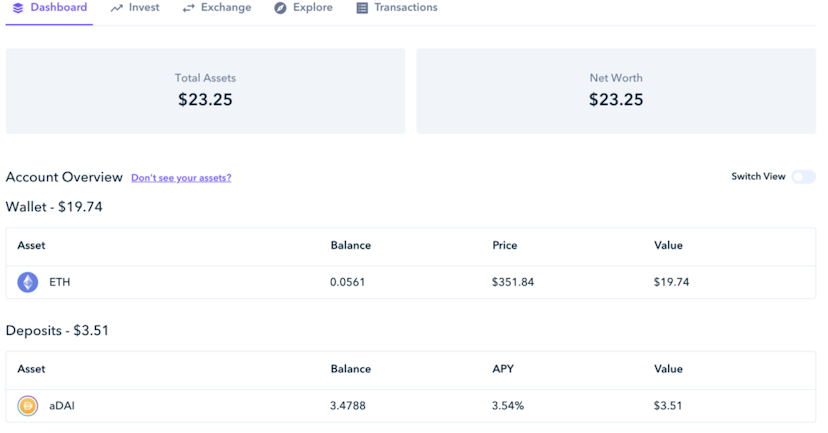

Initial steps are similar for popular portfolio trackers Zapper and Zerion. Go to their webpage and connect the MetaMask wallet you want to track.1. View your holdings, including the DAI you deposited in Aave.

Cerion2

zap2

Both products offer a similar experience, with a slight differentiation on the deeper inner workings of the protocol.

While both Zapper and Zerion can be used to actively raise capital, Zerion is better known as a platform for visualizing wallet assets and portfolio performance. It is worth noting that both trading and lending can be performed through these dashboards, but it is good to get familiar with the protocols and front-ends themselves.

Future of Finance

In this guide, we went through acquiring Ether (ETH), setting up a Metamask account, trading for DAI on Uniswap, and lending that DAI on Aave or Compound. Now that you have eyes on Zapper and Zerion, it’s easy to keep a close eye on those positions while collecting interest.

From here, many users will explore the wider yield farming opportunities, which allow you to earn an additional return on your capital for completing value-added actions in various DeFi protocols.

While the tools in this guide will certainly change over time, we hope you enjoyed this quick primer on getting a foundation in place to take advantage of the future of finance!

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news