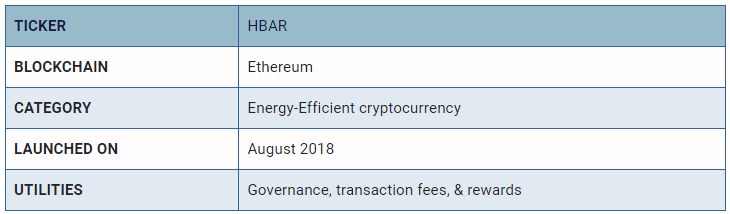

In this Hedera (HBAR) price forecast for 2024, 2025-2030, we will analyze the price patterns of HBAR using accurate trader-friendly technical analysis indicators and predict the future movement of the cryptocurrency.

Ivy (HBAR) Current Market Status

What is Hedera (HBAR)

HBAR is the native utility token of the Hedera network. Hedera is a decentralized hashgraph distributed ledger technology. HBAR was launched during its ICO in 2018. Hedera Network’s main grid became operational in 2019. Hedera Network primarily serves as a distributed file service.

Rather than being built on any blockchain, the Hedera network is built on the hashgraph model secured by the proof-of-stake (PoS) consensus mechanism. It uses a patented algorithm that makes it a non-forkable network. The transactions on Hedera are faster and take place at low costs. The hashgraph distributed ledger is secure and immutable as Hedera deploys asynchronous Byzantine fault tolerance (aBFT).

Recently, Hedera integrated MetaMask via HIP-583, which extends user accessibility. In addition, Hedera concluded a successful proof-of-concept (PoC) trial for stablecoin remittances was conducted with Shinhan Bank and SCB TechX.

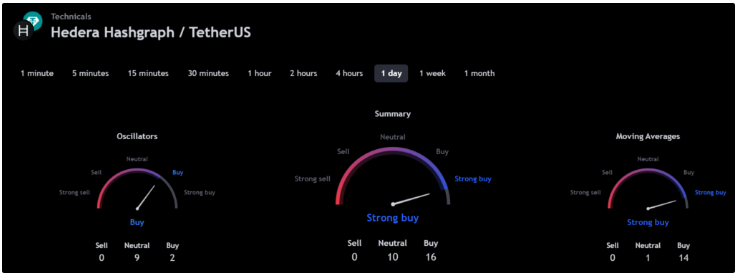

HBAR 24H Technical

Source: TradingView)

Ivy (HBAR) Price Prediction 2024

Hedera (HBAR) is 32nd on CoinMarketCap in terms of its market capitalization. The overview of the HBAR price forecast for 2024 is explained below with a daily time frame.

HBAR/USDT Horizontal Channel Pattern (Source: TradingView)

In the above chart, Hedera (HBAR) has laid out a horizontal channel pattern. A horizontal channel or sideways trend has the appearance of a rectangle pattern. It consists of at least four contract points. This is because it needs at least two lows to connect, as well as two highs. Horizontal channels provide a clear and systematic way to trade by providing buy and sell points. The longer the horizontal channel, the stronger the exit movement will be. There is often a price on the channel after exit. the exit often occurs at the fourth contact point on one of the horizontal channel’s lines.

At the time of analysis, the price of Hedera (HBAR) was recorded at $0.1004. If the pattern trend continues, the price of HBAR may reach the resistance levels of $0.09591 and $0.13685. If the trend reverses, the price of HBAR may fall to the support of $0.08004 and $0.06700.

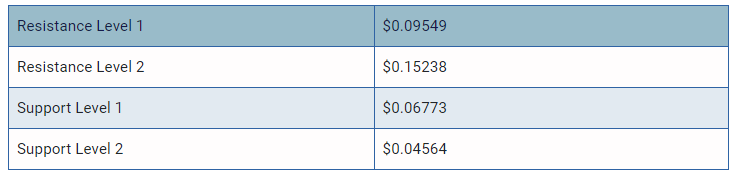

Hedera (HBAR) Resistance and Support Levels

The chart below gives the possible resistance and support levels of Hedera (HBAR) in 2024.

HBAR/USDT Resistance and Support Levels (Source: TradingView)

From the above chart we can analyze and identify the following as resistance and support levels of Hedera (HBAR) for 2024.

HBAR Resistance and Support Levels

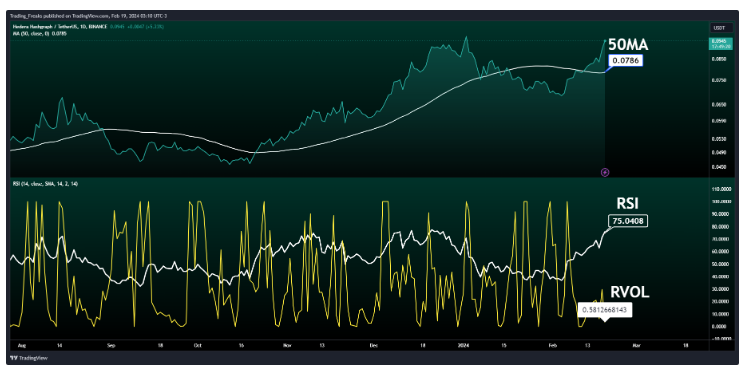

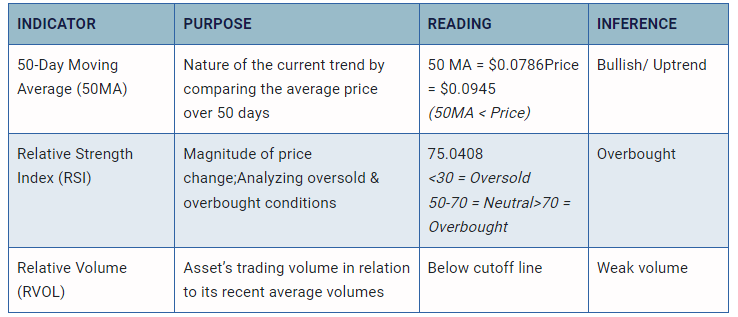

Hedera (HBAR) Price Prediction 2024 – RVOL, MA and RSI

The technical analysis indicators such as relative volume (RVOL), moving average (MA) and relative strength index (RSI) of Hedera (HBAR) are shown in the chart below.

HBAR/USDT RVOL, MA, RSI (Source: TradingView)

From the readings on the graph above, we can make the following conclusions about the current Hedera (HBAR) market in 2024.

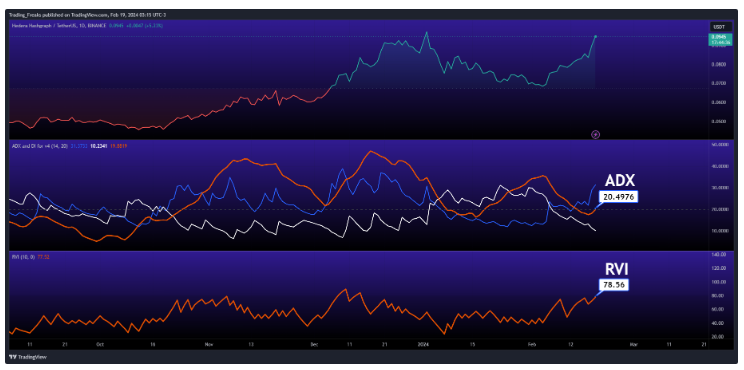

Ivy (HBAR) Price Prediction 2024 — ADX, RVI

In the chart below, we analyze the strength and volatility of Hedera (HBAR) using the following technical analysis indicators – Average Directional Index (ADX) and Relative Volatility Index (RVI).

HBAR/USDT ADX, RVI (Source: TradingView)

From the readings on the chart above, we can draw the following conclusions about the price momentum of Hedera (HBAR).

Comparison of HBAR with BTC, ETH

Now let’s compare the price movements of Hedera (HBAR) with those of (BTC), and (ETH).

BTC vs ETH vs HBAR Price Comparison (Source: TradingView)

From the above chart, we can interpret that the price action of HBAR is similar to that of BTC and ETH. That is, when the price of BTC and ETH rises or falls, the price of HBAR also rises or falls respectively.

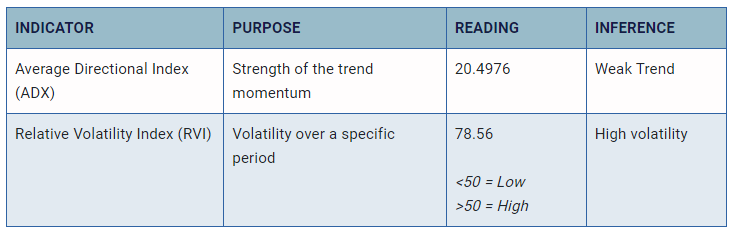

Ivy (HBAR) Price Forecast 2025, 2026 – 2030

With the help of the aforementioned technical analysis indicators and trend patterns, let’s forecast the price of Hedera (HBAR) between 2025, 2026, 2027, 2028, 2029 and 2030.

Closure

If Hedera (HBAR) establishes itself as a good investment in 2024, this year will be favorable for the cryptocurrency. Finally, the bullish Hedera (HBAR) price forecast for 2024 is $0.15238. In comparison, if unfavorable sentiment is triggered, the bearish Hedera (HBAR) price forecast for 2024 is $0.0.04564.

If the market momentum and investor sentiment increase positively, Hedera (HBAR) could reach $0.2. Furthermore, with future upgrades and advancements in the HBAR ecosystem, HBAR can surpass its current high (ATH) of $0.5701 and mark its new ATH.

This content was originally published by our partners at The News Crypto.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news