[ad_1]

Crypto is a high-risk asset class. This article is provided for informational purposes and is not investment advice. You can lose all your capital.

In the latest Bitcoin FOMC analysis, Bitcoin (BTC) price falls and now all eyes are on Jerome Powell’s Federal Reserve FOMC meeting – here’s what to expect for crypto markets.

Bitcoin is no longer a small boy’s game. The approval of spot exchange-traded funds (ETFs) in January means that the deep-seated megaliths of Wall are keeping a close eye on the asset.

This means the world’s most valuable digital asset is more intertwined with traditional finance (TradFi). For this reason, fundamental events that would otherwise not cause much volatility, say in 2021, tend to move prices in 2024.

At the moment, all eyes are on the US Federal Reserve (Fed), and more are eager to know what Jerome Powell, the chairman, has in store for the market.

They could cut rates (unlikely) or hold them steady (as largely expected). However, Jerome’s choice of words during the printing will move the market.

For this reason, the upcoming policy decision on Wednesday, May 1, is shrouded in uncertainty now that the United States economy is heating up and inflation is stubbornly high.

Federal Reserve policy stuck in neutral

Everyone now knows that the US Fed has not been successful even after raising interest rates rapidly in 2022 and introducing new policies to support the country’s banking sector, causing pain for crypto holders.

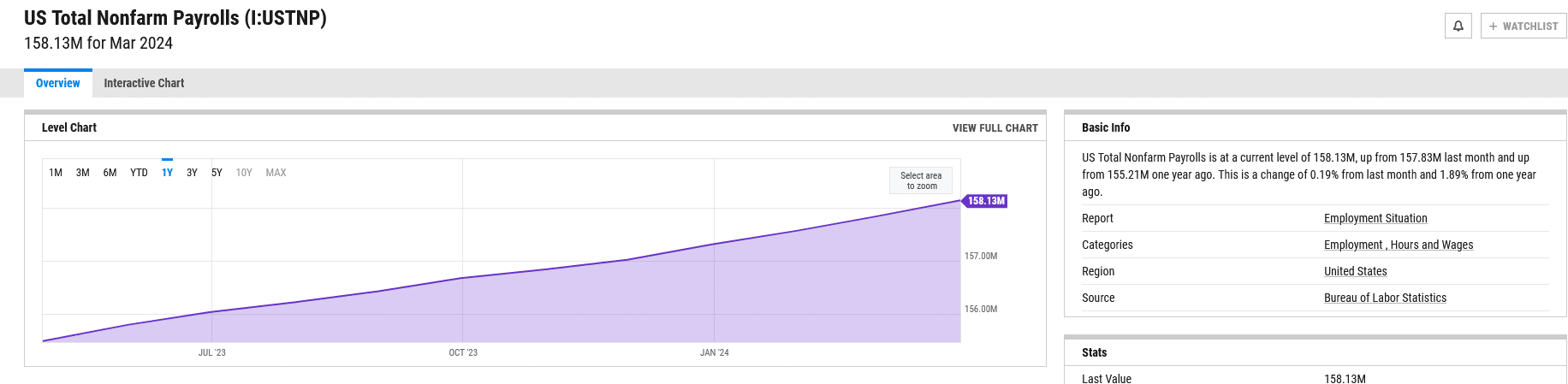

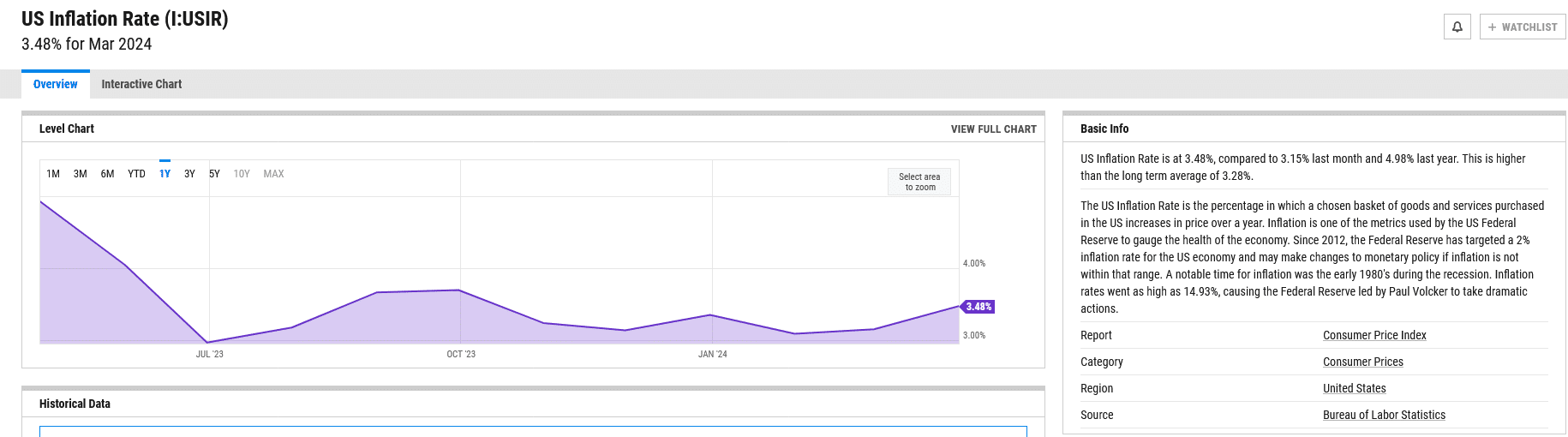

As of late April, inflation is high, dispelling hopes of imminent rate cuts that were highly anticipated in early Q1 2024. Since inflation and other economic data such as the labor market are essential to the data-driven Fed, they are likely to hold rates steady.

Others believe Jerome Powell will change the tune and even consider raising them.

(yChart)

Supporting this forecast is that inflation is falling more slowly than expected, even as house prices cool. The main driver of inflation in the United States is energy. Prices remain high, leading to a cascading effect.

If interest rates remain in the 5.50% zone, the cost of borrowing for mortgages and other loans will remain high. Savers will only benefit from higher returns on their deposits.

Here’s what to expect from Powell’s speech – Implications for Bitcoin?

So, ahead of May 1, analysts expect Powell to reiterate the central bank’s confidence that inflation will eventually fall, but take longer than expected.

Furthermore, as the economy is in a precarious position and the impact of further interest rate hikes will cause more damage, the chairman is likely to suggest keeping rates at current levels if inflation remains stubborn.

(yCharts)

However, keep the words and expectations. Analysts will quickly get through the FOMC minutes a few weeks later. This document will provide informative details to help understand whether more FOMC members are rooting for rate cuts and whether rate hikes have been discussed.

DISCOVER: How to Buy Bitcoin Anonymously without an ID in 2024

Bitcoin caught in the crossfire of TradFi uncertainty

Two days before this event, Bitcoin remains under pressure, trading above $60,000. Interestingly, despite being a solid alternative to gold after the historic Halving event on April 20, the coin is bearing the brunt.

Bitcoin is often marketed as a hedge against inflation and offers better characteristics than bearish gold.

The coin is trading within a tight range, but within the bear bar of April 13. Even after attempts at higher highs after Halving, prices collapsed earlier today, turning price action in favor of sellers.

(BTCUSDT)

Any drop below $60,000 is likely to see BTC crash to $53,000 and even $45,000 in the coming weeks – so watch out for volatility around Bitcoin FOMC.

EXPLORE: Ethereum Exchange Supply Tanking: Last Chance to Buy ETH Below $4,000?

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and is not investment advice. You can lose all your capital.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news