The DeFi world is expanding rapidly, and as the global financial system continues its transformation towards digitalization, DeFi has very high growth potential, attracting the attention of more than 3 million investors worldwide. Therefore, it is essential to understand the assets, markets, investment approaches, etc.

We covered the basics of DeFi in the previous article. In this one we’re going to dive into:

3 Major DeFi Investment CategoriesHow investors earn passive income by participating in DeFi investingCurrent risks of DeFi projects 7 perspectives to evaluate a DeFi project

2 Ways to Invest in Cryptocurrencies

Referring to investment types in cryptocurrencies, they can be divided into fiat and token-based.

Fiat based investment

Cryptocurrencies (also called tokens) are considered stocks, then CEX or DEX is a stock exchange. Alex, an investor, can buy and sell cryptocurrencies on CEX or DEX, sell high and buy low to earn the difference and earn income, referred to as “speculation”. In this case, all Alex cares about is the price changes of cryptocurrencies, using ROI (Return on Investment) as the evaluation indicator.

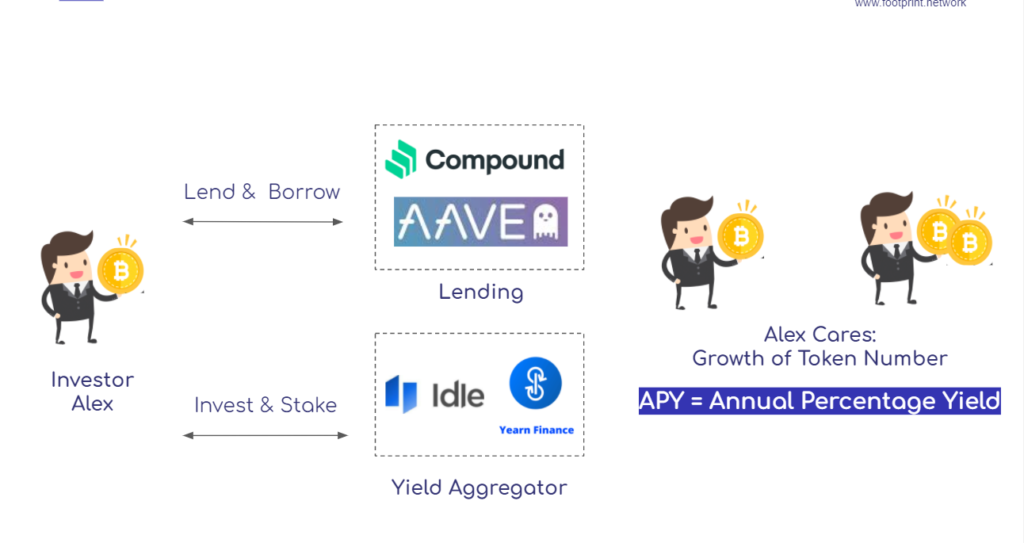

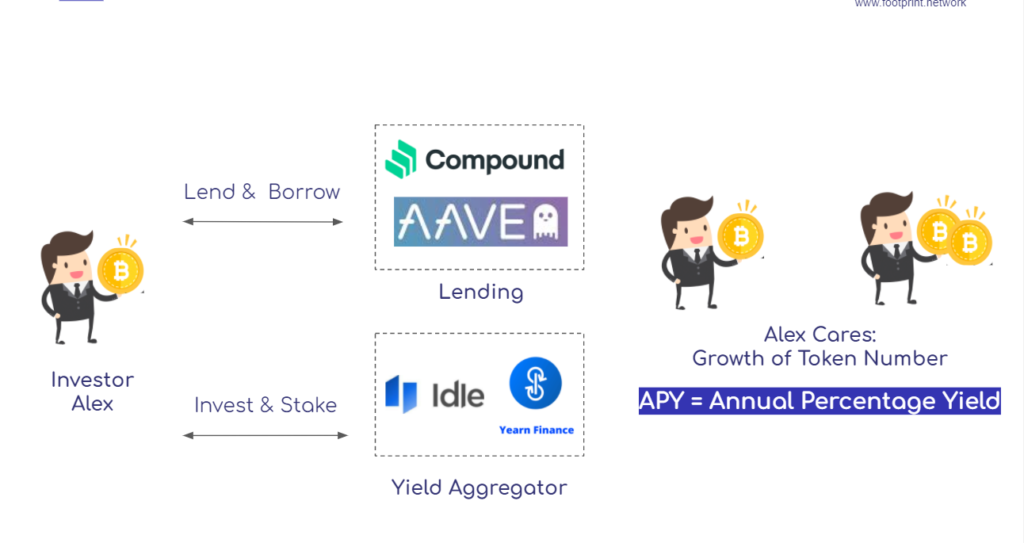

Token-based (or yield farming)

When investors are bullish on certain cryptocurrencies over the long term, the easiest investment strategy is to “Hold” them; while a smarter strategy is to make better use of them by creating greater passive income. For example, investor Alex can deposit cryptocurrencies with lending platform Compound or return aggregator Idle for interest income. In this case, all investor Alex cares about is the growth in the number of cryptocurrencies and the APY earned by Yield Farming.

We will further our discussion in Yield Farming by introducing the 3 Major DeFi investment categories, which are: AMM DEX, Lending, and Yield Aggregator.

DEX: Uniswap as an example

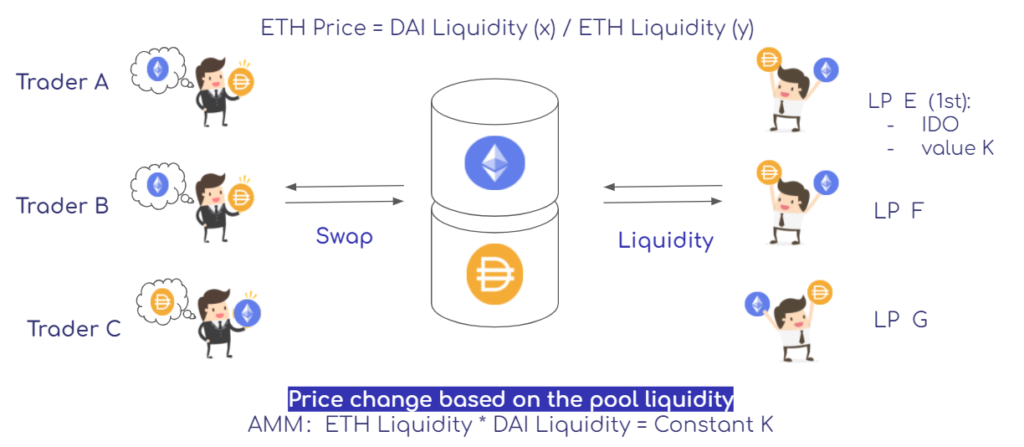

Uniswap is built on Ethereum as the decentralized exchange and supports all cryptocurrencies on this network. Unlike traditional order book exchanges, it uses an AMM (Automated Market Maker) algorithm to enable users to exchange multiple ERC-20 tokens with higher efficiency.

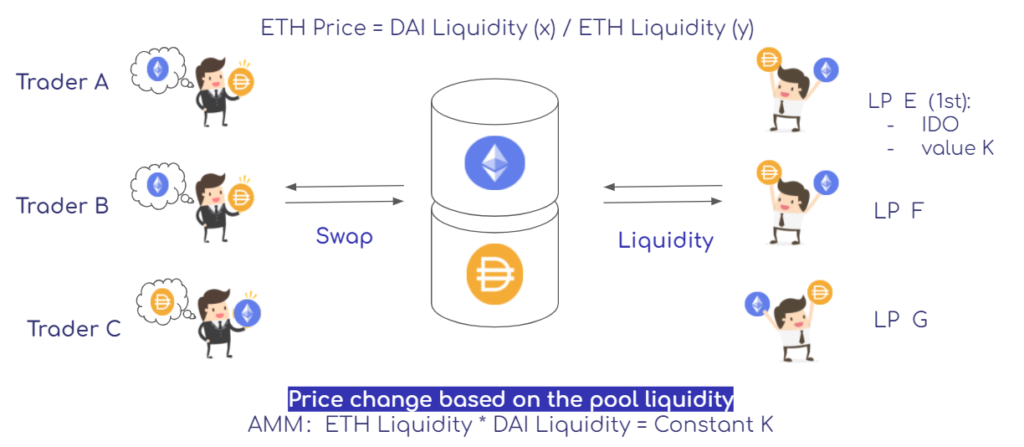

In Uniswap’s AMM model, a liquidity provider (abbreviated as LP) is required to create a pool of liquidity for traders to exchange the required tokens.

There are 2 scenarios included.

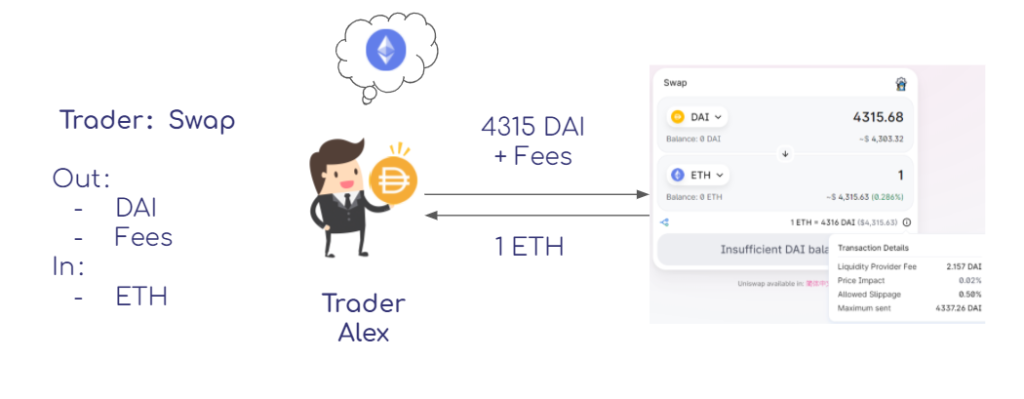

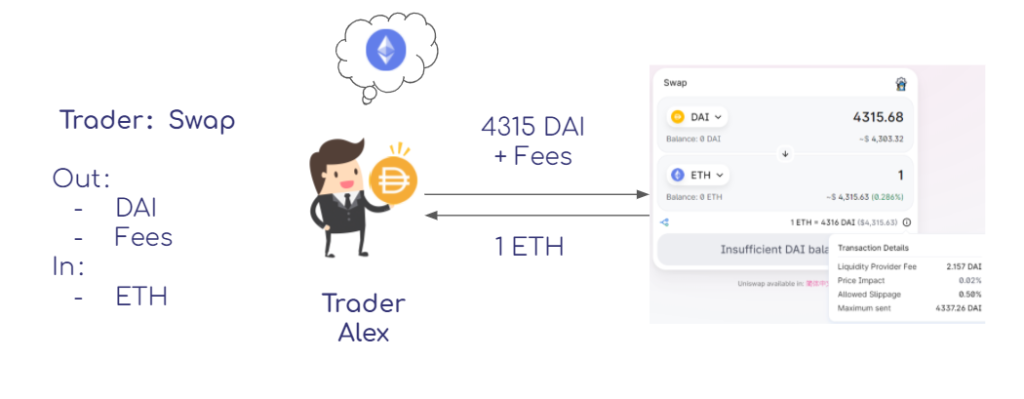

For merchants, they exchange.

Suppose 1 ETH is equal to 2220 DAI, and trader Alex wants to exchange his DAI for ETH. He needs to pay 2220 DAI plus a trading fee (for ease of understanding, all scenarios in this article ignore gas fee) to get 1 ETH.

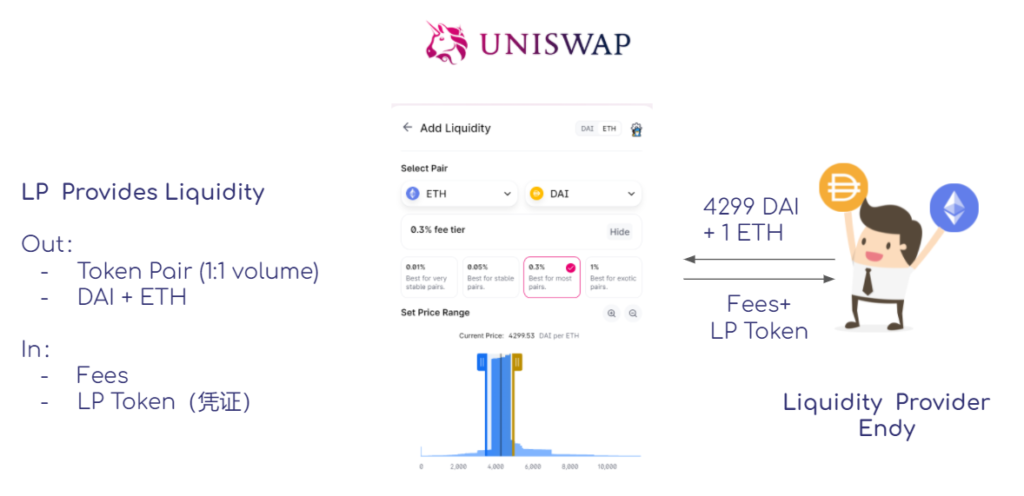

For LPs they provide liquidity.

Endy as LP must provide a pair of two tokens (eg DAI+ETH) to the liquidity pool with equal value. In return, he will receive a split of the trading fees from the trading activities. He will also receive an LP token, which is the credential for providing liquidity and represents his share of the overall liquidity pool.

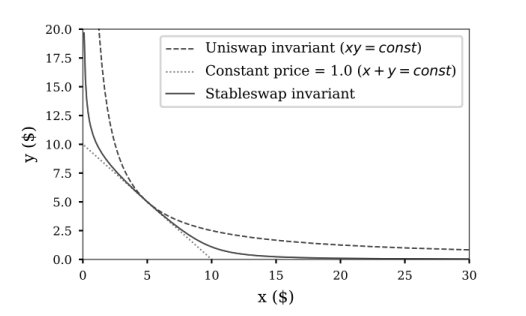

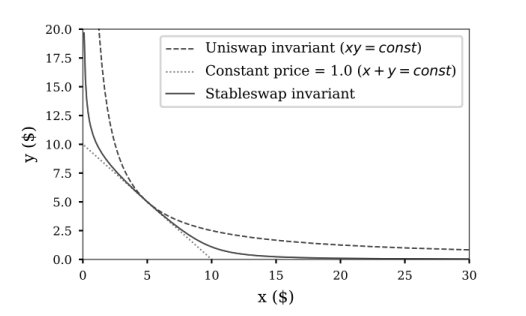

How does it realize the automatic pricing? This brings us to the “constant product market maker” model behind Uniswap’s AMM mechanism. The formula for this model is: x*y=k, where x and y represent the liquidity of each, k is a constant.

It is worth noting that the model does not vary linearly. In fact, the greater the relative amount of the order, the greater the magnitude of the imbalance between x and y. That is, the price of a large order increases exponentially compared to a small order, resulting in an increasing sliding spread.

In the process of providing liquidity, LPs must be aware of permanent losses.

What is impermanent loss (IL)? Here is an example:

Assuming Endy has 2000 DAI and 1 ETH (1 ETH= 2000 DAI), he has 2 options.

Option 1: as liquidity provider (LP)

Provide 2000DAI + 1 ETH to form a token pair to the liquidity poolWhen the price changes: ETH = 4000DAI (outside DEX), arbitrageurs will buy ETH from Uniswap (cheaper), and sell to other DEX with a higher priceThis will lead to a decrease in the number of ETH in the pool and an increase in the price of ETH until it equals 4000DAI. (arbitrage opportunity disappears)At this point, Endy’s LP Token is worth 2828 DAI + 0.71 ETH, which is equivalent to owning 5657 DAI.

Option 2: just hold them

When the ETH price changes to 4000DAI, Endy’s assets are equivalent to owning 6000DAI.

Under the same conditions, “Option 1 provides liquidity” is 343 DAI less than “Option 2 just holds”, or a withdrawal of 5.72%. This loss is called Imperishable Loss. When ETH recovers 2000 DAI, this permanent loss will disappear.

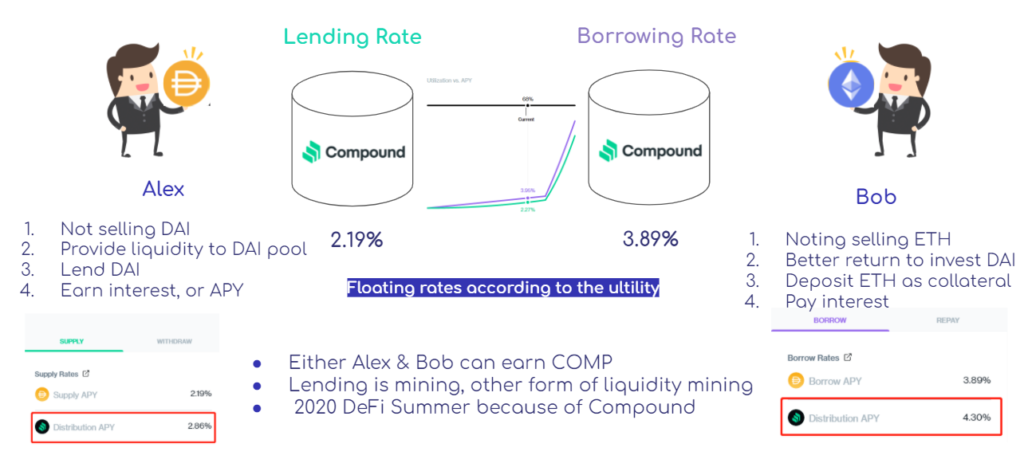

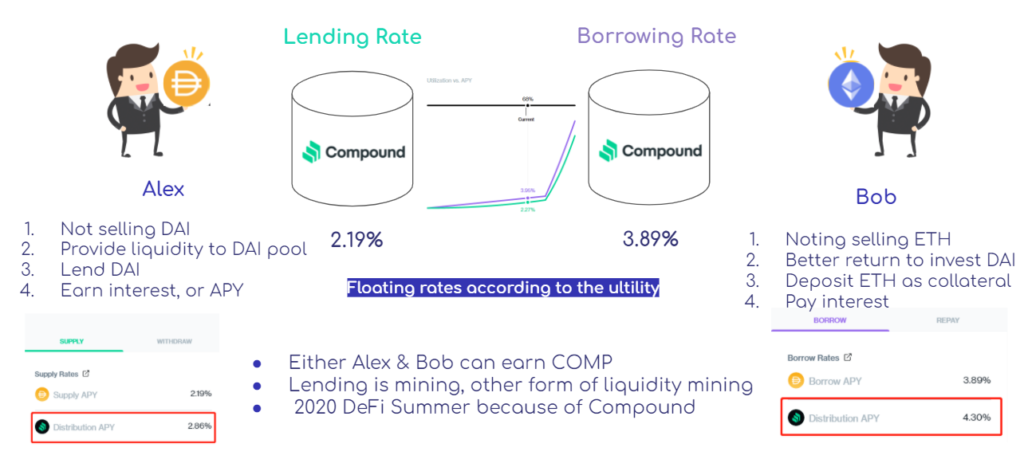

Lending: Compounded as an example

In DeFi’s lending platform, an investor provides a crypto-asset in the pool to earn interest; if this deposit is guaranteed, the investor can borrow another crypto-asset. Currently, DeFi’s lending platform typically uses “overcollateralization,” where the lender provides assets worth more than the actual loan in case of default.

Example:

Alex, the investor, with DAI he doesn’t want to sell, so he puts it in the pool as a lender to lend it to people in need, earning interestBob knows a good investment opportunity in DAI, but he doesn’t want to sell the ETH he has, so he uses ETH as collateral to borrow DAI and pays interest.In this process, both Alex and Bob are rewarded with COMP platform tokens, which we call Liquidity Mining.

Yield aggregator: Idle & yarn

These days, DeFi projects are popping up everywhere. Investors may experience the following issues:

Too many platforms with different interest rates: how to choose the best? Interest rates are always changing, and so are prices:Lenders can be accidentally liquidated, what to do?Lenders may have to keep changing the protocols for better interest rates, causing high gas fees Investors cannot watch the market 24 hours a day.

DeFi’s Yield Aggregators can somehow solve the above problems, where the value of a specific asset provides a complex investment strategy that combines lending, pledging and trading to maximize profit.

Idle: It is an ethereum-based protocol that allows users to get the best interest by investing in a single asset. It currently supports the financial services of Maker, Compound, dYdX, Aave, Fulcrum and other protocols. When you deposit with Idle, you will receive a complex APY consisting of the APR of the token you deposited, the platform token IDLE and COMP.yearn: It is also a protocol on Ethereum with the main goal of generating the highest return for the deposited tokens. It includes programmatic asset management to implement the best strategy.

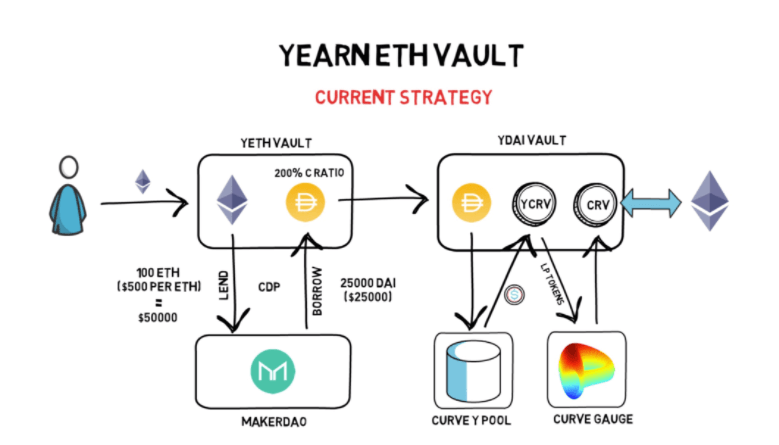

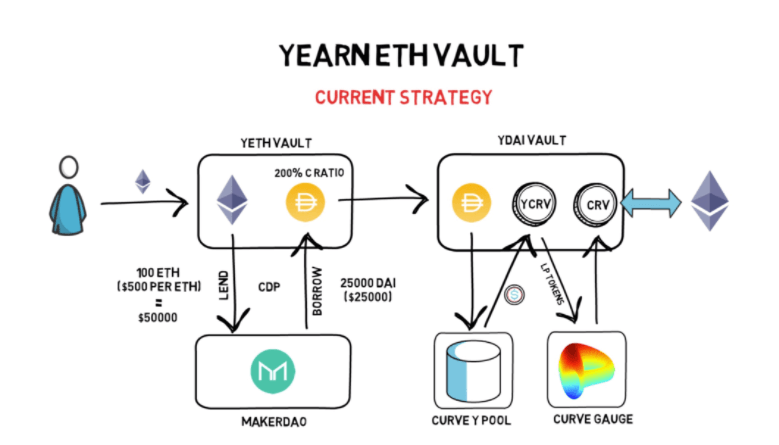

Take the ETH Vault as an example.

The investor deposits ETH in the ETH Vault, which will deposit ETH in MakerDao as collateral to borrow stablecoin DAI.The borrowed DAI is deposited into Curve Finance’s liquidity pool, receiving LP tokens in return and trading fees in the form of basic APYs. LP token can be redeemed in the Curve’s CRV meter to earn CRV rewards.The earned CRV is then converted into ETH, and will be deposited back into the ETH Vault. Such a cycle continues until the investor withdraws.The investor ultimately receives ETH settled interest and pays a certain amount of management fees.

Risk of DeFi projects

The diversity of investment opportunities and the continuous growth make DeFi an attractive and profitable investment. However, as with any investment, there are risks associated with a DeFi investment.

Protocol risks

Smart contracts: hacked (even with audit)Single smart contractProtocols built on various smart contracts Protocol risks Scammers: protocol token + stablecoin pools offering high APYToken dumped by Wales causing price zero The volatility of Token PriceBorrower: Easily liquidated LP: Imperishable lossOperational risksWallet risk: stolen risk of seed phrase, private keysDeFi authorization:Cancel the authorization for an unused protocolDon’t put all your eggs in one basket

How to evaluate a DeFi project

Investors must do their own research (DYOR) Before investing, start with the following 6 aspects:

1. Basic questions to ask:

Which type, on which blockchain, has been audited yet?When goes live, ranking of TVL, 24H usersEither on CoinGecko or CoinMarketCap?

2. Fundraising history with famous inventors

3. Project introduction: Official website + public articles + GitHub

Business model, competitors, differentiating featuresAny negative news? note Too Good reports considering the neutrality of the media Economic model (token distribution for the team: within 15%-20% is acceptable)Code submission frequency from GitHub

4. Attention to the price trend

A boom in a short time? High probability of pumping Risks of dumping by whales causing a large drop

5. Attention to extremely high APY

Way to attract investors by scammers Try to be careful but run fast before it collapses

6. Activities of the community

Questions asked from users: quality of the investors Attitude and effectiveness of admin response

DeFi provides a more convenient place for investors to choose as an alternative to traditional investments. With more and more investors, institutions, capital and developers coming in, a more open, transparent and safer financial system is expected.

This guide is brought to you by Footprint Analytics.

What is Footprint

Footprint Analytics is an all-in-one analytics platform to visualize blockchain data and discover insights. It cleans and integrates chain data so users of any experience level can quickly start exploring tokens, projects, and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own custom charts in minutes. Uncover blockchain data and invest smarter with Footprint.

Mentioned in this article

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news