[ad_1]

Spot trading is the direct purchase and direct sale of financial assets such as crypto, shares, forex or bonds. The platform where you bought the asset delivers that asset immediately. That’s why spot trading makes the first-pass environment. Spot markets are usually offered on an exchange or through an over-the-counter interface. Traders use their assets only when trading spots, there is no margin or leverage.

A primary characteristic of flea markets is that they are usually open for trading to anyone. Assets are also instantly available and merchants can use cash payments. This is why some people will refer to spot markets as cash markets. Mainly because merchants can choose cash to make upfront payments.

A centralized exchange like Binance or Coinbase manages the spot trading interface, regulatory compliance, security and custody of the assets. Each spot trader pays transaction fees, which are used to manage the exchange. Decentralized exchanges, on the other hand, operate a similar service, but one based on blockchain smart contracts.

Trading spot markets is the simplest and most basic way to invest in the cryptocurrency industry. It is also the first transaction that occurs when someone might want to buy a digital coin and hodl. Also remember spot markets exist in traditional markets, think bonds, forex and stocks.

The basic operation of a spot market transaction

There are three important aspects to consider when understanding spot trading on the Binance exchange. These include the spot price, the market order and the volume.

The spot price is the current market price of the digital asset. Then there are the market order on the exchange, allowing traders to buy or sell their crypto holdings at the best spot price. The price on the order book can change at any time given the volatility of crypto. Therefore, there is no guarantee to buy or sell the asset at a different price as the system processes your market order.

Sometimes the volume may be insufficient to fill your order at your target price. For example, you placed an order of 5 BTC at the spot price. The system only has 2 BTC on offer. Therefore, you will have to wait for your order to fill up to 5, but at different prices. However, note that spot prices update in real time and depend on order matches. If you use an OTC platform, the spot prices work differently because there is no order book. However, unlike an exchange – delivery is not instant on OTC and can take you T+ 2 days. T + 2 translates to the date of the trade and additional two business days.

You can trade patches on either a centralized or decentralized exchange. Decentralized exchanges offer more privacy and freedom compared to centralized exchanges. However, this freedom and control comes with a high risk. Lack of KYC, customer service and AML policies is a big puzzle when cybercriminal incidents happen. Only a few decentralized exchanges like the Binance DEX use an order book.

A recent development is Pancake Swap and Uniswap’s Automated Market Maker (AMM). An automatic market maker is a smart contract program for implementing different asset pricing models. Interested buyers pool funds into a liquidity pool or LP and exchange their tokens. A liquidity provider earns by charging transaction fees to anyone who uses the LP.

How to spot trade on Binance?

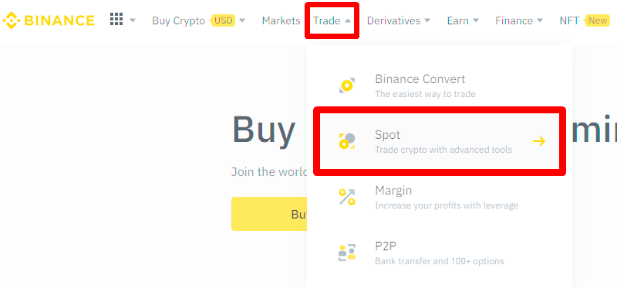

Spot trading on Binance is an easy step-by-step process. Just go to the Binance home page after registration and identity confirmation. Move your cursor on the [Trade] navigation bar and select [Spot] from the drop-down menu.

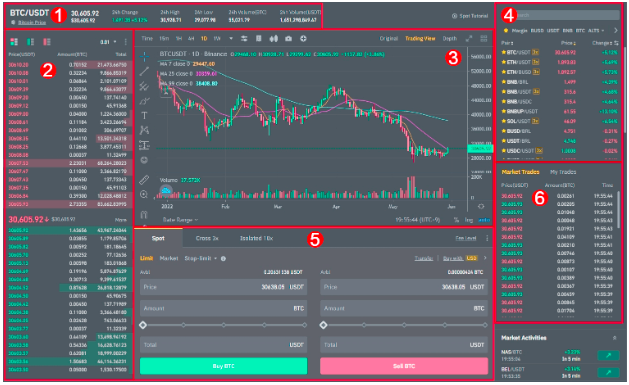

This will usher in the trading view – a trading control panel with several different sections for different capabilities.

I’ve tagged the screenshot of the trade view page to help provide a key. Here are more details:

Number 1 is a label of the cryptocurrency trading pair and some details about its market, such as volume, daily price change and the daily high and low.

Then there is the order book at number 2. This is a list of the assets open buy and sell orders sorted by price. The green list contains buy orders while the red list contains sell orders. When placing a buy order for a given asset, traders choose the lowest offered price. When a particular order requires a higher volume to fill, the order moves to the next best lowest ask price.

Number 3 contains the chart view with custom historical price information. TradingView is also pre-built on this window and installed with a diverse range of technical analysis tools.

Number 4 in the upper right corner contains a search button for different trading pairs. This is where you choose your crypto pair and start trading. Binance allows you to bookmark your favorite pairs by clicking on the rating stars near them. Note that buying crypto with fiat is not mandatory. You can trade between different altcoins at spot prices by choosing the right pairs.

Number 5 is where you create your buy or sell orders. There are three types of orders you can create, a limit, market and a stop-limit order.

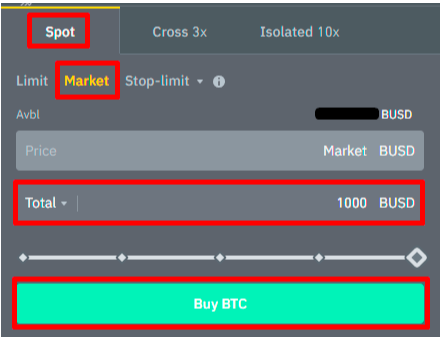

Thinking of an example of a perfect Binance exchange trade? Here is one:

Jack wants to place a market order of $1000 (BUSD) worth of Bitcoin. This will happen by hovering over the Total Field and clicking [Buy BTC]. Then the exchange automatically and instantly delivers the BUSD to the seller, and then you receive $1000 (BUSD) worth of Bitcoin in your Binance spot wallet.

Benefits of the Binance spot market

Transparency of the order book – Spot prices rely on the forces of supply and demand. This is quite different from the futures market which depends on multiple reference prices. Note that the futures market usually derives its price from market data such as the moving average, price index and funding rate. This makes tracking futures market prices relatively difficult compared to spot market prices.

Directness – Spot trading is direct, simple and straightforward. There are few rules and associated risks are low. It is also easy to calculate the risk and reward based on the entry price and the current price.

Set and forget – There is no fear of liquidation when trading spots. This is different from margin and derivative trading, where traders can take significant risks and may even be liquidated. Traders can easily open or exit a trade whenever they want on the spot market. This means spots are the best way to buy and hodl.

Disadvantages of the Binance spot market

Some spot assets are inconvenient to hold – think of buying crude oil as a spot purchase, one might have to contend with the physical delivery of the asset. On the other hand, it gives you the responsibility to buy cryptocurrencies to protect and secure them on convenient cold or hot storage.

Some individuals and businesses require stability rather than the volatile nature of particular assets. For example, spot assets will make it difficult to operate a foreign currency in an operation where the team needs thorough expense planning and evaluation.

Potential profit is low when trading spot markets compared to trading margins or futures. The latter allows you to leverage capital and trade larger positions.

Binance Spot Trading Frequently Asked Questions (FAQ)

1: Where can you trade spot market?

There are several ways to trade spot markets. In addition to spot trading on an exchange, one can opt for an over-the-counter OTC solution. You can also trade with other individuals directly and without a third party through a decentralized exchange like the Binance DEX. Each market platform has its own distinct features.

2. What is a centralized exchange?

A centralized exchange manages the trading assets of the platform. This makes it an intermediary between market participants, and also as the custodian of the assets being traded. One must fund their account or exchange wallet with either fiat or crypto before starting trading. A quality exchange protects user funds and ensures that transactions run smoothly. Other roles of a centralized exchange include managing user KYC (Know Your Customer), meeting regulatory compliance, setting fair prices and providing customer protection. The users then pay transaction fees in return. This makes exchanges profitable in both bull and bear markets, that is as long as they maintain sufficient trading volume and sufficient users. Binance is a centralized exchange.

3.What is a decentralized exchange?

Decentralized exchanges of DEX offer the same services as a centralized exchange. Unlike a centralized exchange, match buying and selling is made possible through blockchain smart contracts. DEX does not ask users to create accounts, but allows them to trade directly with each other without the exchange having to act as a custodial platform. Transactions take place directly from individual merchants’ wallets through the power of smart contracts. Smart contracts are self-executing programs hosted on the blockchain.

4. What is the over-the-counter spot trade?

Over-the-counter (OTC) is also known as over-the-counter trading. Usually, traditional financial assets are traded directly between dealers, brokers and dealers. Spot trading through an off-exchange takes place through various communication methods to organize the transaction. These methods can be instant messages and phone calls. OTC trades do not require an order book and they come with a level of advantage. For example, exchanges may not fill an order at the intended price due to volume fluctuations. This therefore causes a price slide across the majority of small cap coins. This causes traders to place orders at high prices to have their orders filled. Nevertheless, even coins with high liquidity due to experience slip. Especially if the order is large. Therefore, you can consider the benefits of an OTC when trading large amounts of BTC.

Closure

While trading in the spot market is quite simple and straightforward, traders need to arm themselves with adequate technical analysis knowledge, sentiment tracking and in-depth knowledge of assets.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news