Purpose of Bollinger Bands in Cryptocurrency Trading

Bollinger Bands serve as an important technical analysis tool in cryptocurrency trading, enabling traders to:

Assess price volatility

Bollinger Bands allow traders to assess the degree of price volatility in the cryptocurrency market. There can be trading opportunities when the bands widen, as this suggests greater volatility. A contraction of the bands, on the other hand, indicates less volatility and the possibility of price consolidation or trend reversals.

Identify overbought and oversold conditions

Bollinger Bands are used to detect possible overbought and oversold scenarios and thus help traders in their identification. When the price reaches or exceeds the upper band, indicating that it is overbought, a potential selling opportunity may exist. On the other hand, if the price reaches or falls below the lower band, it can be considered oversold, indicating a potential buying opportunity.

Determine trend direction

Traders can use Bollinger Bands to determine the direction of the current trend. If the price moves consistently within the upper band, it may indicate a bullish trend. Conversely, frequent contact with or proximity to the lower band may indicate a downtrend.

Generate reversal signals

Bollinger Bands can be used to generate reversal signals, which are indications of potential trend reversals. For example, a possible reversal of an overextended condition can be indicated when the price exits the bands and then re-enters them (below the lower band for a downtrend or above the upper band for an uptrend).

How are Bollinger Bands constructed?

Bollinger Bands are built using the simple moving average and standard deviation, which are the two fundamental building blocks. These bands provide valuable information regarding price volatility and potential trading opportunities in the cryptocurrency markets.

Here is a detailed guide on how to build Bollinger Bands:

Step one: Calculate the SMA

Traders choose a specific time frame for analysis, such as daily, hourly or another time frame, based on their trading strategy. For the specified period, the previous closing prices for the cryptocurrency under consideration are compiled. Since it represents the last traded price at the end of each period, the closing price is commonly used.

The SMA is calculated by adding the closing prices for the selected period and dividing by the number of data points. For example, if traders analyzed the daily closing prices of a cryptocurrency over a 20-day period, they would add the closing prices of the previous 20 days, divide by 20, and then determine the SMA for that day.

Step Two: Calculate the SD

After calculating the SMA, traders determine the standard deviation of the closing prices during the same period. Essential for assessing price volatility in cryptocurrency markets, the standard deviation measures the spread or variability of prices relative to the SMA.

Step Three: Construct the Upper and Lower Bollinger Bands

Multiplying the SMA by the standard deviation produces the upper Bollinger Band. As mentioned before, the multiplier can be changed based on the preferences of the traders and the current market conditions. To obtain the lower Bollinger Band, the same multiple of the SD is subtracted from the SMA.

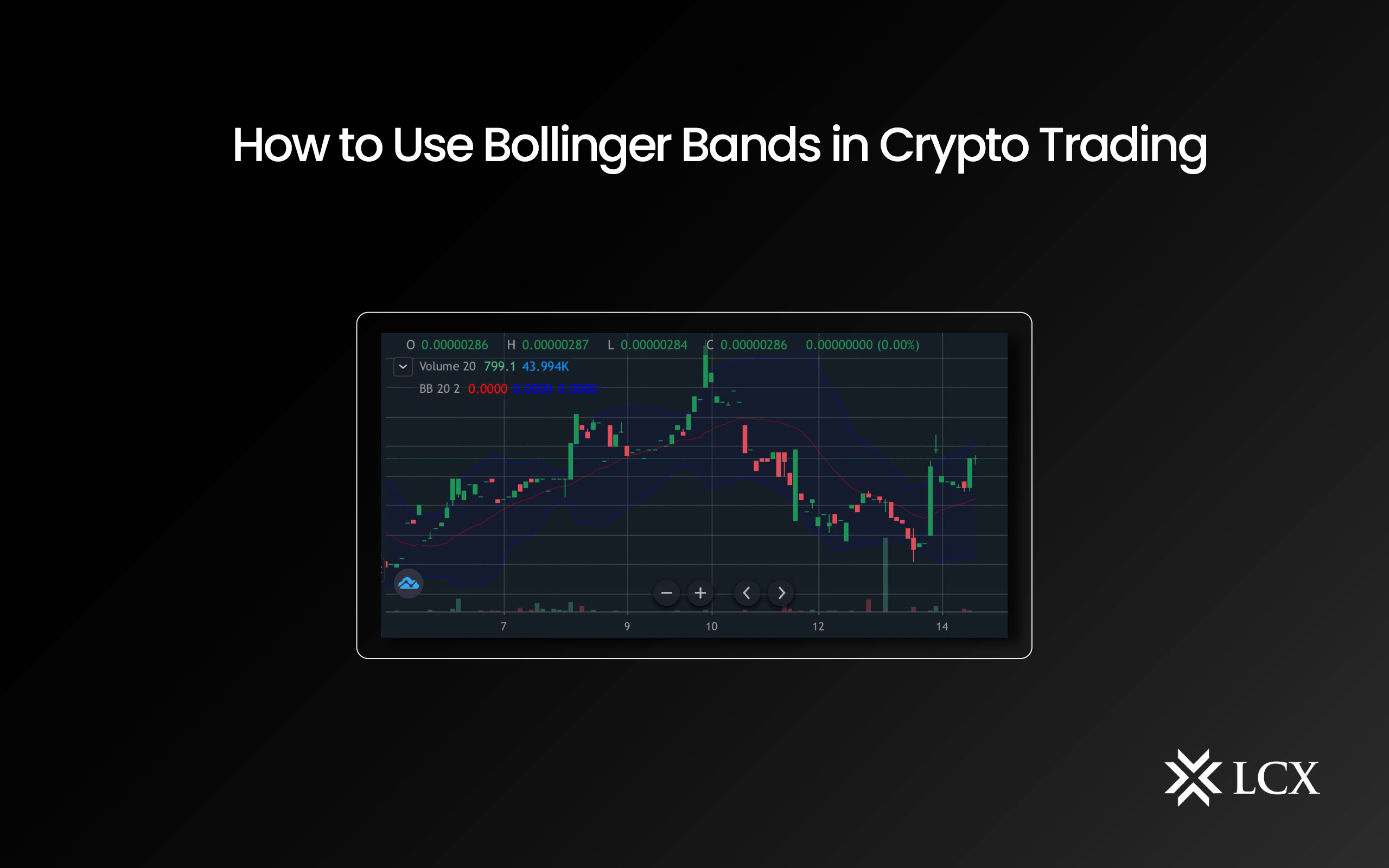

Step Four: Plot the Bollinger Bands on a price chart

After calculating the SMA, standard deviation, upper Bollinger Band and lower Bollinger Band, traders can plot it on a price chart. The center line represents the center line of the Bollinger bands and the simple moving average. When the upper and lower bands are plotted above and below the SMA, a channel is created around the price chart.

Step Five: Interpretation

To understand how to trade cryptocurrencies with Bollinger Bands, it is essential to interpret price signals. For example, when the price reaches or moves above the upper band, it may indicate an overbought condition and a potential selling opportunity.

Conversely, if the price touches or moves outside the lower band, it may indicate that the market is oversold, thereby presenting a potential buying opportunity. The width of the bands provides information about market volatility, with wider bands indicating greater volatility and narrower bands indicating lower volatility.

Crypto Trading Strategies With Bollinger Bands

Various Bollinger Bands based crypto trading strategies used by traders include:

The Bollinger Band Squeeze Strategy for Crypto

The Bollinger Band Squeeze strategy is based on the idea that periods of low volatility in crypto prices (known as a “squeeze”) are frequently followed by periods of high volatility (known as an “expansion”). It functions as follows:

Find the Pressure: Watch for instances where the Bollinger Bands are contracting and moving closer together, an indication of reduced price volatility.

Prepare for a breakout: After a compression, investors expect a significant price change. They do not anticipate the direction of the outbreak, but they are prepared for it.

Entry Points: Traders enter positions after price breakouts of Bollinger Bands (above the upper band for an uptrend, below the lower band for a downtrend), and often use additional confirmation indicators, such as volume.

Stop-Loss and Take-Profit: Use stop-loss orders to limit potential losses if the breakout fails to hold, and set take-profit levels consistent with one’s trading strategy.

Bollinger bands for setting entry and exit points in crypto trades

Bollinger Bands can be used to determine the optimal entry and exit positions in cryptocurrency trading, whether for short-term investments or day trading.

Access points

When the price reaches or breaks below the lower Bollinger Band, indicating a situation of oversold conditions, traders can look for buy signals. When the price reaches or exceeds the upper Bollinger Band, they consider overbought conditions as sell signals. However, additional technical investigation and validation may be required.

Starting points

Traders can use Bollinger Bands to determine when to exit a position. For example, if speculators are long a cryptocurrency and the price approaches the upper band, it may be time to take profits. Conversely, if they are short and the price approaches the lower band, it may be time to close the position.

Combining Bollinger Bands with other trading indicators

Traders often use Bollinger Bands in conjunction with other indicators to supplement their trading strategies.

Bollinger Bands and Relative Strength Index

The combination of Bollinger Bands and the Relative Strength Index (RSI) can help traders identify potential reversals. For example, if the price approaches the upper Bollinger Band and the RSI indicates overbought conditions, a likely decline may be indicated.

Volume analysis

Bollinger Bands and trading volume analysis can be used to validate price movements. A volume increase during a Bollinger Band breach can strengthen the signal’s reliability.

Bollinger Bands and Moving Averages

Traders use moving averages in conjunction with Bollinger Bands to add more context to trend analysis. Bollinger Bands and a moving average crossover technique, for example, can help confirm trend changes.

Limitations of Bollinger Bands for Crypto Traders

Bollinger Bands are a useful tool for cryptocurrency traders, but they are not without their flaws. First, they can generate false signals during periods of low volatility or when markets are moving quickly, which can lead to losses. Second, traders must use additional indicators or analysis techniques to confirm the direction of the trend, as they do not provide directional information on their own.

Additionally, the effectiveness of Bollinger Bands may vary across cryptocurrencies and timeframes. In addition, unexpected market news or events can cause price differences that are not necessarily reflected in the bands, which can surprise traders.

Risk Management Strategies When Using Bollinger Bands

As with any technical indicator, cryptocurrency traders should use Bollinger Bands along with rigorous risk management and analysis. Traders should set up explicit stop loss orders to minimize potential losses in the event that their trades go against them.

Position size is also crucial; to avoid overexposure, traders must assign a certain amount of capital to each trade. In addition, risk can be mitigated by diversifying between various cryptocurrencies and limiting the amount of capital that can be lost in a single trade.

Bollinger Bands should always be used in conjunction with other confirmation indicators and larger market patterns. Achieving long-term success with Bollinger Bands requires maintaining discipline and adhering to a clear risk management strategy.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news