Today we are excited to announce the launch of our new website: Market Intel. Market Intel uses Chainalysis data to provide asset managers and regulators with live data and insights into cryptocurrency usage, as well as the health and growth of cryptocurrency markets. Access is free, and from the site you can subscribe to the Market Intel Report, a weekly email summary of the chain events and trends in cryptocurrency focusing on their short-term implications for cryptocurrency markets and the long-term evolution of cryptocurrencies as an asset class.

Growing the cryptocurrency market with data and insights

Today, most of our customers use Chainalysis products to detect illegal transactions conducted with cryptocurrency for compliance and investigative purposes. But illegal transactions represent only about 1% of all cryptocurrency activity. The data that powers our products also captures the other 99% of activity related to investing, trading and transactions. Market Intel uses the same trusted dataset to provide statistics on the trading, supply, demand, generation and risk of cryptocurrencies.

These actionable insights can equip investors and regulators to more effectively evaluate risks and opportunities in cryptocurrency, which will be crucial as cryptocurrency continues to become a more prominent investment tool. Just this year, prominent investors such as Paul Tudor Jones said they are betting big on Bitcoin, while Charles Schwab recently announced that Grayscale’s Bitcoin Trust is one of the five most popular assets for its millennial clients. Banks are also coming around, as JP Morgan recently began offering banking services to cryptocurrency businesses, while the OCC said last week that federally chartered banks can offer cryptocurrency custody services. All of these events further legitimize cryptocurrency as an asset class and give more people the opportunity to get involved.

But at the same time, investors need reliable data for these efforts to succeed, and regulators need insights into what’s really happening in the markets to invest wisely and effectively oversee the space. In a recent survey of institutional investors, Fidelity Digital Assets found that the third-ranked obstacle to investment, after concerns about price volatility and market manipulation, is a lack of data to provide insight into the health and growth of digital assets and networks. Market Intel can provide the data investors and regulators need to move into cryptocurrency with confidence.

Market Intel is now available in Beta, free, with benchmarks and insights on Bitcoin, Ethereum, Tether (on Bitcoin and Ethereum), Bitcoin Cash and Litecoin, with improvements and additions planned over time. .

Check out the Market Intel website now and sign up for the Market Intel report.

We want your feedback! Send comments on Market Intel to [email protected]

Below we give you a quick summary of the cryptocurrency trends we saw in Q2 2020 to show you how Chainalysis data can help you better understand cryptocurrency markets.

Our latest market insights

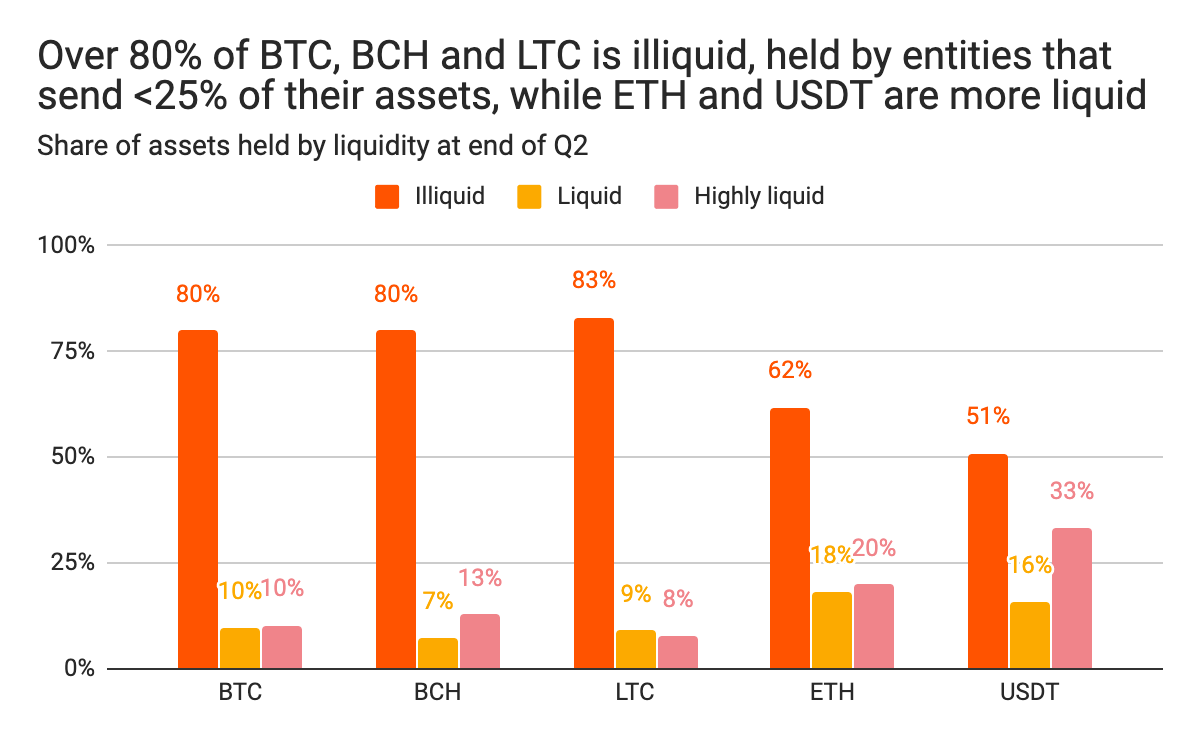

Bitcoin is getting older and colder

At the end of the second quarter, 56% of all mined Bitcoin had been held at its current address for more than a year, and 80% was illiquid, meaning it was held by an entity, in a wallet or group of linked addresses, which on average send less than one quarter of the Bitcoin they receive. This data leads us to the conclusion that most Bitcoin is held as a long-term investment and rarely moves. This long-standing trend of old, cold Bitcoin accelerated in Q2, as the numbers above represent a 3% increase in the share of illiquid Bitcoin and a 2% increase in the share of Bitcoin held for more than a year compared with Q1. The increase in age and decrease in liquidity reflects, or may even drive, the decrease in price volatility since May as investors have become more passive.

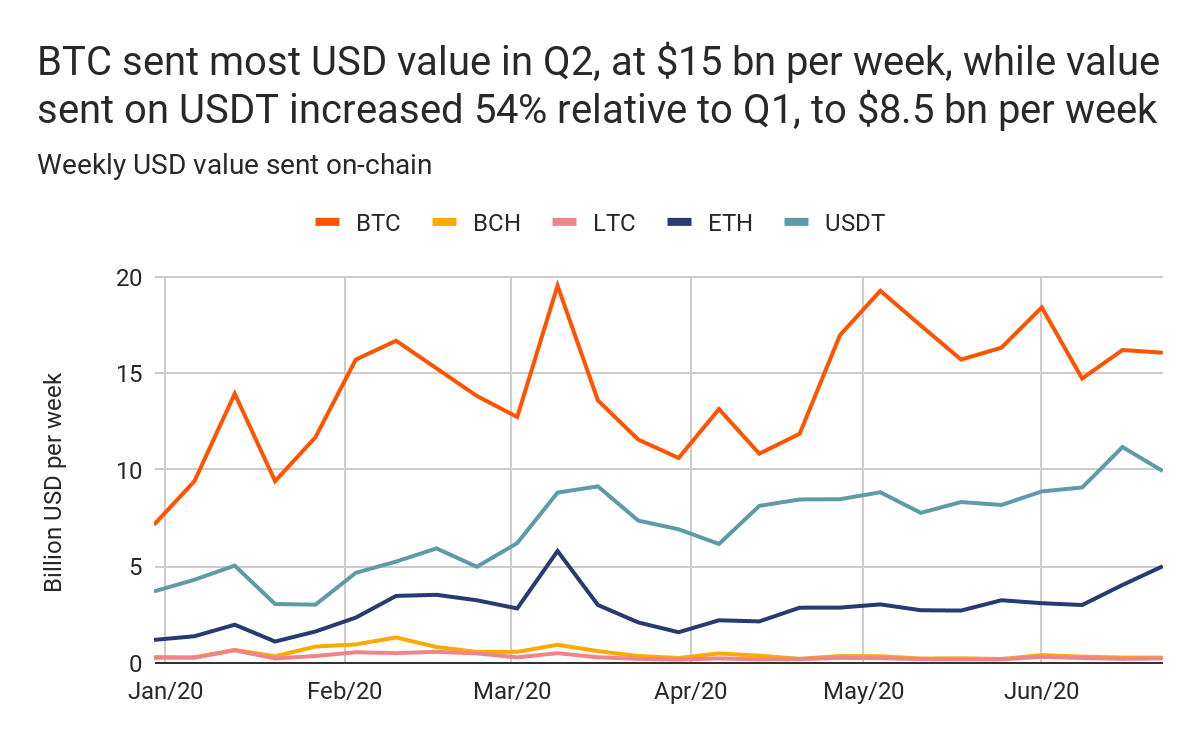

Still, about 10% of the available Bitcoin — about 1.77 million, or $15 billion USD worth — moved between addresses per week on average during the second quarter. Of the Bitcoin that moved, 81% were held for less than two weeks before being sent and 67% were held by highly liquid entities, which we define as those that send more than two-thirds of what they receive. So while a minority of Bitcoin moves regularly, that minority moves quickly, largely circulating between exchanges.

Ethereum acts more like Tether, and Tether acts more like Bitcoin

Our data shows that Bitcoin Cash and Litecoin performed similarly to Bitcoin in the second quarter. Ethereum resembles Bitcoin in terms of age, but has a liquidity similar to Tether. Tether became much more illiquid in Q2, perhaps used more as a store of value, thus behaving more like Bitcoin.

has

Our data shows that Bitcoin Cash and Litecoin are roughly as illiquid as Bitcoin, with an even larger share of assets held for more than a year. Furthermore, Bitcoin Cash and Litecoin matured significantly in the second quarter, with a 15% and 10% increase in assets held for more than a year, respectively, compared to the first quarter. These assets also move much less in terms of USD value per week. Bitcoin Cash’s weekly flow was just 2% of Bitcoin’s in Q2, and Litecoin’s just 1.5%. This combination of obsolescence and inactivity means that these assets are at risk of losing their price support. This may already be happening, as their price per Bitcoin fell by 31% and 33% in the second quarter for Bitcoin Cash and Litecoin respectively.

Ethereum is similar to Bitcoin in terms of the share that has not moved in more than a year. However, 38% of Ethereum is held at liquid or highly liquid addresses compared to just 20% for Bitcoin. Ethereum’s liquidity is more similar to that of Tether, which we analyze on Bitcoin’s Omni Layer and on Ethereum. Surprisingly for a stablecoin often considered equivalent to fiat currency, 51% of Tether was illiquid at the end of Q2. This is a big change from Q1, when only 32% of Tether was illiquid. In this last quarter of global crises, Tether may have found a new use case as a store of value. With the supply of Tether on Bitcoin and Ethereum increasing by 50% in Q1 and 27% in Q2, there is now enough Tether to go around.

While Tether may find a new use as a means of storing value, Ethereum’s transactional use is increasing, perhaps due to increased interest in DeFi (note that we remove ERC-20 transactions from our Ethereum data, so these numbers represents the actual use of Ethereum). However, Tether still leads Ethereum in terms of transaction volume and is second only to Bitcoin on this measure, with $8.5 billion sent on average per week in Q2, a huge 54% increase on Q1 volumes. While these Q2 volumes are an upper-bound estimate that may be revised downward, the trend is clear that the shift to the issuance of Tether on Ethereum, with $3.7 billion added from February 18 to the end of Q2, the transactional usage of Tether increased.

Ethereum on the other hand moved $3 billion per week in Q2, a 15% increase on Q1. It will be interesting to see if Ethereum becomes more actively used and breaks away from the buy and hold profile of Bitcoin, Bitcoin Cash and Litecoin. In contrast, it will be important to track whether more people start to hold Tether as a store of value, making it more like Bitcoin.

This analysis only considered three metrics, but shows that Chainalysis chain data provides insights into cryptocurrencies that are not possible in other asset classes. For more of these insights, head over to Market Intel, sign up for the weekly report, and follow us on Twitter at @chainalysis for more updates.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news