Explore the 2024 potential of new cryptos to watch and uncover narratives that could yield in this upcoming bull run.

Bitcoin (BTC) has risen more than 150% in the past 12 months. According to BlackRock, the industry-wide anticipation of a spot Bitcoin ETF and trillions of dollars in sidelined investor capital have contributed to an interesting bull cycle thesis for 2024’s crypto market.

The total value closed (TVL) in decentralized finance (defi) also grew, increasing from around $38 billion at the start of 2023 to more than $54 billion as the year approached. Despite this jump, defi’s TVL is still several levels below its 2021 peak recorded north of $179 billion per DefiLlama.

This means new cryptocurrencies launched in 2024 could benefit from significant liquidity and attention as retail and institutional investors flock back to digital asset markets. The resurgence in blockchain activity could also signal new cryptos poised to enter the market, joining more than 9,000 existing virtual currencies.

This article will look at three new cryptocurrencies to watch and three narratives that could potentially gain steam amid growing excitement around cryptocurrencies. We chose these projects as they have already established communities, raised millions in funding from trusted venture capital (VCs), attracted thousands to millions of followers, and most have confirmed their 2024 token launch plans.

LayerZero (ZRO)

Launched in September 2021 by LayerZero Labs, LayerZero is a cross-chain messaging protocol that enables developers to build applications that work across multiple decentralized networks. This promotes improved liquidity and usability for users. Several protocols are built on LayerZero’s technology, including Stargate Finance and Radiant Capital, which boast a combined TVL of over $600 million.

LayerZero has also raised about $250 million in multiple funding rounds and is now at a market valuation of $3 billion, fueling community optimism about a token launch and rewards for early adopters. This can often translate into demand for newly launched cryptocurrencies.

The Vancouver-based omni-chain protocol has announced plans to launch its ZRO token in H1 2024. An airdrop is included in the rollout strategy, as LayerZero is backed by some of the biggest crypto-centric investment firms such as Andreessen Horowitz (a16z), Circle Ventures, OKX Ventures and Sequoia.

Additionally, LayerZero could be a head start in the space, a head start on other projects and new cryptocurrencies emerging in the cross-chain messaging ecosystem.

zkSync Era

zkSync is an Ethereum-based scaling solution built on zero-knowledge technology. Commonly known as rollups, the blockchain infrastructure executes transactions from Ethereum’s (ETH) mainnet to alleviate network congestion and offer cheaper gas fees.

This particular layer-2 network was launched in February 2023 by Matter Labs, which raised $458 million. $200 million from that raise was earmarked for zkSync adoption. While the project has not officially announced when its token may be listed, a pricing page on CoinMarketCap has added to speculation of an upcoming launch.

zkSync’s over $500 million TVL and funding positions the L2 network as one of the most important new cryptocurrencies to debut in 2024. The protocol also has a 3.3% market share among L2s, behind only Coinbase’s base, optimism and arbitrage per l2beat.

StarkNet (STRK)

Another new digital currency to watch out for is StarkNet’s STRK coin, which already has a token contract deployed on Ethereum’s blockchain. Israeli blockchain firm StarkWare Industries launched the layer-2 network in February 2022 and has since attracted $36.85 million in TVL.

In December, StarkNet announced a large token distribution program and incentives to drive adoption. This confirmed the network’s intention to launch a native token, an event expected by April 2024.

Furthermore, StarkNet’s plan to pay out more than 1.8 million STRK coins could spur interest in the token, potentially earning it a spot as a new listing coin on tier 1 exchanges.

Hot stories for new cryptos to watch

While the above three tokens fall under the L2 category, which typically attracts hundreds of millions in trading volume after new cryptocurrencies are launched, new cryptocurrencies are likely to appear in a basket of sectors, giving buyers and investors opportunities to choose from.

Identifying narratives during market cycles is a key skill needed to optimize capital and secure profits. Here are three narratives to look for in order to find new crypto projects.

Real World Assets (RWAs)

RWAs exist by adding digital versions of traditional financial instruments such as real estate to a blockchain network. The process is called tokenization and is considered one of the primary use cases of cryptotechnology.

This industry has also grown in recent months, with more than a $2 billion market cap, per Coingecko.

Crypto AI

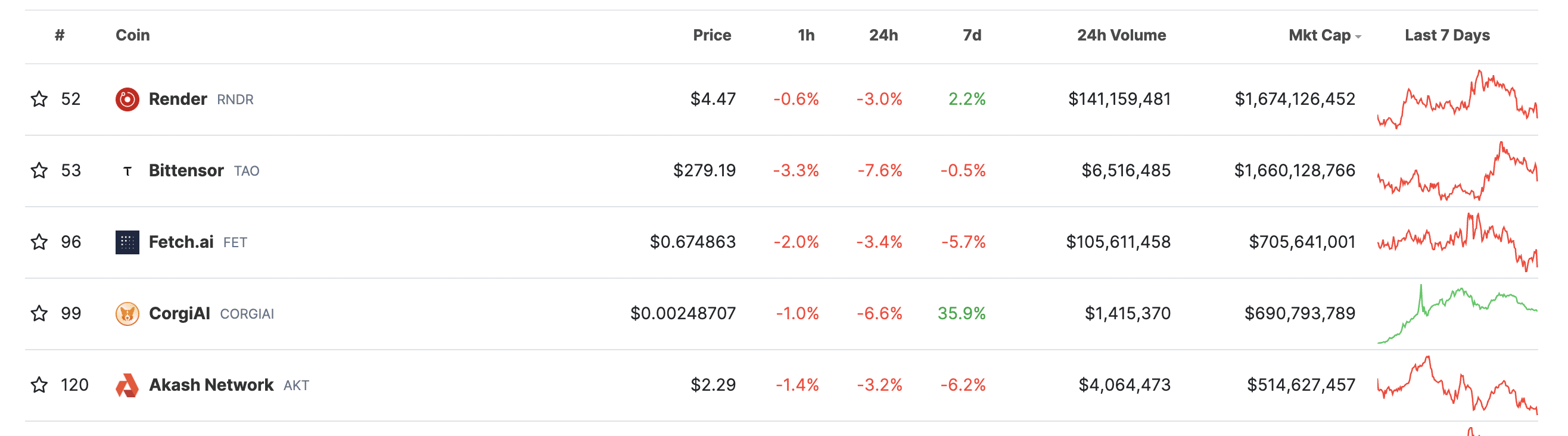

The intersection between cryptocurrencies and artificial intelligence has turned into a $9 billion digital asset ecosystem poised to experience more growth due to increasing chatter around AI and blockchain assets.

The top five crypto AI tokens have risen over 500% each over the course of 2023, making this category a great place to find new cryptos to check out.

Games

The global blockchain gaming scene is on the upswing, with the market size expected to reach $614 billion by 2030. Web3 users also believe that 20% of games overall will adopt blockchain in some capacity, a move that will cost billions investments can attract in gamefi.

Coingecko put the total gamefi market cap at $18 billion, leaving exponential growth on the table and room for new cryptocurrencies should the blockchain gaming industry meet expectations.

Useful tools

Investors can often struggle to find new cryptocurrencies early on or to determine which new crypto has the most potential, as the digital asset landscape is fast-paced by nature. However, there are dedicated platforms where users can research tokens, and find coin data and statistics.

Some of these tools include Coingecko, CoinMarketCap, Dextools, Dexscreener, DefiLlama, Dune Analytics, Etherscan and TradingView. Most of these platforms are free to use, while others offer paid versions with additional features to help users find new cryptos to check out and which new crypto might explode in 2024.

Closure

Opportunities are likely to abound as bullish sentiment floods crypto markets and retail investors once again deploy capital to venture assets. A possible spot Bitcoin ETF also reinforces institutional demand and serves as an endorsement, said Ark Invest’s Cathie Wood.

In this cycle, investors must manage their risk and remain vigilant to avoid scams. Also, don’t forget to DYOR (do your own research) when mapping out new cryptos to check out.

Disclosure: This article does not represent investment advice. The content and materials on this page are for educational purposes only.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news