IntoTheBlock’s on-chain data reveals that more than half of the PEPE addresses are currently profitable, indicating that they are ‘in the black’.

As for the profitability of Pepe Coin holders, the fact that more than half of the addresses are in the black suggests that a significant portion of them are likely experiencing profitability. However, this does not necessarily reflect the whole picture, as market conditions and individual entry points vary.

To get a more comprehensive understanding of the current status of Pepe Coin holders, it would be helpful to consider additional factors such as duration of coin holding, recent market trends and overall sentiment in the cryptocurrency market, especially for meme coins such as Pepe Coin.

More than 50% of Pepe addresses are currently profitable

According to current data, approximately 54% of PEPE addresses are profitable, indicating that these holders will realize profits if they sell their tokens at the current market price. Conversely, about 38% of PEPE addresses are in a loss-making position, meaning that these holders will suffer losses if they decide to sell their tokens now.

Additionally, nearly 8.5% of PEPE holders are at the break-even point, where selling their tokens at the current market price will result in neither a profit nor a loss.

Read more: 9 Best AI Crypto Trading Bots to Maximize Your Profits

This distribution reflects a diverse investment outcome among Pepe Coin holders, with a slight majority currently experiencing profitability.

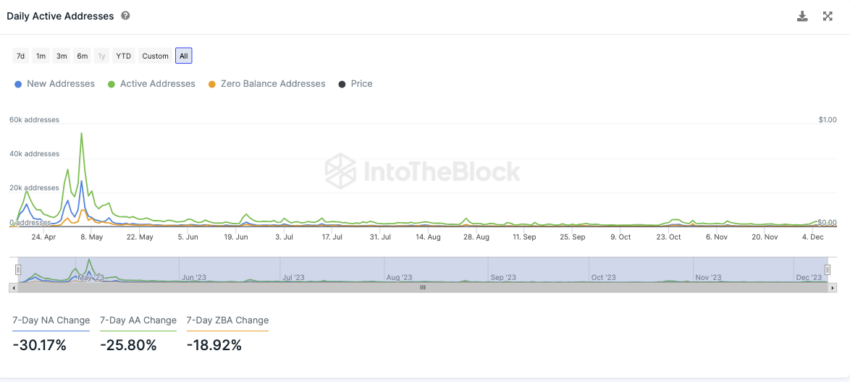

Significant drop in PEPE network activity noted in the past week

This past week there has been a significant drop in network activity for PEPE. This downturn is evidenced by a 30% decrease in the creation of new addresses and a 26% reduction in the number of active addresses.

In addition, there was a decrease of approximately 19% in the number of addresses that no longer have a PEPE balance. Collectively, these statistics indicate a notable decline in engagement and transaction activity within the Pepe Coin network.

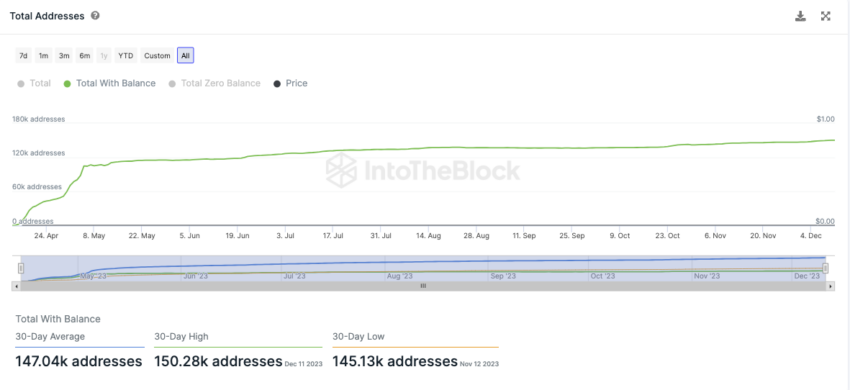

Pepe Network shows a modest growth trend

The growth of the PEPE network is progressing at a slow pace, as indicated by the very flat gradient of its growth curve. Despite this gradual growth, the network has seen an addition of approximately 147,000 addresses that have a PEPE balance over the past 30 days.

This figure indicates a steady, albeit slow, increase in the number of users or investors engaging with Pepe Coin.

PEPE on Telegram: Overwhelmingly positive news prevails

The Telegram community’s sentiment towards PEPE seems overwhelmingly positive based on recent communications. In the past seven days, there were 679 messages that were positive in nature. This compares to only four negative messages.

This significant disparity highlights a strong positive bias or favorable outlook for PEPE among the members of its Telegram community.

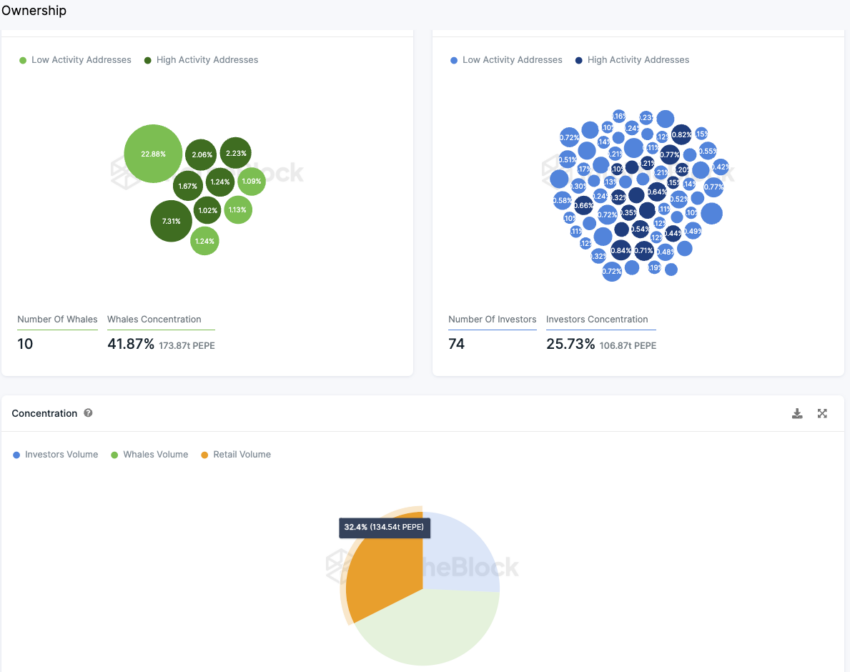

Whale dominance: Almost 42% of PEPE stock held by large holders

PEPE exhibits a concentrated ownership structure, with a significant portion of the tokens held by whales and large investors. Ten whale addresses, each holding more than 1% of the total token supply, collectively control about 42% of it. Six of these whaling addresses are particularly characterized by very high activity levels.

In addition to these whales, there are 74 major investor addresses. Each address holds between 0.1% and 1% of the total token supply, which cumulatively makes up about 26% of it.

As a result of this concentration among whales and large investors, the remaining share available to retail investors is less than one-third of the total supply. This amounts to about 32.4%. This distribution highlights the significant influence of major holders in the Pepe Coin ecosystem.

Read more: Best Upcoming Airdrops in 2023

Disclaimer

In accordance with the Trust Project Guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimers have been updated.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news