[ad_1]

Navigating the complex landscape of financial markets is akin to riding a bull – it requires skill, strategy and a keen understanding of the market’s nuances. Amid the myriad of tools available to traders, one signature pattern stands out as a potential game changer – a bullish engulfing pattern. Like a beacon in the trading world, this two-candlestick formation promises to identify trend reversals and open doors to profitable opportunities. In this dynamic arena, where every move counts, mastering the art of recognizing and exploiting this powerful pattern is akin to holding the reins of the financial bull, directing informed and strategic trades.

Understanding bullish engulfing patterns

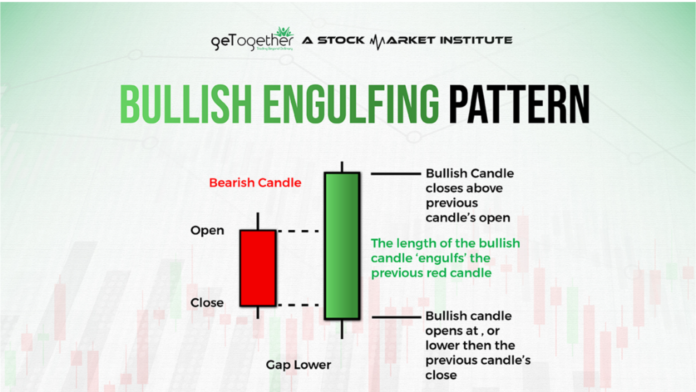

This particular two-candlestick formation indicates a potential reversal from a downtrend to an uptrend. The first candlestick usually indicates a period of selling pressure with a bearish tone. However, the subsequent candlestick is bullish and completely engulfs the previous bearish candle. This reversal pattern indicates a shift in market sentiment, with buyers gaining control.

Identification and Interpretation

Spotting this clear pattern requires a keen eye for candlestick formations. Traders look for a bearish candlestick followed by a larger bullish candlestick that engulfs the previous one. The bigger the second candlestick, the stronger the signal. This pattern is most effective after a significant downtrend, indicating a potential trend reversal.

Interpreting a bullish pattern involves considering the broader market conditions. If the pattern emerges near a support level or a trendline, it confirms the potential bullish reversal. In addition, combining the pattern with other technical indicators, such as moving averages or RSI, can improve the robustness of the signal.

Strategic entry and exit points

Implementing a trading strategy based on this characteristic pattern involves identifying strategic entry and exit points. Traders often enter long positions when this pattern forms, and place a stop loss order below the low of the engulfing candle to manage risk. As the price moves upward, traders can set profit targets based on key resistance levels or use trailing stop loss orders to secure profits.

However, like any trading strategy, it is crucial to be careful and not rely solely on this pattern. Risk management is extremely important, and traders must consider the overall market context, news events and other relevant factors that may affect the trade.

Backtesting and historical performance

Before integrating this pattern into a trading strategy, it is wise to perform thorough backtesting. Analyzing historical price charts and identifying instances where the pattern accurately predicted reversals can provide insights into its reliability. However, it is essential to recognize that past performance is not indicative of future results, and market conditions may evolve.

Integration with Fundamental Analysis

While technical analysis, especially pattern recognition, is a crucial aspect of successful trading, it is just as important to integrate fundamental analysis into the decision-making process. Fundamental factors such as economic indicators, corporate earnings reports and geopolitical events can significantly affect market dynamics. Traders must pay attention to these broader influences to ensure a comprehensive understanding of the market environment and make more informed decisions when interpreting this distinctive pattern.

Time frames and scalability

Another dimension to consider is the time frame in which this pattern is identified. Traders often use multiple time frames to confirm signals and determine the strength of the pattern. For example, a bullish engulfing pattern on a daily chart may carry more weight if it is matched by a similar pattern on a weekly chart. Scalability is also a consideration, with day traders and long-term investors finding value in this versatile pattern.

Finally, traders seek effective tools in the financial markets to navigate the complexities and make informed decisions. The bullish engulfing pattern stands out as a valuable signal for identifying potential trend reversals. By understanding the nuances of this two-candlestick formation, traders can strategically enter and exit positions, ride the bull and optimize their trading performance. As with any trading strategy, it is essential to approach this pattern with a well-defined risk management plan and a comprehensive understanding of market conditions. By combining this pattern with other technical indicators and staying alert to potential pitfalls, traders can harness its power to improve their overall trading success.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news