January 25, 2024

The Fed is falling behind as other central banks jump ahead of digital currencies

It will be a year of divergence between the world’s major central banks. The source of this split will not be interest rates or quantitative easing – it will be technology.

Over the past twelve months, some of the largest central banks in the world have all made significant progress in their development of central bank digital currencies (CBDC) and rapid payment systems. These include the European Central Bank (ECB), the Bank of England, the Bank of Japan, the Reserve Bank of India and the People’s Bank of China.

The Atlantic Council’s GeoEconomics Center’s research shows that in India, for example, testing on the digital rupee project is scaling up, reaching the milestone of over one million transactions per day processed by commercial banks across the country . In the eurozone, the ECB is now in the preparation phase for its CBDC. On January 1, the bank laid out a detailed roadmap and benchmarks for the year ahead, including testing a digital euro and working with a variety of private sector companies on key design features, including offline payments and fraud prevention. Discussions between the central bankers in Germany, France and Italy are already centered on how high to set the limit on individual wallets and which commercial banks will work with the ECB. The reality is that central banks and lawmakers across the Group of Twenty (G20) have moved beyond debating the theoretical merits and concerns with CBDCs, and are instead testing and piloting the technology to see what works and what doesn’t.

Interestingly, these new pilot programs are not limited to wholesale (bank-to-bank) or retail (everyday use) CBDCs. In addition, central banks are investing in new forms of technology in an effort to “future-proof” their currencies for the rise of blockchain, artificial intelligence, and quantum computing — all innovations that could impact how people use money for both legitimate and illegitimate uses. purposes.

Unfortunately, the US Federal Reserve does not seem to be on the same page. At the moment, technological payments innovation within the Eccles building lags behind its peers and competitors. One way to assess this is through the resources available within the organization for research and development. The People’s Bank of China, for example, has more than three hundred people dedicated to working on digital currency. Across the entire US Federal Reserve system, there are fewer than twenty. The Bank of England has an official joint task force between His Majesty’s Treasury and Parliament and a dedicated website to answer common questions. The innovation gap is not just on CBDCs. FedNow, the long-awaited interbank settlement system, took years longer than comparable systems in Europe, and use was limited in the early days.

The apparent belief of some inside the Fed and on Capitol Hill is that the dollar does not need to innovate. This is a miscalculation.

Speaking on Bloomberg’s Odd Lots podcast recently, Federal Reserve Vice Chairman Michael Barr said it could take years to know if the FedNow system is working. But the future of money is not going to wait. Consider cross-border payments – an area that clearly needs an upgrade. The average cost of sending remittances internationally in 2022 was more than 6 percent, with large differences depending on the region. (It is especially expensive to send remittances to countries in sub-Saharan Africa, for example.) Meanwhile, commercial banks often have to wait hours, and sometimes days, to complete large-scale transactions. Ultimately, many of these costs are passed on to consumers. So the idea that the system is good now is not in line with reality – the architecture for financial payments is old, creaky and in need of a major upgrade.

Fed officials often have ready answers about why these innovations are slow. Typically, their answers include that they currently do not see a strong use case and caution about unknown consequences of changing the current system. It makes sense not to want to disrupt the currency that underpins the world economy. But the apparent belief of some inside the Fed and on Capitol Hill is that the dollar does not need to innovate. This is a miscalculation.

Instead of thinking defensively about innovation, the US government needs to drive payments innovation from a position of strength. As the issuer of the world’s reserve currency, the Fed has a unique opportunity to set standards and influence constructive developments about the future of payments. Using its influence at the International Monetary Fund, the G20, and the Committee on Payments and Markets Infrastructure, the United States can help set these standards. But the Fed, working with the U.S. Treasury and other parts of government, must bring options and technological solutions to the table to influence the trajectory. Without his leadership, others will fill the vacuum.

As the GeoEconomics Center’s new Dollar Dominance Monitor shows, there are new alternative financial plumbing systems—including China’s own version—expanding around the world. Think of these systems like pipes being built. The pipes take a long time to build, but once the water is turned on, change happens very quickly. If these cross-border systems are built without the United States and the dollar, the way the dollar is used in trade, reserves and especially sanctions enforcement could shift significantly.

While many are stepping in to fill the innovation gap, including the Bank for International Settlements, the ECB and the Reserve Bank of India, none can replace the issuer of the world’s reserve currency.

What is troubling about this approach from the Fed is that central bankers around the world are asking for the Fed’s help. Central bankers often privately ask some version of, “Where’s the Fed on this?” On a range of issues from privacy to cybersecurity, the Fed’s leadership will be welcomed and its guidance and technological expertise listened to, even if the United States does not determine that there is a need for a particular kind of payment innovation in its own domestic system not.

The United States could make rapid progress, if it wanted to. Researchers and universities across the country, including at the digital currency labs at the Massachusetts Institute of Technology and Stanford University, are doing fascinating work on how to build CBDCs safely and effectively. Large companies in the United States are similarly developing their own CBDC models. The United States is helping other countries build CBDCs with talent from academia and the private sector — but the US central bank is not an active part of the collaboration. Meanwhile, the local Feds, including the Federal Reserve Bank of New York, are conducting important exploration on wholesale CBDCs, including Project Cedar, an experiment between the New York Fed and the Monetary Authority of Singapore. But it’s been almost a year since there was a significant update on the initiative.

An explanation could be that the Fed is working on this, but it is doing so quietly. This would be welcome, but it is not enough. In a politically polarized environment, the Fed’s lack of public communication has led to misinformation about what a possible digital dollar would do — just turn on the news to see it.

What will the future look like if nothing changes? In the absence of more American technology models and standards, a broken system will be built with different designs, cybersecurity standards, and disparate messaging systems. Instead of faster, cheaper and more secure, money will be more tied down but less secure. In 2024, the digital euro will have an enormous standard effect as other countries adopt European solutions to the challenges of anonymity and offline payments. But even the euro will not be able to create a new international standard – the Fed is the one actor that can unite a fractured payments landscape.

Critics of CBDCs were quick to say that these tools don’t work or won’t be effective. But how can anyone know without pilot projects designed precisely to test and answer these kinds of questions? Clearly, some of the Fed’s peers are coming to a different conclusion after investing resources, time and talent in exploring the future of money. Imagine judging that artificial intelligence won’t affect the future of work before you’ve ever used ChatGPT. Once people get hold of the innovation, their perception of what is possible and what is not possible changes rapidly.

The thinking in Washington right now on payments innovation is to wait until after the November election. But the United States doesn’t have a year to waste. A year is an eternity in technology. The gap between the Fed and other major central banks is likely to widen through 2024, and the Fed will have to catch up. Between now and next January, Fed officials should do more to accelerate exploration efforts across all their payments projects, including faster cross-border transfers and CBDCs.

If they don’t, the future of money can quickly pass them by.

Josh Lipsky is the senior director of the Atlantic Council’s GeoEconomics Center and a former IMF advisor.

Ananya Kumar is the Associate Director of Digital Currencies at the Atlantic Council’s GeoEconomics Center.

Further reading

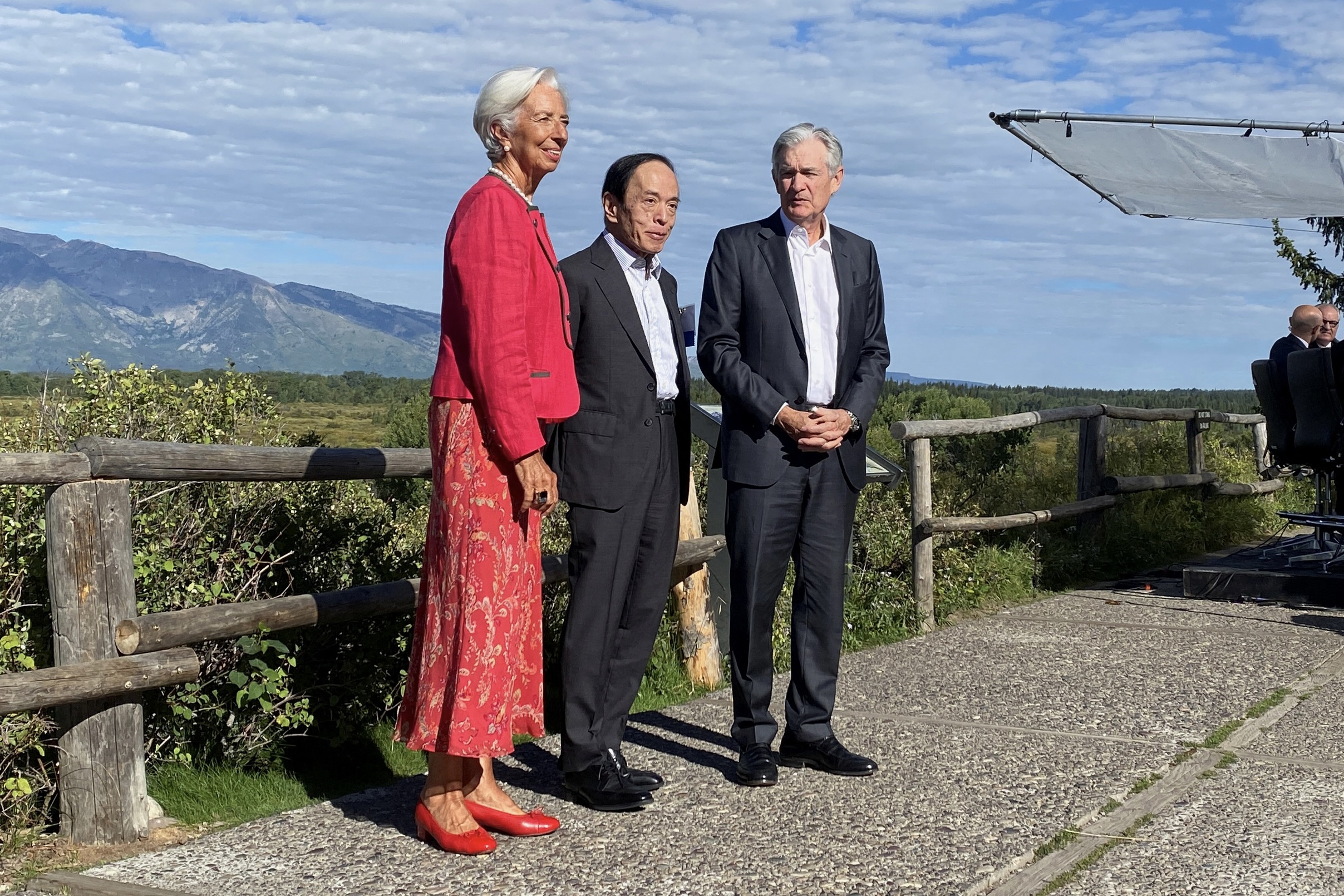

Photo: Federal Reserve Chairman Jerome Powell, European Central Bank President Christine Lagarde, and Bank of Japan Governor Kazuo Ueda take a break outside while attending the Kansas City Federal Reserve Bank’s annual economic policy symposium in Jackson Hole, Wyoming, U.S., August 25, 2023 attend REUTERS/Ann Saphir

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news