[ad_1]

The Cardano ($ADA) ecosystem has made significant strides in the decentralized finance (DeFi) market, as its DeFi ecosystem — launched in January 2022 with the launch of the MuesliSwap mainnet — grew from $50, 9 million in the first quarter of 2023 to more than $150 million, a year-to-date growth of more than 200%.

Top DeFi Projects on Cardano

Here we will examine some of the top performers of Cardano’s DeFi ecosystem based on TVL, user activity and more key factors.

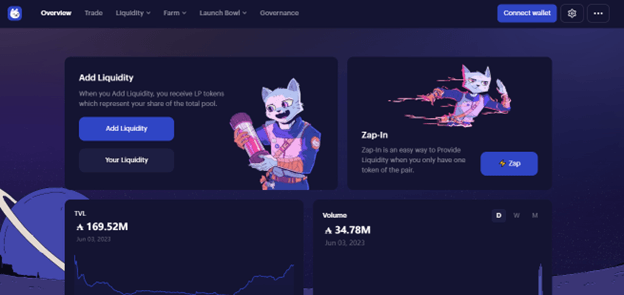

MinSwap: Largest DEX on Cardano

MinSwap is a decentralized exchange (DEX) that allows users to exchange a wide range of cryptocurrencies and provide liquidity on multi-pool farms with an automated yield farming mechanism that provides liquidity providers (LPs) with the best yield in the network.

Liquidity providers deposit funds into what are known as liquidity pools. These pools combine the funds of a specific trading pair and are used as liquidity to settle trades, with automated market maker (AMM) exchanges relying on these pools instead of traditional order books.

Anyone can provide liquidity in a liquidity pool on the Cardano network and on various other blockchains. These pools are now standard in decentralized exchanges that include Curve, PancakeSwap and Uniswap.

MinSwap offers more than 2500 pools divided into four types – stablecoin, constant product, multi-asset and dynamic pools – each showing the potential APY (annual percentage return) for LPs and an automated return farming strategy that generates a percentage of the liquidity LPs relocate to the best performing pools. This division of pools allows LPs to measure risks depending on the pool they choose.

MinSwap made headlines in May 2023 after the TVL boom in the Cardano ecosystem; it is the largest application on the blockchain, with a dominance of 26.8% and $48 million in TVL at the time of writing. We can also attribute its surge in popularity to its beginner-friendly dashboard and UI, which makes it easy to use for regular users.

Indigo: Synthetic Assets

Indigo is a community-controlled protocol that allows users to create synthetic versions of real assets on the Cardano blockchain using ADA or stablecoins. The creation of synthetic assets is possible thanks to the Plutus smart contract platform, which allows developers to write, test and run applications that interact with the Cardano network.

Synthetic tokens offer users exposure to real assets without directly owning them, and on Indigo are called iAssets. These assets track the price of their underlying real world asset – which can be stocks, bonds, commodities, ETFs, etc. Since real assets are often difficult to access for a regular user for a possible number of reasons including geographic restrictions, synthetic assets allow users to gain fractionalized exposure to real assets, removing financial boundaries.

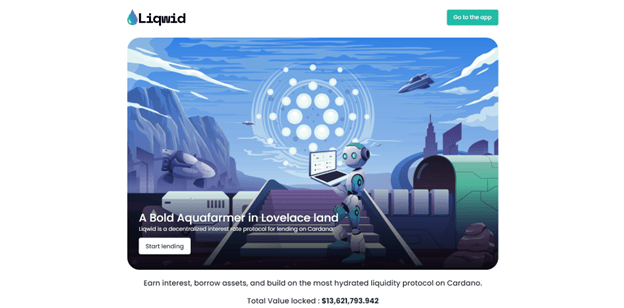

Liquid (LQ)

Liqwid Finance is a DeFi lending protocol audited by Vacuumlabs. It is an open source, non-custodial interest rate protocol that makes DeFi lending easier and accessible to everyone on the Cardano blockchain.

It is currently the third highest ranked DeFi protocol in terms of TVL, with over $19 million. The protocol gained popularity mainly due to its simplicity, user-friendly interface, high-yield pools and its well-structured DAO management system.

Users can earn interest on their Cardano-based assets by staking, they can borrow assets from the lenders on the protocol by collateralizing their positions, or participate in the community by staking their tokens to vote on network proposals or to submit of their own.

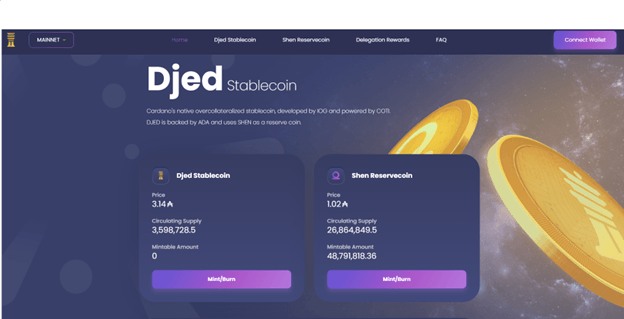

1. The grandfather of Stablecoin

Djed is a multi-chain crypto-backed stablecoin protocol. It uses a multi-currency algorithmic system to ensure price stabilization, in which users buy and sell SHEN—the protocol’s reserve coin—depending on market conditions to maintain DJED’s USD parity while earning a share of transaction fees in the reserve pool. Djed is also supported by ADA.

Djed requires users to overcollateralize their positions to borrow; this is to avoid a Terra-like collapse and ensure system stability. That said, users have to put up between 400% and 800% in collateral before they are issued a loan.

WingRiders:

WingRiders is a fully decentralized Automated Market Maker (AMM) that offers various DeFi services including token exchange, staking and yield farming. It is governed by its DAO, which is powered by the protocol’s native token, WRT, which is a deflationary token with a fixed supply and works both as a utility and governance token.

WingRider allows users to exchange Cardano and ERC-20 tokens, making it easier for users to exchange tokens between multiple networks directly on the protocol. It is also the first DEX on Cardano to support WalletConnect and Lace wallet.

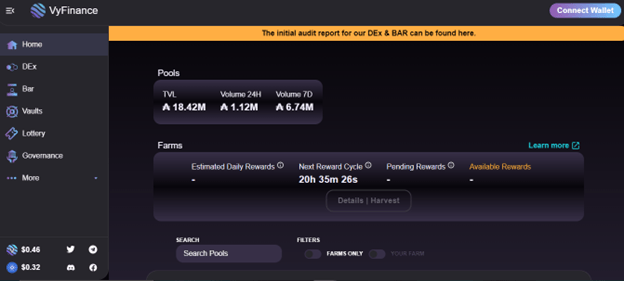

VyFinance

VyFinance is an interactive protocol designed to make DeFi services easier and accessible to anyone, regardless of their level of experience in DeFi. It is the first DEX on Cardano that uses an AI neural network to process all types of services within VyFinance, such as yield farming, staking and provision of non-conservation of liquidity.

Like most protocols, VyFinance has its own native token, VYFI, which has allowed users to receive rewards in the form of crypto and gain voting rights to vote on governance and network proposals – or submit their own.

Other features of VyFinance include Lottery, in which users only need to link their wallet to play; Vaults, in which users can stake tokens on various projects on Cardano, a merchandise store and a blog section that updates the community with protocol changes and upgrades.

MuesliSwap

MuesliSwap is a decentralized exchange on the Cardano blockchain that allows users to trade Cardano native tokens. It is the first native DEX on Cardano that offers centralized exchange-like trading features with a proper UX designed for advanced, fast trading.

The protocol uses a hybrid system that uses decentralized functions and, instead of using an AMM like other DEXs, it uses an on-chain order book linked to its liquidity pools, which provides crypto traders with functions such as limit -, stop and market orders with low fees and quick order matching.

SundaeSwap

SundaeSwap is a DEX and automated liquidity provision protocol that allows users to trade cryptocurrencies, specifically Cardano tokens, on the Cardano blockchain.

SundaeSwap is a native, scalable DEX that runs on an automated market maker (AMM) algorithm, combined with constant product liquidity pools, which helps reduce price slippage in lower liquidity pools.

The protocol is defined by a series of immutable, permissionless and decentralized smart contracts built on Cardano using Plutus, the smart contract programming language of the Cardano blockchain.

1. LenFi (Go)

Aada is a decentralized lending protocol built on the Cardano blockchain. It is a non-custodial, interoperable and peer-to-peer lending and borrowing platform that allows users to lend their assets and earn interest or borrow crypto-assets and use them as financial instruments. Aada Finance is built on powerful and secure Cardano smart contracts.

The platform uses the network’s eUTxO model by leveraging peer-to-peer lending and lending primitives. Lending and borrowing on Aada works in a peer-to-peer fashion, starting with a borrower setting up a loan request. It locks the borrower’s collateral into a smart contract, which can either be canceled and redeemed by the borrower or provided with a loan by a lender. If the latter occurs, the lender sends the loan amount to the borrower’s wallet.

Aada Finance uses NFT bonds to lock loans and deposits, which are redeemable by anyone who provides the underlying NFT and meets the loan terms. The platform launched on the Cardano mainnet on September 13, 2022, making it the first lending and borrowing protocol launched on the Cardano mainnet.

Optim Finance

Optim Finance is a return aggregator for the Cardano blockchain4. It simplifies the process of maximizing DeFi returns by providing innovative passive investment tools that optimize returns on digital assets.

The suite of automated asset management products includes numerous financial strategy-based and smart contract managed pools that enable users to optimize their return potential from whitelisted Cardano DeFi protocols. Optim Finance also provides tools to create Collateralized Debt Obligations (CDOs) and new derivatives on Cardano.

Featured image via Unsplash.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news