[ad_1]

During the presidential race in 2024, the discussion about an American CBDC becomes more intense. Candidates’ contrasting views reflect larger concerns about privacy and government control.

As of January 2024, the situation regarding central bank digital currencies (CBDCs) in the US is characterized by caution and gradual progress, especially compared to the progress made by other countries.

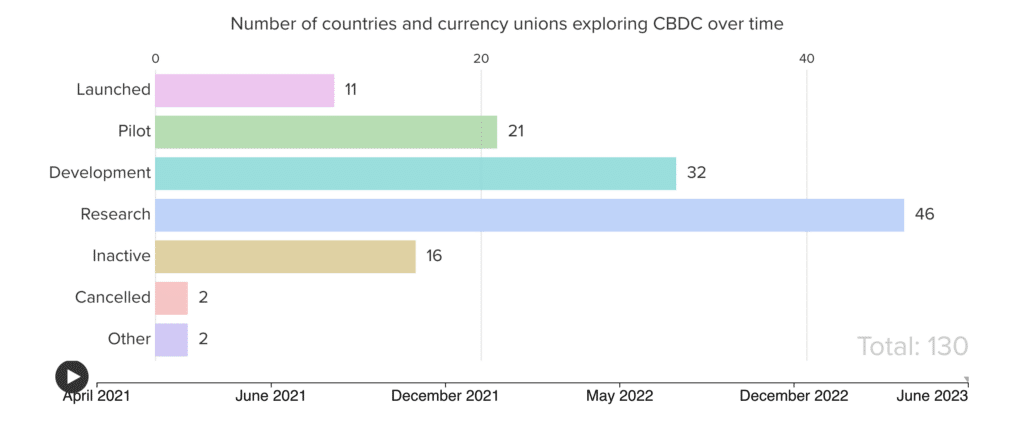

Currently, 11 countries have fully implemented digital currencies, while China, India and several other countries are in the pilot phase.

In the US, the development of a retail CBDC (direct-to-consumer) has made little progress. However, there is forward movement on a wholesale CBDC, which focuses on bank-to-bank transactions.

Amidst this, the Federal Reserve is approaching the idea of a digital dollar with some caution. Fed Chairman Jerome Powell expressed interest in a digital dollar in 2022, but also acknowledged the need for careful consideration due to the dollar’s global significance.

Currently, the US emphasizes research and development in this area, with projects such as the joint effort between the Bank of Boston and the MIT Digital Currency Initiative’s Project Hamilton, and the Bank of New York’s Project Cedar, which explores the technical aspects of CBDCs.

Meanwhile, the US position on CBDCs has also become a topic of interest in the political arena, especially in the context of the 2024 presidential election.

Concerns have arisen about privacy and the potential for a CBDC to serve as a tool for government surveillance, leading to opposition from some political figures.

To delve deeper into this topic, it is important to understand the perspectives of the presidential candidates on CBDCs and whether the US even needs a CBDC.

US Presidential Candidates’ Position on CBDCs

The issue of CBDCs has emerged as a major topic among US presidential candidates in the 2024 election cycle. There is a clear division of opinion, especially among prominent figures in the Republican Party.

Former President Donald Trump has taken a strong stance against CBDCs. During his campaign, he promised to prevent the creation of a US CBDC if re-elected, calling it a “dangerous threat to liberty”.

Trump’s concerns centered around the potential for a CBDC to give the federal government extensive control over citizens’ finances, including the ability to monitor and potentially seize funds without individuals’ knowledge.

This perspective aligns with other Republican candidates, including Florida Gov. Ron DeSantis. DeSantis has proposed legislation in Florida to ban the use of CBDCs, pitching it as an effort by the federal government to increase oversight and control over financial transactions.

Another important voice in the Democratic field, Robert F. Kennedy Jr., also expressed reservations about CBDCs. He warns of the potential for CBDCs to become tools of social surveillance and control, citing the lack of anonymity associated with such digital currencies.

Kennedy raises concerns about the government’s ability to monitor private financial affairs and enforce transaction restrictions, suggesting that CBDCs could lead to greater government intrusion into individual lives.

On the other hand, President Joe Biden has shown a cautious but forward-looking approach towards CBDCs during his term.

In April 2022, he signed Executive Order #14067, which authorized the Fed to begin a formal process to evaluate the risks and opportunities of the US CBDC.

However, no formal design for a US CBDC has been released, nor has a release date been announced under Biden’s administration.

Does the US need a CBDC model?

Economically, the introduction of a CBDC in the US could have far-reaching implications. It can streamline payment systems, reduce transaction costs and transform monetary policy implementation.

For example, in times of economic crisis, CBDCs can enable faster and more direct implementation of measures such as stimulus payments. This was proven during the COVID-19 pandemic when stimulus payments were delayed due to logistical problems in distributing funds.

However, it also raises questions about the role of commercial banks and the dynamics of money supply and demand.

The potential for a CBDC to bypass traditional banking intermediaries could disrupt current financial models, impacting bank deposits and lending activities.

Moreover, the global financial landscape, where the US dollar holds a dominant position, could be affected by the introduction of a US CBDC.

There is debate over how this might affect the dollar’s role as the world’s reserve currency, especially in light of competition from digital currencies such as China’s digital yuan.

Some experts argue that a well-designed US CBDC could strengthen the dollar’s global standing, while others warn of potential risks to its long-established position.

The ongoing research and exploration by the Fed and other institutions is crucial in determining the most appropriate course of action for the US as it directly affects the world economy and the global state of affairs.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news