[ad_1]

Introduction

A key benefit of blockchain technology is transparency. Everything on the chain is visible and publicly accessible, allowing anyone, anywhere, anytime to access and analyze it. This unlocks a new paradigm in trade and investment. You can monitor transactions and transactions of anyone in real time, including those made by the most influential investors or crypto whales. Smart investors often use this transparency to refine their trading strategies and be early adopters of new projects.

In this article, we’ll explore what crypto whales are, how to find their wallets, and check what they’re buying so you can maximize your returns.

What are crypto whales?

Crypto whales are individuals or institutions that hold large amounts of cryptocurrencies. Although there is no set threshold for becoming a “whale”, these entities often hold a significant portion of the total coins in circulation of an asset. These whales are often sophisticated market participants and have a history of being profitable traders.

Why the best crypto whale watching?

As a crypto investor, finding your next profitable trade can be difficult. Tracking crypto whales can help you identify potential market trends and study successful investment strategies.

Whales typically have the power to influence crypto markets due to their significant holdings. Informed market participants often follow whaling activity, assuming they have inside knowledge or significant market insight. Their actions, combined with whale movements, can cause a domino effect, with other traders following suit. Being early to big moves allows you to make the most returns. This is one of the primary reasons for tracking crypto whales.

For example, you can get early signals by monitoring whale activity and time your entries and exits on coins accordingly. Furthermore, if many popular whales are interested in a particular project, you can assume market enthusiasm for the asset.

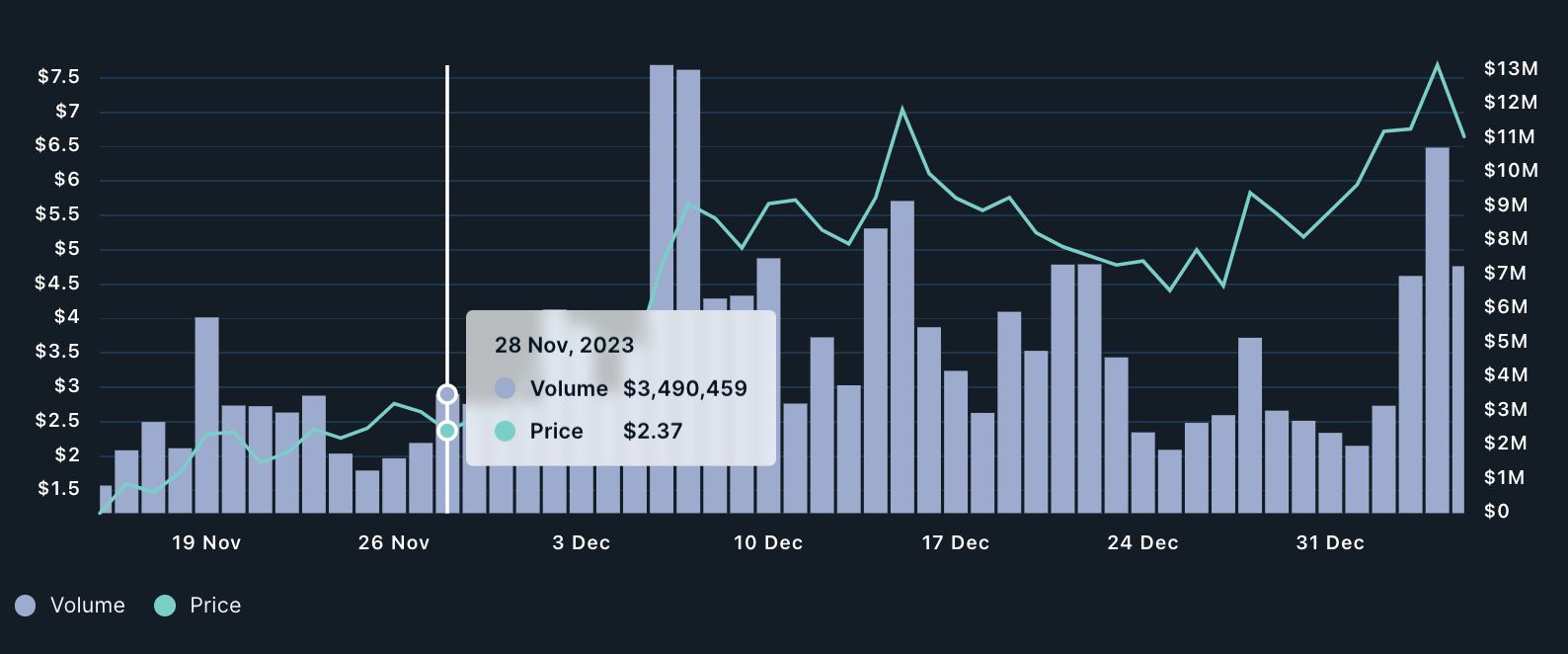

Consider OLAS, an AI crypto project, as an example. We’ve identified Smart Money addresses that are piling it up as we feature our new tool, Signals, in our Office Hours live stream. After that, the token experienced a 3x increase, from $2.39 to a high of $8.47, all within a few weeks.

However, it is important to be careful if a project has too many whales. Since whales can manipulate coin prices, a project with too many whales can be extremely volatile. Therefore, while crafting a crypto investment strategy, tracking the top crypto whales gives you an edge over the average retail participant.

Who exactly are the top crypto whales?

It is important to realize that not all whales are created equal. Some may simply have large balances but are historically unprofitable or have a low return on their investments. Some may be cryptocurrency exchanges that hold crypto assets on behalf of their clients. Tracking these wallets may not provide useful insights for investors with smaller portfolios.

Instead, a better option would be to use a crypto analysis platform like Nansen and look for whales with an extensive history of profitable trading. These investments typically tend to be in more smaller projects or tokens that don’t yet have traction.

In other words, you should follow Smart Money wallets that are extremely profitable in what they do. Smart Money gives you clearer signals and consistent patterns – making it easy to understand their strategies or copy their trades with greater success.

So how do you find these smart whales?

How to find crypto whale wallets?

Discovering crypto-whale wallets requires a thorough exploration of blockchain data, strategic investigative work, and vigilant monitoring, commonly known as onchain analysis. In this section, we’ll go over the top three ways you can find whale purses.

Top holders of tokens you are interested in

One of the first aspects to analyze before investing in a cryptocurrency is its token distribution, which refers to the distribution of the cryptocurrency among its holders. Thanks to the public nature of blockchain data, it is simple to identify the top holders of any cryptocurrency of interest.

By using Nansen, you are able to analyze these important containers efficiently and thoroughly. Simply use CMD + K to search for any character. Nansen provides in-depth insights across various tokens, allowing you to examine important onchain metrics before entering. Access to data points such as the token buy and sell wallets, top deals and Smart Money trends, all at your fingertips.

In addition to identifying the top holders, you can see how their token balances have evolved over time. This insight helps determine the sentiment and interest prominent investors, or whales, have in the sign. Such analysis can help to monitor the activities of major wallets, early investor behavior and illuminate potential strike opportunities.

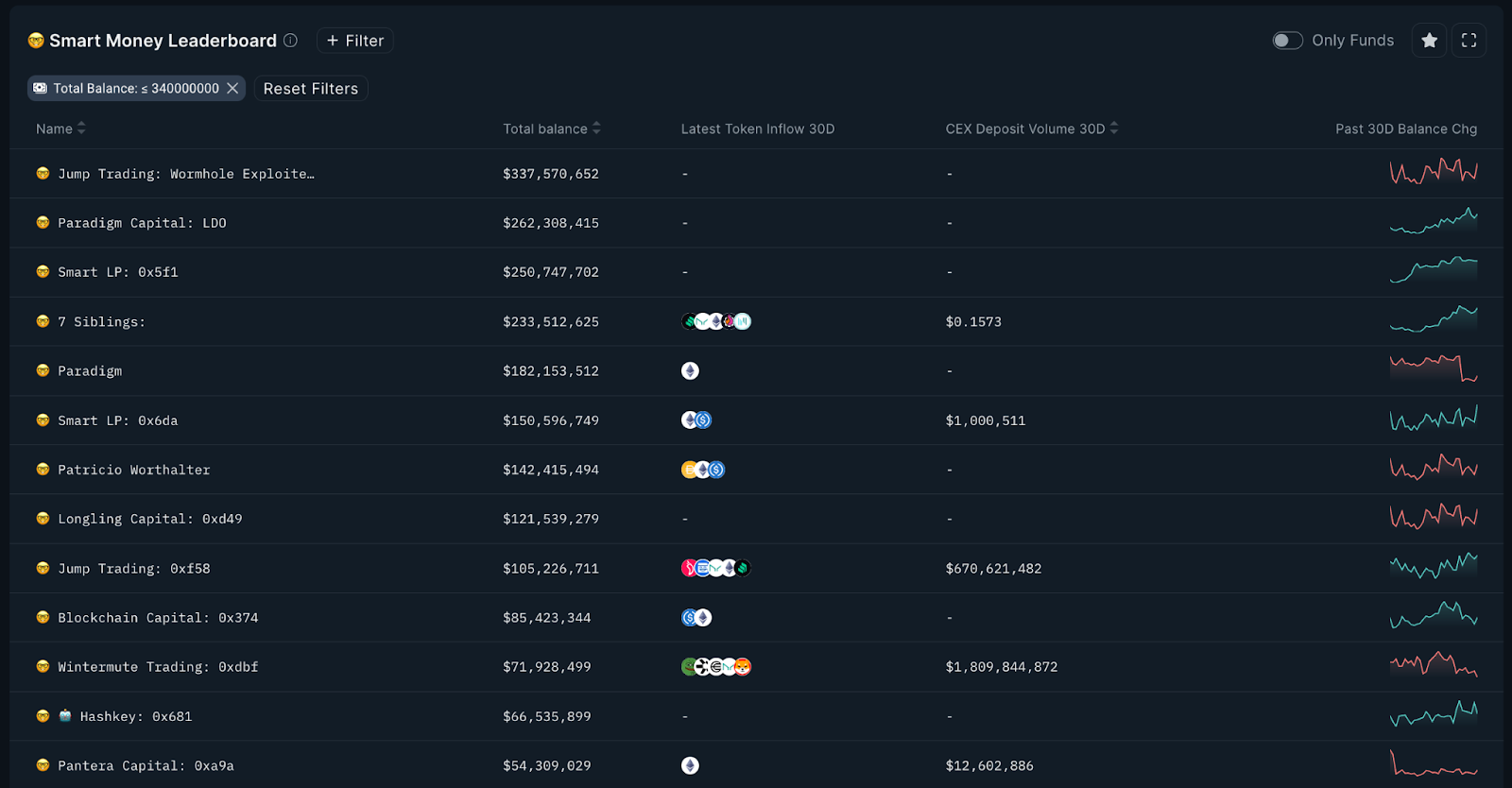

Another approach involves examining the Smart Money wallets with the largest holdings. These wallets are usually operated by sophisticated entities such as trading companies or highly profitable individuals.

Compile your own alpha list

Crypto narratives often move in waves, with multiple tokens trending simultaneously. To effectively follow these trends, it is beneficial to focus not only on wallets that hold large amounts of a single token, but also on those with diverse holdings in various trending tokens. Identifying these wallets is key to spotting early opportunities and ensuring successful trades. Nansen’s Smart Segments tool allows you to quickly identify and label these wallets.

Smart Segments automatically identifies Ethereum addresses that meet your specified criteria and tags them for easy tracking. The list it generates is dynamic and constantly updated to ensure it stays current.

These tags are displayed on various Nansen control screens where the wallets are displayed. To actively monitor these wallets, add them to your watchlist and analyze their activities using the Nansen Profiler. For paying users, Nansen provides aggregated views of the onchain activities of the entire segment, simplifying analysis and decision-making.

Who keeps, buys and sells whales

Tracking Smart Money can be instrumental in identifying upcoming trends and understanding the activity of top market participants. An effective method to discover trending tokens among Smart Money wallets is through Nansen’s Smart Money dashboard.

The Smart Money token holdings dashboard provides an overview of tokens that have seen the most significant changes in Smart Money balances. It also displays the number of smart wallet addresses each token contains, providing a glimpse into the token’s popularity. This information serves as a valuable starting point for investigating signs that may be worth investigating further.

The DEX Trades tab provides both an aggregated overview of the tokens that Smart Money wallets buy and sell, as well as a live view of the DEX trades they execute.

An important thing to note is that tracking Smart Money is not a one-size-fits-all process. Your own trading strategies will influence the signals and statistics you focus on. For example, private sale investors may look at different tokens and metrics compared to airdrop hunters when identifying a trending token.

How to analyze and detect crypto whale activity?

Once you’ve identified the top whales from the above methods, it’s time to set up a system to track them. Tracking them will help you analyze their patterns and strategies, such as trade timing, the type of coins they trade, risk management and reaction to market conditions.

You can analyze and track crypto whale activity directly on the blockchain via tools such as block explorers like Etherscan or big data analytics platforms like Nansen. Block explorers typically focus on raw blockchain data and individual transactions, while data analytics platforms aggregate and analyze them to deliver actionable insights.

Let’s see how these two methods differ and how you can use them.

Block Explorers – Native analytics for blockchains

Block explorers, as the name suggests, allow you to “explore” the blockchain. You can access historical and real-time transactions, wallet balances, block history, etc., on a specific blockchain through a block explorer. Popular explorers include Etherscan for Ethereum and SolanaFM for Solana.

Although block scouts are useful when watching whales, they have their limitations. One of the key issues with block explorers is limited label coverage. Without tags, you cannot know the identity or nature of the wallet.

This leaves that investigative work to you, you have to dig through a lot of historical data to identify the important whaling deals. It is extremely time consuming and can be very challenging without the right expertise. It can also be difficult to understand the nature and context of the overall whaling activity. Plus, if a crypto-whale has multiple wallets (and they often do), identifying, linking, and tracking them can become a significant waste of time. With millions of transactions and addresses, tracking crypto wallets can be difficult. This is where blockchain analytics platforms shine.

Unlock deeper insights with the help of Nansen

Going beyond data aggregation, Nansen enriches onchain data with wallet address labels. This gives users a deeper understanding of what is happening and makes it easier to find, track and analyze crypto whales.

One of Nansen’s most popular features, Wallet Profiler, gives you an in-depth view of a wallet’s activity and current holdings. You can simply search for any entity, ETC, or any of the address you discovered earlier and get an overview of detailed onchain data points that really matter.

Nansen Smart Alerts

Crypto investing requires constant monitoring – keeping track of market trends, asset prices, macro impacts, and especially whale activity. The faster you can interpret and respond to signals of whale activity, the greater your chances of executing successful trades.

With Nansen Alerts, you see investment opportunities as soon as they happen. Nansen’s smart alert feature allows you to efficiently stay on top of whale movements without staying glued to your screen. You can set up alerts on specific wallets, entities, tags, tokens and even NFTs.

When a transaction occurs that meets your criteria, Nansen’s Smart Alert feature immediately sends you a notification via your preferred communication channel – Telegram, Discord or Slack.

Watch the whales with Nansen

In crypto, knowledge is power, and understanding Smart Money movements can be an invaluable advantage. Understanding the dynamics behind price movements is fundamental to trading cryptocurrencies. And whales are a key piece of the puzzle.

Spotting crypto whales can help you contextualize and understand market movements and make an informed investment plan. Data points from crypto whales, fundamental analysis and other indicators can give you unique insights into the market. Tools like Nansen help you effectively navigate through these complex data points and easily locate Smart Money.

Ready to start tracking crypto whales? Start tracking Nansen for free!

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news