[ad_1]

Explore the expected next crypto bull market in 2024-2025, its key drivers, and determine which strategy is optimal for you.

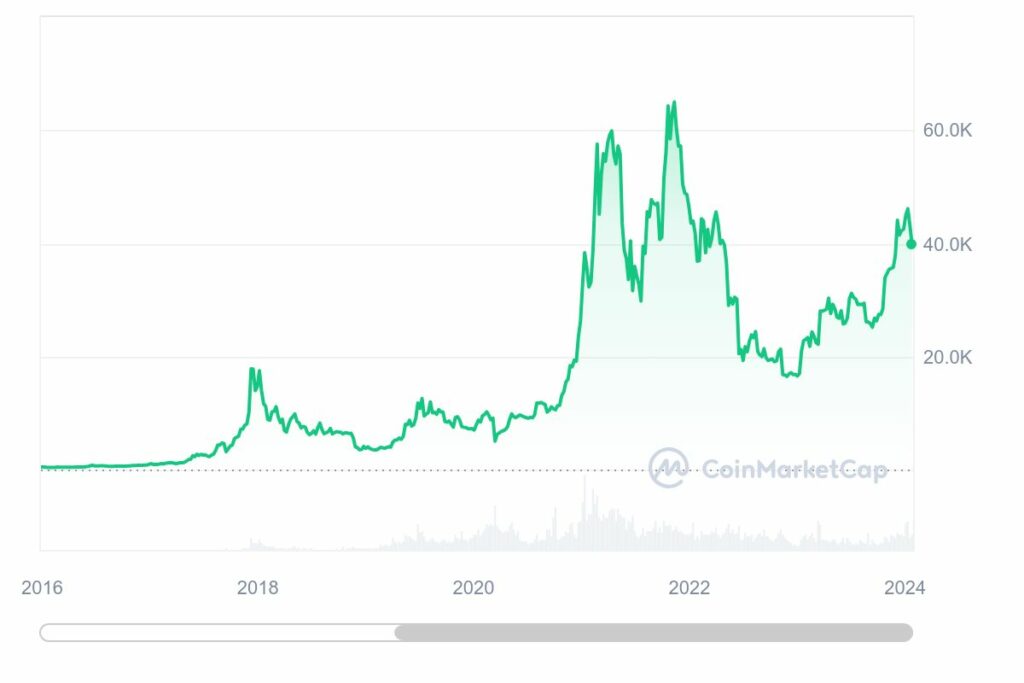

The crypto market has seen several bull and bear cycles since Bitcoin (BTC)’s inception in 2009, which gives clues to the next crypto bull run 2024-2025.

One of the earliest significant bull runs occurred in 2017, when Bitcoin saw a price increase of nearly 20x, peaking near $20,000 levels.

This was followed by a sharp decline in what was later called the “crypto winter”, and saw BTC lose more than 80% of its value, bottoming out around $3,200.

Another remarkable phase was the 2020-2021 bull run. After a period of decline and stagnation, BTC, along with other major altcoins such as Ethereum (ETH), has risen to new heights.

During this period, Bitcoin’s value reached around $69,000 by November 2021, while the overall market capitalization rose over $2.5 trillion before cooling off.

As we look to the future, several factors suggest that another bull run may be on the horizon. So, when is the next predicted crypto bull run, and how should you prepare for it?

Factors that could trigger the next crypto bull run in 2024-2025

Mainstream adoption of BTC ETFs

The introduction of Bitcoin ETFs is an important step in the mainstream acceptance of cryptocurrencies.

These ETFs provide a regulated option for both retail and institutional investors to gain exposure to Bitcoin, potentially leading to broader adoption and increased liquidity.

Currently, the market has seen the launch of several Bitcoin ETFs, including notable ones such as Blackrock’s iShares Bitcoin Trust (IBIT), ARK 21Shares Bitcoin ETF (ARKB), etc.

Since their launch, these ETFs have amassed significant holdings, reflecting growing investor interest.

For example, the 11 US ETFs that track Bitcoin’s price have collectively accumulated more than 644,860 Bitcoins, worth more than $27 billion, signaling a shift in Bitcoin’s position in mainstream finance.

Historically, the introduction of ETFs in other markets, such as gold, has played a crucial role in making the asset more accessible to a wider range of investors, contributing to price appreciation.

For example, the launch of the first gold ETF in 2003 coincided with the start of a 10-year bull market in gold, where its price rose by more than 350%. In the first year after launch, Gold price rose by 20% with an annual inflow of $15 billion into various ETFs.

Drawing parallels, the introduction of Bitcoin ETFs could have a similar impact, providing a more direct and regulated investment avenue in Bitcoin.

BTC halving

Historically, Bitcoin halving events have greatly affected its price and market dynamics. The halving happens roughly every four years, cutting the block reward for miners in half, leading to a greater scarcity of Bitcoin.

The next halving is expected in April 2024, and if history is any guide, it could be a major catalyst for the next crypto bull run 2024-2025.

Examining previous halvings, each event was followed by a significant increase in Bitcoin’s price. For example, after the 2016 halving, Bitcoin’s price rose significantly the following year. The 2020 halving also preceded the remarkable bull run of 2020-2021, where Bitcoin reached new highs.

The 2024 halving is therefore being watched closely, with expectations that it will cause a similar positive impact on the crypto market.

ETH’s Dencun Upgrade and Its Impact on the Crypto Market

Ethereum’s Dencun upgrade, a major step in the network’s development, has been successfully implemented on the Goerli testnet.

This upgrade, implementing EIP-4844 (proto-thanksharding), is focused on increasing data availability for layer-2 digests and improving Ethereum’s scalability.

The primary component, proto-thanksharding, allows for the temporary storage of off-chain data, which is expected to significantly reduce transaction fees for decentralized applications (dapps), especially to the benefit of layer 2 roll-up chains.

The Dencun upgrade is expected to reduce rollup transaction costs by up to 10 times, depending on the demand for blob space. This reduction in gas fees and faster transaction speeds are poised to open up opportunities for more complex applications on layer 2 solutions.

With these technical achievements, Ethereum can become a more scalable and efficient blockchain, making ETH and ETH-based applications a strong contender to flourish in value in the coming months and years.

Macroeconomic factors influencing the expected crypto bull run

When is the next crypto bull run? The crypto market’s trajectory can be heavily influenced by various global economic factors.

Geopolitical tensions, especially in areas critical to the world’s food and energy supply, such as Eastern Europe and the Middle East, are major risk factors facing the global economy.

Any escalation in these conflicts could lead to disruptions in energy markets and supply chains, affecting global economic growth and investor sentiment towards riskier assets such as cryptocurrencies.

For example, an escalation in the Middle East affecting oil production could lead to rising oil prices, which could fuel inflation and lead to risk-off sentiment among investors, which could potentially have a negative impact on riskier assets such as cryptocurrencies.

Additionally, a research report by blockchain analytics firm TRM Labs showed that nearly 80% of jurisdictions around the world have introduced measures to tighten crypto regulations in 2023.

In the absence of a comprehensive regulatory structure for cryptocurrencies in the United States, TRM Labs foresees significant decisions from federal courts in 2024 regarding the potential classification of certain crypto-assets as securities.

In 2023, the European Union (EU) made significant progress in regulating the crypto market by establishing Markets in Regulation of Crypto Assets (MiCA), which sets uniform rules for crypto assets, including consumer protection and environmental safeguards.

The EU has also focused on anti-money laundering (AML) measures. New guidelines issued by the European Banking Authority (EBA) highlight the need for crypto-asset service providers to effectively manage risks related to money laundering and terrorist financing.

These developments could have a significant impact on investor confidence and market stability, both of which are crucial factors in determining when the next crypto bull run will occur.

How to prepare for the next predicted crypto bull run

As we stand on the edge of what many expect to be the crypto bull news of 2024-2025, it is crucial to have a well-rounded strategy.

Reddit-Inspired Gradual Selling Strategy

One investor’s approach involves ceasing crypto purchases after April 2024 and implementing a gradual selling strategy from September 2024. This plan suggests selling a fixed percentage of holdings each month, starting at 4% and eventually 10 % reached. In addition, 25% of the proceeds go to the purchase of Bitcoin and 75% into a high-interest savings account. This strategy emphasizes discipline, especially during volatile market periods.

Diversification strategy

Diversification is key in any investment approach, especially in a volatile market like cryptocurrencies. This involves spreading your investments across various types of crypto assets, such as Bitcoin, altcoins and tokens based on different technologies or with different use cases, and even considering non-crypto investments such as stocks or real estate. The idea is not to put all your eggs in one basket, reducing the impact of any one asset’s performance on your overall portfolio.

Automated trading and dollar-cost averaging

Automated trading algorithms and dollar-cost averaging (DCA) can provide a more hands-off approach to your trading strategy. DCA involves investing a fixed amount in a specific asset at regular intervals, regardless of its price, reducing the impact of volatility. Additionally, you can set up automated trades using algorithmic trading tools based on specific market conditions or signals, helping you take emotion out of the trading process.

Closure

Each of these strategies has its merits and can be tailored to your risk tolerance and financial goals. The key is to stay informed, adapt to market changes and maintain a disciplined approach.

As always, it is wise to consult a financial advisor to align these strategies with your financial situation. Investing more than you can afford to lose is never a good strategy.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news