Not too long ago, Tuur Demeester, a Bitcoin evangelist, shared his views on Bitcoin’s potential to hit the $1 million mark by 2028. Demeester’s take on the matter offers a cautious distinction between a number of the extra bullish predictions within the crypto group.

This tempered perspective comes when others, similar to Samson Mow, have specific strong confidence in Bitcoin’s skill to reach this milestone after its next halving.

$1 million Bitcoin By 2028 is not certain

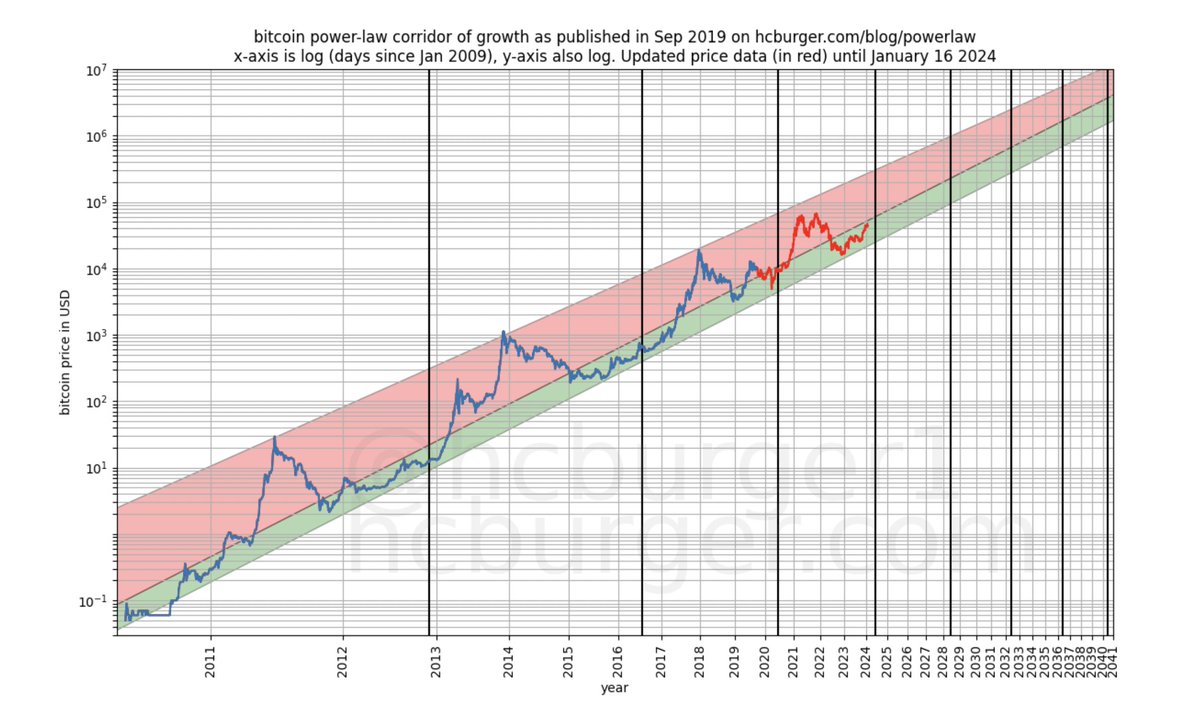

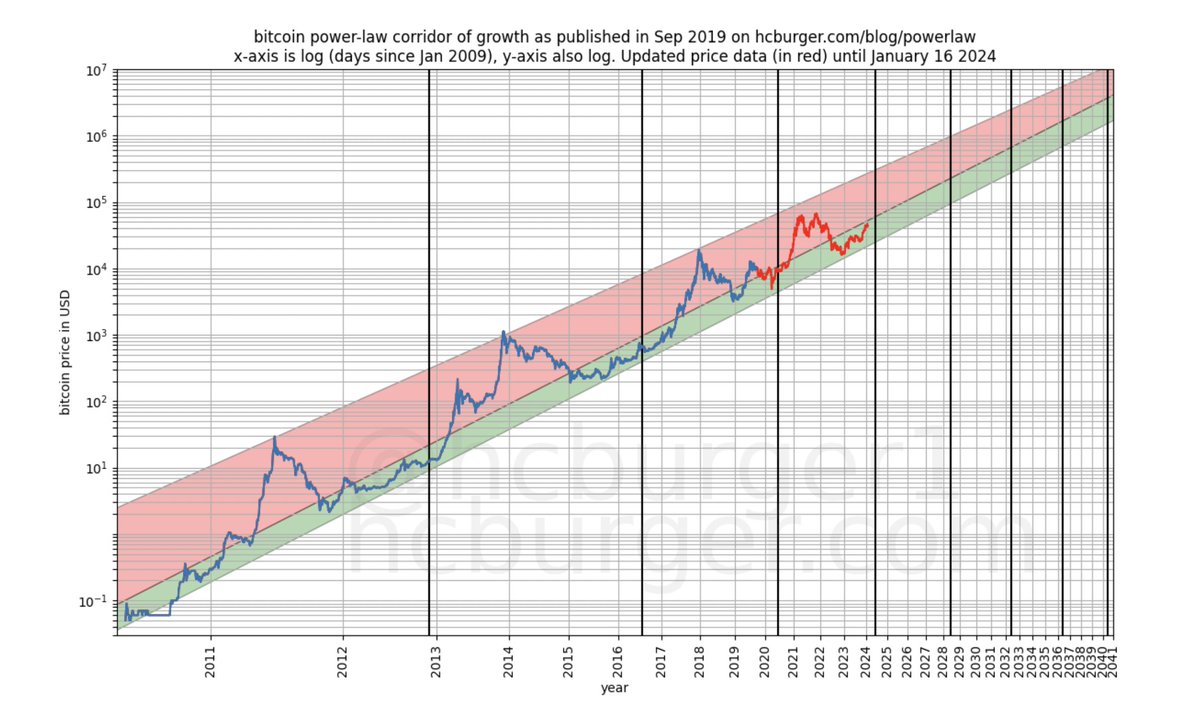

Demeester’s skepticism was articulated in response to a post that shared a chart by investor Fred Krueger, which suggested that Bitcoin could potentially reach the $1,000,000 stage by 2028.

While appreciating the chart’s mannequin, Demeester expressed uncertainty, acknowledging the unpredictable nature of the market and its ability to defy even essentially the most well-constructed fashions.

See extra

Will It Take BTC Until After Summer Time 2028 To Succeed In $1M? I don’t know, but I know that every beautiful mannequin (like this one 🤌) is destined to be used by Mr. Market to be damaged. https://t.co/GcmhfL2C16

— Tuur Demeester (@TuurDemeester) February 2, 2024

The expectation surrounding BTC’s $1 million value is intensely linked to its halving events, which occur approximately every 4 years. After this 12 month halving, the next halving is set to happen in 2028. These opportunities cut the variety of new BTC mined per block in half, limiting supply and likely affecting value.

The upcoming halving, set for April this 12 months, will see the daily coinage of Bitcoin reduced from 900 to 450 cash. Such supply adjustments have traditionally led to imperative value actions, lending credence to the various fashions predicting significant future value increases.

In the midst of these predictions, an X-consumer, who claims to own the expansion plot Demeester referred to, chimed in with insights. They argued that some market laws, such as the time value of cash within the stock market, are much less likely to be damaged.

Similarly, the pure adoption charge of Bitcoin will possibly limit its “explosive” progress, providing room for market actions without breaking the underlying mannequin.

See extra

Hello Tuur, this plot is mine. Some legal guidelines should not be damaged by Mr Market, e.g. the stock market is growing at ~7% p.a. It cannot be damaged upwards due to the time value of cash (mainly). The time-based power law is similarly difficult. to interrupt to the upside as a result will go…

— hcburger (@hcburger1) February 2, 2024

Various views on Bitcoin’s future

Different Bitcoin lovers, like Samson Mow, CEO of Jan3, are extra optimistic. Mow envisions Bitcoin reaching $1 million, likely in a sudden surge that causes “maximum pain” for a number of market players.

This dramatic improvement, he suggests, could happen quickly, within “days or even weeks,” although the exact starting line remains uncertain.

See extra

My essential prediction is that the run as much as $1 million occurs in days to weeks. Place to start TBD.

— Samson Mow (@Excellion) January 14, 2024

In analyzing potential triggers for a Bitcoin rally, Mow considers numerous factors. It embraces Bitcoin-specific statistics such as exchange-traded inflows (ETF), the BTC hashrate, and whale training on Bitfinex. In addition, Mow appears at broader financial indicators similar to Tether’s USDT goods under administration, authorities’ debt funds and debt-to-GDP ratios.

See extra

These are the #Bitcoin macro indicators I’m watching:

⬆️ ETF Inflows⬆️ Hashrate⬆️ Finex Whale Accumulation⬆️ 200 WMA Pattern⬆️ Tether USDt AUM⬆️ Government Curiosity Funds on Debt⬆️ Debt GDP Ratios⬆️ Nation State Bitcoin Adoption⬆️ Real Cash Inflation⬆️ Real Cash Inflation

— Samson Mow (@Excellion) January 28, 2024

Mow believes that these elements, mixed with the adoption of the nation state, real inflation costs and the M3 cash supply, can significantly affect Bitcoin’s effectiveness.

Amidst the talk, Bitcoin has seen quite a surge before now 24 hours, reclaiming the $43,000 mark with a current buy and sell value of $43,123.

Featured photo from Unsplash, Chart from TradingView

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news