This post is an excerpt from our 2023 Geography of Cryptocurrency report. Download your copy now!

We are excited to unveil the fourth annual Chainalysis Global Crypto Adoption Index. The purpose of the index is simple: we combine on-chain data and real-world data to measure which countries are leading the world in grassroots crypto adoption. Grassroots crypto adoption isn’t about which countries have the highest raw transaction volumes – anyone can probably guess that the biggest, richest countries are way ahead. Instead, we want to highlight the countries where average, everyday people embrace crypto the most. To do this, we designed the Global Crypto Adoption Index to identify countries where most people put most of their wealth in cryptocurrency. We’ll explain the full methodology below and then provide the top 20 countries on our index, along with some key takeaways.

Keep reading, and we’ll discuss:

Our Global Crypto Adoption Index methodology

The Global Crypto Adoption Index consists of five sub-indices. Each of those sub-indices is based on countries’ use of different types of cryptocurrency services. We rank all 154 countries for which we have sufficient data on each sub-index, weight the rankings by characteristics such as population size and purchasing power, take the geometric mean of each country’s ranking across all five, and then normalize that final number on a scale of 0 to 1 to give each country a score that determines the overall ranking. The closer the country’s final score is to 1, the higher the ranking.

To calculate our sub-indices, we estimate countries’ transaction volumes for different types of cryptocurrency services and protocols based on the web traffic patterns of those services’ and protocols’ websites. We recognize that web traffic data is not perfect. Some crypto users almost certainly use VPNs and other tools that hide online activity. But given that our index takes into account hundreds of millions of transactions and 13 billion web visits, we are confident that any erroneous transaction volume due to VPNs is too small to compromise the data as a whole. We also cross-check our index with local crypto experts and operators around the world, which gives us more confidence in this methodology.

Below is a description of each sub-index, how it is calculated, and why we believe it is valuable for measuring grassroots crypto adoption.

On-chain cryptocurrency value received at centralized exchanges, weighted by purchasing power parity (PPP) per capita

The purpose of this sub-index is to rank each country by total cryptocurrency activity occurring on centralized crypto exchanges, and weight the rankings to favor countries where that amount is more significant, based on the income of the average person in that country. We calculate this by estimating the total cryptocurrency received on-chain by users of centralized services in each country, and weighting that value based on PPP per capita, which is a measure of the country’s income per inhabitant . The higher the ratio of on-chain value received to PPP per capita, the higher the ranking. In other words, if two countries received equal amounts of cryptocurrency from centralized services, the country with lower PPP per capita would be ahead.

On-chain retail value received at centralized exchanges, weighted by PPP per capita

The purpose of this metric is to measure the activity of non-professional, individual cryptocurrency users at centralized services, based on how much cryptocurrency they transact compared to the purchasing power of the average person. We do this by measuring the amount of cryptocurrency received at centralized services by users in each country, similar to the above, but only counting value received in retail-sized transactions, which we designate as transactions under $10,000 USD worth of cryptocurrency. We then rank each country according to this measure, but weight it to favor countries with a lower PPP per capita.

Peer-to-peer (P2P) exchange volume, weighted by PPP per capita and number of internet users

P2P trading volume accounts for a significant percentage of all cryptocurrency activity in emerging markets. For this sub-index, we rank countries according to their P2P trade volume and weight them to favor countries with lower PPP per capita and fewer internet users, with the aim of highlighting countries where more residents share a larger share of their overall income and place wealth. in P2P cryptocurrency transactions.

On-chain cryptocurrency value received from DeFi protocols, weighted by PPP per capita

DeFi (decentralized finance) is at the forefront of cryptocurrency. Given the sector’s importance to innovation in crypto, we want our adoption index to highlight countries where users conduct a disproportionately large portion of their financial activity using DeFi protocols. For this sub-index, we rank countries according to their DeFi transaction volume, weighting the rankings to favor countries with lower PPP per capita.

On-chain retail value received from DeFi protocols, weighted by PPP per capita

We want our index to highlight the DeFi activity of non-professional, individual cryptocurrency users, just as we do for centralized services. So, this sub-index ranks each country by DeFi transaction volume executed in retail-sized transfers, weighted to favor countries with lower PPP per capita.

The 2023 Global Crypto Adoption Index Top 20

Country Region Overall index ranking Centralized service value received ranking Retail centralized service value received ranking P2P exchange trading volume ranking DeFi value received ranking Retail DeFi value received ranking

In the

Central and South Asia and Oceania

1

1

1

5

1

1

Nigeria

Sub-Saharan Africa

2

3

2

1

4

4

Vietnam

Central and South Asia and Oceania

3

4

4

2

3

3

United States

North America

4

2

8

12

2

2

Ukraine

Eastern Europe

5

5

3

11

10

10

Philippines

Central and South Asia and Oceania

6

6

6

19

7

7

Indonesia

Central and South Asia and Oceania

7

13

13

14

5

5

Pakistan

Central and South Asia and Oceania

8

7

7

9

20

20

Brazil

Latin America

9

9

11

15

11

11

Thailand

Central and South Asia and Oceania

10

8

15

44

6

6

China

East Asia

11

10

5

13

23

23

Turkey

Middle East and North Africa

12

11

9

35

12

12

Russia

Eastern Europe

13

12

10

36

9

9

United Kingdom

Central, Northern and Western Europe

14

15

20

38

8

8

Argentina

Latin America

15

14

12

29

19

19

Mexico

Latin America

16

17

18

30

16

16

Bangladesh

Central and South Asia and Oceania

17

18

19

33

22

22

Japan

East Asia

18

22

21

49

18

18

Canada

North America

19

25

23

62

14

14

Morocco

Middle East and North Africa

20

27

25

21

26

26

The first key takeaway here is that the Central and South Asia and Oceania (CSAO) region dominates the top of the index, with six of the top ten countries in the region. As we explore in the full report, the circumstances driving adoption in each CSAO country are unique, leading to different usage trends and profiles of most popular services.

Global adoption is down, but not in one important subset of the world

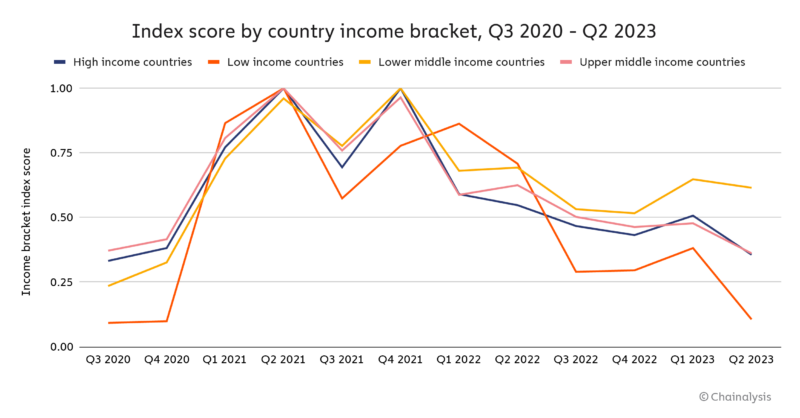

There’s no sugarcoating it: Global grassroots crypto adoption is down. We can see this in the chart below, where we apply our Adoption Index methodology globally by summarizing all 154 countries’ index scores for each quarter from Q3 2020 to date, and re-indexing them again to show adoption growth over time around the world .

While there has been a noticeable recovery since the shutdown of late 2022, around the time FTX explodedGrassroots adoption is still well off its all-time highs.

But this is not true everywhere. More specifically, there is one important segment of countries where grassroots adoption has seen a much stronger recovery than anywhere else: Lower Middle Income (LMI) countries. BMI is one of four designations used by the World Bank to classify countries by income level, based on gross national income (GNI) per capita. Those categories are as follows:

World Bank income classification GNI per capita range Example countries

High Income (HI)

> $13,205

USA, UK, Saudi Arabia

Upper Middle Income (UMI)

$4,256 – $13,205

Argentina, China, Russia

Lower Middle Income (LMI)

$1,086 – $4,255

India, Nigeria, Ukraine

Low Income (LI)

< $1,085

Ethiopia, Sudan, Yemen

Many of the top countries on our Global Crypto Adoption Index, from Central and South Asia to Africa, are in the LMI category, and collectively LMI countries have seen the biggest recovery in grassroots crypto adoption over the past year. In fact, LMI is the only category of countries whose total grassroots adoption remains above where it was in Q3 2020, just prior to the most recent bull market.

This could be extremely promising for crypto’s future prospects. LMI countries are often countries on the rise, with dynamic, growing industries and populations. Many of them have undergone significant economic development in recent decades to rise out of the low-income group. And perhaps most important of all, 40% of the world’s population lives in LMI countries — more than any other income category. If LMI countries are the future, then the data indicates that crypto is going to be a big part of that future. This, combined with the fact that institutional adoption — driven primarily by organizations in high-income countries — continues to gain steam even during the ongoing crypto winter, painting a promising picture of the future. We could see a combination from bottom to top and top-down cryptocurrency adoption in the near future if these trends hold, as digital assets meet the unique needs of individuals in both segments. We’ll explore these trends and more in our full 2023 Geography of Cryptocurrency report.

This material is for informational purposes only and is not intended to provide legal, tax, financial or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with the Recipient’s use of these materials.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news