The crypto market experienced a significant downturn on Thursday, April 25, 2024, with the global crypto market cap falling 4.30% to $2.36T, according to data from CoinMarketCap. This decline was accompanied by notable declines in major crypto assets, raising concerns among investors and market analysts.

Major cryptocurrencies are facing sharp declines

As a result, Bitcoin, the world’s largest cryptocurrency by market capitalization, experienced a 4.08% decline, with its price falling to $63,836.89. Ethereum, the second largest cryptocurrency, followed with a 3.85% drop, trading at $3,134.27. Moreover, Solana, one of the prominent altcoins, suffered a significant drop of 7.10%, with its price currently standing at $146.13.

Impact of misinformation on market sentiment

However, the market downturn can be partially attributed to the recent clarification from BlackRock, a leading asset management firm. As reported earlier by Captain Altcoin, there was a misinterpretation of news about BlackRock’s plans to sign its funds on the Hedera network. BlackRock has since clarified that it has no commercial relationship with Hedera and does not intend to subscribe its funds to the network.

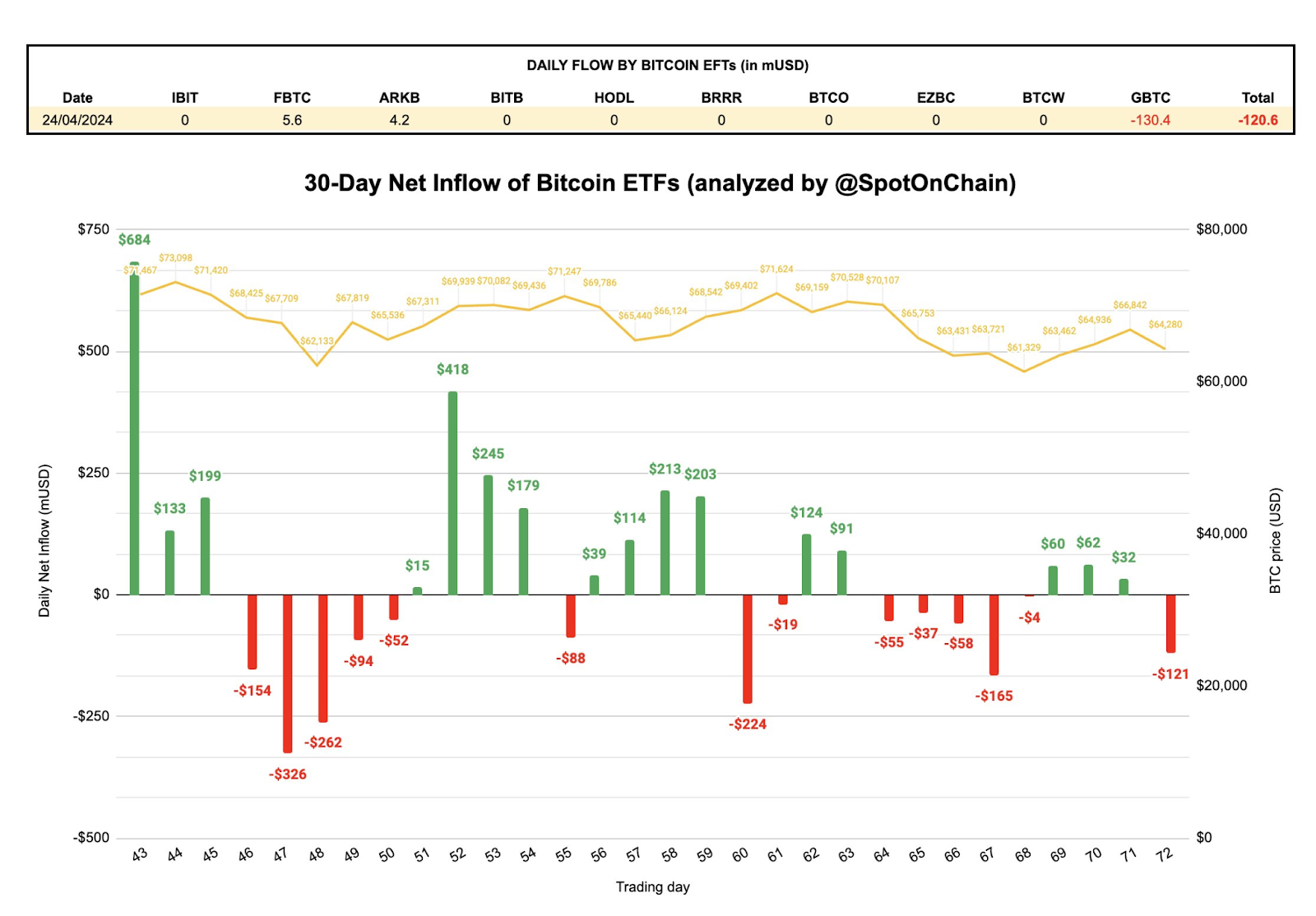

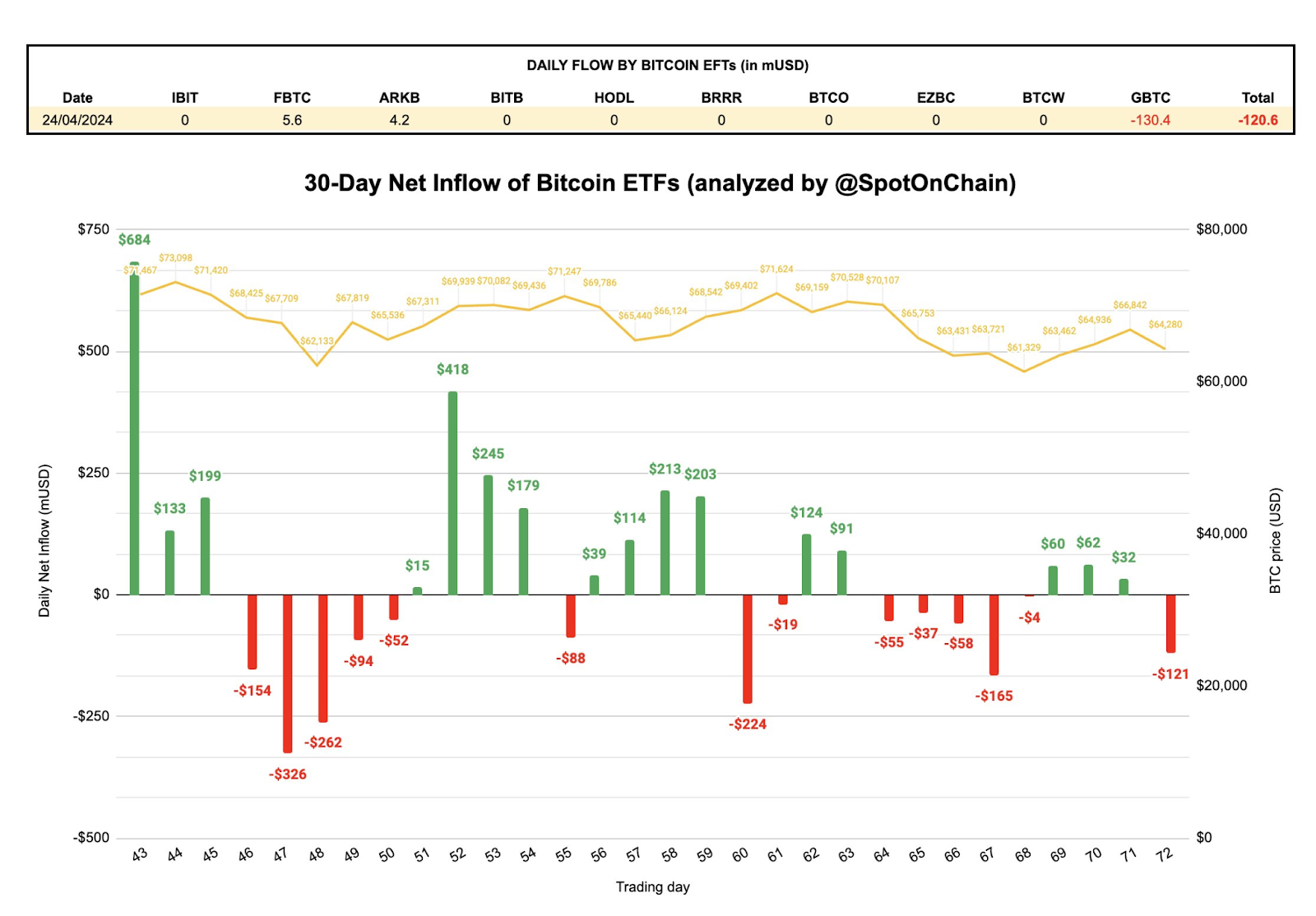

Additionally, data from Spot On Chain, a crypto analytics platform, revealed a negative net inflow of $121M for Bitcoin ETFs on April 24, 2024. Notably, the BlackRock iShares Bitcoin Trust (IBIT) had no inflows, ending its streak of 72 straight. trading days with inflows. Furthermore, the one-day outflow of the Greyscale Bitcoin Trust (GBTC) rose to $130.4 million, 1.95 times higher than the previous trading day.

Significant trading activity

In addition to these factors, Lookonchain (@lookonchain) reported that a trader deposited 395 BTC ($26.3 million) with Binance to buy before the Bitcoin price dropped four hours ago. This trader bought 536 BTC ($35.15 million) at an average price of $63,729 between April 5 and April 18 and then sold it at $66,530 over the past two days, making a profit of about $1.5 million.

Explosion in Meme Coin Market; How to find potential successors of $WIF, $PEPE and $BONK?🤫

The key? Get in early, especially during the ICO phase. Check out NuggetRush today! This new memecoin combines play-to-earn games with authentic gold mining ventures. Seize the opportunity with continuous pre-sale prices! Additionally, prepare for $NUGX’s upcoming launch on major exchanges.

Show more +

Ethereum transaction fees

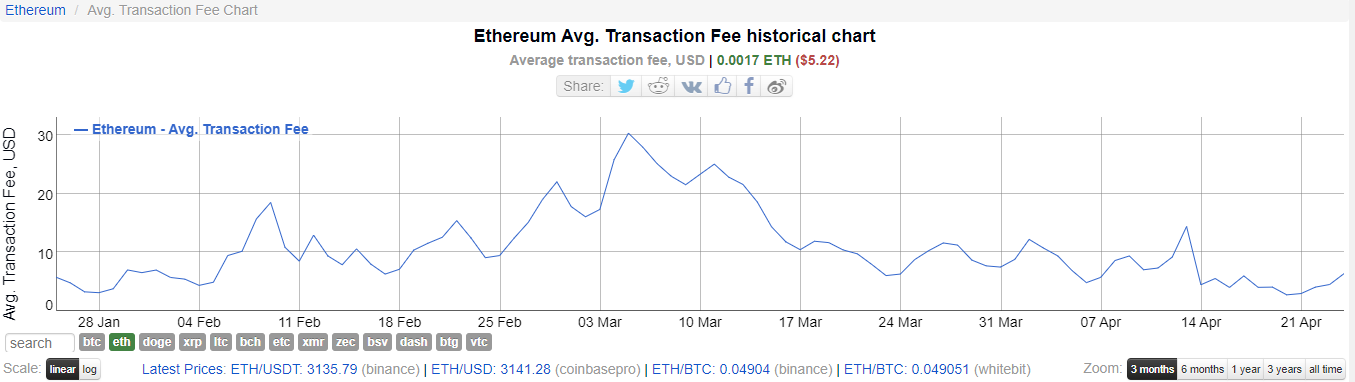

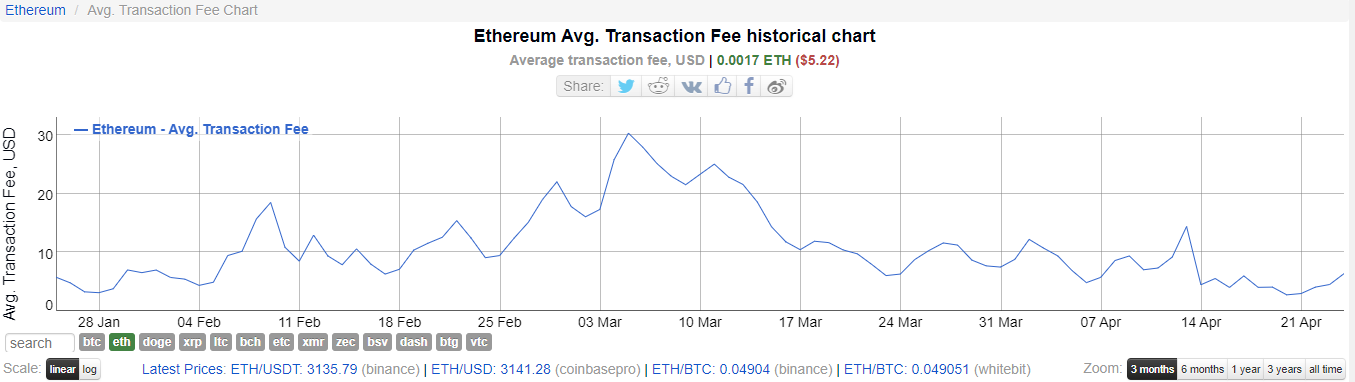

As a result, the low trading volume and reduced demand for cryptocurrencies contributed to the overall market downturn. Additionally, transaction fees on the Ethereum network are currently relatively low, ranging from $5 to $10. During periods of high volume and bull runs, these fees can rise to over $200, reflecting current market conditions.

The average transaction fee for Ethereum has historically been volatile, with several peaks and troughs observed over time. While the fee reached a significant peak of around $30 in mid-February, indicating increased demand or network congestion, it has since fallen to nearly $5 during periods of lower activity.

Source: BitInfoCharts

Overall, the combination of market sentiment, regulatory concerns and trading dynamics contributed to the crypto market’s decline today.

Looking for a small cap coin that can explode 10x? We revealed a few last week alone. Get all our future calls by joining our FREE Telegram community.

Check NuggetRush ($NUGX)

Sponsored: Invest responsibly, do your own research.

Being in its ICO stage, NuggetRush offers an excellent opportunity for early investors to get in at potentially lower prices. a distinctive and immersive experience Foster a strong community by encouraging physical encounters between members NFT integration with prominent characters

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news