[ad_1]

Enjoy the Empire newsletter on Blockworks.co today. Get the news delivered straight to your inbox tomorrow. Subscribe to the Rich newsletter.

Break the cycle!

Are we about to avoid the precedent of a volatile four-year cycle?

Framework Ventures co-founder Michael Anderson thinks so… if and when we get formal SEC approval for ETH ETFs.

But he noted that the market structure began to change after Grayscale’s court victory last August (which also pushed the SEC to approve the spot bitcoin ETFs).

“In previous cycles, you had bitcoin as the primary asset that people would enter the ecosystem with, and then they kind of move on to another thing, like Ethereum, or maybe, you know, one of the other kind of alt platforms, ” Anderson said.

“DeFi summer brought everyone into Ethereum, and then they went further and further off the risk curve. But at each of those moments, they would sell the primary or the initial asset to move to the next level, and then do it again to move to the next level. But I think what we’re seeing now, with the inflows into these ETFs, is that there’s no sort of ‘selling as you move from bitcoin to ether’, bitcoin to something else, or ether to something else .

With that in mind, ETF flows “will dampen volatility pretty drastically,” he added. This can be enough to break the market out of its current cyclical pattern, because you don’t have “mass selling” when people move from one asset category to the next.

There are a few things that remain unchanged this cycle. The duel stories of potential “Ethereum killers”, for example.

Last go around, it was Optimism and Arbitrum, Anderson said. Before that it was Solana and Avalanche. The two emerging now aren’t necessarily ETH killers, but Berachain (which Framework invested in) and Monad caught Anderson’s eye this time.

“Less and fewer people will transact on ETH mainnet going forward, is the general perspective, whether it’s an L2, L3 or an ecosystem where it’s completely abstracted away,” Anderson said. “[And that’s] kind of the ideal state that our direction is heading towards.”

“Then it’s not really about killing ETH. It’s more about adding more layers of abstraction on top of ETH so you don’t even know you’re touching it, would be the ultimate goal.”

With more L2s, prices may return to deflationary. “We’re kind of in that transition period of the applications haven’t really reached scale yet, where we now have the cheap transaction prices to support massive scale, but like, the curves haven’t crossed yet,” he added.

Framework’s eye infrastructure is playing at the moment, but that focus doesn’t mean they aren’t interested in apps, too.

Last week, when EthCC concluded, there was a lot of talk about how the conference seemed very focused on infrastructure and applications were more or less forgotten.

But while apps may not be a conference topic, that doesn’t mean they’re being ignored by VC. Anderson’s firm is currently intrigued by “games and weird consumer apps,” like Puffpaw’s vape-to-earn system to help people quit vaping on Berachain.

“Our perspective is that the first applications to reach this level of steel that the infrastructure now supports are games,” he said.

At the end of the day, however, infra will also remain in Anderson’s mind. “We’re always going to need bigger, faster, cheaper blockchains,” he said.

Maybe we won’t see an ETH killer this round, but we’re definitely seeing an extremely interesting cycle playing out in real time.

– Katherine Ross

Data center

A petty Polymarket pool puts the odds of an ETH ETF trading by July 26 at 83%. Uniswap and Tether are still the no. 1 Ethereum apps by fee spent, with 2,010 ETH ($6.7 million) and 838 ETH ($2.8 million) burned in the last 30 days. Telegram trading bots BananaGun and Maestro are third and fourth, each with more than 400 ETH ($1.33 million). Memecoin MOG entered CoinGecko’s top-100 and is currently its top performer, rising 52% in the past week. BTC and ETH both gained 4.5% in the past day to $62,570 and $3,340.

Summer time sadness

Ethereum is in the middle of a vibe session.

At least, that’s according to Twitter metrics, which are notoriously fickle.

Following EthCC last week in Brussels, questions swirled about whether the ecosystem was truly on the way to mass adoption.

Were there enough interesting crypto applications in the pipeline to justify all the venture funding in infrastructure?

This is not exactly a new problem for the crypto space. Outside of a few extreme periods, such as the short inscription spam that crippled a string of EVM chains last year or the legendary CryptoKitties hoarding, there have always been more blockchains than users can actually use.

Wallets, lending protocols, decentralized exchanges, and prediction markets are all applications. And when it comes to crypto, apps within all of those categories are about as popular as can be among the people who are actually here.

To be clear, Solana — the last line of defense for monolithic blockchain design — has its own brand of congestion issues.

But it’s hard to argue that there isn’t some layer-2 fatigue out there when it comes to Ethereum.

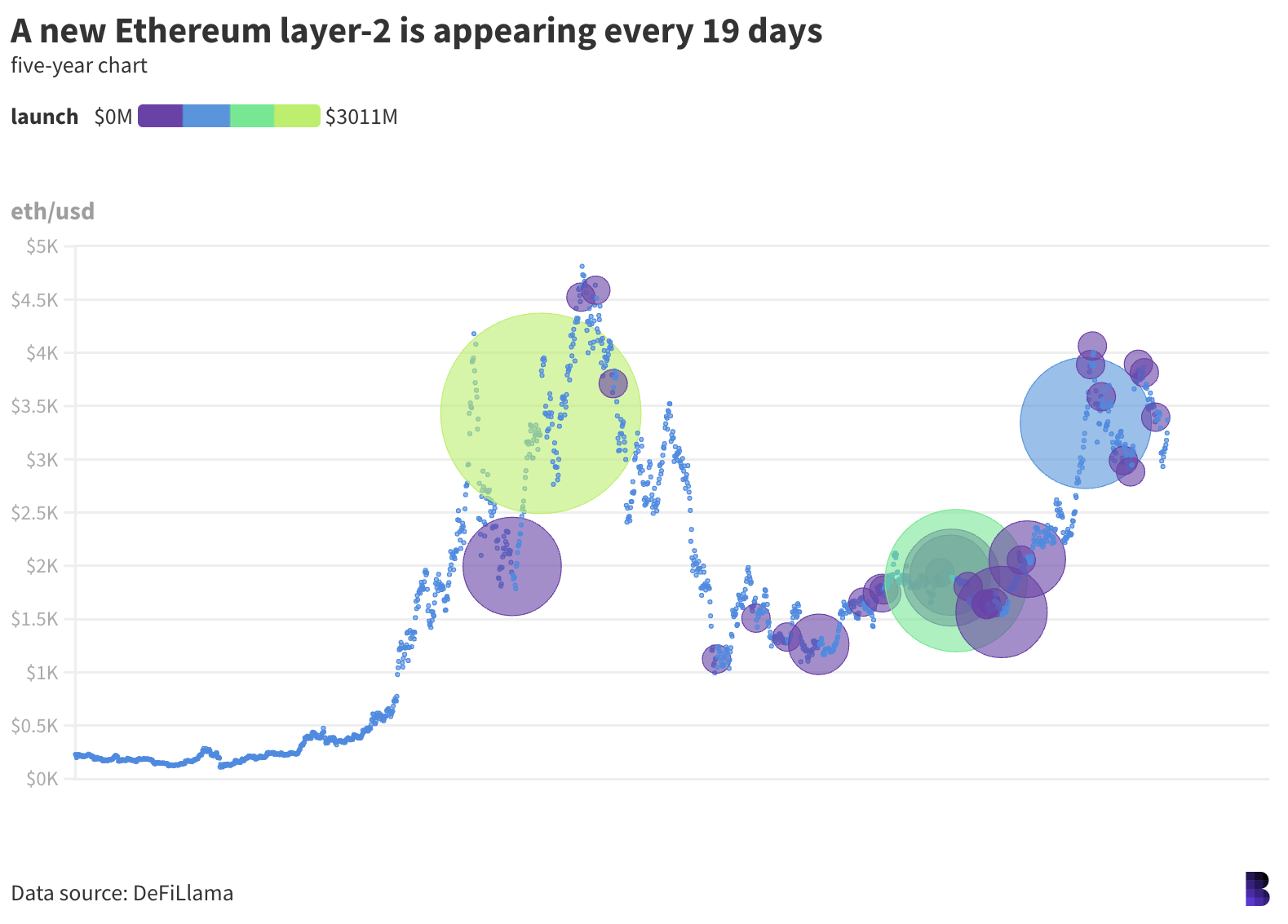

Over the past year, at least 19 layer-2 Ethereum networks have launched, per DeFiLlama data. Each has its own brand of applications – usually at least one DEX and a lending protocol – leading to fragmentation of users and liquidity across the various chains.

“Vibecession”—a term coined by financial commentator Kyla Scanlon—refers to the phenomenon of widespread negative sentiment about the economy, despite things being pretty much okay, and even rising.

In the same vein, Ethereum’s vibe session is probably not actually indicative of the actual health of the underlying ecosystem.

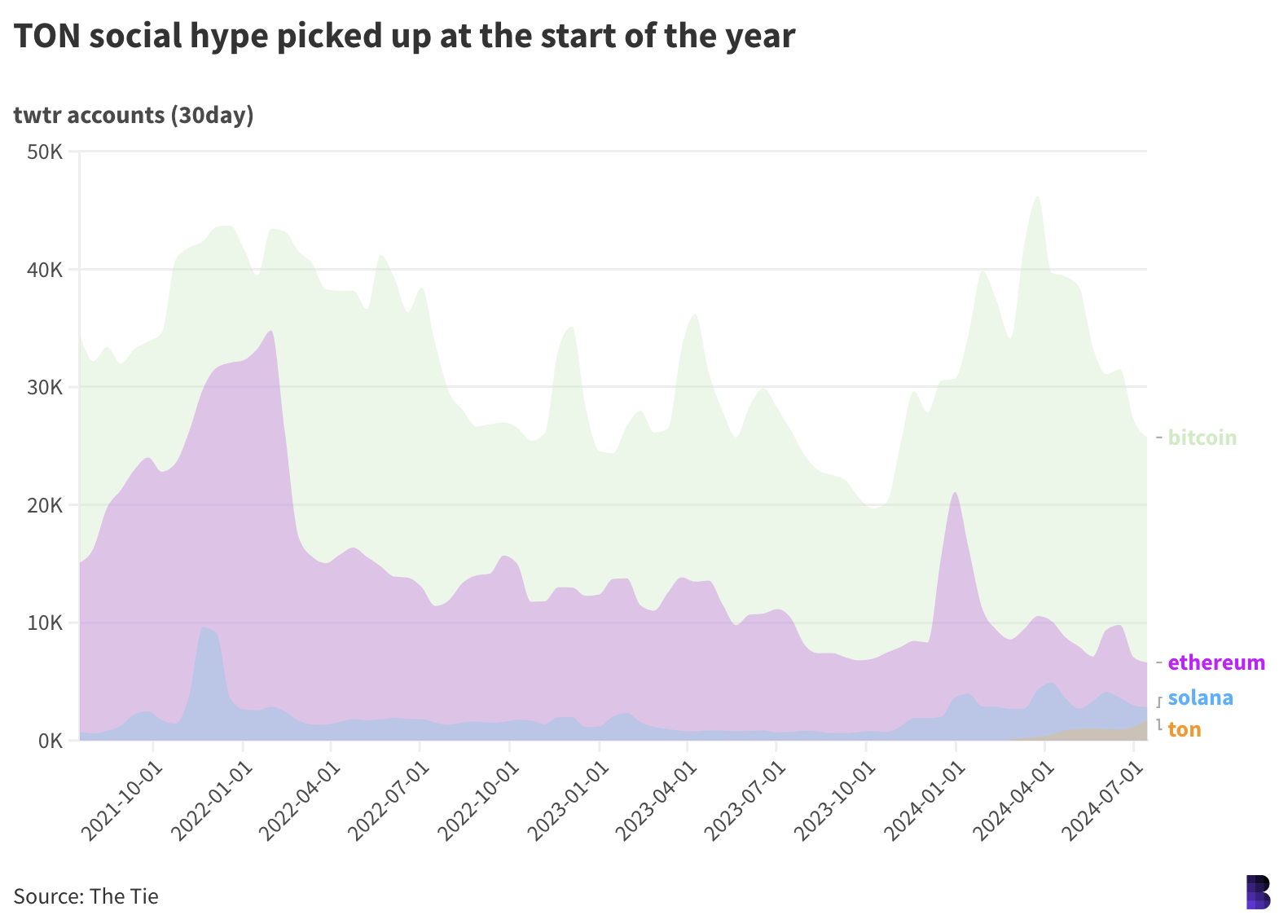

But it is possible to point to sadness in the data: When the market bottomed in November 2022 after the FTX debacle, there were as many as 35,200 Twitter accounts posting about Ethereum every day, based on a 30-day average.

Now there are only 6,600 – an 80% drop.

Solana also got a boost after FTX, likely due to the ecosystem’s connection to Sam Bankman-Fried, and a subsequent fall.

But since the bitcoin bull market really kicked off last October, the number of Twitter accounts posting about Solana has exploded from under 700 to nearly 3,000 currently.

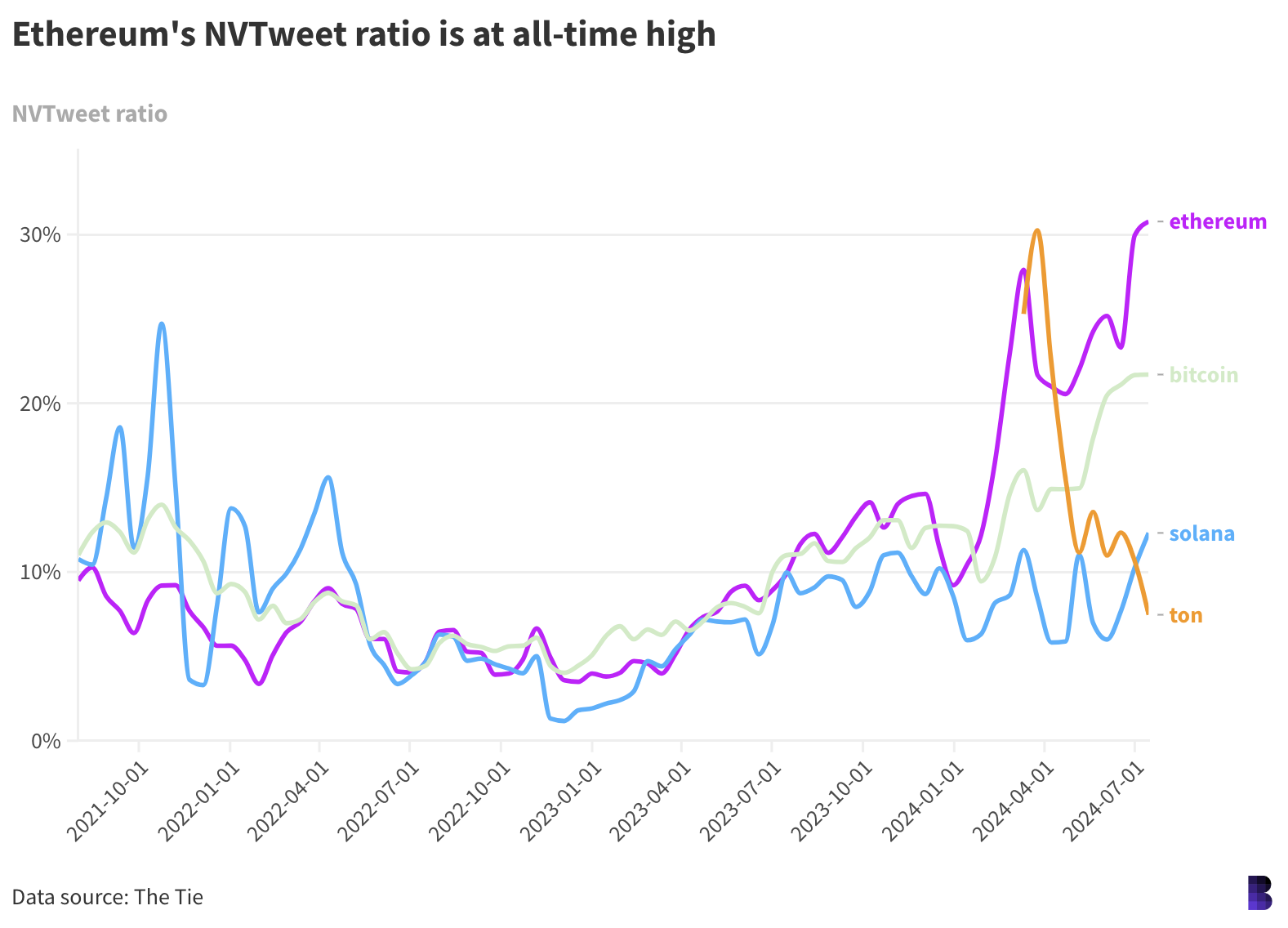

Perhaps most telling of all is Ethereum’s “NVTweet ratio.” Data provider The Tie developed the metric to compare a cryptocurrency’s social media activity to its market cap: How many tweets does each project have per $1 million in market cap?

A lower NVTweet ratio means more tweets per $1 million market cap—correlating social media chatter with high valuations.

It appears that Ethereum’s NVTweet ratio has more than tripled since December – when markets were betting hard that the SEC would finally approve spot bitcoin ETFs.

This means that ether’s market cap is growing faster than its Twitter mention, which may reflect less retail involvement in Ethereum markets, according to The Tie.

“An increasing NVTweet™ ratio may indicate that a particular coin’s market is increasingly driven by institutional trading.”

And there’s your vibe session.

—David Canellis

The Works

Bernstein says there is a ‘Goldilocks scenario’ playing out for bitcoin miners. Alexey Pertsev, the Tornado Cash developer convicted of money laundering by a Dutch court, has been denied bail, DLNews reported. BlackRock’s assets stand at a whopping $10.6 trillion, the world’s largest asset manager has announced. Former Chainalysis chief economist Philip Gradwell has joined Tether as its head of economics. Digital asset investment products saw $1.44 billion in inflows last week, with bitcoin topping the fifth-largest weekly inflow on record, CoinShares noted.

The Reef

Q: What does bitcoin say going up after Trump’s assassination attempt?

I’ve seen some analysts note that the price action in bitcoin — which rose to $62,000 after the assassination attempt — is driven in part by another week of impressive ETF flows.

All told, it’s hard to discern how much the ‘safe haven’ play can be versus the ETF play.

Either way, the overall market was in a strange place. But it could give the environment an unexpected catalyst, pushing bitcoin further up and getting it out of the sideways rut it’s been in for months.

The other thing is that the stock market, for example, loves certainty. I think it’s fair to say that this is also imprinted on bitcoin at this point. The attempt on Trump’s life completely derailed the unknowns surrounding Biden’s re-election bid, and – according to some rumors – even secured his place as a Democratic candidate.

There is a lot of speculation out there, and it is not clear whether bitcoin is truly treated as a safe haven asset or if it is just the perfect storm that traders have been waiting for.

– Katherine Ross

The general consensus right now is that crypto could generally do well under a second Trump term.

But price action right now is most likely just noise.

For the longest time, bitcoin was viewed as a hedge against global instability. A flight to the safety of uncensorable hard money that cannot, at least idealistically, be confiscated by totalitarian regimes.

Except that wasn’t always the case. Bitcoin crashed alongside the stock market during the worst of COVID, and more recently it fell more than 10% when Iran attacked Israel in April.

The odds of Trump winning the election are increasing, and if anything, bitcoin rising after he survives suggests that crypto markets reckon the world will be safer and more stable if he’s re-elected, at least for the average crypto- investor.

Either that, or it was the “buy the rumor” part of the “sell the news” arc. Classic.

—David Canellis

Start your day with the best crypto insights from David Canellis and Katherine Ross. Subscribe to the Rich newsletter.

Explore the growing intersection between crypto, macroeconomics, policy and finance with Ben Strack, Casey Wagner and Felix Jauvin. Subscribe to the On the Margin newsletter.

The Lightspeed newsletter is everything Solana, delivered to your inbox every day. Subscribe to daily Solana news from Jack Kubinec and Jeff Albus.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news