The recent surge in the cryptocurrency market, fueled by notable rallies in major coins such as Bitcoin and Ethereum, has instilled optimism among investors. With significant events like the approval of the US Spot Bitcoin ETF and the Bitcoin Halving shaping the landscape, investors are now considering the potential duration of the ongoing bull cycle.

Meanwhile, CryptoQuant founder Ki Young Ju recently shared insights based on on-chain data, suggesting a possible timeline for the current bull cycle to end.

Analyze On-Chain Data for Bitcoin’s Bull Cycle End

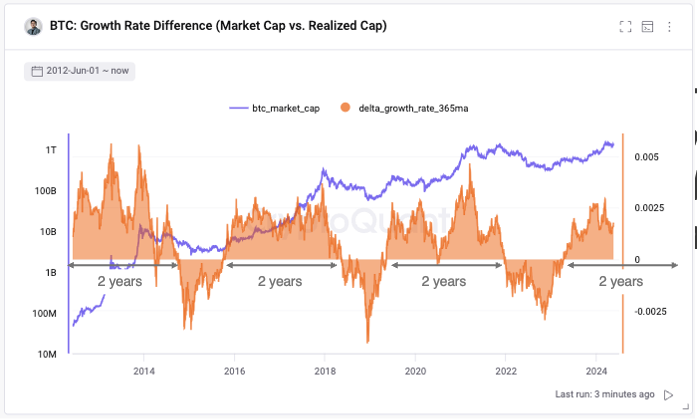

Ki Young Ju, CEO of CryptoQuant, focused on on-chain data to provide insights the trajectory of Bitcoin’s bull cycle. Sharing a Bitcoin price chart on the X platform, Ju highlighted that the cryptocurrency is currently in the midst of its bull cycle, with its market cap exceeding its realized limit.

Meanwhile, he said that such cycles usually last based on historical trends for about two years. So, considering the current pattern, he hinted that the current Bitcoin bull cycle could end by April 2025.

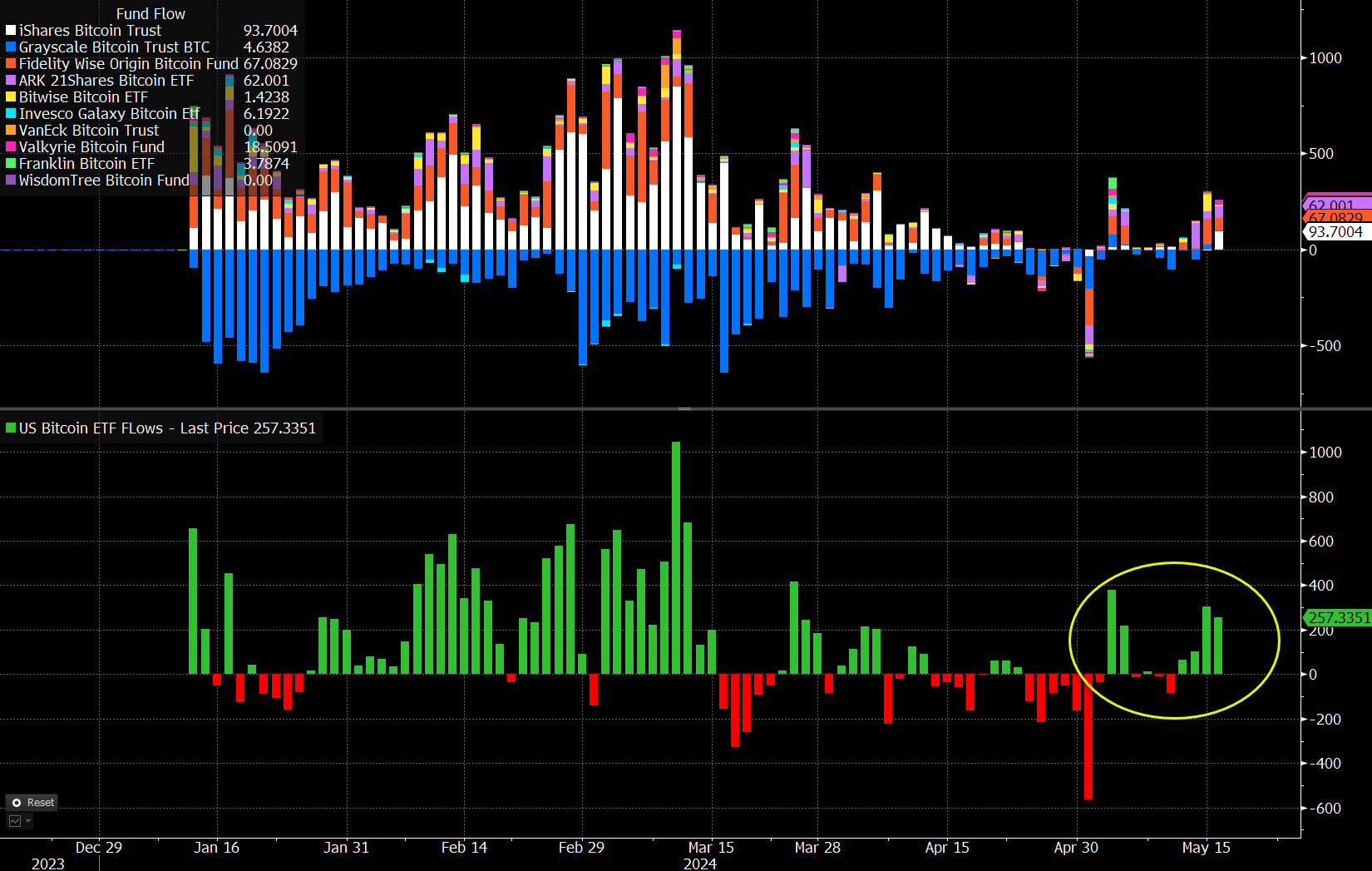

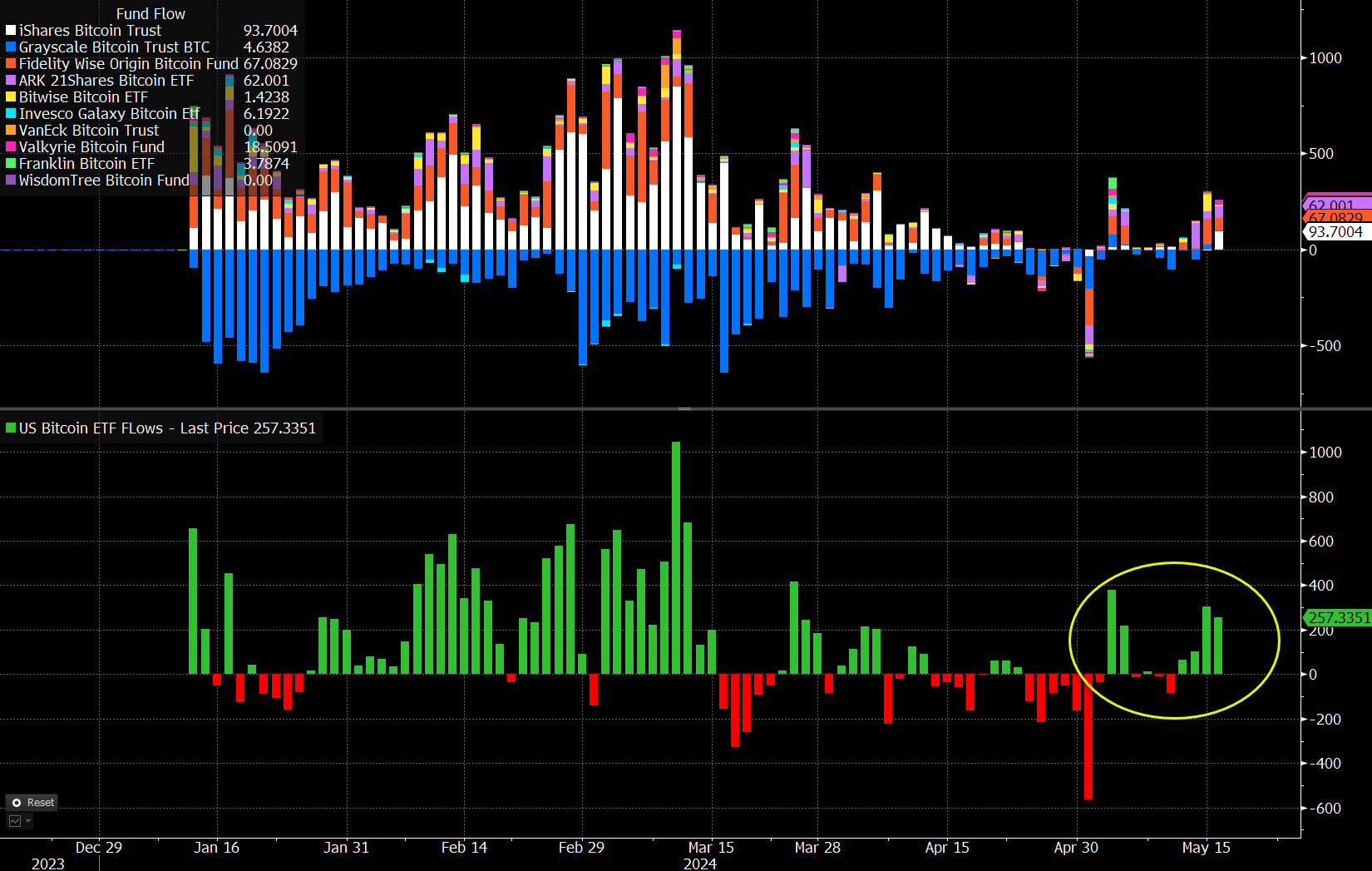

Ju’s analysis comes especially at a time of positive sentiment in the crypto market, with the US Spot Bitcoin ETF sees significant inflows this week. According to Farside Investors data, the ETF recorded inflows of more than $726 million over the past four days, reflecting renewed investor interest.

Commenting on the development, Bloomberg Senior ETF Analyst Eric Balchunas noted the ETF’s robust performance, with inflows totaling $1.3 billion over the past two weeks. He said that the significant inflows this week helped offset previous outflows and restore confidence among investors.

Also Read: Tether Pumps Liquidity With $1 Billion USDT Coins In 12 Hours, Crypto Market Rally Soon?

Market Sentiment Amid Regaining Momentum

The crypto market enthusiasts seem to be regaining confidence in the digital asset space as evidenced by the recent performances of cryptos like Bitcoin, Solana and others. Especially the recent US Consumer Price Index (CPI) data contributed to strengthening investor confidence.

The data revealed a cooling of inflation in April compared with the previous month, indicating a potential shift in the Federal Reserve’s dovish stance on policy rates. If inflation continues to fall, this could prompt the Fed to do so is reconsidering its monetary policy, which could potentially affect market dynamics and investor sentiment in the coming months.

Despite the positive developments, volatility, although reduced, seems to be dominating the market at present. According to CoinGlass data, the Bitcoin Futures Open stake has fallen by 1.36% over the past 24 hours while it has risen by about 1.26%. in the last four hours to 490.28K BTC or $32.65 billion.

Meanwhile, the Bitcoin price has seen minor gains and is trading at $66,440.54, up 0.53% from yesterday. On the other hand, trading volume fell by 23.31% to $30.20 billion, with the BTC touching a 24-hour high of $66,545.81. Over the past 30 days, the flagship crypto has gained nearly 7%, while noticing a weekly surge of more than 5%.

Also Read: Here’s How This Solana Trader Made $200K With $1.5K In 5 Minutes

Disclaimer: The content presented may include the personal opinion of the author and is subject to market conditions. Do your market research before investing in cryptocurrencies. Neither the author nor the publication holds any responsibility for your personal financial loss.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news

✓ Share: