Long-term gold charts help investors identify long-term gold trends. The long-term gold charts highlight some important trends. We look at several long-term gold cards in this article.

RELATED – Our Gold Price Predictions for 2024 2025 2026 – 2030.

Each long-term gold chart provides a unique perspective on gold’s historical performance:

The 10-year chart provides useful insights into recent trends. The 20-year and 50-year charts provide in-depth and insightful views of gold’s performance over the medium and long term. lasting value.

Understanding these charts helps investors make informed decisions based on historical trends.

Historical maps – beyond the headlines

In the fast-paced world of investing, news headlines and market sentiment can create short-term noise that can overshadow the broader trends.

Analyzing these charts provides a clearer picture of gold’s performance over long periods of time, helping to distinguish between temporary market reactions and sustainable (dominant) trends.

Gold has long been considered a safe haven asset, responding to various economic and geopolitical events:

While news headlines can drive immediate price movements, they often do not reflect the underlying long-term trends that affect gold’s value. Long-term charts allow investors to look past the noise and focus on the broader patterns and trends that have historically guided gold’s performance. .

By examining gold’s performance over different time frames, investors gain insight into how gold has performed over various cycles and environments.

While news and short-term market movements are important, long-term gold charts provide a comprehensive overview of gold’s historical performance, providing a more stable foundation for investment decisions.

The most useful long-term gold chart – 10 years

The 10-year gold price chart is highly useful for short- to medium-term investors.

It provides insights into recent trends and market dynamics:

Post-Financial Crisis Recovery: This chart captures gold’s recovery after the 2008 financial crisis, highlighting significant price movements and market reactions. Volatility and Resilience: The past decade has seen significant volatility, driven by shifting interest rates, inflation concerns and geopolitical events. The chart provides practical insights to navigate these fluctuations. Revival: In recent years, gold has strengthened as a safe haven asset amid rising inflation and global uncertainties, making this chart particularly relevant to current market conditions.

Check out our 10-year gold price chart >>

The most informative long-term gold chart – 20 years

The 20-year gold price chart provides deep insights into gold’s performance. It shows:

2000s bull market: This chart illustrates the early 2000s bull run, driven by economic uncertainty and rising demand for safe-haven assets. 2011 peak and correction: The 2011 peak and subsequent correction are prominent features, reflecting shifts in economic conditions and market sentiment. Recent Trends: Recent years have seen renewed interest in gold, particularly during periods of economic instability and inflation, providing valuable context for long-term investment strategies.

Go to our 20-year gold chart page >>

The most informative long-term gold chart – 50 years

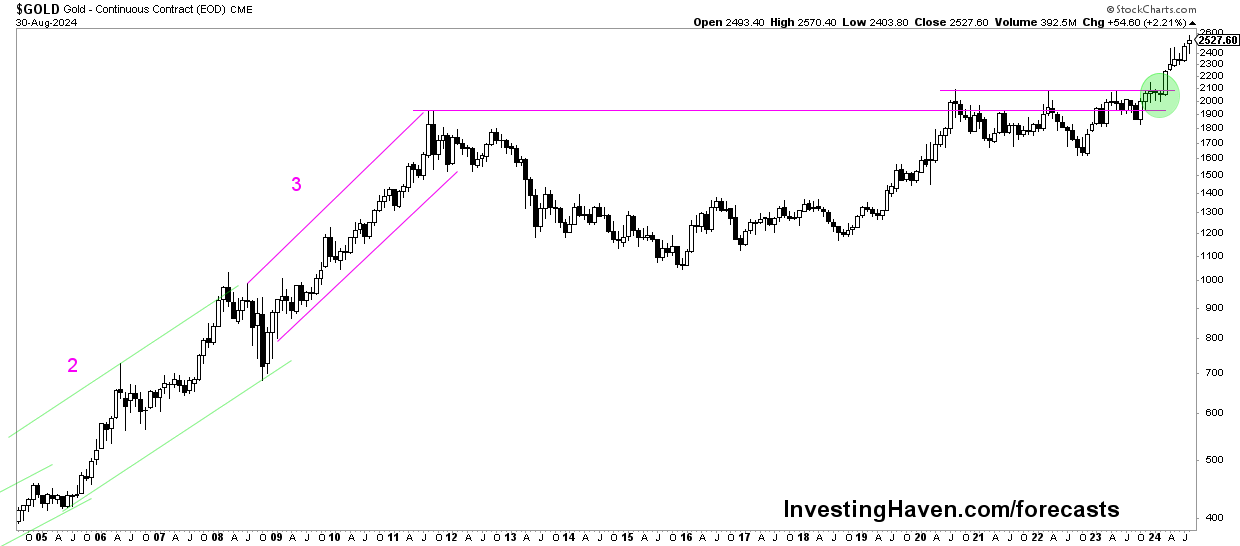

The 50-year gold price chart provides extensive insights into gold’s performance over various cycles:

Long-term bullish trend: This chart highlights a long-term bullish trend, with gold showing resilience and growth over five decades. Historical events: Key events such as the end of the Bretton Woods system and major financial crises are reflected. They offer insights into gold’s role as a hedge against economic instability. Cyclical Patterns: The chart reveals cyclical patterns and long-term gold trends. They help investors understand gold’s historical behavior in different economic environments.

Check out our 50-year gold price chart >>

The long-term gold chart

The 100-year gold price chart provides a comprehensive historical perspective:

Century-Long Trends: This chart shows gold’s performance over a century. This emphasizes its enduring value and role as a long-term store of wealth. Major Historical Events: The chart covers significant periods including the Great Depression, World War II, and economic booms and busts. This illustrates gold’s resilience through varying economic conditions. Long-term resilience: The 100-year view emphasizes gold’s ability to maintain value and act as a hedge against long-term economic uncertainty.

Check out our 100-year gold price chart >>

Conclusions

Charts with a long-term time frame provide valuable insights into gold’s performance over various time frames.

By examining the 10-year, 20-year, 50-year and 100-year charts, investors can gain a comprehensive understanding of gold’s historical trends and its role as a safe-haven asset.

This overview provides a context for making informed investment decisions based on long-term trends.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news