This post is an excerpt from our 2023 Geography of Cryptocurrency report. Download your copy now!

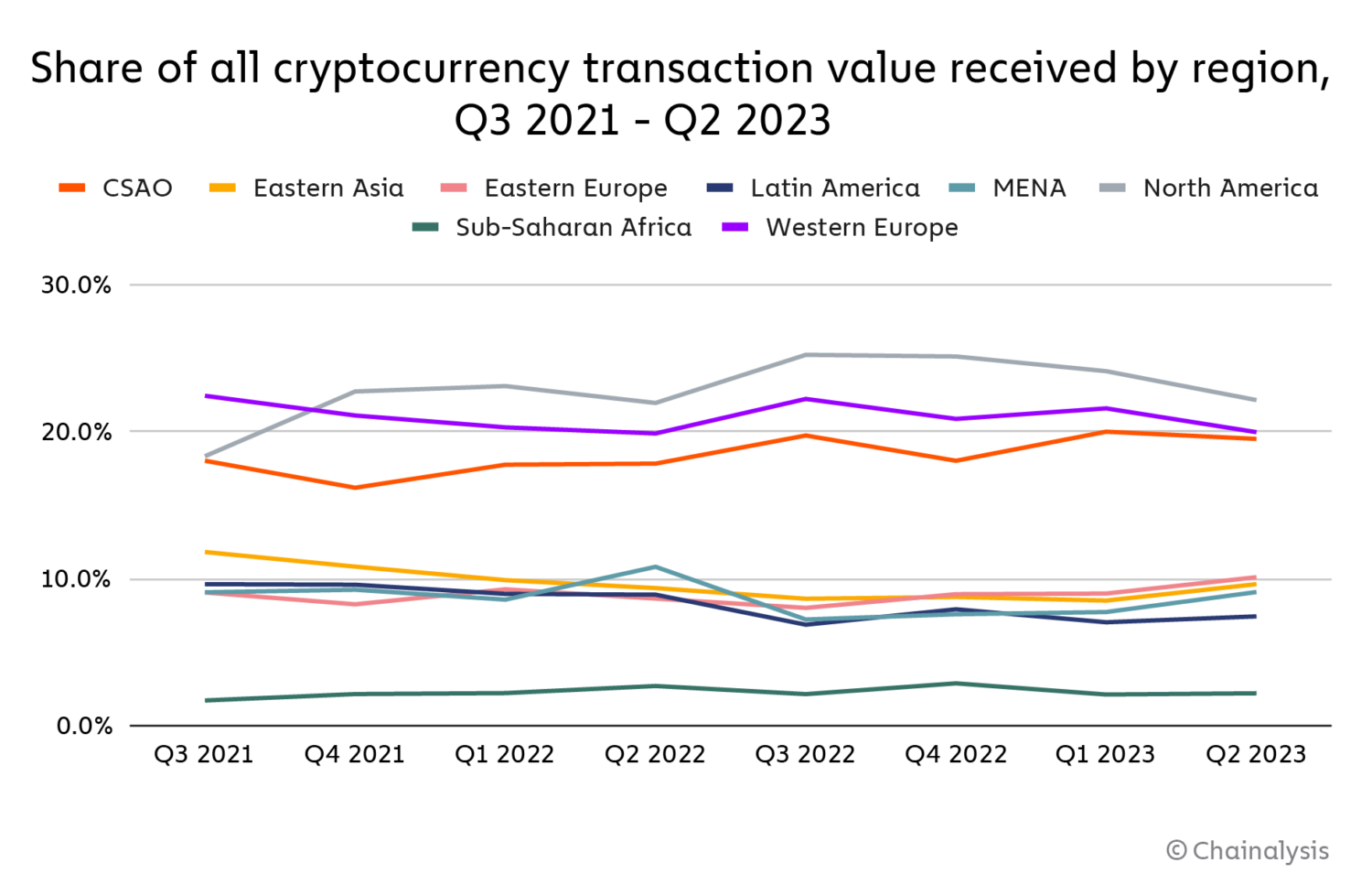

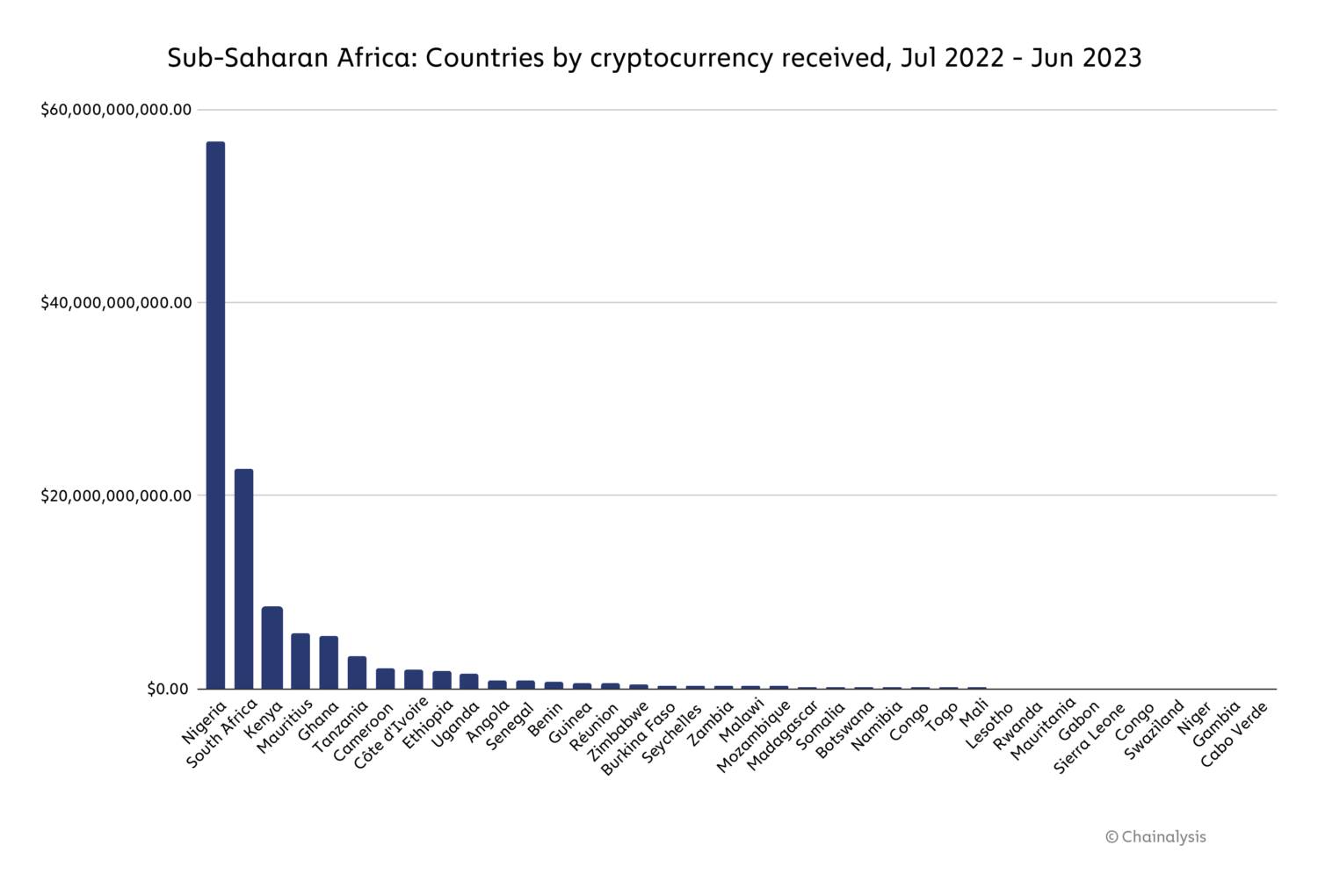

Similar to previous years, sub-Saharan Africa has the smallest cryptoeconomy of all regions, accounting for 2.3% of global transaction volume between July 2022 and June 2023. During that period, the region has an estimated $117.1 billion of off-chain value received.

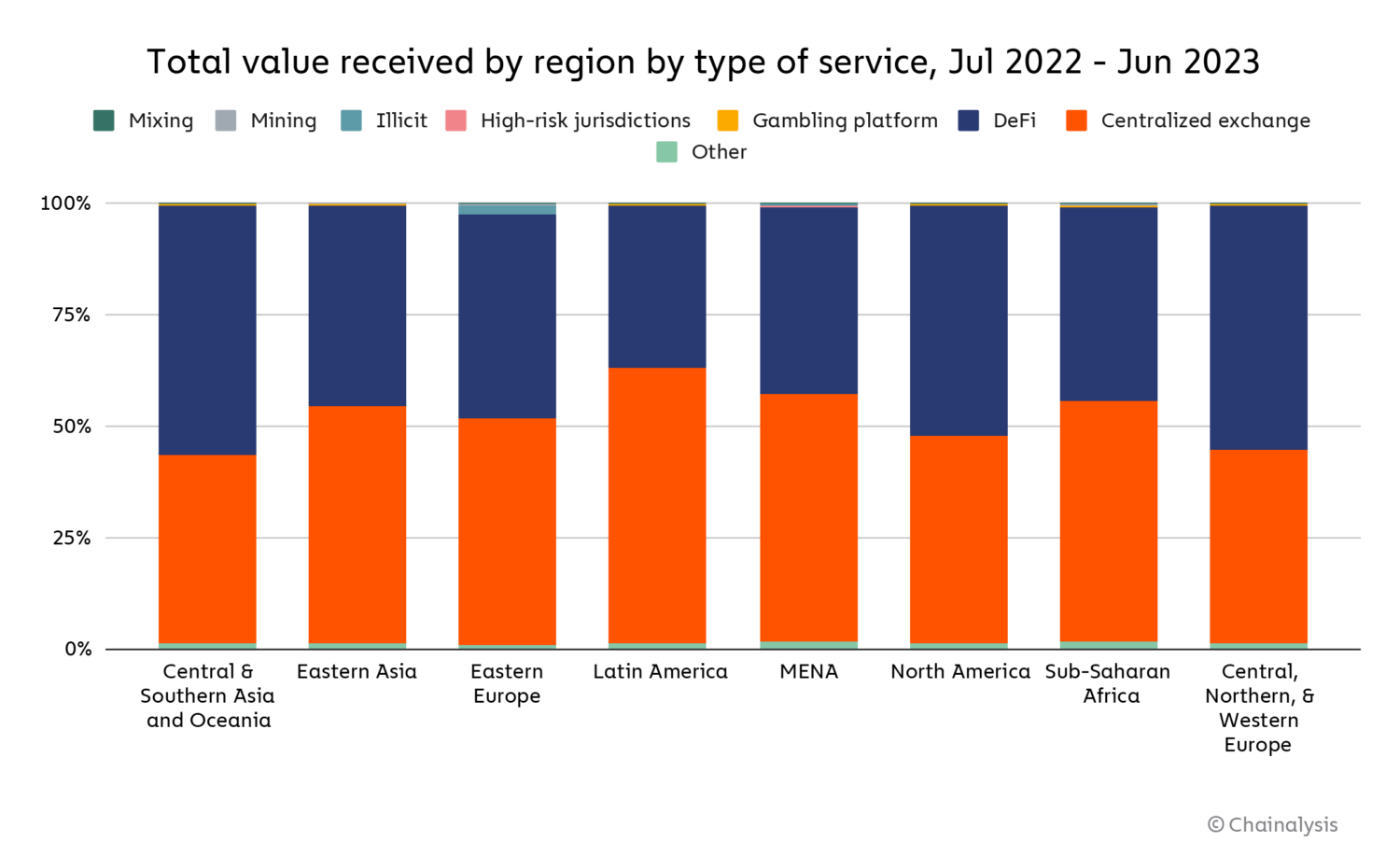

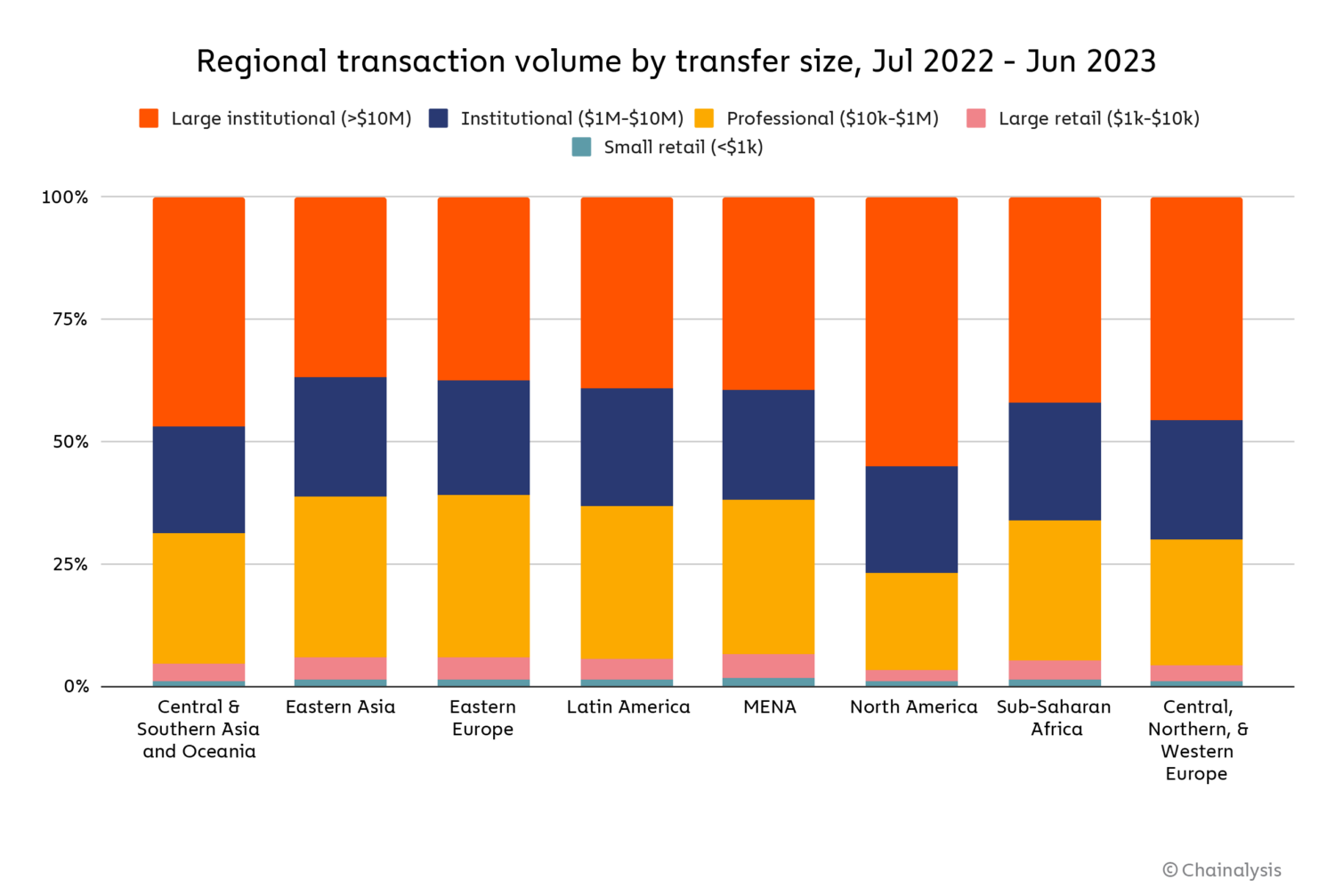

Across the region during the period studied, centralized exchanges are the most used platform type, facilitating more than half of all transaction volume. Sub-Saharan’s cryptocurrency market also appears more retail-driven than most, with a greater share of transaction volume coming in transactions under $1 million in value compared to most other regions.

Although sub-Saharan Africa has consistently been one of the smallest markets for cryptocurrencies, a closer analysis shows that crypto has penetrated key markets and become an important part of many residents’ daily lives. As we’ll explore in more detail later, no country demonstrates this better than Nigeria, which ranks second overall on our Global Crypto Adoption Index and also leads the region in raw transaction volume.

Other countries in the region that are high on the index include Kenya (21), Ghana (29) and South Africa (31). Keep reading to learn what’s driving crypto adoption in sub-Saharan Africa and learn how recent regulatory developments have impacted local markets.

Citizens are flocking to Bitcoin and stablecoins to protect against inflation and debt

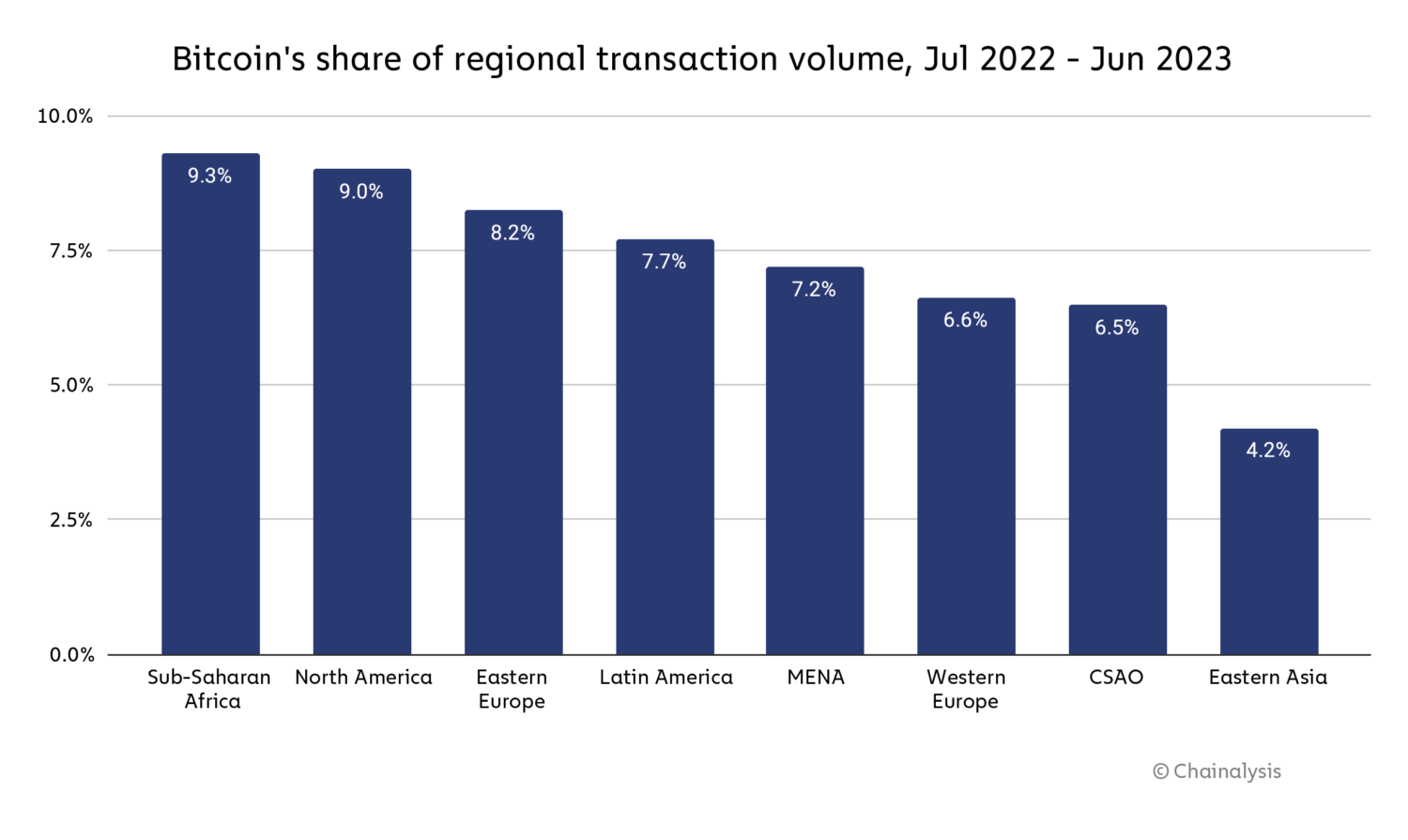

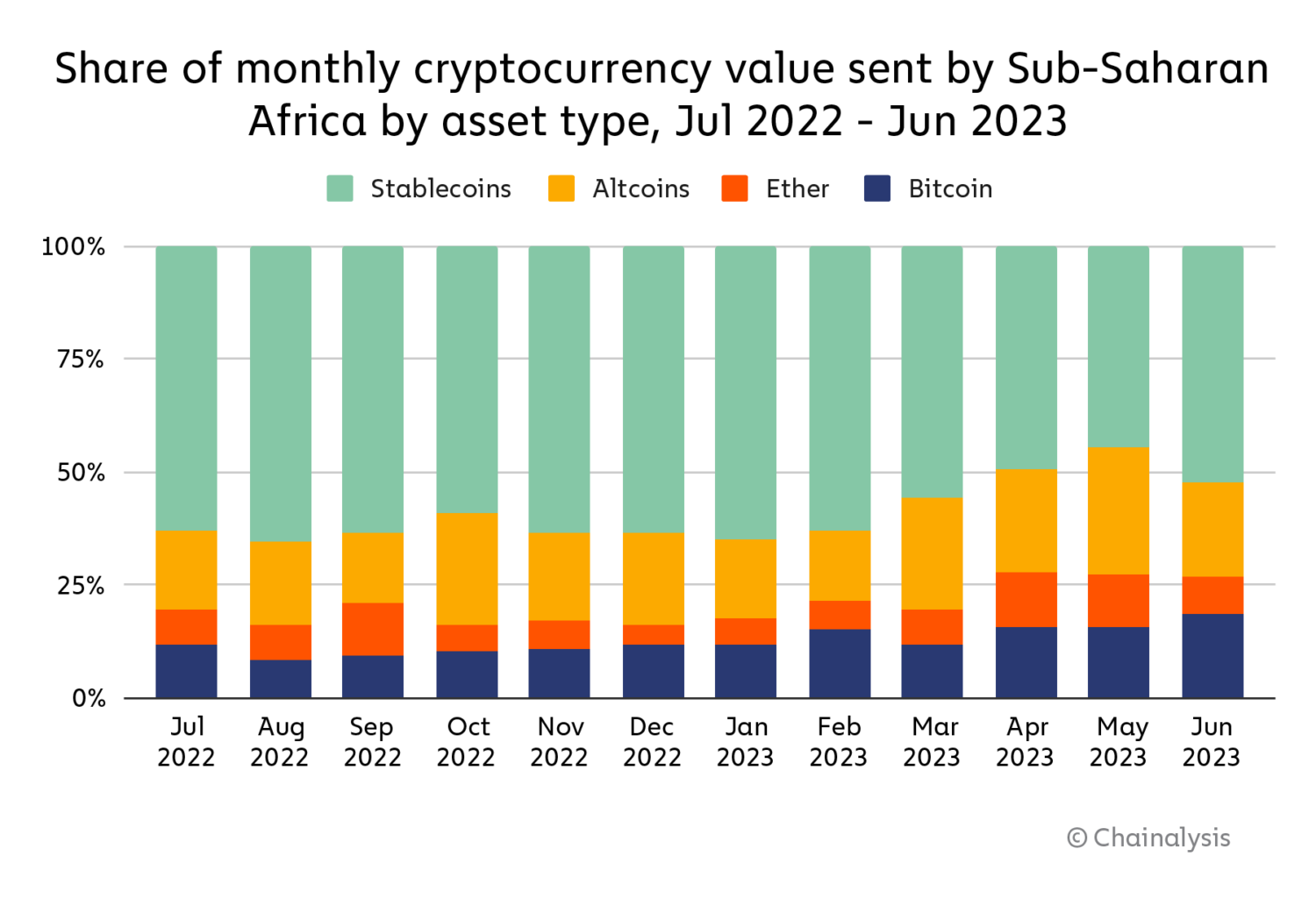

In no region is Bitcoin more dominant than sub-Saharan Africa, as the world’s first cryptocurrency accounts for a larger share of transaction volume there than in any other region.

Why the excessive uptake of Bitcoin? It may be that residents of Africa south of the Sahara resort to so-called digital gold for an alternative store of value. Many countries in the region have struggled with rising inflation and debt, making cryptocurrency an attractive way to store value, preserve savings and achieve greater financial freedom. In Ghana, for example, inflation has reached 29.8% in June 2022 after 13 consecutive months of increases – this is the highest level in two decades. With relatively few financial opportunities, many Ghanaians have turned to Bitcoin. Nigeria, Kenyaand South Africa have all faced similar issues over the past few years, and all are showing a large amount of grassroots cryptocurrency adoption – this is probably no coincidence.

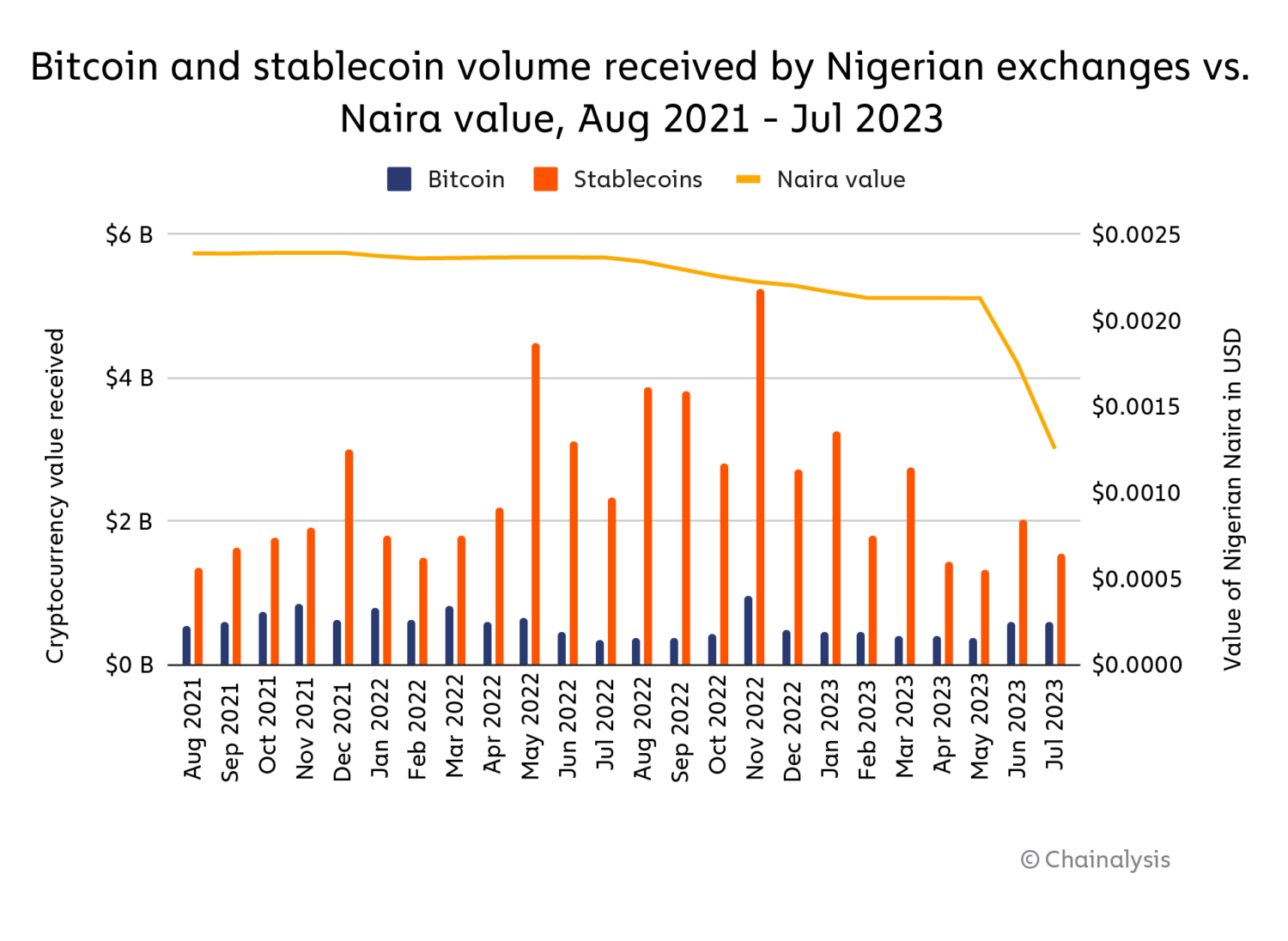

However, experts on the ground tell us that some market participants have turned away from Bitcoin and to stablecoins lately, as they generally see less price volatility than Bitcoin, whose price is at an all-time high. Moyo Sodipo, co-founder and CPO of Nigeria-based cryptocurrency exchange Bushprovided some insight into this activity, saying: “When Busha became popular around 2019 and 2020, there was a huge frenzy for Bitcoin. A lot of people weren’t keen on stablecoins at first. Now that Bitcoin is losing a lot of its value has, there is a desire for diversification between Bitcoin and stablecoins. However, market shifts are not dampening activity. People are constantly looking for opportunities to hedge against the devaluation of the Naira and the continued economic decline since COVID.”

Spotlight: Nigeria is Africa’s leading crypto economy

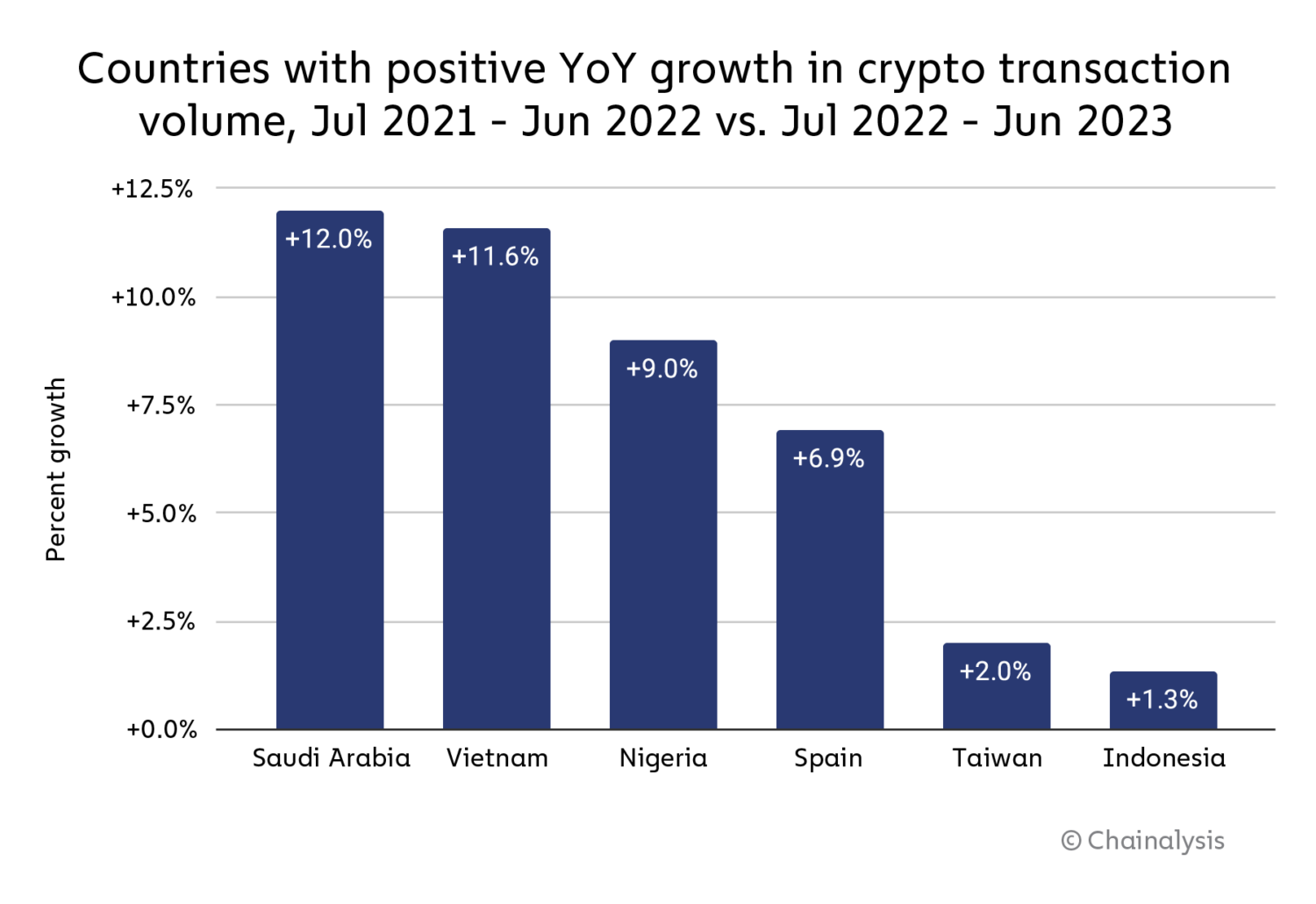

Nigeria boasts the largest population and economy in sub-Saharan Africa, and as discussed above, also the largest cryptocurrency economy. Perhaps even more strikingly, Nigeria’s crypto economy continues to grow despite market turmoil. In fact, Nigeria is one of only six countries in the top 50 by size worldwide whose crypto transaction volume grew year-on-year in the period we studied. His growth rate of 9.0% places him third among these six.

The evidence suggests that crypto is one solution to Nigeria’s economic challenges. Since 2016, Nigeria has suffered from two major recessions, fueled by an unstable political situation, the COVID-19 pandemic and the collapse of oil prices. Consequently, Nigerians of all ages face high unemployment – more than 20 million people were looking for work in 2021 – and many are moving to other countries.

The recent Naira crisis exacerbated these issues. In 2022, the Central Bank of Nigeria announced its intention to redesign the Naira and issue new notes in order to combat inflation and counterfeiting, as well as take more control over how much currency circulates.

Unfortunately, the resulting cash shortage has put enormous pressure on the country’s unmanned population and caused uncertainty about the use of old notes – all during an election period and a record high inflation rate of more than 20% at the beginning of 2023. Nigeria’s uncertain economic climate has encouraged many citizens to seek financial alternatives, increasing the value proposition of cryptocurrency.

These dynamics are reflected in the data. On the graph below, we can see that interest in Bitcoin and stablecoins has generally increased as the Naira’s value has decreased, especially during the most recent extremely sharp declines in June and July of 2023. The higher increases around May and November of 2022, however, is likely to be driven more by users trying to trade on the volatility spurred by TerraLuna and FTX’s crashes, respectively, as opposed to the local economic situation.

At the same time, interest in altcoins has recently grown across the region. Moyo Sodipo explained: “On days when the market tanks, we have also seen a buying frenzy. It depends on the dynamics of the market at that time. Whenever there is a new memecoin, like Dogecoin or Shiba, there was also a buying frenzy. Someone will always be interested in a sign that looks like it could make you the next few thousand dollars. The chart below illustrates this increase in altcoin activity, as well as the proportionally large percentage of monthly stablecoin value.

Regulatory developments throughout sub-Saharan Africa are opening the door for more crypto growth

Regulation also brought activity to exchanges in sub-Saharan Africa. South Africa in particular has been one of the region’s leaders when it comes to crypto regulation and the development of supporting trading frameworks. At the end of 2022, the Financial Sector Conduct Authority (FSCA) announced a licensing regime for cryptocurrency businesses and declared that crypto-assets are financial products, giving them greater legal clarity, and also empowering financial investigators to better fight illegal activities in the space.

The country’s proactive approach to regulation has removed much regulatory uncertainty and thus encouraged trading of established and emerging digital tokens. In fact, citizens of the country traded billions of dollars value of digital currency in recent years. According to Marius Reitz, general manager of Africa at South Africa-based exchange Luno, “The dominant use case for crypto in South Africa currently revolves around investment. Over the past 3 years, the number of customers who have a meaningful crypto balance on Luno has increased by almost 50%.” He added: “In markets with no regulatory ban, we tend to see the industry develop more responsibly as the market operates above ground, with more productive interaction between regulators and exchanges. But bans do not stop people from crypto want. The crypto industry will continue to grow with or without regulation. It’s only in everyone’s best interest that there is some sort of pragmatic regulation in place that protects consumers and creates a safer operating environment for everyone.”

The Central Bank of Kenya (CBK) has also navigated and issued the crypto landscape statements about potential volatility risks at the same time as leaders are considering the implementation of a CBDC. At the beginning of 2023, the government proposed a bill advocates for a consistent security definition of digital currencies and diligent record keeping by licensed crypto traders. Around the same time, the Nigerian government a national blockchain policyhighlighting ways blockchain adoption can benefit the country and pave the way for future legal framework.

In Mauritius, which is slightly behind Kenya in terms of raw cryptocurrency transaction volume, the Virtual Assets and Initial Token Offering Services Act of 2021 provided comprehensive legislation for issuing new tokens. The country’s continued commitment to consumer protection has helped promote crypto adoption and has attracted traders while other countries in the region have issued explicit or implicit bans on certain crypto-related activities.

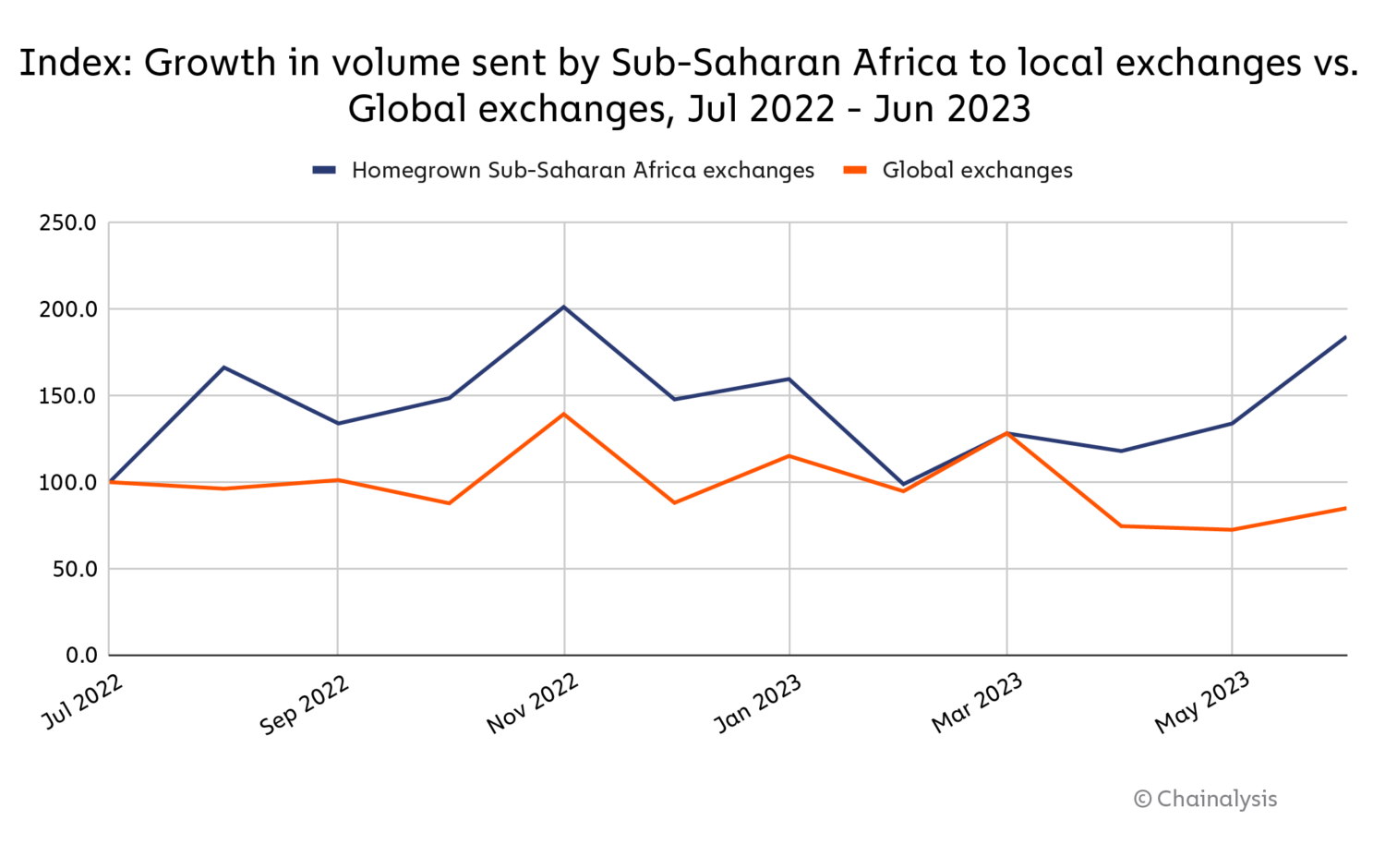

The increased regulatory clarity provided by the flurry of recent legislation could help Africa’s local cryptocurrency industry. As discussed above, many of the major crypto regulations enacted by Africa’s largest countries came around early 2023. Check out the chart below, which compares relative growth in Sub-Saharan use of local, homegrown crypto exchanges to international exchanges.

The consumer safety afforded by better regulations, the confidence those regulations give to consumers, and the ability of local crypto businesses to comply with those regulations may be part of the reasons why local African exchanges outgrow international competitors since early 2023 overtaking within the region.

What’s Next for Sub-Saharan Africa’s Crypto Economy?

The future of cryptocurrencies in sub-Saharan Africa looks bright, with major countries such as Nigeria already taking their place as global leaders in crypto adoption. Increasing regulatory clarity across the region also appears to be bolstering growth, which local crypto operators appear poised to take advantage of. However, the most important lesson is the same one we’ve learned from studying emerging markets over the years: While residents of wealthier nations may have bought and sold more cryptocurrencies than those from emerging markets, the latter have a greater day-to-day need for cryptocurrency, very much in line with the original vision for Bitcoin and the sector as a whole.

This material is for informational purposes only and is not intended to provide legal, tax, financial or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis does not warrant or guarantee the accuracy, completeness, timeliness, suitability or validity of the information in this report and shall not be responsible for any claim attributable to errors, omissions or other inaccuracies of any part of such material.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news