Whether you want to analyze specific cryptocurrencies or understand what is happening with the crypto market as a whole, crypto signals can provide a good starting point. They can indicate the best times to buy or sell a particular cryptocurrency, usually informed by specialized algorithms and based on various factors such as technical analysis, current market trends and news events.

In this article, we’re going to explore some of the best crypto signal providers to help you decide which might be best for you. But first, we’ll showcase some of the features on CoinCodex that provide crypto-signals functionality, especially when used in conjunction with each other.

List of Best Crypto Trading Signals in 2024:

CoinCodeCap – The best crypto signals provider overall Signals Blue – In-depth crypto analysis AltSignals – Forex and crypto signals Crypto Rand – Direct contact with successful and experienced traders Wolf of Trading – The largest crypto signals Telegram group CoinScreener.ai – Crypto signals generated by AI

Crypto trading signals on CoinCodex

You can find several different types of signals on the CoinCodex platform. The coin details page contains a real-time price chart sourced from over 400 different cryptocurrency exchanges. Prices are weighted according to the trading volume of the exchange so that the displayed price reflects the actual state of the market as closely as possible.

Below the price chart, you can find detailed information about the cryptocurrency you are interested in, ranging from basic information, such as the current price and market capitalization, to more advanced information, such as volatility, supply inflation, and volume to market capitalization. relationship.

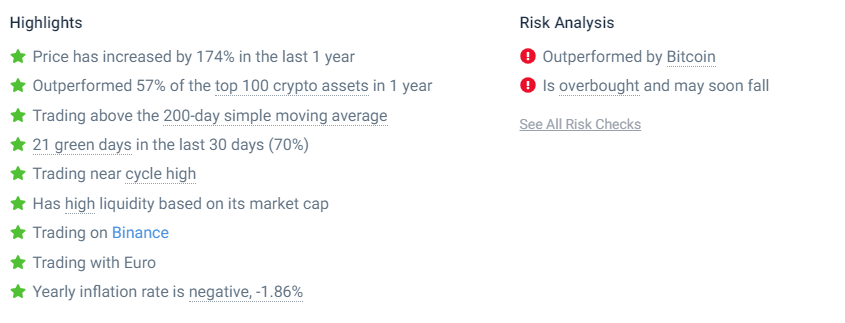

Then there’s a highlights and risks section where you can quickly identify a cryptocurrency’s strengths, as well as risks worth paying attention to. For example, we can see that Ethereum has strong liquidity and is trading above the 200-day SMA, but it is currently in an overbought zone (based on RSI) and is outperforming Bitcoin in terms of price.

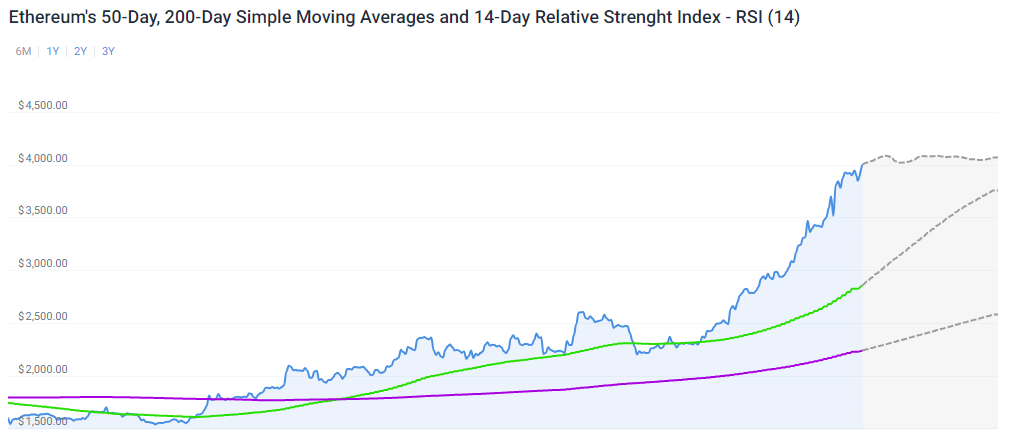

The price prediction section provides much more information that will help you determine whether a cryptocurrency is currently a good buy or not. It includes various technical indicators such as moving averages, RSI and support and resistance levels. Let’s take a look at some examples from our Bitcoin price prediction section.

You can find crypto signals like key SMAs (simple moving averages) and EMAs (exponential moving averages) for any cryptocurrency. There is also data for a range of technical analysis tools such as RSI, Stoch RSI, MACD and many more. These values can provide a solid base if you want to use line trading to gain insight into future price movements of a particular cryptocurrency (or even stocks and fiat currencies).

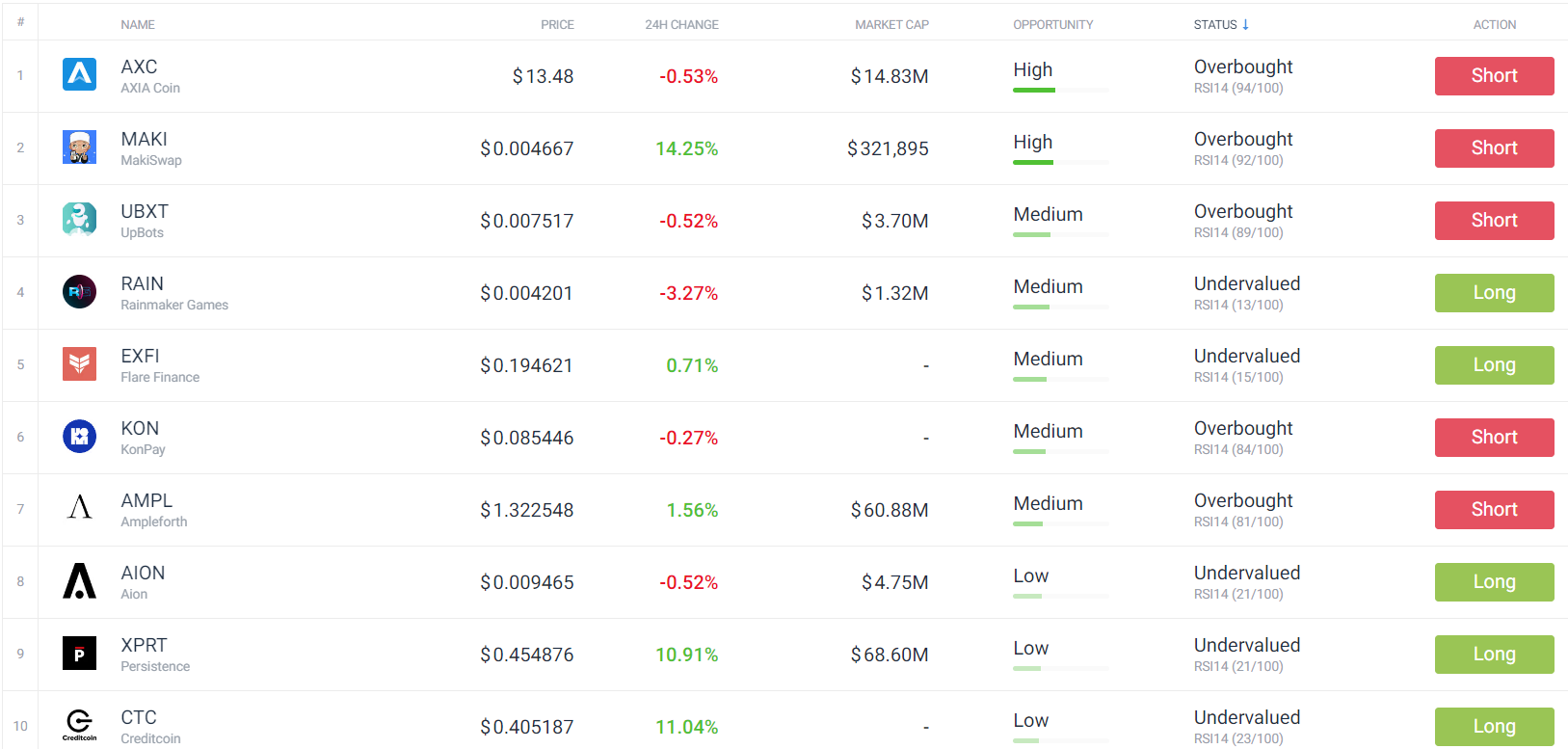

On CoinCodex, you can quickly get trading ideas by looking at our list of potentially overvalued and undervalued cryptocurrencies. We use the popular RSI (relative strength index) indicator to identify interesting trading opportunities in the crypto markets. If an asset’s RSI is at 70 or higher, it is an indication that the asset is overbought. Conversely, an RSI reading of 30 or lower indicates that the asset is undervalued.

These cryptocurrencies can also be sorted by market cap, making it easy to filter out low market cap cryptocurrencies that may have liquidity issues.

Of course, you should not only use the RSI to make trading decisions. It is important to analyze cryptocurrencies from different perspectives to get as much information as possible about them before entering into a transaction.

The 6 Best Crypto Signals: Investigate Top Providers in 2024

In the following sections, we are going to showcase some of the best free and paid crypto signal providers available right now.

1. CoinCodeCap – The best provider of crypto signals in general

CoinCodeCap provides cryptocurrency trading signals to help users make informed trading decisions. They provide detailed crypto signals that include entry points, profit targets and stop loss prices. The service emphasizes the importance of quality over quantity and continuously monitors trading pairs. They also offer a subscription-based service where subscribers receive exclusive access to trading signals and support. CoinCodeCap aims to simplify the trading process by conducting research and analysis for users, allowing them to trade efficiently without constantly monitoring the market.

Key features:

Wide variety of signals (low leverage future signals, high leverage signals, spot, NFTs) Support for Cornix bot YouTube life sessions $499 for lifetime access ($599 for NFT signals)

Visit CoinCodeCap

2. Signals Blue – In-depth crypto analysis

Signals Blue is a provider of high quality crypto signals, emphasizing the use of knowledge and experience in creating their signals, which are analyzed and consulted with specialists worldwide. The service offers flexible access across different time zones and uses AI-based tools to monitor the cryptocurrency market. Signals Blue focuses on delivering only profitable signals, avoiding ‘pump and dump’ strategies. Their offerings are tailored for both beginners and experienced traders, with detailed, easy-to-understand services and dedicated support. Membership options vary, including lifetime access, and the service includes the ability to integrate with Cornix Automation and API-Webhook Signals.

Key features:

Crypto signals with target prices, percentage profit goals, and more Signals shared on Telegram Explanations using technical analysis charts Subscription starts at £229.99/month (which can be discounted when using a 6-month or annual plan)

Visit Signals Blue

3. AltSignals – Forex and crypto signals

Founded in late December 2017, AltSignals provides crypto and forex trading signals and analysis. They aim to provide both technical and fundamental analysis to help clients trade effectively and profit in the long term. AltSignals emphasizes adapting to market conditions and avoiding scams in the crypto industry. They offer consistent Binance Futures and Forex signals with high accuracy and have a strong track record of results. Their service is designed for durability as it has been running continuously since 2017.

Key features:

Forex and crypto signals $100/month for each signal package (Forex, Binance Futues, Binance Spot, High Leverage) Use AltAlgo Indicator, a proprietary technical analysis tool, for generating signals Use native token ASI for management, contests and member rewards

Visit AltSignals

4. Crypto Rand – Direct contact with successful and experienced traders

Crypto Rand offers a comprehensive range of services for cryptocurrency traders and investors. It includes a private trading room where traders are assisted by analysts, who learn to trade cryptocurrencies safely. In addition, Crypto Rand offers an investment fund focused on early-stage blockchain innovation and a weekly newsletter covering market analysis, opinion articles, fundamental research and news. The founder of Crypto Rand is a technology enthusiast and entrepreneur who entered the cryptosphere in 2015, bringing a wealth of experience in trading, market analysis and blockchain consulting.

Key features:

Technical and fundamental market analysis Public signals focusing on the best crypto market opportunities Weekly newsletter focusing on fundamental research and important market trends Assistance from experienced traders

Visit Crypto Rand

5. Wolf of Trading – The largest crypto signals Telegram group

Wolf of Trading is a Telegram group with over 186,000 subscribers, making it one of the largest crypto communities. It focuses on providing members with useful trading insights and general crypto news and facts. Most people follow Wolf of Trading for their analysis of technical patterns, focusing on Bitcoin, Ethereum and other popular cryptos. In addition to Telegram, Wolf of Trading also shares their insights on X (formerly Twitter).

Key features:

Technical Analysis of Crypto Markets General Crypto News Market Trend Updates Crypto Signals Shared on X and Telegram

Visit Wolf of Trading

6. CoinScreener.ai – Crypto signals generated by AI

CoinScreener.ai is a tool designed for crypto traders, providing AI-driven trading signals and insights. It tracks more than 1,000 markets and large trading volumes, and tracks the activities of top traders. The platform emphasizes AI-powered technical analysis to provide real-time market data and insights, which help identify trading opportunities. Aimed at both beginners and experienced traders, CoinScreener.ai provides alerts on significant market movements and whale activity in the cryptocurrency market.

Key features:

AI-powered insights into market trends Whale activities on over 1000 futures and spot markets Top trader activities on thousands of trading pairs Free limited access, $8.25/month for full access

Visit CoinSreener.ai

The bottom line

Thanks to resources like CoinCodex and various specialized platforms, users have access to a wide range of crypto-signals that allow them to get detailed information about what is happening in the market. However, the difference between various services is quite large, so you should try them yourself before making a decision.

If you’re looking to get started with crypto, check out our ultimate guide to investing in crypto to get up to speed on everything you need to know about buying cryptocurrencies and storing them safely. Also check out our article if you want to learn how you can use crypto data to find new meme coins early and potentially uncover the next Shiba Inu before it explodes.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news