Reason to trust

Strict editorial policies focusing on accuracy, relevance and impartiality

Created by industry experts and carefully reviewed

The highest standards in reporting and publication

Strict editorial policies focusing on accuracy, relevance and impartiality

Football price of the lion and players some soft. Each Arcu Lorem, Ultrices any children or, Ullamcorper football hatred.

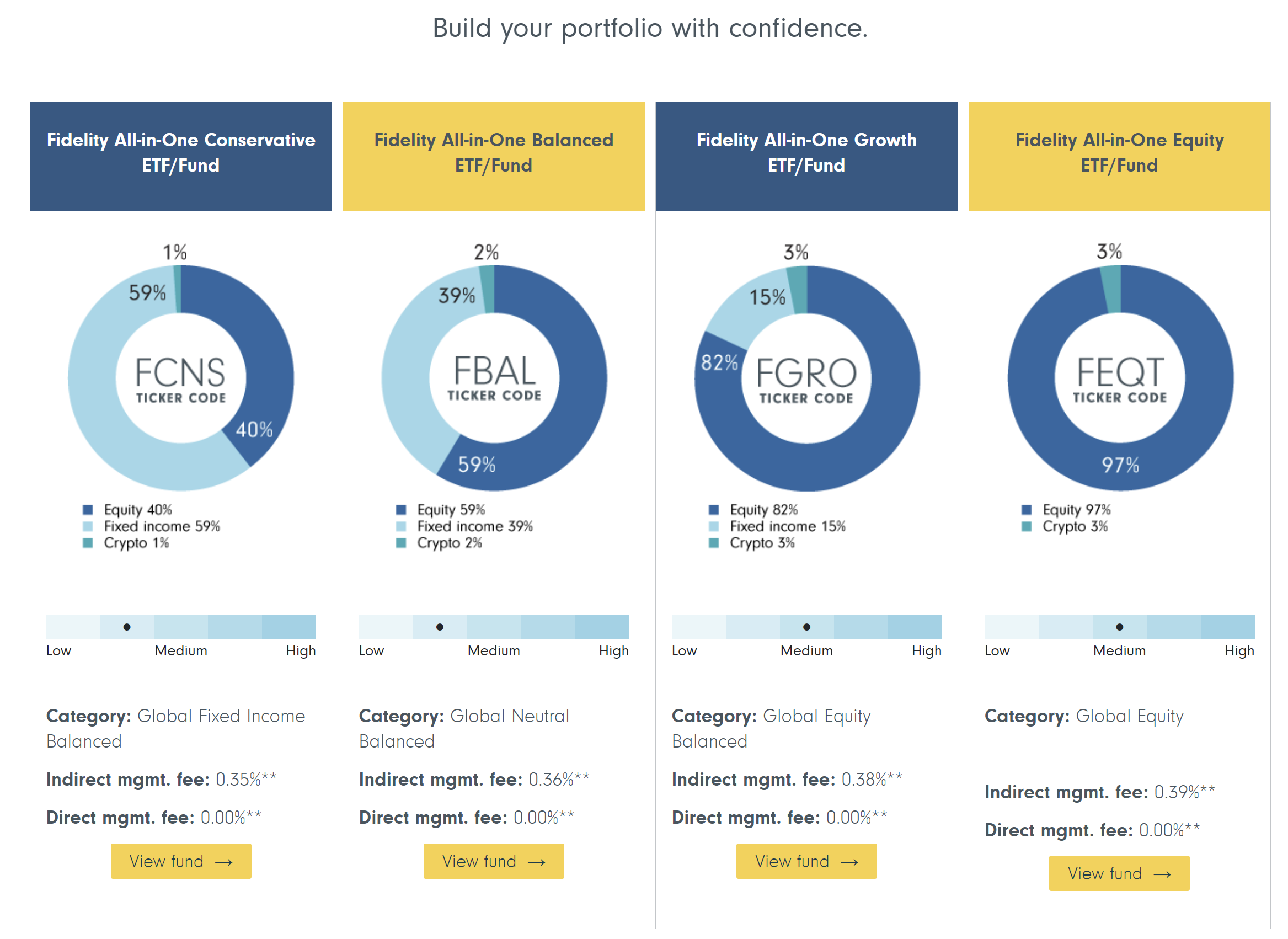

In a major shift within the financial industry, Fidelity Investments recommends, with its large $ 12.6 trillion assets under administration, now recommended that the traditional portfolio model of 60/40 should develop to include a 1-3% award to crypto, specifically by its mock Bitcoin ETF (FBTC). This groundbreaking move is not just a nod to the emerging crypto market, but a potential catalyst for unprecedented demand, which may be channeling hundreds of billions of dollars in Bitcoin.

Matt Ballensweig, head of Go Network at Bitgo, took to X (formerly Twitter) to express his anticipation and declare, ‘I said this since the day of ETF approval that Pandora’s Box has been opened, the asset managers of the multi-trillion dollar BTC and crypto will sell their massive distribution channels. Fidelity now creates blueprint portfolios with 1-3% crypto. “

Related Reading

According to this sentiment, Clement III, a well -known analyst, noted about the possible ripple effects of Fidelity’s recommendation. ‘Fidelity now recommends a 1-3% crypto award in your portfolio. Gateway drug. What happens if that 1-3% turns 3-6%? Slowly suddenly, ‘Clements notice and emphasize the potential for crypto award growth.

Which can mean for bitcoin price

Adam Cochran, a partner at CEHV, further expanded on the implications of Fidelity’s movement for Bitcoin’s adoption and price lane. In a detailed analysis shared on X, Cochran set out an ambitious future where the inclusion of crypto in traditional portfolios could lead to a significant re -evaluation of Bitcoin’s value. “How fucking wildlife is it to see. 60/40 Portfolios is now 59/39/2, ”begins Cochran, who underlines the historical milestone of Crypto to become a core asset.

Cochran compares the internet adoption rates with cryptocurrency, saying: ‘Hell, the internet has been running for 30 years and does not reach 10 million users until 1995. But the most non-conservative estimates placed Crypto ownership at 450 million worldwide (conservative is more like 200 m) which is in 2001 like the Internet. “

Related Reading

He emphasizes the great economic impact of digital progress, “Today the Internet has somewhere around 5.5b users – 12x what it did in 2001. But according to Bea, the impact of the digital economy is exponentially great with each year of growth.” By drawing this parallel, Cochran sets the way for a crypto market that can have exponential growth in value and influence.

Cochran’s approach to calculating Bitcoin’s future valuation involves analyzing the potential influx of funds from traditional investments. ‘If it follows the change to 59/39/2, you look at a new $ 1.6 tonnes … Since the current market is $ 2.24 trillion total market cap … we get a cash to value rate of 9.3%. “

The core of Cochran’s analysis lies in his valuation forecast, where he says: ‘Prorata between coins on their current relationships and it’s $ 748,500 BTC and $ 43,635 ETH in buying raw places. But since we know that there is an idea that things are running, and we have things like ETH’s return question and burn, we are usually a few multiples above the price of our question for raw place. “

Cochran’s conclusion reflects a strong belief in the transformative potential of cryptocurrencies within traditional investment portfolios. “At the end of the day, even gold did not break into a meaningful way in the 60/40 portfolio, so I think it blows past the $ 12t mcap of gold over time is a no-brainer.”

At press time, BTC traded at $ 57.175.

Popular image created with Dall · e, map of tradeview.com

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news