Bitcoin price hit a 30-day high of $68,457 on Monday, July 22, 2024 as BTC markets responded to crypto-friendly Donald Trump extending his lead after Biden bowed out of the presidential re-election race.

Biden announcement sends BTC price to 30-day peak

After surviving a mild correction scare on Friday, July 19, Bitcoin price entered another uptrend over the weekend, following a dramatic turn in the US presidential election race.

On July 21, US President Joe Biden announced a decision to withdraw from the 2024 re-election race. Investors expect this move could further tilt market momentum in favor of Donald Trump, a self-proclaimed crypto-friendly candidate.

As a result, Bitcoin experienced significant buying pressure over the weekend, along with the rest of the crypto markets.

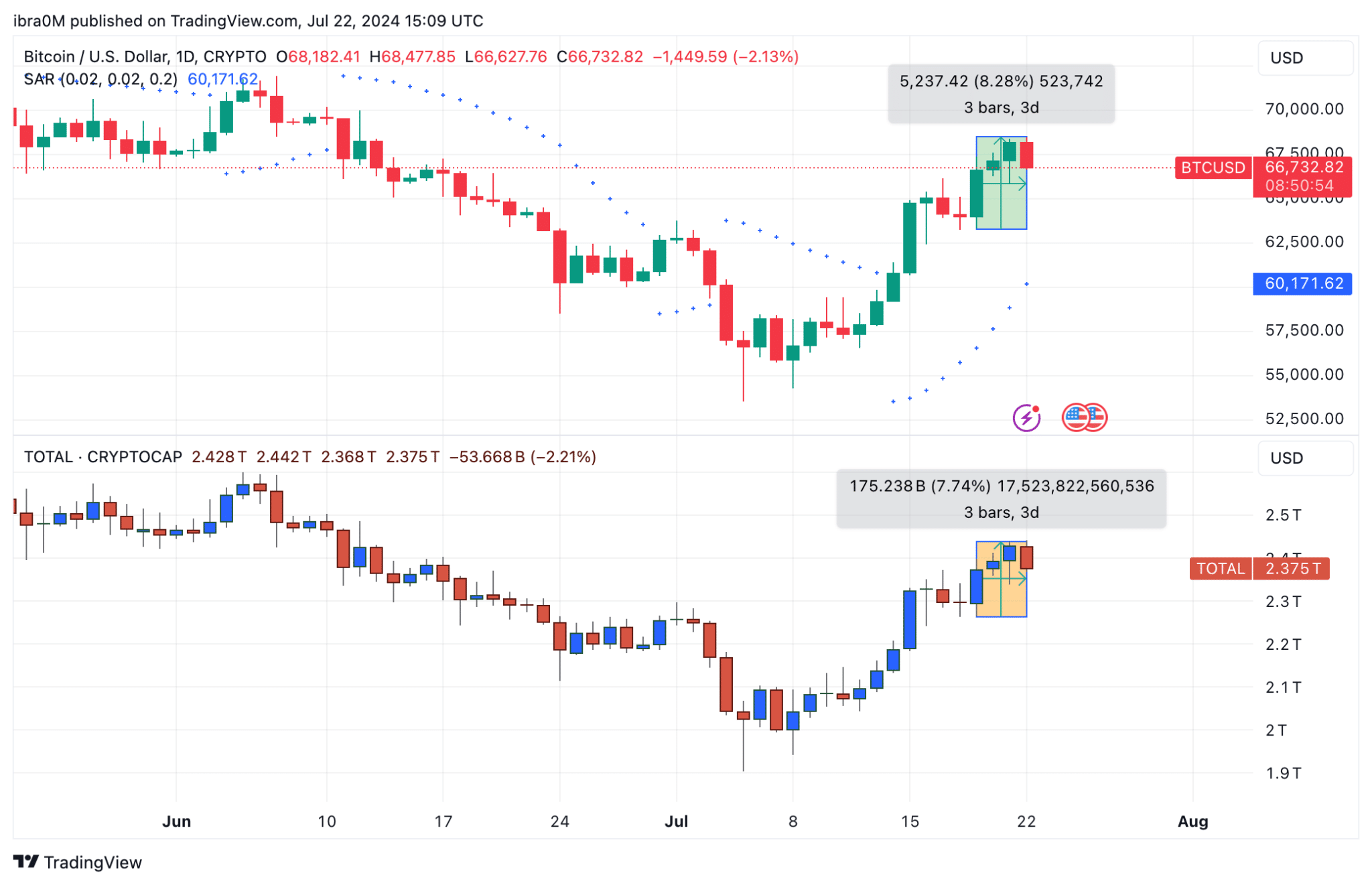

Bitcoin price fell to a daily timeframe bottom of $63,294 amid intense market volatility on Friday, July 19. However, following Biden’s announcement on Sunday, Bitcoin price climbed 8.28% to $68,477 as US markets opened on Monday, July 22.

Notably, $68,477 is the highest Bitcoin price has traded in over 30 days dating back to June 10. This shows that US investors are taking bullish positions on BTC as Trump extends his lead ahead of the presidential elections scheduled for November 2024. .

What’s more, as the Bitcoin market cap rose by more than $100 billion during the 8.2% weekend rally, the rest of the altcoin markets also benefited from the improved market sentiment. The Crypto TOTAL Cap chart above clearly shows how the total valuation of the broader crypto market increased by 7.74% (~$175 billion) during the last 72 hours.

During Biden’s administration, US authorities were embroiled in long-running legal battles with various crypto entities, including Ripple, Binance, Coinbase, Uniswap, to name a few. The administration also secured convictions from top figures, including Sam Bankman-Fried and Binance co-founder/CEO Changpeng Zhao.

Unsurprisingly, the positive market reaction over the weekend suggests that investors are interpreting that a Donald Trump presidency could potentially provide a more favorable regulatory landscape for the broader crypto markets than the sector has experienced under the Bidens.

If this growing story continues, it could build up a strong resistance buying wall preventing dramatic near-term corrections as Bitcoin price moves closer to the $70,000 milestone.

BTC Price Prediction: $70k Target Now In Sight

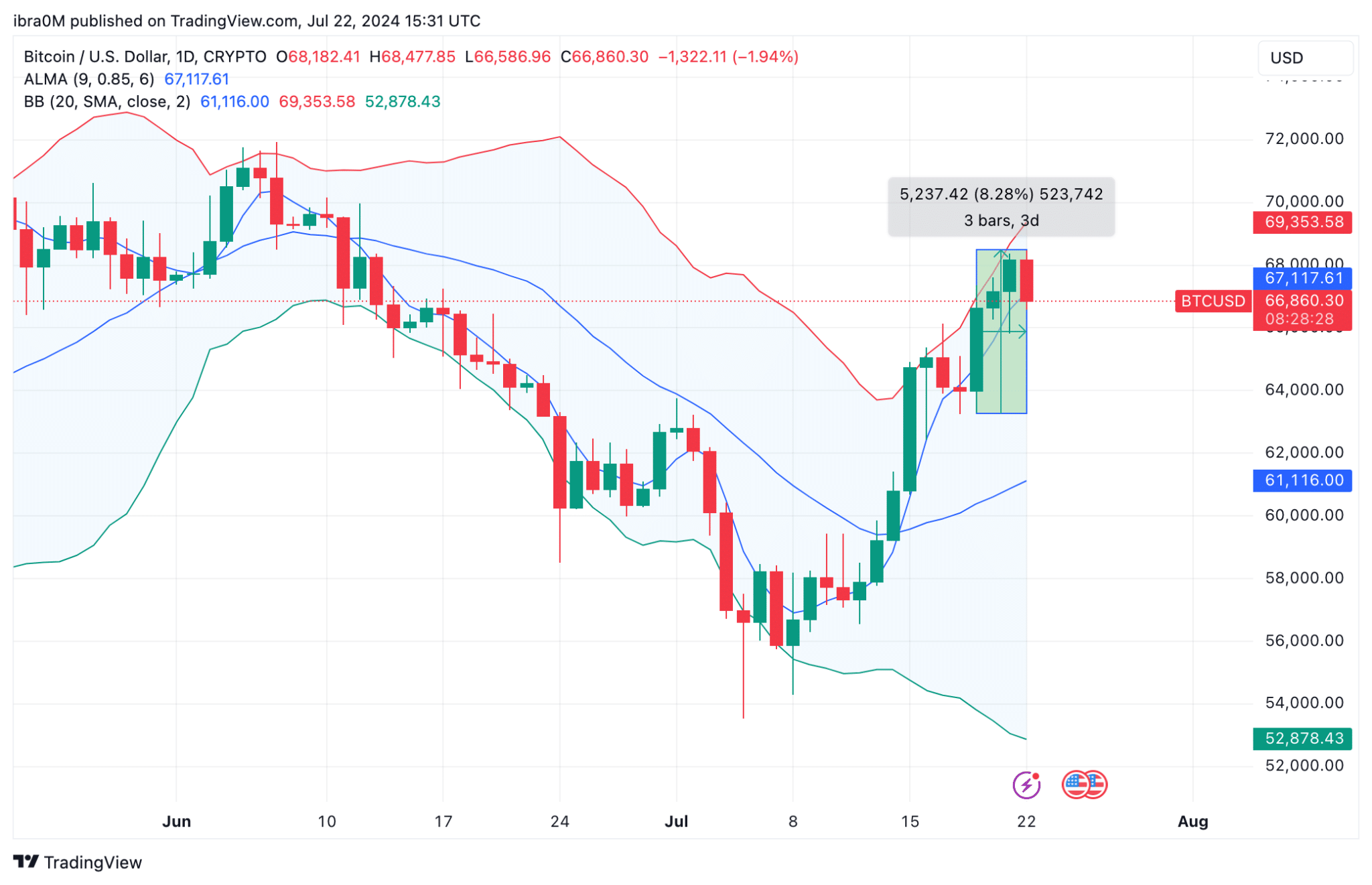

Bitcoin price action over the past 72 hours indicates a significant uptrend, recovering strongly from its recent lows. The price climbed back above the 9-day Arnaud Legoux moving average (ALMA) of $67,117.61, suggesting short-term bullish momentum.

Moreover, the Bollinger Bands (BB), with the upper band at $69,353.58 and the lower band at $52,878.43, are expanding, indicating increased volatility, which is often a precursor to a major breakout.

Currently, Bitcoin is facing resistance around the $68,000 level, as evidenced by the recent pullback from its high. If BTC can break through this resistance, the next significant target will be $70,000, which is in line with the upper Bollinger Band.

On the downside, immediate support lies at the 9-day ALMA of $67,117.61, with a more substantial support level at the lower Bollinger Band of $61,116.00.

The recent three-day gain of 8.28% as highlighted on the chart further supports the bullish outlook. However, traders should remain cautious due to the increased volatility. A sustained move above $68,000 could pave the way for further gains towards the $70,000 target, but a failure to sustain this level could lead to a pullback to the mentioned support zones.

Overall, while the technical indicators suggest a bullish trend with a $70,000 target in sight, traders should watch for potential resistance at $68,000 and closely monitor the support levels to manage their positions effectively.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news